Summary:

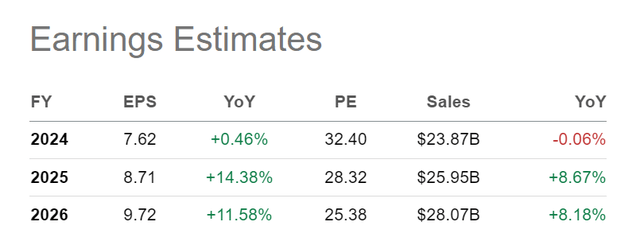

- The valuation is historically high, while sales are falling year-on-year.

- Danaher is issuing worse forecasts for 2024 than analysts estimate.

- Overall, I think the negative aspects outweigh the positive ones, at least in the short to medium time horizon.

- From a long-term perspective, you can see that there have always been better times to buy.

LaylaBird/E+ via Getty Images

Investment Thesis

Danaher Corporation (NYSE:DHR) has a fantastic track record of growing its business, acquisitions, spin-offs and generally outperforming the broader market. Nevertheless, the valuation is historically high, while sales are falling year-on-year. The company is issuing worse forecasts for 2024 than analysts estimate. That means the probability of a negative surprise in both revenue and EPS is high. Observing the P/E ratio over the past years has shown that there have always been better entry points, so I would rather wait for these points than buy now.

Overview

Danaher is a conglomerate in the Life-science and Biotech sector. Through the spin-off of the Environmental & Applied Solutions segment, Danaher wants to focus more strongly on diagnostics, biotechnology, and life science and considers these three segments its main business areas.

Danaher is a leading global life sciences and diagnostics innovator, helping to solve many of the world’s most important health challenges. Ultimately improving quality of life for billions of people today, while setting the foundation for a healthier, more sustainable tomorrow.

For many industries, the aging society is a big challenge. However, one could argue that if you make money in life sciences, biotechnology, and diagnostics, the aging society could be a long-term opportunity. As Danaher consists of many different individual companies, it is difficult to draw definitive conclusions about this statement. However, overall, older people need more medical treatment in one form or another, and the number of older people is increasing rapidly, especially in Western countries.

The past: Financial Progress & Trends

Many companies in the medical technology sector first gained and then suffered from the consequences of the pandemic. The global disruption to supply chains and generally strong demand led to a boom as customers stocked up on supplies. Once the pandemic ended, demand declined, and medical technology customers also began to reduce their now abundant stocks. Apart from that, many shares in the medical and especially biotech sector were overhyped especially in 2021.

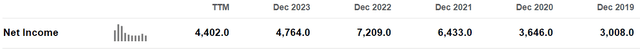

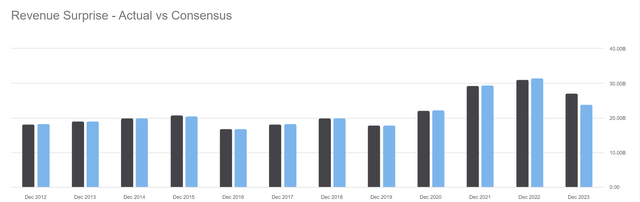

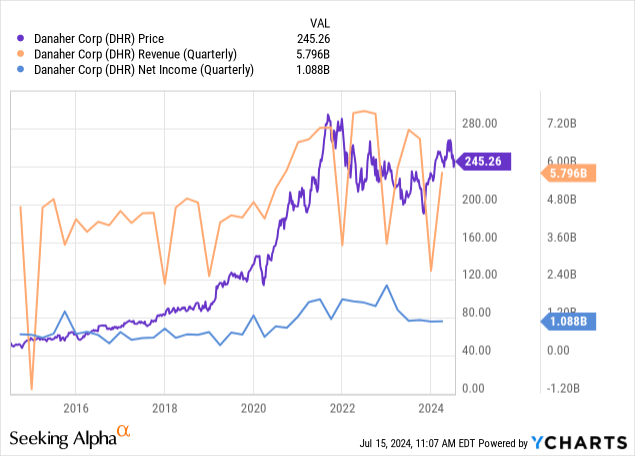

Below is an overview of the revenue and net profit over ten years, shown in relation to the share price. Interestingly, the upward trend in sales and net income seems to have been broken since around 2022. However, we must remember that 2020 to 2022 were exceptional years, and we would realistically have to compare sales today with 2019. From this perspective, the chart shows that sales and net income are comparatively stronger. However, net income in the trailing twelve months is about 50% higher than in 2019, while the share price rose from around $90 to currently $246.

In recent months, the share price has returned to an upward trend, but there are no signs yet that sales and net income will follow this movement. From this, I conclude that the valuation of the share must have become more expensive in recent months, and we will look at this aspect below.

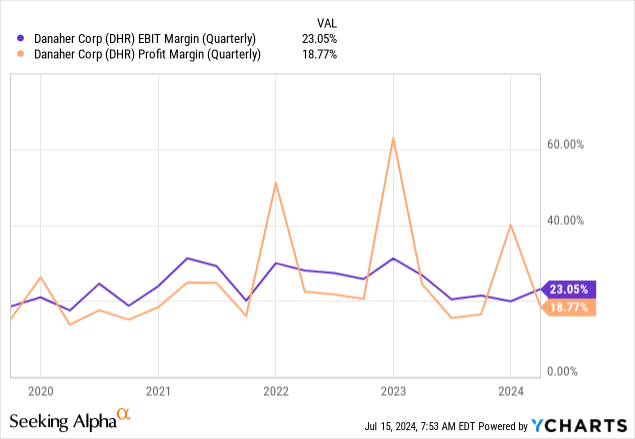

This particularly strong pandemic period is also reflected in the profit margins. Although margins have fallen recently, they are still a solid 19%.

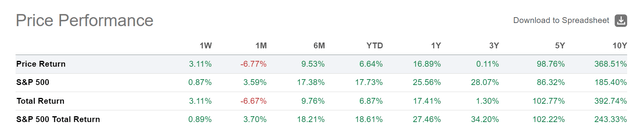

Overall, Danaher has been an extraordinarily successful company that has managed to grow and outperform the S&P 500 over very long periods. This is particularly extreme if you look at the chart since the 1990s. In the last five years, the performance has been the same, and in the previous three years, Danaher has not outperformed anymore.

The present: Valuation & current developments

The company’s enterprise value is $195B, its market cap is $183B, so its net debt is about $12B.

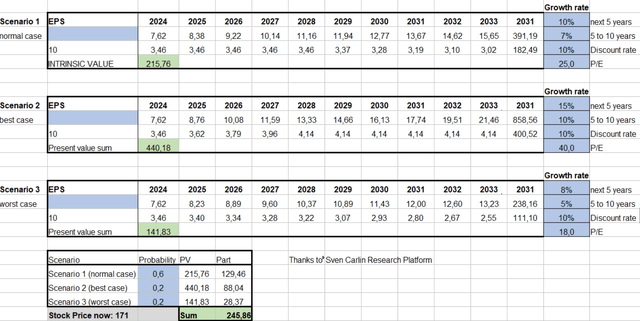

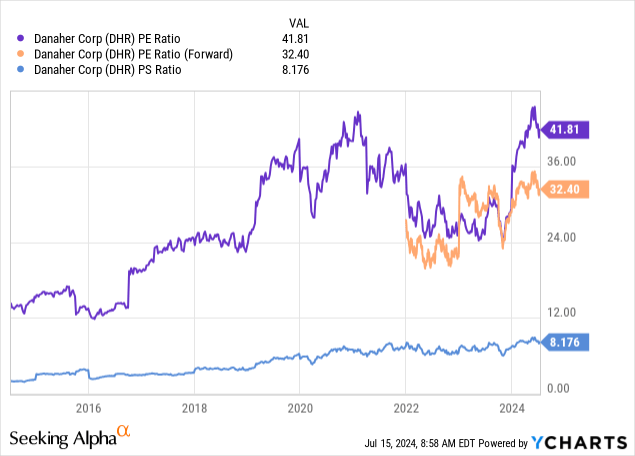

I have created a detailed analysis with three different scenarios to determine the current fair value with a DCF analysis. The normal scenario is indicated as the most probable variant. My assumptions for the growth rates are not hugely different, but the projected PE ratio is the most significant difference between these scenarios. After my DCF analysis, the following chart shows the historical P/E ratios. In the pre-pandemic period, this figure was between 15 and 24. Therefore, the “normal case” contains a P/E ratio of 25, which I consider high, but the market has attributed a high P/E ratio to the company for many years. Of course, this process includes several estimates and the calculation is not exact. Nevertheless, this approach allows us to approximate a fair value. The result is interesting: the current fair value with these assumptions corresponds almost exactly to the current share price.

This chart shows the PE and forward PE ratios for the last ten years. The valuation is almost historically high currently.

The business segment’s performance in Q1 2024 was mixed. The Biotech segment showed a sharp decline in sales and margins, while Diagnostics performed better and is the largest revenue driver overall.

| Revenue Q1 2024 | YoY change | Operating Profit Margin Q1 2024 | YoY change | |

|

Biotech |

$1.5B | -18.6% | 21.3% | -1070 BPS |

| Life Sciences | $1.75B | +2% | 13.5% | -530 BPS |

| Diagnostics | $2.5B | +6.5% | 32.8% | +430 BPS |

| Overall | $5.8B | -2.5% | 22.6% | -290 BPS |

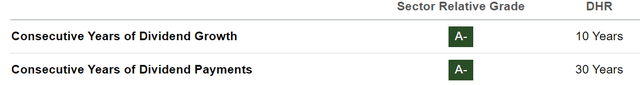

Dividend

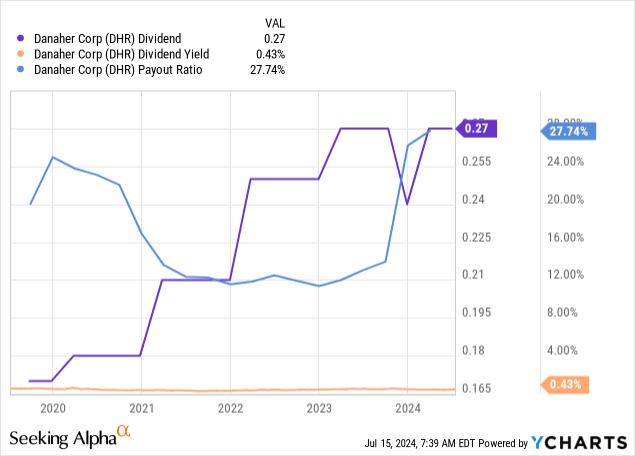

Anyone who bought the share many years ago can now enjoy a high yield on costs, as the company has continuously increased its dividend for ten years and has been paying a dividend for 30 years. That is an excellent track record.

However, the current high valuation of the shares means the yield is low. Although the payout ratio has risen recently, it is still low. In the last five years, the annual increase has been around 10% per year.

The future: Outlook

As far as the outlook for the next quarter and the year as a whole is concerned, the management says:

For the second quarter 2024, the Company anticipates that non-GAAP core revenue will be down mid-single digits year-over-year. For full year 2024, the Company continues to expect that non-GAAP core revenue will be down low-single digits year-over-year.

So, for 2024, the company expects a low single-digit revenue decline. It therefore seems somewhat incomprehensible that the analysts’ estimates are better, with sales expected to remain almost unchanged.

We should assume that the company can estimate its development more accurately than analysts. Considering the past, we see that the analysts’ estimates were usually quite good, but the revenue expectations for 2023 were too high. Looking at the statements above, we can probably conclude that the expectations for 2024 will be again too high. That means the probability of a negative surprise in both revenue and EPS is given, which could lead to a negative reaction in the share price.

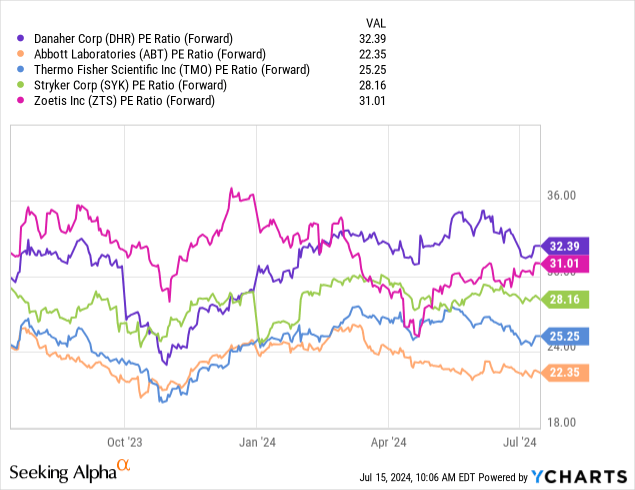

Risks

This last point about a potential negative surprise should not be underestimated. As we all know, the market does not like negative surprises, especially when a stock’s valuation is already high. Negative surprises could lead to a revaluation. In addition, it is questionable whether the market will continue to attribute such a high PE ratio to the share in the future. The current valuation appears high compared to competitors and the company’s history.

In a 20-year chart, we see a normal development for almost every company: Even if revenue increases constantly, the percentage growth per year decreases. Maintaining high percentage growth figures is difficult when revenue increases from millions to billions. So, earnings per share will also tend to grow less and less in percentage terms per year.

This final argument is not so much a risk but nevertheless a negative aspect: Investors who are not themselves experts in biotech and diagnostics will find it difficult to assess the company’s actual activity, especially with regard to the competition. To put it the other way around, an easy-to-understand business like Coca-Cola is an advantage for private investors. The difficulty of understanding the company is particularly a problem when assessing future developments.

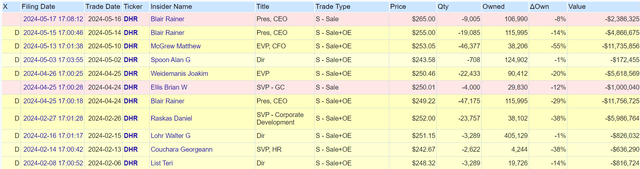

Share dilution, insider trades & SBCs

These three things are standard checks I make in every article, as excessive stock dilution and stock-based compensation can disadvantage shareholders. In addition, insider trades sometimes contain valuable information about management’s confidence.

These are all insider trades of the last six months.

Conclusion

On the plus side:

– excellent track record of outperforming the market

– continuously growing dividend and still a low payout ratio

– the aging society might benefit the company

Negatives include:

– high valuation (almost at a 10-year high)

– significant downside potential of 20% to 30% if the stock market were to value the share again at the pre-pandemic P/E ratio

– it is a complex business that is difficult to comprehend

– the higher the revenue, the more difficult it will be to maintain a high percentage revenue growth

– low dividend yield

– analysts’ earnings estimates are better than the company predicts

Overall, I think the negative aspects outweigh the positive ones, at least in the short to medium time horizon. Why should you buy the share when it is historically highly valued, analysts’ estimates seem too high for the current year, and sales are falling year-on-year? From a long-term perspective, there have always been better (cheaper) times to buy the share, so I think it is likely that there will be better entry points. Therefore, I give the stock a neutral hold rating, as I would not buy at the moment. But I can understand that investors who have been invested for years, made good profits, and whose yield on cost is higher, do not want to sell either.

Here is a quick checklist to summarize some of the most essential aspects.

|

Investor’s Checklist |

Check |

Description |

|

Rising revenues? |

Yes (if we consider the pandemic as an exception) |

Increasing over longer periods |

|

Improving margins? |

Relatively stable |

Possible competitive edge |

|

PEG ratio below one? |

No, it is rather high (about 3) |

PEG ratio below one may suggest undervaluation |

|

Sufficient cash reserves? |

Yes |

Vital for the survival & growth, especially of unprofitable companies |

|

Rewards shareholders? |

Yes |

Returning capital to shareholders |

|

Shareholder negatives? |

Yes, growth in outstanding shares |

Actions that disadvantage shareholders |

|

Stock in an uptrend? |

Yes |

Trading above its 200-day moving average? |

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.