Summary:

- Fear has swung the lithium pendulum to the oversold side.

- Financing is Lithium Americas’ final hurdle before construction.

- Lithium Americas’ production is currently slated to start in late 2027 – early 2028.

- The patient investor could be rewarded given current price levels.

duoogle

Why are Lithium Stocks Down?

Market sentiment has turned overtly negative on the majority of lithium and electric vehicle (EV) companies. Most people, including myself, have been asking the question; why? There are a few points that come to mind and seem to track with the current sentiment:

- LCE spot pricing has come down from its unsustainable high of >$80,000/ton. For those who follow the industry, this was expected. However, the sustained decline has surprised most. The majority of lithium is produced from brine or spodumene. Lepidolite is another source for lithium. While lepidolite is considered to be high on the cost curve for production, it has not stopped lepidolite producers from ramping up production. In China, lepidolite production has doubled in the past two years and currently is the largest source of lithium in the country. For those who are familiar with the Global Lithium Podcast, the producer, Joe Lowry, recently put out an article that I think perfectly sums up the current state of affairs. The short version, China, and the major EV producers, is purposely propping up lepidolite production to keep the downward pressure on lithium spot pricing. The consequence of doing so results in delays and cancellations of western powers from entering the market, which further solidifies China’s grip on lithium, and ultimately the electric vehicle market. It is the best piece of literature I have read that makes any logical sense as to what is currently going on and is a breath of fresh air from the mainstream media grasping at straws and providing their “expertise” on the matter. Sarcasm aside, I strongly encourage others to read it and provide their thoughts on the matter.

- Lithium demand was ‘slightly’ overhyped and the current downward revisions are viewed in a very negative light. This likely won’t be a popular answer with many, but it is one of the topics that needs to be addressed. Back in 2019 and 2020, individuals and analysts were saying electric vehicles would take over the roads by 2030 and predicting automakers would be producing vehicles by the millions in 2025. I do not disagree with the trends that are occurring. (EV) adoption is up, affordability is improving, and some of the anxieties that previously plagued individuals are showing signs of progress. However, some of the predictions were pretty off base. Tesla is nowhere near the 5 million mark that some were calling for. In 2023, they produced 1.845 million vehicles, that number will likely rise in 2024, but I have serious doubts of them hitting 5 million in the next 1.5 years.

- For mining companies, particularly those who are pre-production, low lithium prices lead to delays in investment which tends to cascade into further issues and ultimately delays production. Thacker Pass has been feeling this effect since last year. Lithium Americas (NYSE:LAC) expected this to be finalized in late 2023, but is struggling to seal the second tranche as well as the DOE Loan. I suspect it has something to do with the current depressed share price, but that is just speculation.

All of the above points seem to be bad news for lithium, right? Yes, but I would argue most of these issues have been baked into the current market and, in some instances, significantly overblown.

What is the Future of the Lithium Market?

Electric vehicles are continuing to grow in numbers and with that comes a growing need for the lithium, which is utilized in their batteries. Yes, some of the mining companies have adjusted their forward-looking estimates down. Earlier this year, Albemarle did just that when they cut their 2030 lithium demand forecast by 10% to 3.3 million metric tons (MMt LCE). However, for reference, the 2023 lithium demand was 1.0 MMt LCE and is forecast to reach 1.3 MMt LCE in 2024. That means Albemarle is forecasting industry demand to increase by 2.5X in the next 6 years. That is a monumental growth that is going to require huge expansions and further producers to come online.

The fact that growth has “slowed” does not concern me as much as it seems to have scared the market. It simply means the rate of change has come down. To those who follow the industry closely, this was to be expected. 2023 saw sales grow 31% and some companies are forecasting that growth number to be in the 25-30% range for 2024. Has it slowed? Yes. Is the industry still growing at a double-digit pace? You betcha! And why wouldn’t it? Electric Vehicles are gaining more and more traction around the world. Pun not intended.

Advantages of Electric Vehicles

EV’s are straight up cool. I was a naysayer for years until a friend gave me a ride in his Tesla. From that point on, my perspective changed. From the instantaneous acceleration, to the sleek interior, down to the technology that the vehicle is built around. This was in 2018. To make things even better, the technology has only gotten better and is continuing to improve. I love to hear people spout their thoughts, which stem from uninformed source, who will make claims like:

-

“Yes electric vehicles don’t consume gas, but the process of making them is worse for the environment than any gas powered car.” or

-

“Electric vehicles aren’t as efficient as gas powered vehicles” and my personal favorite,

-

“The technology is unproven”

While I won’t be debunking all of these claims, I do feel the need to provide a 10,000-foot view of the differences between EVs and ICEs. The table below provides a few technical points to chew on. And remember, EV’s are only continuing to improve in their technological innovations.

|

Electric Vehicle (EV) |

Internal Combustion Engine (ICE) |

|

|

Annual Emissions (CO2 equivalent) Source 1 |

2,727 lbs |

12,594 lbs |

|

Average Travel Range Source 2 |

234 miles |

403 miles |

|

Fuel Source |

Electricity* |

Petroleum |

|

Vehicle Efficiency Source 3 |

77% |

12% – 30% |

*Electric generation comes from various sources of power depending on region

Annual emissions are already a mile apart from one another. The travel range gap is real, but most of the manufacturers are improving their vehicles’ battery ranges. Tesla’s current vehicles have a range of 272 to 402 miles depending upon the model and options you choose, which essentially makes the travel range discussion a moot point. Yes, it takes time to charge them. But even this has been improving with the introduction of superchargers in the past few years.

Shifting the focus to an economic perspective, I’ve heard the arguments that EVs are more expensive than ICEs. Historically, this is true. However, given the improved economies of scale as well as some other worldly factors, the price of EVs are coming down. The below table provides another lens in which to view EV’s versus ICEs.

|

Electric Vehicle (EV) |

Internal Combustion Engine (ICE) |

|

|---|---|---|

|

Average Purchase Price: |

$54,000 or ($46,500 w/ $7,500 EV Credit) |

$44,000: Source 2 |

|

Average Annual Fuel/Charging Costs: Source 3 |

$1,000 |

$2,430 |

|

Average Annual Insurance: Source 3 |

$2,280 |

$1,530 |

|

Average Annual Maintenance: Source 4 |

$1,190 |

$1,440 |

|

Average Annual Operating Costs (sums above three rows): |

$4,470 |

$5,400 |

The general idea here is there are pros and cons to both sides. There is no one size fits all for everyone. However, from my perspective, EVs continue to improve on multiple fronts and have continued to come down in price. At the end of the day, the winner is the consumer.

Oil & Gas Companies are Investing in Lithium

I work for a large oil & gas company (who will remain unnamed). Even our executives have stated, along with other refiners in America, that gasoline demand in the United States has plateaued and is expected to decline in the future. Some sources say this decline could start as soon as 2027, but dates will likely vary based on sources. To me this fact is telling. It says the Internal Combustion Engine (ICE) is not dead, but is no longer growing when it comes to market share. It says any additional vehicle growth will be captured by the electric vehicle market (either pure electric or hybrids, both of which require the raw materials for batteries). And finally, it says electric vehicles are not some blip on the map that will go away. They are here to stay and will continue to increase in numbers and popularity. Don’t just take my word for it. Oil & Gas companies are paying more attention to the electric vehicle transition and beginning to place bets:

-

Exxon Mobil signs MOU to supply 100,000 metric tons of lithium

-

Equinor to invest >$100 million to progress Standard Lithium’s Arkansas and Texas projects

-

Saudi Aramco and ADNOC are exploring lithium production

-

Occidental Petroleum forms Joint Venture for lithium extraction

This is simply the oil & gas companies. There are billions of dollars being plowed into EVs from the auto manufacturer’s side.

Lithium Americas’ Update

General market trends and correlations aside, we are here to understand how Lithium Americas (LAC) fares in all of this. If you’re reading this, then I’m assuming you’re mostly familiar with LAC and the fact they are building out the lithium mine (Thacker Pass) in Nevada to supply lithium. Their website can give you the fun facts about them, so I’ll do my best to give you my two cents on where I believe they are headed in this current market environment.

I reached out to Lithium Americas’ Investor Relations Group recently. While they weren’t willing to provide any earth-shattering information, the below bullets outline the tidbits of information I was able to glean in combination with their most recent presentation:

-

LAC expects to close the DOE Loan during the second half of 2024

-

LAC was unwilling to provide specifics (as was to be expected) on the matter. However, based on the boilerplate response I received, it seems like it is mainly formalities and paperwork.

-

-

They expect the DOE Loan will close in conjunction with GM’s Tranche 2 ($330 Million)

-

Per LAC’s 2024 Q1 press release, GM’s Tranche 2 is contingent upon the DOE Loan.

-

This means without the DOE Loan, GM will likely re-negotiate the second investment in some way or another

-

I suspect there are conversations going on between the two companies at the moment, given the depressed share price (more on this later).

-

-

The loan from the DOE is at applicable U.S. Treasury rates, and interest repayment will begin after production begins at the site.

-

Good news, considering there is a 2–3 year lag from when the funds likely become available to when they have to start paying interest.

-

Where will Lithium Americas be in 5 to 7 years?

This is purely speculation on my end based on the information I have available to me at the time of writing. With that said, I’ve tried to forecast a timeline of major milestones and when they could reach completion.

|

2024 Q3 |

DOE Loan closes and LAC secures 75% of project funding |

|

2024 Q4 |

GM Tranche 2 closes and LAC issues $330 Million worth of shares |

|

2025 Q1 |

Major construction and procurement starts for Phase 1 |

|

2027 Q4 |

Phase 1 reaches mechanical completion |

|

2028 Q1 |

Phase 1 starts up and operates at 50% capacity for 1 year. |

|

2028 Q4 |

Phase 2 starts engineering and construction efforts. Assume capital costs increase by 25% |

|

2029 Q1 |

Phase 1 reaches 100% capacity |

|

2031 Q1 |

Phase 2 reaches mechanical completion |

|

2031 Q2 |

Phase 2 starts up and operates at 50% capacity for the remainder of 2031 |

|

2032 Q1 |

Thacker Pass phase 2 reaches 100% production capacity |

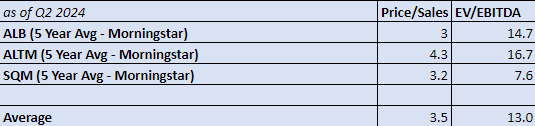

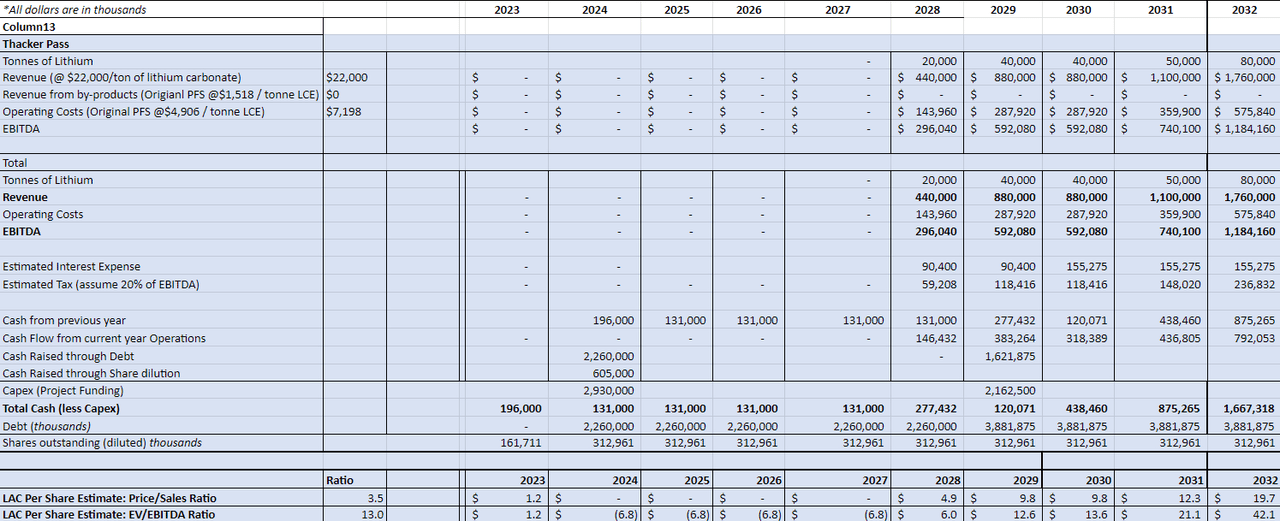

With this timeline, I’ve tried to forecast the company’s financials, given the information provided in the Definitive Feasibility Study (DFS). Finally, I’ve attempted to forecast what a realistic stock price may look like based on competitors’ financial ratios. I used the ratios from currently producing competitors (Albemarle (ALB), Sociedad Quimica y Minera de Chile SA (SQM) and Arcadium (ALTM)) in an attempt to understand what LAC might look like when they are a lithium producing company. The below graphic shows the ratios used, followed by the second graphic, which provides rough estimates of what the financial picture could look like, stepping into 2032.

Financial Ratios used for Price Analysis (Self)

Financial Estimates (Self)

Future (LAC) Price Estimates

2028 Estimate Price Range: $5 – $6

2029 Estimated Price Range: $10 – $13

2030 Estimated Price Range: $10 – $14

2031 Estimated Price Range: $12 – $21

2032 Estimate Price Range: $20 – $42

For those who read one of my previous LAC articles, they will know I performed a similar forecasting exercise. For those wondering why LAC’s values look so different from last time, the primary reasons are as follows:

-

In 2023, Lithium Americas separated its North American and International assets from one another. As a result, LAC is the new Lithium Americas that owns Thacker Pass and Lithium Americas (Argentina), owns the Argentina Assets (Cauchari Olaroz, Pastos Grande and Sal de la Puna).

I plan to do a similar article and analysis on LAAC in the near future, as their assets also have significant value.

-

Project costs have gone up a lot from the previous estimates provided by LAC’s PFS.

-

Project delays have pushed timelines and resulted in delayed production and ultimately financial monetization.

- Lithium peers have all suffered price declines, which negatively impacts the financial ratios used to drive peer to peer comparisons from a ratio standpoint.

Risks

No company is a sure fire winner. Risks are involved everywhere, and LAC has plenty of them. In no particular order, the major risks I foresee are as follows:

-

United States Presidential election: Donald Trump is a wild card. He loves America, but I don’t know how he will view the DOE Loan subsidies. If the loan is not closed by the time the election comes around, there could be serious timeline delays if Trump decides to pull back on government subsidies (the DOE Loan funds) to boost these industries.

-

Trade War: Considering China dominates the (EV) world and is responsible for the bulk of EV production, if a trade war breaks out, then you can expect (EV) adoption to slow.

-

Failure to close the funding gap: If the DOE Loan and GM come through, finances are set and LAC will be a lithium producer. If financing is not secured, I expect at least 1–2 years of additional delays. In addition, given the current depressed share price, the second $330 Million GM investment would result in GM owning ~50% of the outstanding shares if they are purchased at market pricing. This is slightly concerning, yet not a dealbreaker. The risk being that GM would have the majority say on every decision. The results of those decisions may benefit GM but at the expense of LAC shareholders.

Conclusion

The day investors are waiting for is when Thacker Pass can reach full capacity (Phase 1 & 2). That day is likely in the early 2030s. However, for the patient investor, the risk reward profile appears favorable given the current state of the lithium market and what is forecast to become of it.

The risks for LAC are concerning and should not be downplayed. However, I’ve been following this company since 2019 and can say they are the furthest along of all junior lithium miners in the United States and, in my opinion, are the most likely to succeed. The lithium quantity and quality is great. The DLE technology has been piloted and proven. The permits have been issued. The design has been finalized, and financing is the last major hurdle before the construction of this mine. I expect the DOE Loan to eventually close, followed by GM’s second tranche. A renegotiation could occur. However, you have to remember that GM was not the only suitor for LAC’s partnership. If things fall through, then I would not be surprised to see LAC form a second strategic partnership. Time will tell.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LAC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.