Summary:

- Explosive growth in the AI industry led to a massive rally for Nvidia Corporation stock, which continues to perform well post-stock split.

- Investors are underestimating Nvidia’s sales potential in the data center segment, poised to exploit accelerating growth in the AI market.

- Nvidia’s AI capabilities, including Generative AI, position it at the forefront of the AI revolution, with potential for substantial sales growth and multiple expansion.

BING-JHEN HONG

Explosive growth from the artificial intelligence industry triggered a massive rally for Nvidia Corporation (NASDAQ:NVDA) in the last year. The stock has done well even after a ten-for-one stock split and some investor concerns about the sustainability of Nvidia’s growth path.

Considering the mind-blowing momentum in Nvidia’s main business, data center, I think investors are still underestimating Nvidia’s sales potential, particularly as the expansion of the data center market and the AI cluster upscaling opportunity are concerned.

The company is poised to exploit accelerating growth in the data center segment and, in light of big investments in machine-learning capabilities, Nvidia’s valuation is actually not excessive at all.

Nvidia has the profit growth to back up its valuation, and the risk/reward relationship still looks rather compelling.

Nvidia’s Data Center Sales Momentum And Machine-Learning Opportunity

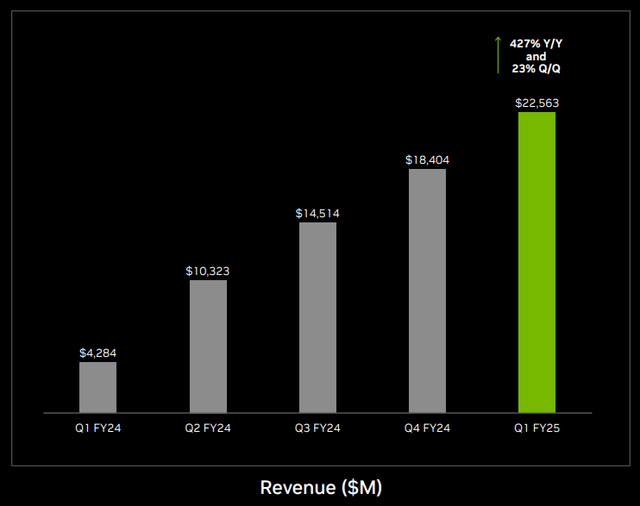

Nvidia’s 1Q earnings were spectacular, particularly in the data center segment where sales skyrocketed to $22.6 billion, reflecting QoQ growth of 23%.

Total sales reached $26.0 billion, up 18% QoQ, which put the company on a run-rate to a $100 billion plus sales trajectory each year.

Sales in data centers accounted for a whopping 87% of sales in 1Q25, up from 60% a year ago. Nvidia’s data centers profit from the sale of the Hopper GPU platform. With demand for machine-learning capabilities only growing, there is a good chance that Nvidia will manage to outshine even its last earnings release in the remaining three quarters of the company’s present financial year. The reason is that growth for data center GPUs does not appear to be temporary, and the AI cluster upscaling opportunity is significant.

The machine-learning market is red-hot as companies are struggling to get their hands on GPUs. Nvidia’s chips are used for various purposes such as edge-to-cloud computing, the powering of automotive driving technology, cryptocurrency mining and professional applications. In recent quarters, however, they are mainly used by large data centers that need to stack them with tens of thousands of GPUs to train large-language models.

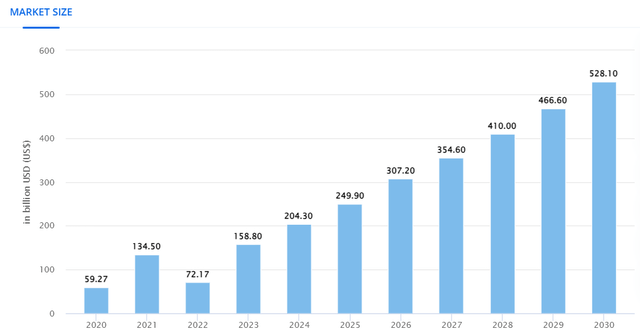

Machine learning is a very compelling sector that is poised to see skyrocketing growth until the end of the decade, and Nvidia is sitting right at the spearhead of this AI revolution. This growth is also secular, driven by demand for AI capabilities, not by temporary factors.

The market for machine learning is poised to grow at 19% per annum, according to Statista Market Insights, which obviously presents an enormous lever for Nvidia to scale its existing AI capabilities.

Nvidia could profit from this accelerating growth through its main GPUs that power AI applications, but also through its AI software platform, which is mainly marketed to companies.

Nvidia AI software includes Generative AI capabilities. These could help companies deploying Nvidia’s AI arsenal to realize productivity increases, optimize supply chains/cost structures, and deliver in-depth analytics insights that could impact the speed and accuracy of business and investment decisions.

Nvidia’s GPUs, like the RTX, are used for deep learning purposes and Nvidia’s lead processor, the NVIDIA H100 Tensor Core GPU, is used as the foundation for artificial intelligence usage on the data center level.

The NVIDIA H100 Tensor Core GPU has been designed for optimizing the development, training and at-scale deployment of generative AI/language models that are demanded by almost every major company right now. It was the fastest GPU available in the market and therefore particularly demanded by companies that require a fast tackling of AI and HPC workloads.

With Nvidia providing the cornerstone of such generative AI/language models, Nvidia has positioned itself at the very center of the AI revolution.

Nvidia has a pole position in the AI processor market (as reflected in its financials) over competitors like Advanced Micro Devices, Inc. (AMD) which only recently got around to announcing competing processors.

One product that is coming users’ way is the AI accelerator MI300X, which is specifically tailored to support machine learning. Currently, Nvidia is the leading AI processor manufacturer. According to Advanced Micro Devices’ (AMD) CEO Lisa Su, industry demand is substantially outstripping supply. This means both Nvidia and Advanced Micro Devices are poised to see big upside in data center sales and GPU shipment growth moving forward.

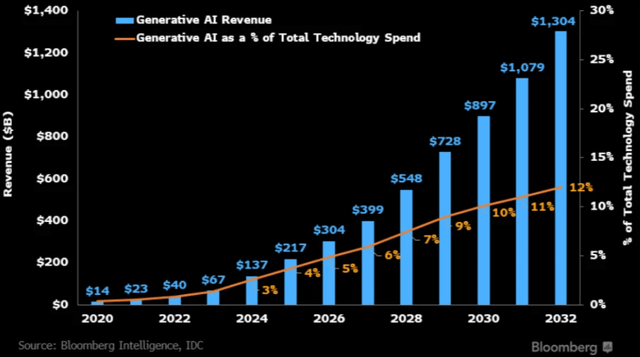

Expanding the view beyond mere machine learning potential, and including all Generative AI pathways for monetization, leaves us (and Nvidia) with an even rosier picture for sustained, long-term sales growth.

As a long-term investor, I am primarily interested in seeing strong underlying market growth that a company at the forefront of its industry, like Nvidia, can leverage to its advantage and, possibly, grow even faster than the market.

According to Bloomberg Research, the Generative AI market is poised to grow even faster than the Machine Learning market. Generative AI leverages concepts like deep learning and neural networks and is used primarily, but not exclusively, in the content creation space.

The market for Generative AI is anticipated to grow to $1.3 trillion by 2032, up from just $67 billion in 2023. This means the market is anticipated to grow 39% per year in the next nine years.

The takeaway for investors here is that the AI revolution more likely than not indicates that we are at a very early stage of AI adoption. Put simply, Nvidia’s AI growth curve is just getting started, which implies substantial potential, if not for multiple expansion, then for sales growth.

Generative AI Revenue Growth (Bloomberg Intelligence, IDC)

AI Cluster Upscaling And Sales Estimates

Common clusters to train artificial intelligence models include tens-of-thousands of GPUs, but the market seems primed for exponential growth in this core area of Nvidia’s business. In turn, this could lead to investors still underestimating Nvidia’s data center sales growth potential. The trend is for much bigger AI clusters and supercomputers, which could drastically increase demand for GPUs moving forward.

AMD’s Lisa Su said at the end of last year that the chip company anticipates to see the data market grow into a size of $400 billion by 2027. Nvidia owns more than 90% of this market.

Some companies, like Microsoft and OpenAI, have said they intend to build supercomputers with more than 1 million GPUs to train large-language models (“LLMs”). With AI GPU training clusters now made up of 10ks of GPU, the AI clusters used in the future could potentially include millions of GPUs, representing a 10x increase over the present size.

My view here is that the upscaling in the size of AI clusters (a larger number of GPUs included in a training cluster), represents an opportunity for Nvidia particularly to leverage its strength in the GPU market. H200 chips are shipping in the latter half of this year, and Nvidia’s Blackwell GPU is hitting the market as well at the end of the year. These new chips promise higher performance and reduced power consumption, which could make them top-sellers for Nvidia at a time of accelerating demand for compute.

If AMD’s estimate for $400 billion in data center chip sales by 2027 is correct, then Nvidia could capture $360 billion or more of this market, considering a present market share of 90% in the AI GPU market. Nvidia had a GPU shipment share of 98% in 2023, but could lose some market share to other GPUs offers from AMD or Intel.

With that said, though, Nvidia’s new Blackwell GPU launch later this year, could supply a solid growth catalyst and the same is true for the start of H200 shipments.

Presently, based on 1Q sales, Nvidia has a run-rate sales volume of $104 billion and sales are anticipated to grow 35% next year. This sales estimate could thus be conservative, however, and, based on AMD’s market projections, Nvidia’s data center sales could be more than triple between 2024 and 2027, to more than $300 billion, up from $90 billion in 1Q (on a run-rate basis).

With just about $100 billion in run-rate data center sales today, Nvidia could be poised to grow its sales at closer to 50% annually, leaving room for a multiple decompression.

Why Nvidia Is A Steal At $130

Nvidia’s multiple is, in my opinion, shockingly moderate given the 30% (or much higher) annual sales growth potential that is presented by the Machine-Learning market (40% by the Generative AI market) and Nvidia’s accelerator release road-map.

Presently, Nvidia is selling for just 35x leading (next year’s) profits, which seems shockingly inadequate when considering the company’s implied sales growth potential.

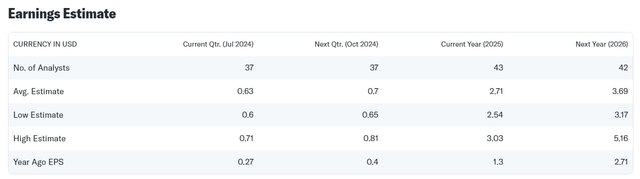

Nvidia, based on the Yahoo Finance consensus, is anticipated to earn $3.69 per share this year, implying a YoY profit growth rate of 36%. AMD is anticipated to earn $5.56. AMD’s consensus reflects 59% YoY profit growth as the chip company accelerates its AI GPU products. Thus, AMD is selling for 33x leading earnings.

With a nearly identical earnings multiple, I would choose Nvidia any day of the week given its commanding market share in the GPU market.

Furthermore, I think that the market underestimates Nvidia’s sales growth for reasons stated, which means the actual valuation ratios may not be as high as they appear.

In my view, Nvidia could sell for 45x leading earnings (implied intrinsic value of $166) when considering the ramp in data center sales in the next three years, catalyzed by growth in Machine-Learning and in the escalating size of AI GPU clusters.

Earnings Estimate (Yahoo Finance)

What Could Go Wrong?

Nvidia might not be able to realize its AI potential, or grow slower than I proposed in the calculation above. With that being said, though, Nvidia’s growth potential is very secular and sustainable, in my view, and the company is already taking a big bite out of the evolving AI opportunity. Over the long run, 126% YoY growth rates are not sustainable, so there might be a point of sales growth deceleration moving forward.

My calculation above was also assuming that Nvidia could possibly grow its sales 50% per annum, and there is no guarantee that this will be realized either.

My Conclusion

Nvidia presented stellar growth in the last year, due to skyrocketing growth in data centers.

Though the stock has soared, Nvidia’s earnings potential is shockingly reasonable when considering the underlying AI market opportunity that is set to drive the company’s main business data center. With the stock selling for 35x leading earnings, I think that investors are getting a very good deal.

The real potential moving forward will be in Machine-Learning and Generative AI. This is poised to boost the scale of AI GPU training clusters. Since Nvidia’s processors are the preferred choice for companies to train their AI models right now, it is in an excellent position to leverage its H200 and Blackwell GPU chips and scale shipments up into a red-hot market.

The 35x earnings multiple as well as the potential for substantial sales estimate beats in the data center segment moving forward make Nvidia a solid growth investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.