Summary:

- Plug Power Inc. operates in a growth market but struggles with execution and cash burn, leading to ongoing dilution risk.

- The company has consistently missed management guidance and analyst estimates, with weak operational performance and poor cash flow.

- Despite being in a growing industry, Plug Power’s weak fundamentals, ongoing cash burn, and high valuation make it an unattractive investment choice.

Mikhail Konoplev/iStock via Getty Images

Article Thesis

Plug Power Inc. (NASDAQ:PLUG) is active in a growth market, but the company’s execution remains sub-par. The company burns through cash at a rapid pace, which increases the risk of ongoing dilution. PLUG has missed management guidance repeatedly in the past, which is why I believe that staying away from PLUG could be a good choice.

Past Coverage

I have covered Plug Power in the past here on Seeking Alpha, most recently around three years ago, in 2021. In that article, I talked about the company’s weak track record when it comes to execution and concluded that I was avoiding the stock due to the above-average risks. With several years passed since then, it is time to take another look at Plug Power. With shares down by 75% over the last year alone, PLUG clearly has had a hard time — rising interest rates hurt the stock, but so did PLUG’s weak operational performance.

Plug Power: Growth Market Exposure But Weak Fundamentals

Plug Power is active in a major growth market — hydrogen power. But while being active in a growth market is positive, it does not mean a company will do well. And even if a company in a growth market does well operationally, its stock may not do well if the valuation is too high. Cannabis is a good example of a growth market where many companies are not performing well. Microsoft (MSFT) during the dot.com bubble is a good example of a company in a growth market that is doing well operationally, and which nevertheless was not a good investment — shares were too expensive, and investors that bought MSFT at the highs in 2000 had to wait for many years to break even.

Plug Power is not like Microsoft, however — it is doing way worse operationally. This has been the case for many years, despite Plug Power’s ambitious goals. But management missed these goals again and again and has not been able to generate profits even with close to $1 billion in sales, despite targeting profits way earlier.

Profitability is not the only major issue at Plug Power, however. The company also struggles with a very weak cash flow picture. Over the last year, the company burned through $1.0 billion in operating cash flow, even before accounting for the company’s capital expenditures. When we add those, at $600 million for the last four quarters, PLUG burned through $1.6 billion of cash. At this rate, the company will have to issue large amounts of debt or dilute shareholders substantially in the near term. The company’s balance sheet at the end of the last quarter was in a rather weak shape, after all, with just $170 million in cash and short-term investments, and $70 million in long-term investments. At the cash burn rate over the last four quarters, that $240 million is enough to cover just two months of cash usage, thus PLUG could have run out of money during the second quarter if not for new financing.

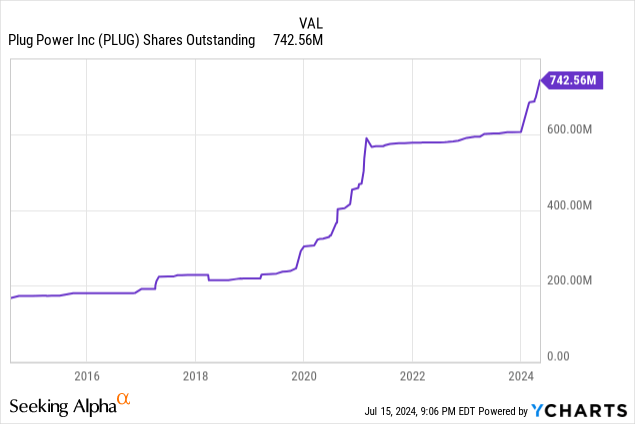

The company got a $1.7 billion conditional loan guarantee from the government, and it most likely continued to issue shares, as it has done for many years:

Over the last decade, PLUG’s share count rose by around 350%. This means that for every share in 2014, there are around 4.5 shares today — each share’s portion of the company has declined to around 22% of what it was a decade ago. When the company keeps issuing shares, it will generate some cash inflows that can be used to fund the operating cash burn. PLUG could also slow down its growth investments to save money on the capital expenditures part of the cash flow picture, although this would slow down its business growth and may turn off growth-focused investors. No matter what, the cash flow picture is pretty bad, and PLUG does not have the balance sheet flexibility it had a couple of years ago — at the end of 2021, Plug Power had almost $4 billion of cash, but that has all but vanished.

Plug Power: Q2 Outlook

The company delivered pretty bad results during the most recent quarter, Q1 2024, with revenue declining by a massive 43% year over year, and with earnings per share coming in at a negative $0.46 — annualized, that’s more than half of the current share price. On top of that, Plug Power missed estimates widely on both lines.

PLUG will report its Q2 results a couple of weeks from now, so let’s take a look at what investors can expect from the company’s upcoming quarterly numbers.

Analysts are currently predicting that the company will report a little less than $190 million in revenue, which would be down by close to 30% compared to the previous year’s quarter. The good news is that the forecasted decline is less severe compared to the first quarter, but that’s about it. The bad news is that a major top-line decline is far from great, especially for a presumed growth company. And on top of that, PLUG has a very clear history of underperforming analyst estimates — or, phrased differently, analysts have a clear tendency to overestimate PLUG. The company has missed the analyst top-line estimate during five out of the last eight quarters, with the “net miss” (accounting for misses and beats) of $17 million per quarter on average. If history is a guide, we may thus expect PLUG’s revenues to come in closer to $170 million to $175 million for the second quarter. There is, of course, no guarantee that PLUG will miss estimates again, but the historic trends suggest that there is a solid chance (or risk) of another revenue miss. It is worth noting that analysts are forecasting a significantly better top-line performance during the second half of the year. The project business can lead to lumpy revenue recognition, thus it is entirely possible that PLUG’s revenues will be better in Q3 and Q4, with full-year revenue being forecasted to be roughly flat versus 2023.

Analysts are expecting losses from the company in Q2, which is hardly a surprise. The forecasted loss per share is $0.30 for the second quarter, which would be a significant improvement versus the first quarter. Since revenues in Q2 were most likely higher compared to Q1, both according to the official analyst estimate and according to our “adjusted” estimate, operating leverage has hopefully helped PLUG in reducing its losses — but the company will have generated losses once more.

Investors should look out for management’s guidance and comments about the expected growth rate during the second half of the year — will the analyst community be right about improving business growth? Any comments about the company’s plans to fund its cash burn rate and future capital investments will also be important and could influence the stock price following the earnings release.

PLUG: Better To Stay Away

The hydrogen industry is growing, and Plug Power and its peers could benefit from political support — although that is less likely under a potential Trump administration. But despite the market’s growth, PLUG’s results continue to be weak, and the company’s fundamentals look pretty bad.

With a hefty cash burn rate and no meaningful balance sheet reserves, Plug Power is in a pretty weak financial situation. Issuing debt would likely be very costly due to the fact that PLUG is unprofitable, which makes loans risky, and since interest rates are much higher than they were a couple of years ago. Issuing equity is more likely but will result in ongoing dilution.

Today, Plug Power trades at 2.5x this year’s expected revenue. That is not a high valuation per se and might be justified if the company gets its profitability up substantially. But as long as Plug Power keeps losing money at a massive pace and as long as growth investments are only funded via massive dilution, Plug Power remains a rather unattractive investment, I believe. PLUG is forecasted to become profitable in 2027, but there is no guarantee of that — a couple of years ago, analysts also thought that PLUG would be profitable in 2024, which has clearly not come true. Between dilution, weak fundamentals, and substantial uncertainties about the future, I believe that it could be a good decision to stay on the sidelines. I am not interested in owning shares in Plug Power, despite the positive macro backdrop for the hydrogen industry.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!