Summary:

- Qualcomm’s Snapdragon chips for PCs should be a growth catalyst, opening up an entirely new segment.

- Qualcomm’s auto segment is doing exceedingly well, with about 30% growth.

- Its sustainable licensing business has margins in excess of 70%.

- Even after a 74% gain in the past year, the stock is still attractive, with a potential upside of 50% in the next two years.

Orest Lyzhechka/iStock via Getty Images

I wrote about QUALCOMM (NASDAQ:QCOM) 3 times in the past year, with the last article on 12/21/2024, reiterating a buy at $143.

Citing growth from autos, its partnership with Microsoft (MSFT) for AI PC’s and its treasure trove of patents and licenses for high margin revenue, I also made a sum of its parts valuation, estimating that Qualcomm was worth $249Bn in market cap and undervalued by 57%. At today’s price of $200, Qualcomm is close to that number with a market cap of about $222Bn. Even though I’m close to my target, I’m reiterating another buy. I strongly believe in the company and believe that the stock deserves a higher multiple on strong earnings growth and the opening up of another revenue stream from PC’s.

In this article, I want to focus on AI PCs – will Qualcomm’s Snapdragon set the market on fire, or is it just the usual hype, and will fizzle out when we realize that without the computing power of the cloud, there’s precious little AI that can be done on a desktop, laptop, or a tablet like the Surface.

I also want to update its auto pipeline, which I wrote about at length in July 2023, elaborating how the race for the auto cockpit was dominated by the three giants, Nvidia (NVDA), Qualcomm and Mobileye (MBLY), with massive pipelines in excess of $60Bn and the necessary scale and experience to thrive in one of the most difficult markets – the computer on wheels. For the level of difficulty, don’t look further than Apple’s (AAPL) $10Bn auto write off.

I’ll also update the financial forecast.

The Snapdragon Elite for PCs.

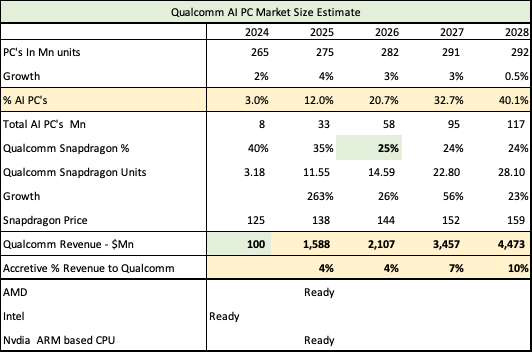

I cobbled together an estimate of possible PC revenues for Qualcomm from Gartner, Canalys and others. I believe this is a conservative forecast.

Qualcomm AI PCs (Bloomberg, IDC, The Verge, WSJ, Barrons, PC Magazine, Fountainhead, Seeking Alpha)

Assumptions:

1. PC growth rates as per IDC.

The PC market has never been a fast-growing market and as we can see above, the CAGR from 2024 to 2028 of 265Mn units to 292Mn units is just 2.5%.

According to Jitesh Ubrani, research manager with IDC’s Worldwide Mobile and Consumer Device Trackers..

Commercial buyers, both enterprise and educational, are on the cusp of a refresh cycle that begins later this year and reaches its peak in 2025.

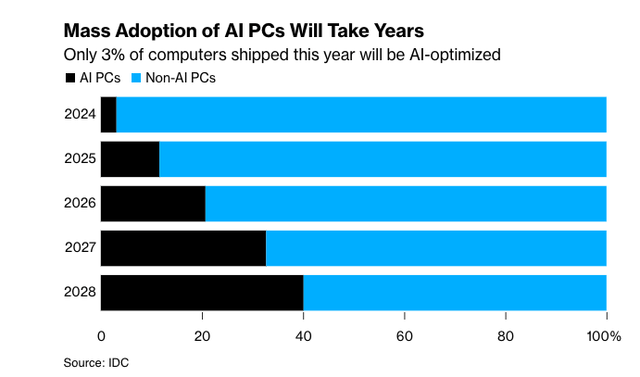

2. The percentage of AI PC’s is from a Bloomberg article, sourced from IDC as illustrated below.

I’m going with this estimate and the assertions that initially AI will be mostly co-pilot, with limited uses. I also don’t believe that there will be too many benefits derived from AI for a while, simply because a) the computing power needed to make a major difference in output and in usefulness – such as in cybersecurity, biotech, code testing, or data ingestion and analysis will only be available in the cloud. b) Personal computing AI applications and tools will take a while to develop.

I also believe from the low level of PC growth that AI PC’s will be cannibalizing regular PC purchases as total PC’s are only slated to grow from 265Mn to 292Mn a CAGR of just 2.5%.

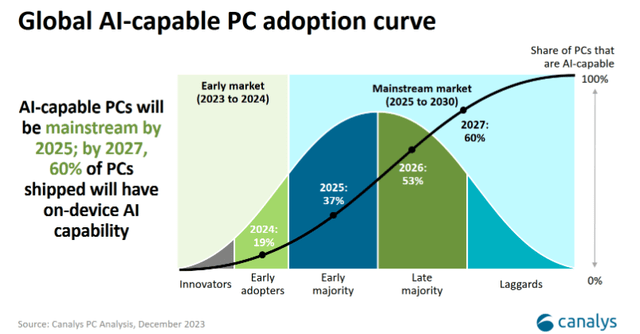

I’m including a report from Canalys, which forecasts higher rates of adoption, but I’m going to be conservative here. I’d be happy to be pleasantly surprised if Qualcomm hits it out of the park!

Global AI capable PC adoption (Canalys)

Like Canalys, there are other estimates, such as this one from Forbes, which suggests that AI PC’s are higher, and Intel alone is going ship 40Mn AI PC’s in 2024. Again, if those estimates are correct, I’d happily take them, they only augur well for Qualcomm.

3. The PC market share of Qualcomm’s Snapdragon’s Elite series is from Samik Chatterjee, an analyst at JP Morgan Chase. Based on his assumption of 25% by 2026, I estimated a higher percentage in 2024 and 2025 for Qualcomm for two reasons a) They have an exclusive with Microsoft through 2024, b) AMD (AMD) and Nvidia won’t be ready before 2025.

4. Pricing assumption of only $125 for the Snapdragon chip is also on the lower side, which I estimated assuming heavy OEM discounts and Microsoft driving a hard bargain for exclusivity. The AI PCs are priced substantially higher at retail, so this will be revised by me subsequently.

Based on these assumptions, I arrived at $400Mn in revenue for Snapdragon Elite, which I reduced to $100Mn for FY2024 because Qualcomm has a September Year end, and a) they launched in June and b) management has guided to negligible PC revenue for FY2024. But the going gets better from FY25, with estimates of $1.6Bn, growing to $2.1Bn in FY26 as AI PC’s start taking a larger share of the pie. And even as new entrants start taking share, Qualcomm continues to grow, with big inflections in 2027 and 2028.

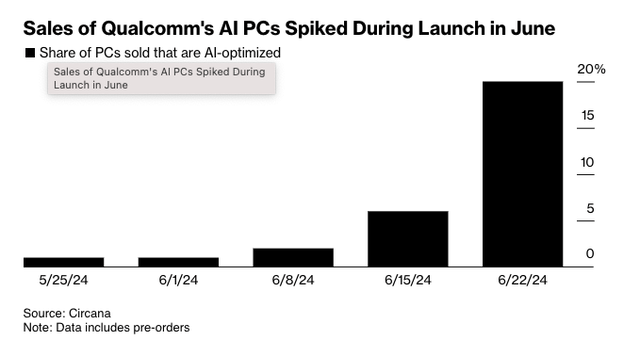

Qualcomm’s PC adoption (Circana)

That’s a 20% spike in the last week of the launch, indicating that demand should be good. These numbers look good for Qualcomm, and again I may have been conservative with only $400Mn in PC revenue for 2024.

In terms of competition, Snapdragon compares well in performance with Intel (INTC), AMD and Apple.

Battery and price should be key to Qualcomm’s success in penetrating and expanding this segment. From the verge article.

Better performance and longer battery life for less money are going to be the major selling points for most people — and these Snapdragon Copilot Plus PCs hit all three.

Regardless of the accuracy of the estimates, which will get better over time, the crucial and critical factor for Qualcomm is they have created an entirely new business segment – a segment they could not penetrate even after trying for a decade. And because this is business segment cannibalized from regular PC growth, the real story is that new entrant Qualcomm has a much larger benefit than AMD and Intel, who are replacing existing PCs with AI ones – the overall PC market is mostly stagnant with just 2-3% growth.

And as the Verge article states, this can only grow from here with more Apps and usage.

And now that every major Windows laptop manufacturer has at least one Snapdragon X-based machine, there should finally be enough of an install base to entice developers at large to create native Arm64 versions of their apps, which will make these an easier sell.

In two years, even with these low-ball estimates, PC’s can be accretive to about 7% of total Qualcomm revenues and help make up for the loss of 80% of Apple’s modem business from FY2027.

Qualcomm Revenue Segments (Qualcomm, Seeking Alpha, Fountainhead)

Here are the estimates of Qualcomm’s revenue segments from FY2024-2026. I may be conservative for the phones business as well, especially with iPhones bouncing back with iPhone 16 shipments expected to be over 90Mn, higher than the 80-84 Mn estimated earlier, and Qualcomm likely getting better prices for its new N-3 chips for its Android devices.

While PCs are the smallest segment now, it’s growing the fastest, it will be over 4% in FY2026 and even higher in FY2027 when Apple’s modem business goes down by 80%.

Qualcomm’s Auto Segment

The auto story, which I wrote about in detail in July 2023 projected Qualcomm’s pipeline at $30Bn. It continues to do extremely well, with the pipeline having grown to $45Bn. The auto segment grew 33% in 1H of FY2024 and is slated to grow 28% for the full year. Qualcomm continues to ramp up design wins all over, including in China.

Qualcomm Auto Pipeline (Qualcomm)

Summarizing from the same previous article, the crucial factors in auto-tech are

- Scale, experience, and production, which is really something Qualcomm excels at.

- Qualcomm wants to be your “Digital Chassis”, building a services platform at scale, using its production experience in phones as its foundation.

- Connectivity is Qualcomm’s key strength and a big reason for its success in ADAS (Advanced Driver Assistance Systems).

- Qualcomm could take market share being more flexible and building heterogeneous SoC’s the way they did in phones and IoT.

Auto-tech is one of the most difficult markets to excel in, it is fragmented and constantly evolving between technology and the traditional assembly line. Projects take years from blueprint to production, and Qualcomm has threaded this needle exceedingly well. With these reasons I can see the big four, Qualcomm, Nvidia, Mobileye and Tesla (TSLA) consolidating market share and getting stronger as weaker players get weeded out or absorbed.

Challenges

Challenges remain, and one of the biggest threats could be the loss of the handset business. Besides the iPhone, Qualcomm’s biggest customers are Android phone makers like the giant Samsung Electronics (OTCPK:SSNLF) with a market cap of $407Bn and revenues of $230Bn; it has the tech expertise to make chips for its own phones. Qualcomm has to constantly look over its shoulder.

Qualcomm’s IoT business is lower by 20% in the first six months of FY2024, with excess inventory still being cleared out. This could take longer to recover. The high margin (over 70%) licensing business is stagnant this year with no growth. These two are a drag on overall revenues.

And even as I take very conservative estimates for the AI PC business, this is still a Show Me story with a lot of sharks like Intel, AMD, and Nvidia jumping in the mix.

Reiterating Buy

Qualcomm Valuation (Qualcomm, Seeking Alpha, Fountainhead)

I’ve revised the model including the PC business, the numbers are upbeat.

I estimate revenues growing 13% and 9% in FY25 and FY26 respectively, with the fast-growing auto and PC segments as the main catalysts. Earnings growth is even more appealing. Qualcomm is a high operating margin business with a lot of leverage, especially helped by the licensing segment, with over 70% in operating margins. Earnings grow much faster at 55%, 20% and 14% in FY24 – FY26. At $200, Qualcomm is very reasonably priced at 20x current year earnings and a strong bargain at just 15x FY26 earnings of $13.60. Given its market leadership in auto-tech, AI PC’s, and sustainable, and recurring high margin licensing business, Qualcomm should be priced at least 22x earnings. It spends a good 25% of revenues in R&D, which will enable it to continue innovating and growing. Even after that it still returned $1.6Bn to shareholders with $0.7Bn in share buybacks and $0.9Bn in dividends. At 22x 13.6 FY2026 earnings the stock has the potential to reach $300 in two years, that’s a strong 50% return on investment in two years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of QCOM, NVDA, AMD, MSFT, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.