Summary:

- Texas Instruments stock price has jumped due to the AI boom, but revenue projections show a decrease in sales and inventory levels are rising.

- Company’s heavy reliance on analog chips for revenue, overvaluation by forward P/E, and inventory build-up make it a risky investment at current prices.

- Despite potential in analog AI chips, challenges like declining revenue, high inventory, and inflated valuation make Texas Instruments a strong sell.

Serhej Calka/iStock via Getty Images

Investment Thesis

Since the beginning of this year, Texas Instruments (NASDAQ:TXN) stock price has increased by roughly 21%. I believe this has largely been driven by the AI boom. Unfortunately, I think reality paints a very different picture.

My first concern is Texas Instruments’ reliance on analog chips to generate revenue. While analog chips are important for multiple applications, they do not benefit as significantly from AI advancements as other semiconductor segments (they play a key role but are much less important than GPUs and more commoditized). These chips are used for power management, signal processing, and interfacing with digital systems, but are unable to supply most of the core computational power needed for AI applications.

Despite this increase in stock price mentioned above, revenue projections show a decrease compared to the previous year. Looking forward, the company’s revenue estimates ending in December 2024 show a decrease of 9.97% year over year. With this, the company’s balance sheet data shows an uptick in inventory levels, meaning that an increasing level of the company’s capital could be stuck in unsold goods. With this decline in revenue and Texas Instruments’ inventory increase, I’m concerned shares are pricing in an outcome that is just not supported by street estimates and company growth potentials.

To this point, their valuation appears stretched. With the declining revenue and earnings projections I mentioned above, Texas Instruments’ valuation indicates the market has really high confidence in their future, leading me to believe they are overvalued. Their forward P/E non-GAAP ratio and their forward PEG Non-GAAP ratio are far above the sector median. To me, this indicates that the market is not pricing in many of the concerns I listed above, only bullish scenarios.

Given Texas Instruments’ decreasing revenue, their overvaluation, and heavy reliance on analog chips, I think this makes the company a risky investment at these prices. Their chips play a key role, just not one that sets the company up well with these valuation numbers in my opinion. With this, I believe Texas Instruments is a strong sell.

Background

Texas Instruments was founded in 1930 and has been a leader in the semiconductor industry, known for their large collection of analog and embedded processing products. Since their founding, the company has supplied technology that has been used in a wide range of applications including communications equipment, automotive, personal electronics, industrial, and enterprise systems. One example of their technology being used in the automotive sector is Texas Instruments teaming up with Delta electronics to work on onboarding charging and power technology.

As I mentioned above, Texas Instruments’ primary business revolves around analog chips, which consist of a mini collection of circuits combined into one semiconductor chip. These chips are essential for converting real-world signals such as sound, temperature, and pressure into digital data that electronic devices can process this information.

Within the AI sector, analog chips are mainly used in edge computing devices. These chips enable these devices to quickly and locally process information. In addition to increasing device operation speed, analog chips also consume a minimal amount of power (power consumption is becoming a major issue in the AI industry).

While analog chips are used in the AI sector, they do not contribute as significantly to AI solutions compared to the likes of AI CPUs and GPUs by companies like Nvidia (NVDA) and Advanced Micro Devices (AMD). Digital chips and processors handle the heavy computational tasks associated with AI, analog chips play more of a supporting role by managing power consumption and interfacing with sensors and other input devices (this is far more commoditized). On top of this, analog signals are vulnerable to generation loss, noise, and distortion. Analog signals are also usually lower quality when compared to digital signals.

Inventory Buildup

I believe Texas Instruments’ business model is over-reliant on their analog chips when trying to play the AI market, which is becoming a major challenge faced by the company given their growing inventory. Recent reports point toward a $1 billion+ build-up in Texas Instruments’ inventory. This inventory accumulation is potentially problematic as I believe it ties up capital in unsold goods, impacting the company’s liquidity and financial flexibility.

According to the latest balance sheet data, the company’s inventory levels have been on an upward trend. The company’s inventory rose from $2.757 billion at the end of 2022 to $4.083 billion by the end of March 2024.

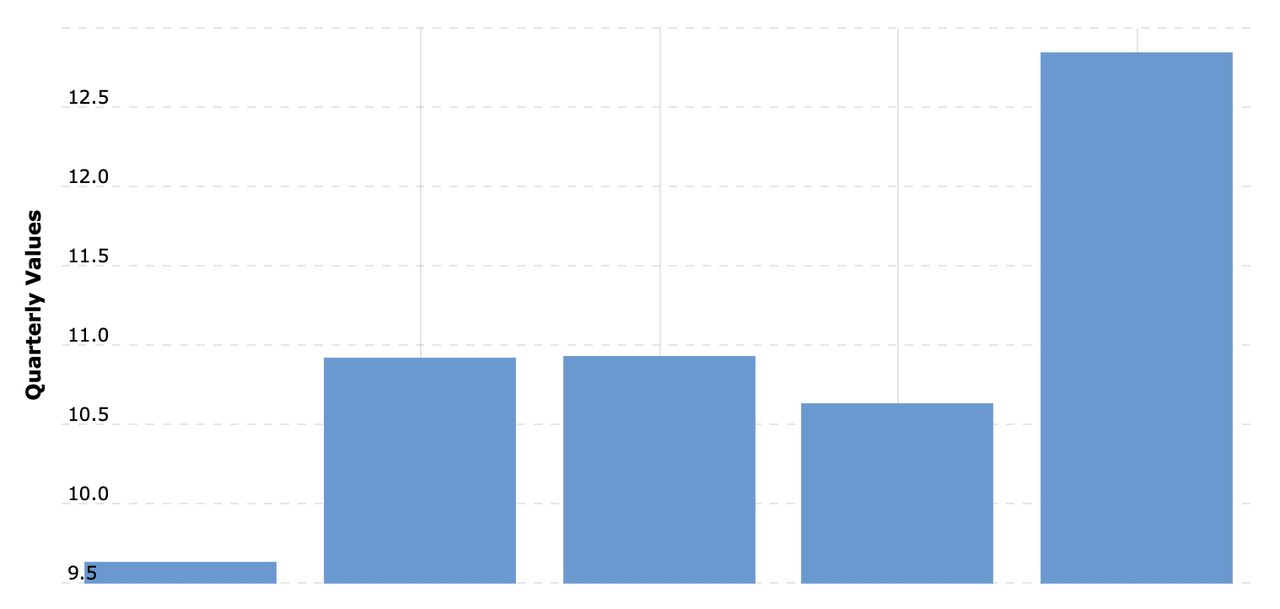

I think it is especially important that Texas Instruments should be using this capital for reducing debt, considering the company’s long-term debt has been increasing. Below is a chart of their long-term debt over the last year (April 2023- April 2024). The company’s debt is up around 33% over the last 12 months.

Texas Instruments Debt Load (Macrotrends)

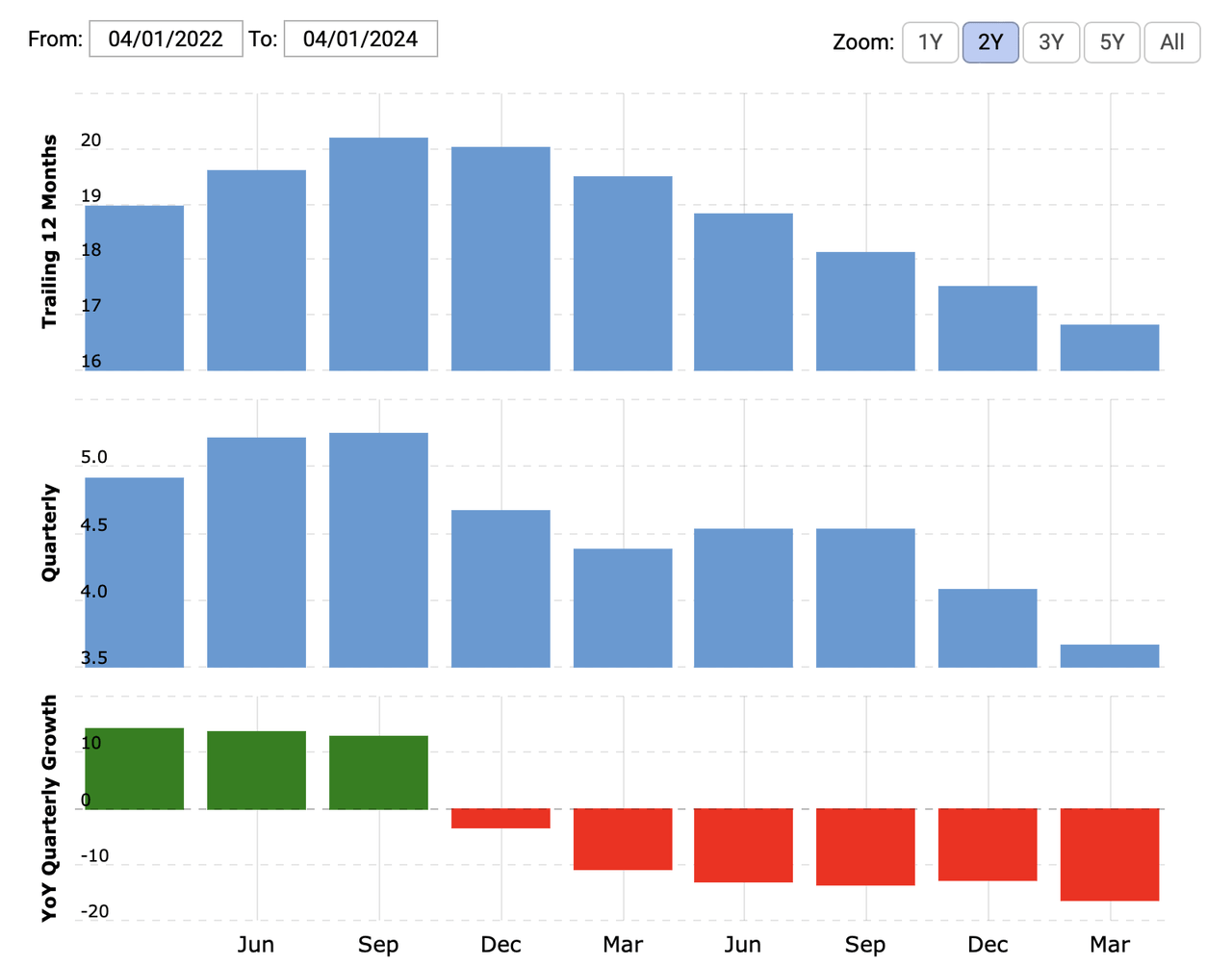

I believe one of the biggest drivers of this is their revenue growth trends. The increase at the end of the most recent fiscal year (FY 2023) tells me they might have overestimated inventory going into the end of the year. The chart below shows Texas Instruments’ revenue growth over the past 2 years. I think it’s telling:

Texas Instruments Revenue Performance (Macrotrends)

Looking at the trailing YoY revenue growth by quarter, the company hit a two-year low (bar furthest to right) of revenue growth in Q1, with revenue dropping to $16.801 billion in March of 2024, compared to the revenue high (3rd bar from left) of $20.19 billion in September of 2022 (the peak).

Valuation

Despite what I believe to be a growth problem, Texas Instruments is currently strongly valued by market participants (investors). I believe these are overly optimistic market expectations. As demonstrated above in the revenue chart, revenue has been on the decline, looking forward this seems to be the case. Not only is revenue expected to decrease, but so is the company’s EPS. After the 25+% decrease in EPS projected this year, the EPS is expected to increase 25.59% next year. This means that after 2 years, EPS levels will still not be at the FY 2023 EPS levels (due to the base effect, EPS would have to grow ~33% in 2025 to get back to 2023 levels). These EPS levels will likely be reached at some point in 2026, so we are talking about an almost 3-year earnings trough.

Looking forward to December of this year, revenue projections estimate a 9.97% year-over-year decrease, dropping to $15.77 billion. Like I mentioned before, the company’s EPS projections follow the same trend, with an EPS decrease of 25.84% to $5.21/share by December.

Despite this, their valuation demonstrates what I believe to be strong market confidence, which, I believe, is unwarranted. The company’s forward Non-GAAP P/E ratio is 38.72, 54.55% above the sector median. Other metrics seem to be inflated as well. For example, their forward Non-GAAP PEG ratio is 15.50, 669.35% above the sector median.

I believe this overvaluation indicates that the market is not pricing in bearish events. I think considering their increasing inventory, this is a bad set up. With this, if shares were to converge to the sector median of the forward Non-GAAP P/E ratio, this would represent a 35.3% downside.

Bull Thesis

Despite the challenges facing Texas Instruments, the main compelling bull thesis is centered around the potential of analog AI chips and the company’s strong positioning in the analog market.

My main reason for the bearish outlook on Texas Instruments is the over optimism of cases for Analog chips within the AI sector. However, there is still the potential for some analog chips to gain traction. For example, during Texas Instruments’ session at the Bernstein’s 40th Annual Strategic Decisions Conference, when asked about how much revenue Lehi will support at full capacity, CEO Haviv Ilan stated:

So, I think it’s close to $4 billion, which is aligned, and it depends on the mix. It’s going to start with the embedded and later on had what we call high-speed mixed signal of analog. And this is what we do right now. So, 45- nanometer this year and next year is analog. So, when we complete that, more than $4 billion of revenue support, it’s a very nice fall-through – Conference Transcript.

On this note, the total addressable market (worldwide) for analog chips is expected to hit $77.90 billion by the end of this year. The annual growth rate CAGR from 2024 to 2029 is roughly 10.08%, leading to a projected TAM of $125.90 billion by 2029. Being a leading company in the analog market, Texas Instruments has the opportunity to benefit heavily from this in the long run.

Analog chips are by no doubt a significant source of revenue for the company. With this, certain high speed analog chips definitely have a place in the AI market in the future. The problem is that I solely think the issue here is a large mismatch between market analog expectations and what I believe to be reality.

Takeaway

Texas Instruments has played a large role in the semiconductor industry, with the potential to maintain a substantial portion of the large Total Addressable Market of analog chips as they become more relevant in the AI sphere. Even despite their strengths, the company still faces significant challenges such as declining revenue growth, inventory levels, and an inflated valuation.

While there is long-term potential for analog AI chips and Texas Instruments’ market positioning is promising, the current stock price appears overvalued. Given these factors, I believe Texas Instruments shares are just too high, making the stock a strong sell in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Noah Cox (account author) is the managing partner of Noah’s Arc Capital Management. His views in this article are not necessarily reflective of the firms. Nothing contained in this note is intended as investment advice. It is solely for informational purposes. Invest at your own risk.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.