Summary:

- AMD stock has underperformed S&P 500 since my last ‘Sell’ recommendation. Now I upgrade to ‘Buy’ with a $195 fair value.

- Strong data center growth, weak gaming, and embedded segments.

- Acquisition of Silo AI is positive for growth strategy; estimated 10% revenue growth in FY24.

JHVEPhoto

I called out to cash out Advanced Micro Devices’ (NASDAQ:AMD) stock in my previous article published in February 2024, expressing concerns about the over-optimism regarding the company’s growth potential and high stock valuation. Since the publication, its stock price has only increased by 1.5%, significantly underperforming the S&P 500 index, which returned 14.8%. I think the market sentiments have now cooled down and the acquisition of Silo AI is quite positive for AMD’s growth strategy. I upgrade AMD to ‘Buy’ with a fair value of $195 per share.

Strong Data Center Growth; Weak Gaming and Embedded

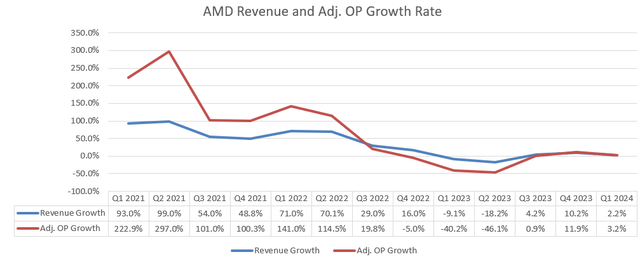

In Q1 FY24, AMD delivered 2.2% growth in revenue and 3.2% growth in adj. operating profits, as depicted in the chart below. The company presented strong growth in data center, a recovery of the PC market, and sluggish growth in gaming and inventory destocking in embedded.

My biggest takeaway from the earnings is its strong growth momentum in data center, with MI300 surpassing $1 billion in cumulative revenue since the launch in Q4 FY23. In addition, its next-generation Turin EPYC processor is on track to launch later this year. As reported by Tom’s Hardware, the 3nm chips mark the debut of AMD’s Zen 5 architecture for data center chips, potentially being 5.4x faster than Intel’s competing current-gen Xeon chips in key AI workloads.

AMD’s data center business generated $2.3 billion in revenue in Q1 FY24, growing 80% year-over-year. It is worth noting that data center accounts for more than 42% of total revenue currently. I anticipate AMD’s data centre business will continue its growth momentum in the near future for the following reasons:

- With its MI300 product launch, AMD has been more engaged with cloud computing and enterprise customers. In other words, AMD has been expanding its total addressable market and customer base with innovative product pipelines. With the new Turin processor launching later this year, I believe AMD could further engage more cloud and enterprise customers.

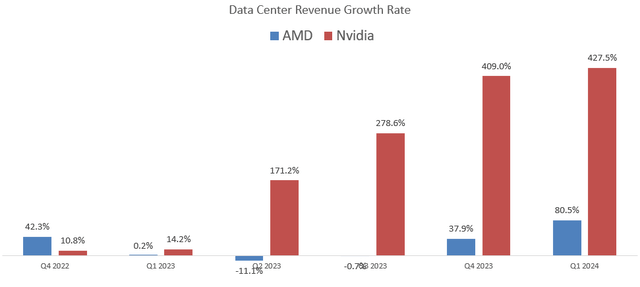

- Nvidia (NVDA) continued its strong growth momentum in data centers, delivering 427% year-over-year growth in Q1 FY25. During the earnings call, Nvidia’s management expressed strong optimism about the data center growth propelled by AI training and inference workloads. Nvidia’s positive view on data center spending provides me with strong confidence in AI demands.

- As disclosed in a recent conference, AMD plans to introduce MI325 later this year, powered by 288 gigabyte HBM3E memory. Then AMD is going to introduce MI350 next year, based on the new architecture of CDNA 4. In my view, AMD has a strong AI product pipeline in the coming years, contributing to the company’s strong growth.

FY24 Outlook

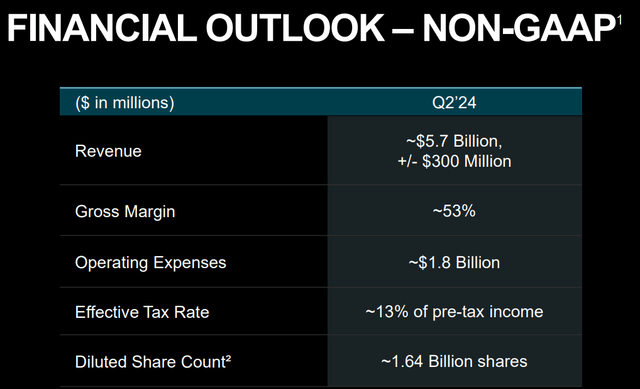

AMD guides for 6% year-over-year growth in Q2 FY24. Due to the visibility of its backlog, I don’t expect its actual Q2 result to significantly deviate from its guidance.

I am considering the following factors for its FY24’s growth:

- As discussed, I anticipate AMD’s data center business will continue its growth momentum in the near future, as AMD’s MI300 productions continue to ramp up. Additionally, AMD has expanded its relationship with key cloud hyperscalers including Microsoft (MSFT), Oracle (ORCL) as well as Meta (META), as highlighted over the earnings call. As such, I assume AMD can grow its data center revenue by 90% in FY24.

- For the Client segment, AMD’s revenue surged by 85% year-over-year due to weak comparables in Q1 FY23. I anticipate AMD’s Client business will grow by more than 80% in Q2, then start to moderate to the market growth.

- Both gaming and embedded business are in the downturn of the cycle. AMD launched its Radeon RX 7900 CGR desktop graphics card during the quarter to strengthen its portfolio in the gaming industry. The embedded business is facing strong challenges in inventory destocking currently, as I pointed out in my previous coverage. I don’t anticipate that either gaming or embedded businesses will deliver any growth in the near term.

Overall, I estimate AMD will deliver 10% revenue growth in FY24, assuming 90% growth in data center, 20% growth in Client, and a 40% decline in both gaming and embedded.

Acquisition of Silo AI

AMD announced to acquire Silo AI on July 10th for $665 million. I favor the deal for the following reasons:

- Silo AI could potentially offer open-source AI software capabilities for AI training and inference on AMD compute platforms. The combination of software and hardware could strengthen AMD’s leading position in the AI field.

- The software for AI training and inference could help AMD engage more enterprise customers, offering both software architecture and GPU solutions.

- Silo AI has solid experience in AI implementation, with more than 200 successful projects. The company has successfully applied its AI technology in various industries, including pharmaceuticals, and traditional manufacturing.

Valuation Updates

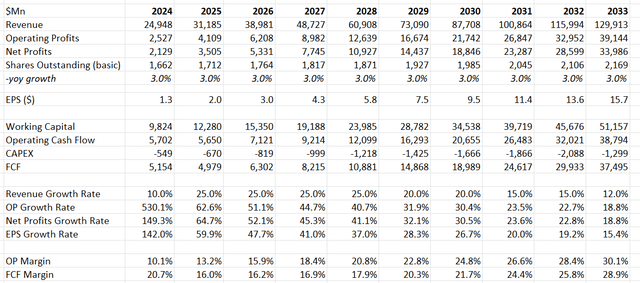

As AMD’s data center business is growing at a much faster rate than its other businesses, I estimate that data center will represent more than 60% of AMD’s total revenues in the near future. GMI predicts that data center GPU will grow at a CAGR of 28.5% from 2024 to 2032.

Assuming AMD will grow in line with the market growth, the data center business could potentially contribute 18% to the topline growth from FY25 onwards. For AMD’s other business lines, including Client, Gaming and Embedded, I assume these businesses will grow in line with the overall semiconductor industry growth.

As such, I calculate that AMD will grow its revenue by 25% from FY25. In the model, I project the growth rate gradually moderates to the industry growth, reaching 12% in FY33.

I anticipate the margin expansion will come from the gross profit and R&D leverage, as well as reducing amortization of acquisitions. Assuming 150bps expansion from amortization, 50bps leverage from gross profits and 5-10bps from R&D, I calculate AMD’s operating margin will reach 30.1% by FY33.

AMD DCF – Author’s Calculations

The WACC is calculated to be 12.6% assuming: risk-free rate 4.2% ((US 10Y Treasury Yield)); beta 1.81 ((Seeking Alpha)); equity risk premium 5%; debt balance $4.8 billion; equity $55.8 billion; tax rate 13%.

Discounting all the future FCF, the fair value is calculated to be $190 per share, as per my estimates.

Key Risks

The biggest risk for AMD is its powerful competitor: Nvidia. As illustrated in the chart below, AMD’s growth rate in the data center business has been lagging behind Nvidia. As Nvidia possesses the first-move advantage, Nvidia has established more partnerships with both cloud and enterprise customers. Additionally, Nvidia is poised well to share the AI growth with its ecosystem including servers, memories and AI software vendors.

AMD and Nvidia Quarterly Earnings

From the competition’s perspective, AMD has to continue investing heavily in its GPU products, and the company is playing a catching up game.

Conclusions

I favor AMD’s strong product pipeline in the data center market, with MI325 and MI350 coming in the near future. Data center will account for more than 60% of AMD’s total business in the near future, as per my estimates. I upgrade AMD to ‘Buy’ with a fair value of $190 per share.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.