Summary:

- Amazon.com, Inc. stock is up 28% on a year-to-date basis and 44% on a 12-month basis, yet it’s still a bargain.

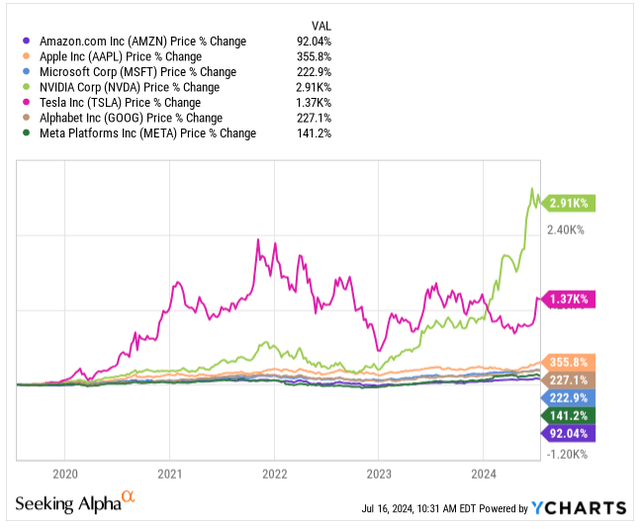

- Zooming out, Amazon has lagged in performance to all of its Mag 7 peers significantly in the past 5 years.

- Amazon’s transition from a pure growth play to a more mature company with meaningful margin expansion has strengthened investors’ confidence.

- The reignited AWS growth fueled by integration of AI applications and the Advertising segment is expected to drive growth in the years to come.

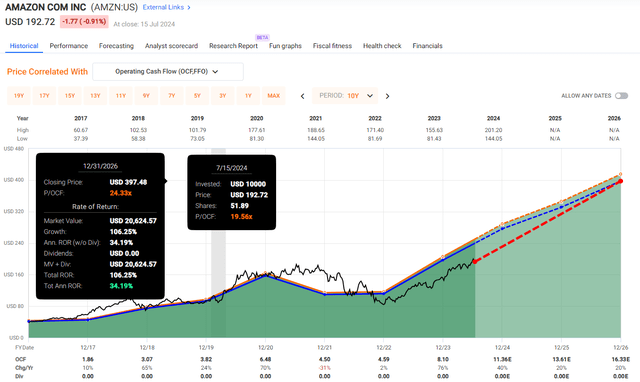

- I see Amazon as one of the best stocks money can buy in the mega cap space, thanks to a 25% discount to its historical OCF valuation.

Julie Clopper

Back in December 2023, I set a 2024 price target for Amazon.com, Inc. (NASDAQ:AMZN) shares to hit $220. This was challenged by many fellow investors, saying that I am too optimistic about the company’s prospects following a period of stellar price appreciation after the 2022 slump.

Indeed, the stock is up 28% on a year-to-date basis, and 44% on a 12-month basis, rewarding shareholders (including myself) handsomely.

Yet, if you zoom out and look at the performance of the past 5 years, the stock is up “only” 92%, significantly trailing all other Mag 7 companies.

Naturally, the lag in the stock performance compared to its peers is not a standalone reason to buy the shares, but it’s a perspective to consider.

Price Appreciation (Seeking Alpha)

Today, I am sitting on 50%+ gains with my Amazon shares. Instead of waiting on a major pullback to deploy the dry powder, I am continuing to accumulate shares at today’s prices as the company trades at 19.6x its blended P/OCF, well below the 10-year average of 24.3x.

In fact, I see Amazon as one of the best deals out there in the mega-cap space thanks to their revived AWS growth fueled by highly welcome AI applications, unrivaled leadership in e-commerce, and accelerating growth of the advertising unit.

With Amazon’s transition from a pure growth play to a more mature company with meaningful margin expansion, I still rate the company as a STRONG BUY thanks to expected strong OCF growth and low valuation.

Business Update

This year has so far been a successful one for Amazon. Following the Q1 earnings in April, where the company reported a 13% increase in Net Sales, reaching $143.3B compared with $127.4B, the stock price has been defying gravity.

No surprise, each of the core segments has reported double-digit growth with AWS stealing the spotlight with re-accelerating growth, from its already overall large base:

- North America segment sales increased 12% YoY, reaching $86.3B.

- International segment grew 10% YoY, reaching $31.9B, slowed down by 1% negative impact driven by inferior FX.

- AWS segment rocketed 17% YoY, reaching $25B, compared to 13% growth last quarter and 16% a year ago.

Altogether, Amazon brought in a record-breaking $15.3B of operating income in Q1 compared to only $4.8B the year prior and beating the $12B guidance.

If you still question what is the reason, behind Amazon’s stock appreciation, consider that Amazon Web Services (“AWS”), growing at 17%, is alone responsible for $9.4B of the operating income, accounting for 61% of the total.

As we speak about a company with a market cap of $2T, let that sink in.

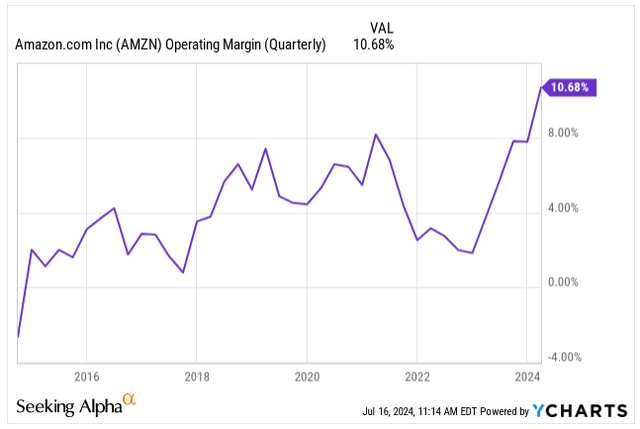

Before I delve more in-depth into AWS’s success, the margins have been the bright spot for Amazon this quarter, with Operating Margin topping 10.7% with a potential for more growth in the following quarters, further strengthening the case for a “year of efficiency.”

Operating Margin (Seeking Alpha)

All of Amazon’s segments have delivered a margin expansion in Q1, including the International segment, turning a profit once again after two difficult years of losses.

The operating cash flow, a metric I follow closely, particularly for businesses with major reinvestment back into their operations, has increased 82% to $99.1B.

Now back to the star of the show, Amazon Web Services.

Finally, the segment has re-accelerated its growth partially thanks to AI application integration, shrugging off some fears of Microsoft’s (MSFT) Azure eating its lunch. Instead of being mindful of capital spending as in 2022 and 2023, customers appear to shift back to the modernization of workloads, which should help AWS to keep growing at high double-digit rates in the following years.

While some investors question the monetization of AI applications in cloud-based services, Amazon’s commentary, similar to Microsoft’s points to customers signing longer and larger deals. This builds the case for AI data center infrastructure investments, with Amazon’s CAPEX projected to hit $14.9B this year.

As we are only in the early innings of AI integration, generative AI has the potential to bring in tens of billions of dollars to Amazon’s top line through AWS, making the segment more important than ever before.

That’s why the company is working relentlessly on new applications such as the AI-powered software development assistant Q, launching the large language model Bedrock, and acquiring AI startup Anthropic for $4B to challenge Microsoft’s supported OpenAI’s Chat-GPT with the chatbot Claude.

To ensure shareholders’ satisfaction, it’s key for Amazon to close the perception gap with Microsoft, which appears to be at the forefront of AI integration into its ecosystem.

To put AWS’s 17% Q1 growth into perspective, Microsoft Azure grew by 31% and Google (GOOGL) (GOOG) Cloud grew by 28% during the same period. Keep in mind that each is working with a different installed customer base and as AWS is the elephant in the room. I am not expecting its growth rate to come close to Microsoft’s or Google’s, but the key is to retain the majority of the market share.

However, AWS is not the only growth driver in the town.

The Advertising business has been on the rise in the last few years, in Q1 reporting 24% growth, bringing in $11.8B in sales, expected to grow at a 20%-ish rate over the coming years.

In e-commerce, Amazon continues to enjoy the place of the undisputed leader, capitalizing on the investments made in the prior years with the best-in-class customer experience. Amazon Prime, a vital part of its retail business, continues to attract customers back to its e-commerce platform regularly, creating a core advantage with loyal customers and recurring revenue for Amazon.

Even though the retail business, including the International, represents 82% of the net sales, it makes up only 39% of Operating Income.

Amazon is set to report its Q2 earnings on the 1st of August. The management has guided to deliver anywhere between $144 — 148B in Net Sales, 10% YoY at the upper end of the range, alongside $10 — 14B in Operating Income or 82% YoY growth compared to the prior year.

Thanks to the resilient US economy and once-again booming IT spending, the guidance appears to be on the more conservative side and my expectation is for Amazon to beat on both the top and bottom line.

Valuation

197x.

That’s how many times you would multiply your money if you invested in Amazon at its IPO.

An investment of $10,000 turned into $1,970,000 today. What a compounding success.

Back in 1997 when Amazon had its IPO, I was not even three years old.

Investors who were lucky enough to buy the shares anytime between 1997 and 2020 have achieved remarkable ROR, riding the success of the e-commerce and cloud provider.

These are just hard facts. I know nobody who managed to scoop Amazon’s shares before the turn of the millennia. However, I know more than enough investors who did not buy Amazon’s shares in the last 10 years, claiming the company is trading at a very high premium.

Indeed, the stock is currently trading at a blended P/E of 50.5x and has traded on average since 2004 with a P/E of 119.4x.

Very rich valuation, or is it?

Perhaps looking at the conventional P/E ratio, trying to value a company that never in its history (except for the last 24 months) cared about its profit margins and bottom-line expansion as the business prioritized reinvestment into its operations is not the right approach.

Instead, I argue to look at the Price to Operating Cash Flow or P/OCF as this valuation metric better captures the cash generation potential without having to prioritize the bottom-line growth.

Since 2017, Amazon’s shares traded on average at 24.3x its P/OCF, growing its OCF at 25.4% annually.

The company is currently priced at a blended P/OCF of 19.5x, implying a 25% discount to its historical average.

Perhaps slowing growth? Not at all.

Amazon is projected to average 26.6% annual OCF growth over the next three years:

- 2024: OCF of $11.36E, YoY growth of 40%.

- 2025: OCF of $13.61E, YoY growth of 20%.

- 2026: OCF of $16.33E, YoY growth of 20%.

With further potential to grow OCF 15% — 20% for the remainder of the decade.

In my view, there is no reason why Amazon should trade at a depressed valuation thanks to the US economy being in good form and continuing enterprise investments into modernizing workload, benefiting AWS.

I am expecting Amazon to be one of my top-performing stocks over the coming years, with a potential for 34% annual ROR as the valuation reverts towards its historical mean.

Takeaway

In summary, Amazon presents one of the best value buys among the mega caps, trading discounted to its historical valuation, without signs of slowing growth.

The US economy is firing on all cylinders, without any major recessionary warnings, with further enterprise spending, propelling Amazon’s key engine, AWS further.

I am continuously building my stake in Amazon, even though I am sitting on 50%+ gains. I see up to 34% annualized upside over the next three years, thanks to meaningful margin expansion, AWS accelerating growth, e-commerce undisputed leadership, and advertising becoming another key contributing area to the bottom-line.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.