Summary:

- Transocean’s financial performance has improved, with revenue up 17.6% and its net loss turning into a gain of $98 million.

- Backlog has declined slightly, but recent contract wins and high spot rates for offshore rigs bode well for the company.

- Management has made moves to improve the debt picture, including buying back high-interest notes and issuing new debt at lower rates.

- But until backlog starts to rise again, it’s too early to turn bullish.

MarkusBeck

The last couple of months have not been particularly pleasant for oil rig owner Transocean (NYSE:RIG). Back in late March of last year, I wrote an article about the company wherein I rated it a “hold.” At the time, I mentioned that the picture for the business was looking up. Average revenue per day was growing, and the net debt picture for the company had improved ever so slightly. Backlog was, admittedly, starting to fall. But because of how cheap shares were and the longer-term outlook for demand in its space, I felt as though the picture no longer looked bad.

Because of the falling backlog, I believed that it was too early to become bullish on the stock. And sure enough, shares have plummeted, dropping 18.2% since then. That’s far worse than the 4.7% increase seen by the S&P 500 over the same window of time. Since then, some additional data regarding the company has come out. Financial performance for the business is improving and shares are looking quite cheap. Unfortunately, backlog is still declining. But because of how small the most recent decline was and because of some contract wins that the company has gotten under its belt, my optimism has improved slightly. I wouldn’t go so far as to upgrade the stock just yet. But I don’t think we are terribly far off from that point.

The picture is getting better

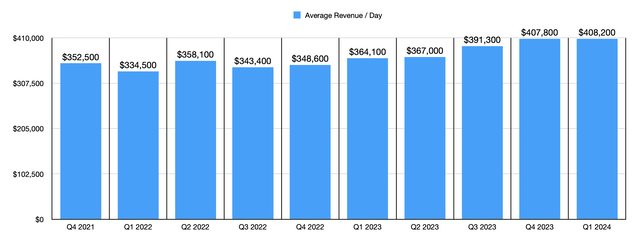

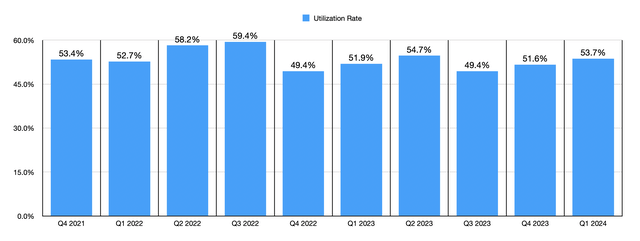

Given the time that has passed since my last article on Transocean, we have only seen data come out covering one additional quarter. Almost across the board, however, the data that did come out has been positive. Revenue for the first quarter of the 2024 fiscal year was a robust $763 million. That’s 17.6% above the $649 million reported just one year earlier. There were a couple of drivers behind this sales increase. For starters, the number of operating days grew from 1,750 to 1,785 while the firm’s rig utilization rate expanded from 51.9% to 53.7%. A big driver of the increase in sales, however, came from a surge in the company’s average daily revenue per rig from $364,100 to $408,200.

Author – SEC EDGAR Data

All combined, about $80 million of the firm’s revenue increase came from the higher average daily rate that was charged to customers. However, the company did also benefit to the tune of $35 million from increased activity of one of its harsh environment floaters by the name of Transocean Norge. Operations of its new build ultra-deep water floater, the Deepwater Titan, that was placed into service in May of 2023 added $25 million to the firm’s sales increase. And another $10 million was attributable to an increase in reimbursement revenue. There were some offsetting factors like a reduction in revenue efficiency and a decline seen as a result of the firm’s sale of one of its harsh environment floaters. But on the whole, the good outweighed the bad.

Author – SEC EDGAR Data

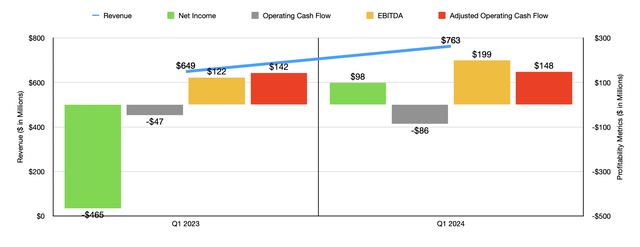

The firm’s bottom line improved remarkably as well. In the first quarter of 2023, the company reported a net loss of $465 million. The same time this year, it boasted a gain of $98 million. There were some negatives for the company, such as a rise in operating and maintenance expenses from $409 million to $523 million. However, the business did benefit from a drop in interest expense from $249 to $117 million. To be clear, the picture would have been worse on a relative basis than it ultimately was if it weren’t for certain anomalies. As an example, in the first quarter of this year, the company booked a loss on the disposal of assets of only $6 million. Last year, that number was $170 million. In addition to this, while last year it had to pay out $51 million in income taxes, this year it got a return of $191 million.

Author – SEC EDGAR Data

Other profitability metrics mostly improved. There was one exception, which was operating cash flow. It worsened from negative $47 million to negative $86 million. If we adjust for changes in working capital, however, we would get a slight improvement from $142 million to $148 million. And lastly, EBITDA for the company expanded from $122 million to $199 million. These improvements are most certainly nice to see, especially considering how difficult the offshore drilling market has been in prior years.

Author – SEC EDGAR Data

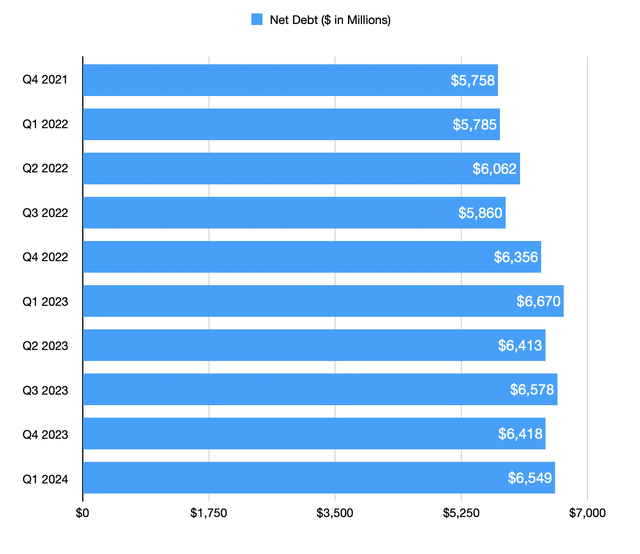

Not everything reported by management was positive. The fact of the matter is that net debt for the company totaled $6.55 billion at the end of the most recent quarter. That’s an increase of $131 million compared to the $6.42 billion reported in the final quarter of 2023. Fortunately, it’s down from the $6.67 billion reported in the first quarter of 2023. And it’s also within the range of where net debt has been from the final quarter of 2022 through the present day. Even though it’s unfortunate that we saw an increase during this time, at least we can say that the picture on this front has truly stabilized.

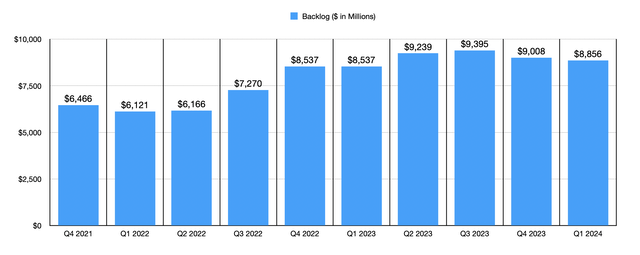

Another bittersweet data point that investors should consider is a backlog. This represents the value of all contracts throughout their expected lives. After peaking at $9.40 billion in the third quarter of 2023, the backlog took a hit, dropping to $9.01 billion just one quarter later. We will know that the company has truly gotten past the worst of things when the backlog starts to increase. However, we did see a small decline to $8.86 billion in the most recent quarter, Fortunately, that’s a drop of only 1.7%. But a decline is still a decline, nonetheless. The good news is that, since the end of the first quarter, the company has one some contracts. This included a $195 million deepwater drillship contract in April, $161 million worth of contract extensions and exercised options for harsh environment semisubmersibles that was announced in early June, and a $188 million ultra-deepwater drillship contract extension announced near the end of June. When you combine with this the fact that spot rates for offshore rigs are at a nine-year-high, the picture should certainly bode well for a firm like Transocean.

Author – SEC EDGAR Data

Even though it’s a bit dated, an article from late April of this year touched upon how, because of the increase in spot rates that we have seen, offshore drilling rig operators have even started looking at what the source calls “novel rig deals” in order to limit dayrates. Examples include the decision by some contracting parties to acquire majority ownership interests in the rigs that are leased out to them, and joint ventures between major energy companies to buy up drill ships. Although these types of maneuvers can be expensive in the near term, they can help to lock in costs for long-term projects. For its part, the management team at Transocean has taken advantage of a favorable pricing environment to sell off at least one non-core asset. This is a fifth-generation semisubmersible rig by the name of Deepwater Nautilus. It recently agreed to sell that off, as well as related assets, for $53.5 million. The firm did announce that it will book a non-cash impairment charge of between $140 million and $150 million associated with this. But considering that the rig was built 24 years ago, its overall value to the company is probably negligible.

Management is making some other interesting moves. In short, over the past couple of months, the firm has worked to change up its overall debt picture. On April 18, for instance, the company announced that it was buying back $594.9 million worth of notes that were due in 2027. They carried a hefty interest rate of 11.50% per annum. The firm did end up paying $621.7 million for these notes for a premium of $26.7 million. But the reduction in interest expense alone should amount to $68.4 million each year. At the same time, the company also bought back, at par, $249.4 million of notes that were supposed to come due next year. They carried a considerably lower interest rate of 7.25%. But even so, that’s $18.1 million in reduced interest expense.

As of the end of the most recent quarter, Transocean had cash on hand of only $716 million. And in this industry, you never want to run low on cash. Ultimately, this led the company to issue some additional debt. This included $900 million that’s supposed to come due in 2029 and another $900 million that is supposed to come due in 2031. These carry annual interest rates of 8.25% and 8.50%, respectively. Ultimately, this issuance is larger than the debt reduction that the company announced. And as a result, overall interest expense is expected to grow by roughly $64.3 million on an annualized basis. But if you strip out the debt that’s essentially being used to pay off the aforementioned note repurchases, the effective interest rate on the extra debt is about 6.72%. With other instruments with staggered maturities of between 2025 and 2041 carrying annualized interest rates of between 4% and 8.75%, with much of it near the higher end of the scale, there’s the potential to ultimately save on interest.

We don’t really know how all of the company’s capital will be deployed. We do know that management stated that any remaining net proceeds from its debt issuance will be used for other priority guaranteed notes. But it would be a bit premature to guess which ones and in what amounts. We do have acknowledgment from management that the company did decide to issue a notice of redemption for the 2025 priority guaranteed notes. These have interest rates of 4%, with an effective interest rate at this time of 6.9%. But with only $234 million in debt outstanding there, the firm will still have plenty of cash to redeem other debt securities.

Author – SEC EDGAR Data

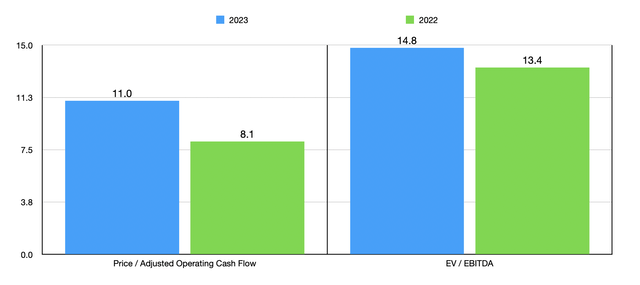

Until we have more clarity regarding these maneuvers, it makes more sense than anything to value the company just based on its historical figures. Obviously, since the 2024 fiscal year is already looking up, these numbers will likely relay a more conservative assessment of the company than what will ultimately be achieved. But as investors, it’s always better to be more conservative than liberal in assessing opportunities. In the chart above, you can see how shares of Transocean are currently priced. This is based on data from both 2022 and 2023. I wouldn’t call the company cheap at this point, especially considering that there is some uncertainty for investors to contend with. But the stock isn’t expensive either.

Takeaway

At this time, I would make the case that Transocean is showing continued signs of improvement. Recent maneuvers made by management do create some uncertainty. However, the overall outlook for the company and the industry as a whole appears to be improving. I don’t think I can consider myself bullish on the business until we see backlog start to grow. So for now, I have decided to keep it rated a “hold.” But I don’t think it will be terribly long from now until I can finally upgrade the stock to a soft “buy.”

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!