Summary:

- Comprising 5% of my portfolio, Broadcom is my portfolio’s largest holding.

- The company’s net revenue and adjusted diluted EPS surged higher in its fiscal second quarter.

- Broadcom’s debt load is manageable and further buoyed by exceptional profitability and growth prospects.

- Shares of the tech juggernaut could be priced at a 19% premium to fair value.

- Since my position in Broadcom is full, I’m content to hold here.

A view of Broadcom’s corporate headquarters.

JHVEPhoto

It’s been about 15 years since I have followed the theoretical aspects of investing. As a real-money investor, I have been putting my money where my keyboard is for almost seven years.

In that time, I have been eager to absorb as much wisdom from the investing greats as possible. In my view, former fund manager at Fidelity Investments’ Magellan Fund, Peter Lynch, belongs on the proverbial Mount Rushmore of investing legends.

Here is one of my favorite quotes that I picked up from him over my investing career:

- “All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.”

In the investment universe, few stocks embody the spirit of this quote as much as Broadcom (NASDAQ:AVGO) (NEOE:AVGO:CA). Since my initial purchase in December 2019, I am up 387% on my shares. That’s even including 25% of my position being purchased as recently as January 2023.

To my credit, I was dead on right to buy ownership stakes in this business. I was even more right to hold on to it over the years. AVGO has ascended to a 5% weighting in my portfolio, which is about 3x its weighting in the S&P 500 index (SP500). That makes it my largest holding, by approximately 2% over Amazon (AMZN).

When I initiated coverage in January, it was with a hold rating. In that time, shares of AVGO have gone on to soar 52%. That’s almost triple the 18% returns of the S&P 500 in that time.

Today, I’m going to be reiterating my hold rating on AVGO. By no means is this a slash against how the company is executing.

Last month, AVGO posted yet another double-beat in its fiscal second quarter. These results and recent big tech stock splits prompted the company to announce a 10:1 stock split that became effective yesterday. I also believe AVGO is prudently managing its debt load. Although it’s not enough to keep up with the rally in the share price, I am substantially raising my fair value estimate.

Excellent Execution And Secular Tailwinds Working In Its Favor

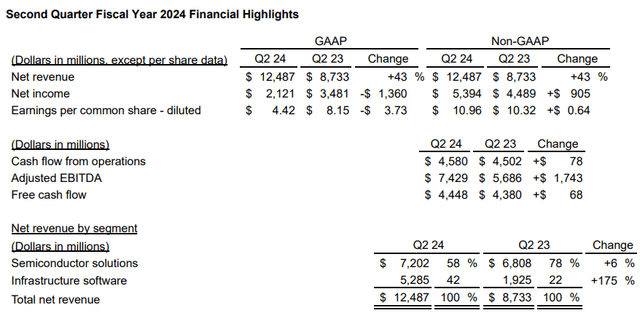

AVGO Q2 2024 Earnings Press Release

Few companies have a track record of delivering impressive earnings as consistently as AVGO. Heading into the most recent quarter, the company met or exceeded analysts’ expectations for both net revenue and adjusted diluted EPS in 16 straight quarters.

When AVGO shared its fiscal second-quarter results on June 12, it further built on this streak. The company’s net revenue soared 43% year-over-year to $12.5 billion during the quarter. That came in $480 million above Seeking Alpha’s analyst consensus. Even backing out the contributions from the VMWare acquisition that closed last November, net revenue would have grown by 12%.

AI revenue continued to be the major growth driver for AVGO. Per CEO Hock Tan’s opening remarks during the Q2 2024 Earnings Call, this revenue skyrocketed by 280% over the year-ago period to $3.1 billion in the fiscal second quarter. This more than compensated for the cyclical weakness of semiconductor revenue for the quarter.

Even for a staunch growth stock like AVGO, this pace of growth in such a short time is unprecedented. Just how impressive is this new business growth for the company?

Well, AVGO upped its AI revenue mix as a percent of Semiconductor Solutions segment revenue for FY 2024 from 25% when I last covered it to at least 35% now.

The company’s adjusted diluted EPS grew by 6.2% year-over-year to $10.96 during the fiscal second quarter ($1.096 split-adjusted). For perspective, that was $0.12 ($0.012 split-adjusted) ahead of Seeking Alpha’s analyst consensus.

The process of incorporating VMWare into the overall business weighed on profitability in the fiscal second quarter. This is why AVGO’s non-GAAP net profit margin dipped by 820 basis points to 43.2% for the quarter. Along with the higher share count, this is what led net revenue growth to outpace adjusted diluted EPS growth during the quarter.

Looking ahead, AVGO’s growth outlook remains very encouraging. The FAST Graphs analyst consensus is for adjusted diluted EPS to surge 13.2% to $4.78 in FY 2024.

In the months since the VMWare acquisition, AVGO has optimized the product SKUs from 8,000 to four core product offerings per Tan. As the higher-margin AI and software solutions businesses become a bigger part of the company’s net revenue mix, margins should recover to pre-acquisition levels. From there, incremental margin expansion is a realistic expectation in my view.

That’s why I also believe the FAST Graphs analyst consensus of adjusted diluted EPS climbing by 25.6% to $6 in FY 2025 is on point. Another 16.2% growth in adjusted diluted EPS to $6.97 is anticipated for FY 2026.

On the topline side of the equation, there’s plenty of room for AVGO to run further as well. The global semiconductor market and global software market are anticipated to grow at high-single-digit rates annually to comfortably top $1 trillion each by 2032 per Expert Market Research.

Merely maintaining market share and executing bolt-on acquisitions in these markets can support double-digit annual net revenue growth in the years to come. Combine that with share repurchases and the aforementioned margin recovery, and it’s easy to see how AVGO’s growth prospects are vigorous.

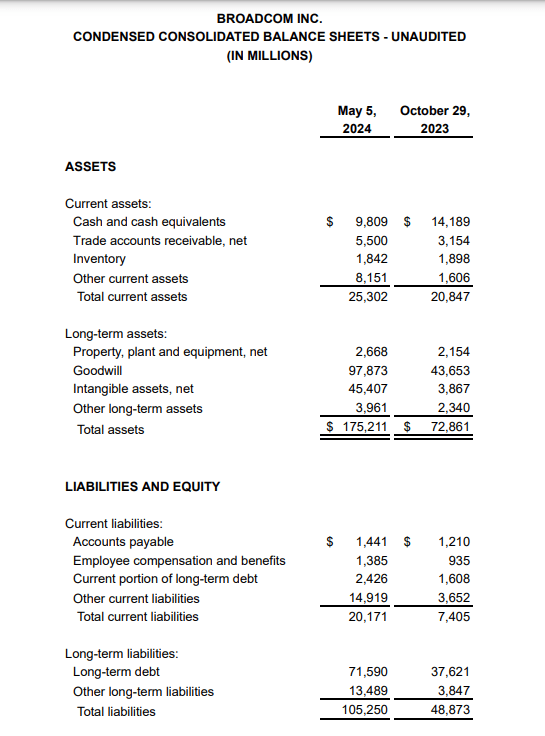

AVGO Q2 2024 Earnings Press Release

AVGO has been a master of maintaining a healthy balance sheet. The company’s net debt load as of May 5, 2024, was $64.2 billion.

AVGO is forecasting that adjusted EBITDA will amount to 61% of its $51 billion net revenue estimate for FY 2024. This equates to a net leverage ratio of 2.1, which is manageable in absolute terms.

In relative terms, AVGO’s balance sheet isn’t the most impressive in big tech. But in investing, I view debt as a tool. When a management team knows how to use it, debt can be a blessing. Given the savvy management team headed by Tan, this company has earned the benefit of the doubt. Thus, the BBB credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to AVGO’s Q2 2024 Earnings Press Release and AVGO’s Enabling AI Infrastructure Presentation).

Fair Value Could Be $140+ A Share

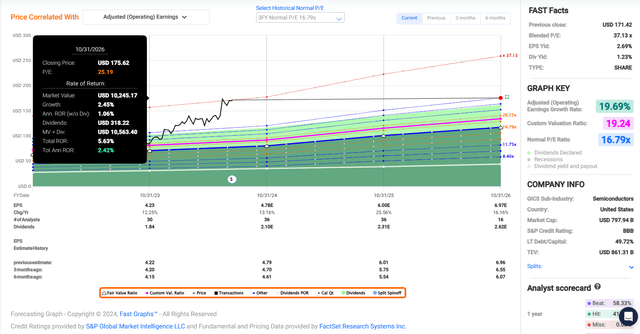

FAST Graphs, FactSet

After soaring 50%+, I do believe that shares of AVGO are overvalued. Shares are priced at a current-year P/E ratio of 35.2. That’s more than double the three-year normal P/E ratio of 16.8 per FAST Graphs.

However, I am meaningfully upping my fair value estimate at this time. I believe that a re-rating of four standard deviations above this normal valuation multiple is justified. That would be a fair value P/E ratio of 25.2.

This is because of a few points. For one, the increasing share of net revenue being derived from infrastructure software bodes well for margins. Additionally, a growing mix of AI-related revenue is another source for margin expansion in the years ahead.

Not to mention that the company’s three-year annual growth potential is nearly 20%. This is not even considering that AVGO consistently finds a way to beat analyst expectations. So, percentage growth moving forward could be just as strong as it has been in recent years.

AVGO’s current fiscal year is about 71% complete. That leaves another 29% of FY 2024 and 71% of FY 2025 to come in the next 12 months. This is how I’m weighing the FAST Graphs analyst consensus for adjusted diluted EPS to get a 12-month forward adjusted diluted EPS input of $5.60.

Applying my fair value multiple, I get a fair value of $141 a share. Relative to the $168 share price (as of July 16, 2024), this would be a 19% premium to fair value. AVGO could well beat the analyst adjusted diluted EPS consensus over the next few years. If it matches the consensus and returns to my fair value multiple, cumulative total returns through October 2026 would be 6%.

Huge Dividend Growth Is Just Getting Started

The Dividend Kings’ Zen Research Terminal

AVGO’s 1.2% forward dividend yield is below the IT sector median forward yield of 1.4%. This is why Seeking Alpha’s Quant System gives it a C grade for forward dividend yield.

AVGO shines in every other conceivable way, though. The company’s adjusted diluted EPS payout ratio is on pace to come in at around 44% for this fiscal year. That’s below the 50% that rating agencies prefer from AVGO’s industry per The Dividend Kings’ Zen Research Terminal, which leaves it with a buffer. This also explains how the company earns an A+ grade for dividend safety from the Quant System.

The company’s five-year compound annual dividend growth rate of 16% is also double the sector median of 8%. That is sufficient for an A grade from the Quant System for this metric.

The icing on the cake is that similar dividend growth can continue for the foreseeable future. The Quant System anticipates annual forward dividend growth of 13.8%, which would also be twice the sector median of 6.9%.

That would allow AVGO to extend its 13-year dividend growth streak. Compared to the 1-year sector median dividend growth streak, this is adequate for an A grade from the Quant System for consecutive years of dividend growth.

Risks To Consider

Unsurprisingly, AVGO is among my absolute favorite businesses in my portfolio. Even so, it has risks that must be weighed.

Just as I alluded to in my previous article, the biggest risk to AVGO may well be internal. CEO Hock Tan has recently pledged that he will remain the company’s CEO for at least five more years.

This buys the company time to prepare the next generation of leaders to transition beyond Mr. Tan. When it comes to Wall Street CEOs, I maintain that Mr. Tan is the best of the best. So, AVGO will certainly need all the time that it can get to find a replacement even close to par. If they can’t find a CEO resembling Mr. Tan’s immense talent, the company’s fundamentals could eventually suffer.

Another risk to AVGO is its customer concentration and geographic concentration. Through the first half of FY 2024, roughly 40% of net revenue came from its top five customers (page 33 of 68 of AVGO’s Q2 2024 10-Q Filing). If any of those customers experienced financial difficulties or switched to a competitor, that could hurt AVGO’s growth story.

A significant portion of the company’s net revenue comes outside of the United States. This opens it up to the risks of unfavorable foreign currency translation and potential trade wars. If U.S. relations with China become further strained, that could harm the company’s results and growth potential.

Finally, AVGO’s success depends on continued innovation and the ability to protect its intellectual property. If the company can’t achieve these two objectives, that could result in a loss of market share. This could also put a damper on AVGO’s growth prospects.

Summary: Broadcom Is A No-Brainer Holding For My Portfolio

I’m very glad to own AVGO in my portfolio. For me, it’s a must-own stock. It’s a proven leader in rapidly growing industries. AVGO’s use of debt is also savvy in my opinion. I’m already overweight this one by a good bit.

If I didn’t have an overweight position in AVGO, I’d probably be looking to begin adding on a pullback to $150 or below (about a 5% premium to fair value). The growth prospects would likely be ample from such a valuation to deliver healthy total returns over the next few years.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.