Summary:

- Palantir Technologies Inc. is opening up AIP to developers around the world.

- This could lead to mass adoption and thoroughly change the company’s direction, just like the Model 3 did for Tesla.

- Palantir’s AIP has the potential to tap into a $500 billion market, and current estimates do not reflect this.

John M Lund Photography Inc/DigitalVision via Getty Images

Thesis Summary

Palantir Technologies Inc. (NYSE:PLTR) stock has been making moves in the last few weeks, and I believe this might be the reason.

The company has just opened up its Artificial Intelligence Platform (AIP) to developers around the world, with some limitations, but also a lot of freedom to build on it.

This move will be incredibly significant in allowing Palantir’s AIP to reach mass adoption. Ultimately, this could have the same effect on Palantir as the Model 3 release did for Tesla, Inc. (TSLA) and the electric vehicle (“EV”) market.

In my last article, I discussed Palantir’s potential as a key government contractor, calling it the “Defense Buy Of The Century.” However, this source of revenue may pale in comparison to what Palantir can achieve if AIP receives mass adoption.

Palantir is bringing AI to the masses and if it succeeds, it will be highly rewarded, as will investors who foresee this.

The Model 3 Moment

Palantir has laid out the foundation for mass adoption of its AIP, by expanding its free developer tier. To understand the importance of this move, and how exactly it will impact Palantir’s future, we must take a walk down memory lane.

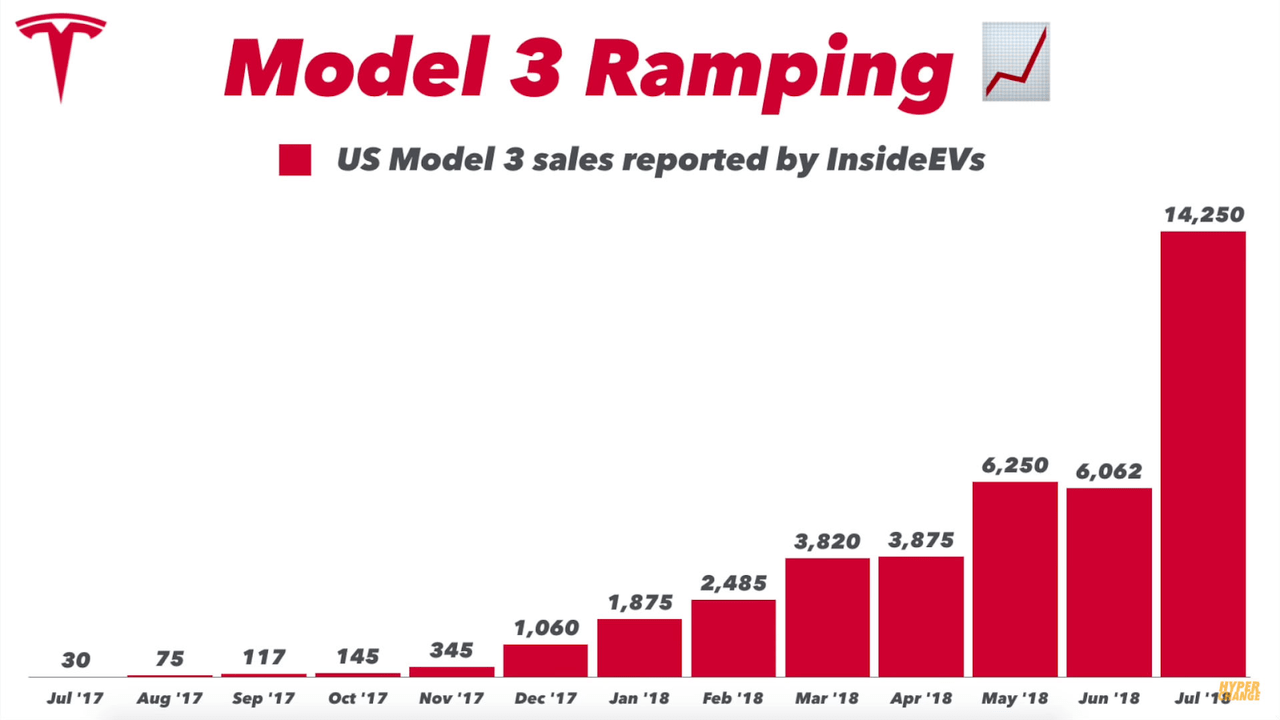

Back in July 2017, Tesla launched the Model 3, an affordable EV that was fit for everyday use.

Sales of the Model 3 skyrocketed over the following years, and it became the best-selling EV for the next three years, surpassing over 1 million cumulative sales by 2021.

This was a turning point for Tesla, which had been teetering on the edge of bankruptcy not long before.

The Model 3 became arguably the first mass-adopted EV. Tesla did two key things with the Model 3 that made a difference:

-

Made the car more affordable.

-

Made owning an EV “cool.”

The Model 3 was the best advert for itself. At its price range, it was accessible to many, and as more and more people saw the car and tried it, its value became apparent.

AIP Mass Adoption

Palantir has now made its Artificial Intelligence Platform “free” for developers. This is limited to 5 users and 60 ontologies, but it is a big step up from the previous free trial, which expired after 30 days.

To an extent, Palantir is making AIP “open-source,” allowing developers around the world to build on it.

This will create potentially limitless adoption. As more developers begin to use this tool, they will begin to see the value in it, and word of mouth will do the rest, leading to exponential growth in users.

Like Tesla’s Model 3, Palantir is opening the doors to mass adoption by reducing the barriers to entry, and this will do wonders for the company.

Ultimately, there are three key ways this benefits Palantir.

-

The aforementioned word-of-mouth marketing.

-

The increased value of the network as more developers build on it.

-

Network effects.

Allowing developers to use AIP will inherently make the platform much more valuable since they will naturally discover new use cases, and create applications and systems that Palantir itself or its large enterprise clients might not have even thought about.

In turn, this creates a network effect. As the AIP ecosystem becomes more robust and filled with useful applications, the potential appeal and benefit to any individual user increases.

Tapping A $500 billion Market

The implications here are huge for Palantir, especially if we consider just how successful AIP has already proven since its launch.

And I would say what you see both on AIP and on foundry is de facto customers using our product pretty much on their own. And that’s, again, why you see a revenue growth up to 26% compared to last year on per person revenue, because we’re making more money with the same number of people roughly.

Source: Earnings Call.

AIP is already growing organically, as its existing customers are using the platform more and more. That proves that AIP does indeed solve real-world problems, and that’s something the whole world will soon know.

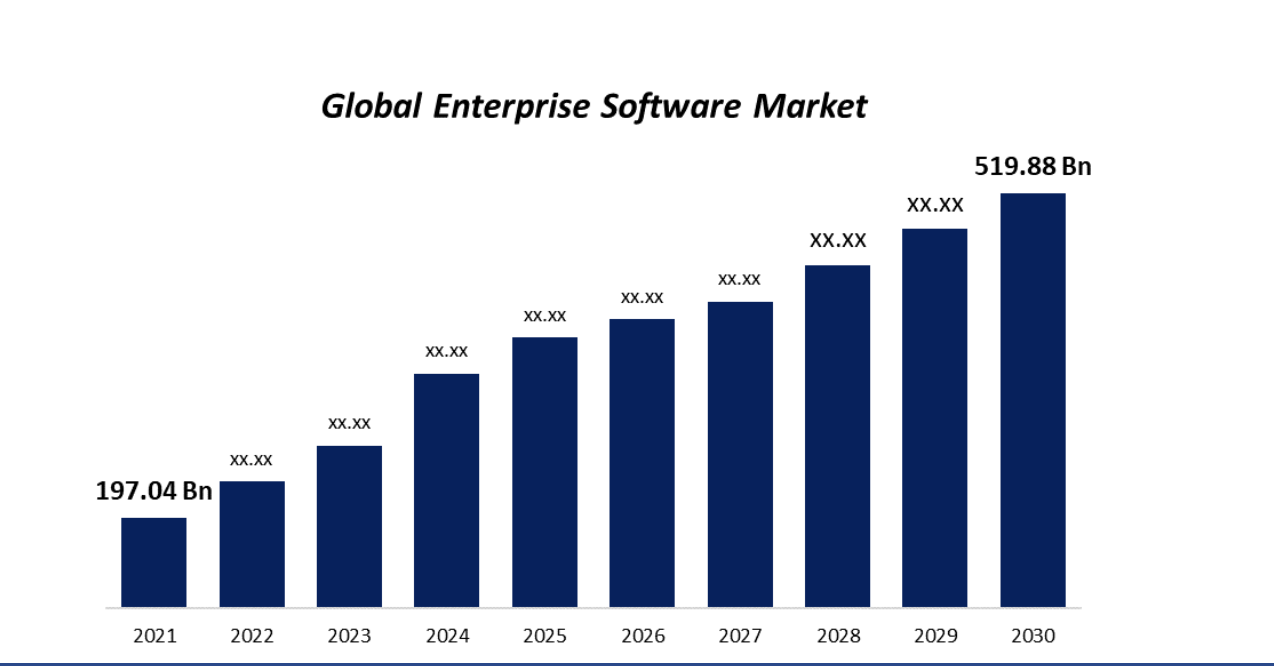

This opens up the door to a massive market for Palantir:

Global Enterprise Software Market (Spherical Insights)

Global enterprise software is expected to grow at a CAGR of 10.95%, reaching $519 billion by 2030.

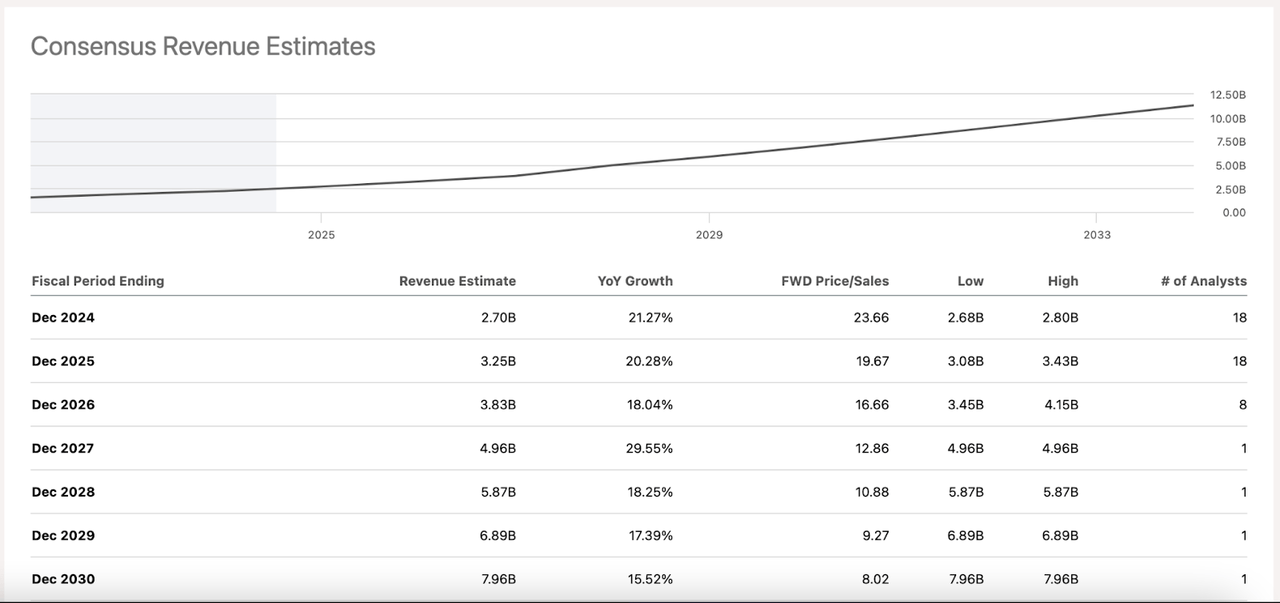

If AIP is really as revolutionary as it seems, just how much of this market would Palantir stand to capture?

It’s not unreasonable, in my opinion, to think that Palantir’s footprint in the space could one day rival that of another behemoth in this industry; SAP SE (SAP).

SAP commands around 10% of the Enterprise Resource Planning (ERP) market and has annual revenues of around $30 billion.

With a 10% market share, Palantir’s revenues from commercial contracts alone could be close to $50 billion by 2030. Even half of that would put us at $25 billion, with a relatively “meager” 5% market share.

Though estimates that far out are few, analysts expect Palantir to achieve revenues of $8 billion. This seems like a conservative estimate considering the potential market AIP is tackling.

It’s not like Palantir has any limitations to its revenues. There aren’t meaningful supply constraints. Revenues could hypothetically explode to the upside. It could be just a matter of AIP reaching a critical mass.

Takeaway

You might say Palantir doesn’t look like it can achieve such a lofty goal. That’s probably what many people thought of Tesla ahead of the Model 3 release when the company was mere months away from bankruptcy. Two years later, it was one of the most valuable companies in the world.

Similarly, not many would have predicted NVIDIA Corporation (NVDA) would begin to grow at triple-digit rates, and now here we are.

AIP is a relatively new product, and we are just beginning to see what it can do for its users and for Palantir Technologies Inc.’s revenues.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

This is a high-risk/high-reward opportunity, which is exactly what I look for in my YOLO portfolio.

Joint the Pragmatic Investor today to get insight into stocks with high return potential.

You will also get:

– Weekly Macro newsletter

– Access to the End of The World and YOLO portfolios

– Trade Ideas

– Weekly Video