Summary:

- A critical test for AT&T Inc.’s stock rally approaches.

- The dividend will be covered, but a strong free cash flow print could spark a guidance increase.

- The revenue driver expectations are provided, with a discussion of uncertainties.

- A dividend increase, or prioritize debt?

- What could break this momentum.

Thomas Barwick

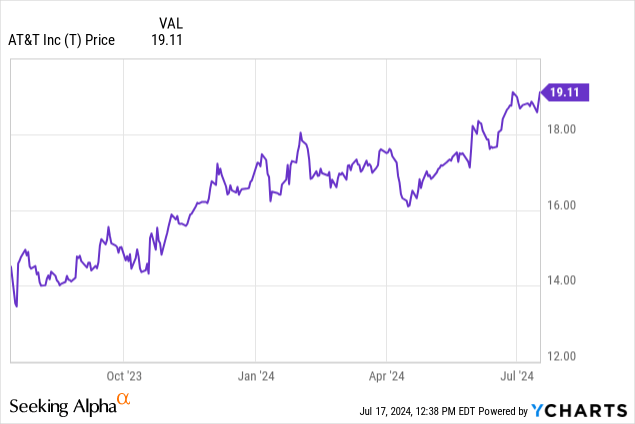

We are now approaching a very critical earnings season, and this is the catalyst we believe could trigger the next major move in markets, and a shift in sentiment. In recent sessions we have seen a rotation from big tech and chips and into industrials, energy and small caps. Quietly, however, one of our pound of the table names in AT&T Inc. (NYSE:T) in the $14-$16 range has rallied to 52-week highs with nice momentum in the stock.

In full disclosure, we guided our members to take some profit at $19 and let the rest run as a house position, collecting all future dividends, gains, and spins. Make no mistake, it was years of pain for the stock. In fact, we were bearish for a number of quarters as the stock got pounded, but about a year ago, we really started getting bullish. Those returns, including the dividend, have been a pleasant change of pace for what AT&T investors were used to.

But the momentum we are seeing faces a critical test next week with Q2 earnings being reported pre-market on Wednesday, July 24th. The report and more importantly the outlook could keep the momentum going, or easily put a stop to it. We will be closely watching Q2 earnings for any signs that there is stress on revenue drivers and cash flows, and will be closely watching the outlook. In this column, we discuss what we are looking for.

Q2 cash flow is paramount to the momentum

We are looking for $30.00 billion to $30.20 billion in revenues in Q2, but more importantly we will be watching cash flow. It is simply a key indicator that dictates so much of this stock’s trading. With better expectations for flows this year, we have seen momentum. Why? Well, better cash flow translates to better share prices, and vice versa. Now, to bring in cash and chip away at debt, the company has engaged in a number of asset sales over the years.

Of course, there are only so many assets that can be strategically sold off. We will point out that over the last few years, AT&T has monetized many billions in non-strategic assets as well. So, we will watch cash flows, and it all begins with that revenue target.

Back in reported earnings from Q1, the view was a consensus of $30.51 billion. With $30.00 billion in revenues, this was a miss versus consensus, and the market did not love this. A revenue miss in Q2 could be painful as if it is anything other than modest, down line items in the report will likely take it on the chin. Keep in mind that, now more than ever, telecoms have been promotional to attract customers, and this could lead to churn. The major telecoms are all competing for the same customer base, plus there are more and more smaller players popping up, including offerings from cable companies. That said, with our view for revenue, we are expecting commensurate operational expenses with Q1.

The Q1 revenue fell 0.4%, but EPS was a slight surprise at $0.55 per share and surpassed consensus by $0.02. As we come into Q2’s report, we expect a quarter-over-quarter that is flat to up 0.8%, and we also expect earnings of $0.57-$0.59 per share, which would be a slight decline. This is because we still think expenses will remain elevated beyond what we would like, and commensurate with Q1.

The fact is that revenue growth will be muted all year. There is not much that is going to change that now or in the future, especially if promotional activity reduces revenue per subscriber. Additionally, any updates to guidance will be key. Back in Q1, operating expenses were $24.2 billion, roughly flat from a year ago, but this was at the higher end of our expectations. That said, it’s all about cash flow in our opinion because, after all, this is a key income name for many investors.

Free cash flow is key

Free cash flow in Q1 was $3.1 billion, up from $1.0 billion from a year ago. We expect to see more year-over-year gains on this critical metric. Cash from operating activities was up $0.9 billion from a year ago to $7.5 billion. CAPEX was just $3.8 billion, below the $4 billion we expected. There was also a $0.8 billion cash paid for vendor financing, leading to capital investment of just $4.6 billion compared to $6.4 billion a year ago. This all combined for free cash flow that more than covered the dividend. With $2.09 billion in dividends paid, the dividend payout ratio was 67%, which is outstanding for Q1.

For Q2, we likely will continue to see positive dividend coverage. Management has guided annual free cash flow of $17-$18 billion, and in the Q1 call, management projected 40% of this would be in the first half. 40% of $17.5 billion at the midpoint is $7.0 billion. With $3.1 billion in Q1, we are thus targeting $3.7 billion in free cash flow on the lower end of the range, to $4.3 billion on the higher end of free cash flow. Assuming cash from operating activities of $7.2-$8.0 billion, capex of $3.6 to 4.3 billion, and unknown estimates for additional financing, we see the free cash flow hitting this range. As such, we expect easy coverage of the dividend.

Revenue drivers in Q2 and earnings results

You will want to watch for wireless postpaid growth and net fiber adds. In Q1, we saw Mobility revenues were up 0.1% from Q1 2023, driven by service revenue growth of 3.3% from subscriber and postpaid ARPU growth. This was offset by lower equipment revenues on lower sales volume. Prepaid adds were just 1,000 in the quarter. That said, postpaid phone net adds were 349,000. There was also a record low for Q1 for postpaid churn, at just 0.72%.

For Q2, we are looking for flat to up 1% on mobility revenue. Furthermore, we are looking for the 18th straight quarter of more than 200,000 net fiber adds, and are targeting 215,000+. Business lines largely have been a wildcard, and this has been weak for several quarters. Business wireline revenues were $4.9 billion, down 7.8% year-over-year in Q1 due to lower demand for legacy voice and data services and product simplification, pressure on data services, and growth in fiber. We expect another annual decline, and are targeting $4.95 to $5.05 billion, small single-digit declines versus a $5.3 billion print a year ago.

Overall, the fiber adds, and postpaid net adds (looking for 275,000+) are likely to remain strong, while the prepaid adds are tough to gauge, but we are looking for a range of a loss of 5,000 to a gain of 5,000.

Final thoughts

We came back to AT&T stock over a year ago with a strong buy conviction in the $14-$16 range. We have seen some strong gains from those levels while collecting $2+ more in dividends. At our Investing Group, we now have moved to a house position after backing out the initial investment plus half of the profit and letting the rest run. We see AT&T Inc. as a solid income name with a 6% yield and a secure dividend.

As we approach the Q2 report, we see it as vital to sustaining the momentum. We will watch for churn, watch the aforementioned revenue drivers, and especially keep an eye on cash flow. We think a free cash flow result at the high end of the range could lead to a guidance revision higher on the range for free cash flow. The annual 2024 free cash flow will again be more than sufficient to cover the dividend, and while the debt remains a bottleneck to raising the dividend, the latter is not out of the question. That said, we would prefer to see excess cash flow be prioritized to the substantial debt.

Your turn! Let’s hear from you

Did you come back to AT&T when we turned bullish last year? What are you doing with AT&T stock? Do you think the momentum can continue? Are you generating extra income from your holdings like we do at our service by selling covered calls? Are you a buy and hold forever type, or do you trade around the position? Let the community know your thoughts below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Looking for more returns like this? That is what we do at BAD BEAT Investing

Enjoy more rapid-returns and income with our strategy to advance your savings and retirement timeline by embracing a blended trading and income approach!

Our prices will soon rise but you can take an EXTRA 20% off right NOW through this T article with this link.

Try us out, with a money back guarantee if you are not satisfied (you will be). There’s also a light version of BAD BEAT, on sale for 55 cents a day with great benefits too. Come take the next step! Start WINNING