Summary:

- Danaher Corporation stock saw a high single-digit percentage increase from April to mid-June, but has since given up most of the gains.

- Concerns about inventory destocking in the bioprocessing market have impacted investor sentiment, but expectations are already priced in.

- Despite short-term challenges, Danaher’s medium to long-term prospects remain positive, with good growth starting FY25.

Sundry Photography

I last covered Danaher Corporation (NYSE:DHR) in April, discussing the company’s good medium to long-term prospects. While the stock experienced a high single-digit percentage increase from my article until mid-June, it has since given up most of its gains and is now trading at the same level as when the previous article was published.

The company is due to report its earnings on 23rd July before the market opens. If we go by commentary from some of the company’s peers in the bioprocessing industry as well as regulatory developments like the delaying of the BioSecure Act, I am expecting a downbeat quarter. However, with the stock seeing a significant correction since mid-June, most of these negatives seem already priced in. I continue to take a medium to long-term view with a potential recovery starting in FY25 while maintaining a buy rating on the stock.

The health of the bioprocessing end market has been a big concern among DHR investors over the last several quarters. This market has seen inventory destocking in recent quarters as the companies, that built up excess inventory due to supply chain constraints following COVID-19, are now reducing inventory levels as the supply chain situation has normalized. Now, inventory destocking can’t continue forever and DHR investors are waiting for an eventual recovery in the bioprocessing market as destocking ends.

However, it seems like they may have to wait longer. The commentary by some of DHR’s peers with high exposure to bioprocessing markets like Avantor (AVTR) and Sartorius AG (OTCPK:SARTF) has not been that positive in recent conferences, and in their meetings with sell-side analysts. Earlier this month, Citigroup downgraded Avantor stock, citing “the softer bioprocessing commentary across the market” and management commentary around “concerns on elevated customer inventory.” So, no signs of inflection yet in these markets.

Now, the good news is most of the stocks exposed to the bioprocessing end market have already corrected since mid-June when some of these companies started communicating their inter-quarter commentary with analysts at conferences. DHR has also seen a similar correction and the expectations are really low going into the earnings. So, I am not expecting a significant downside.

Further, we have already entered the second half of this year, and some investors may start focusing on 2025 commentary rather than the 2024 outlook. Since DHR has been witnessing destocking among its bioprocessing customers for almost a year, we are likely close to the bottom and, if management chooses to comment on the 2025 outlook, I am expecting a positive tone.

Another important theme for the company is recovery in the Chinese market. The Chinese government plans to provide funds for equipment upgrades across various sectors, including healthcare. As these funds start getting deployed over the next couple of quarters, it should help the company’s sales in 2H 2024 and the next year. I am not expecting any benefit in Q2 from this stimulus, but any commentary around funds deployment in the coming quarters and bidding activity would be closely watched out.

The recent lower-than-expected inflation data has again increased discussion around potential interest rate cuts. A potential reversal in the interest rate cycle in the U.S. as well as globally is another factor that should encourage customer’s investment in equipment and support DHR’s demand.

The company is also poised to benefit if the BioSecure Act is passed by U.S. lawmakers. This Act was excluded from the National Defense Authorization Act (NDAA) last month, but has bipartisan support and should provide a competitive advantage to the U.S. Medtech/Healthcare Equipment firms if passed in the fall or after the election.

Overall, the inventory headwind continuing in the bioprocessing end market and the BioSecure Act getting delayed have impacted investors’ sentiments since mid-June, and expectations are not high going into the earnings. The stock has already seen some correction reflecting lowered expectations. However, these headwinds appear temporary in nature and mostly priced in, indicating limited downside.

I continue to focus on the company’s medium to long-term prospects. In my opinion, we are close to the bottom. The company should start posting good growth from FY25 onwards as inventory destocking ends (helping consumable demand), the interest rate cycle reverses (helping equipment demand), Chinese stimulus benefitting growth and increased competitive advantage against foreign peers if BioSecure Act passes.

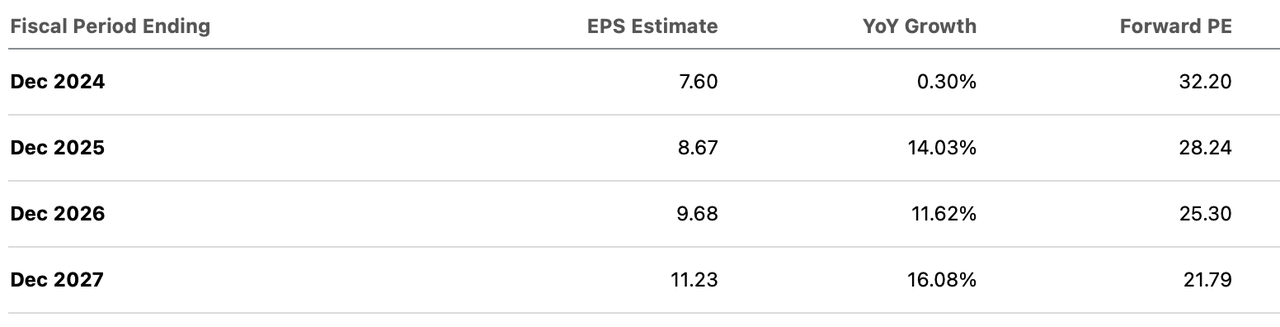

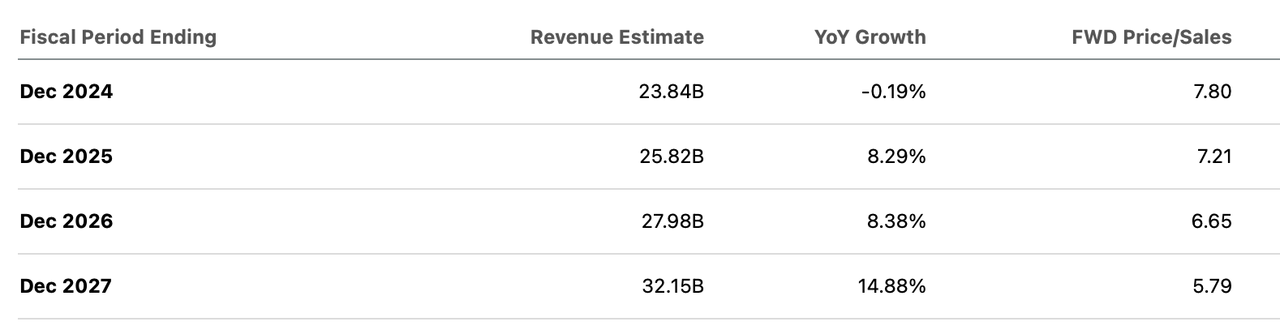

If we look at the consensus EPS and revenue estimates, DHR’s growth is expected to accelerate from FY25 onwards.

DHR Consensus EPS estimates (Seeking Alpha)

DHR Consensus Revenue estimates (Seeking Alpha)

Over, the last 5 years, the stock has traded at a historical forward P/E of 29.75x. While DHR’s P/E on current year EPS is slightly higher than its 5-year average P/E, if we look at FY25 and FY26 EPS consensus estimates, the company is trading discounted. Danaher has an exceptional track record of creating shareholder value over the long term. The company is expected to return to its strong EPS growth from FY25 onwards, which should improve investor sentiments and drive the medium to long-term upside. Hence, I continue to have a buy rating on the stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article is written by Ashish S.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.