Summary:

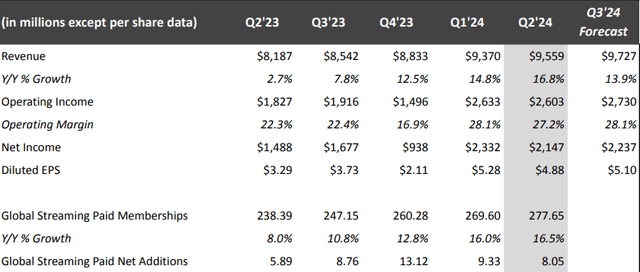

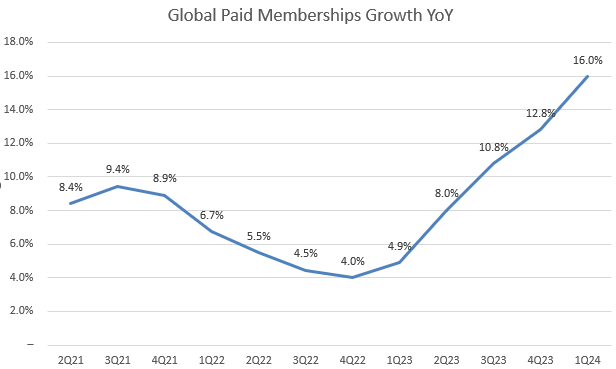

- Netflix’s 2Q FY2024 earnings demonstrated continued acceleration in global paid membership growth, even amidst price increases and the paid sharing initiative, driving strong revenue growth.

- The company has issued weaker-than-expected revenue guidance for 3Q FY2024, primarily due to price changes in Argentina and the devaluation of the local currency against the US dollar.

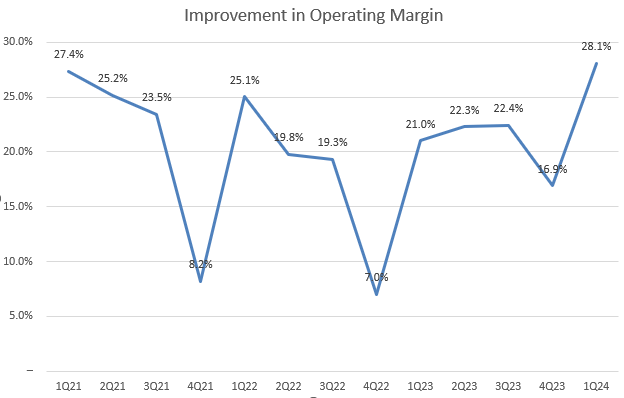

- After NFLX achieved a record operating margin of 28.1% in 1Q FY2023, management has forecasted the same 28.1% margin for 3Q FY2024, which significantly supports earnings growth.

- Despite the recent rally, the stock is currently trading at a lower multiple compared to last year. The stock’s non-GAAP PEG fwd is 1.19x, which is 21.5% below the sector average and 24.5% below its 5-year average.

- The company’s strategic focus on sports entertainment will diversify its content offerings and generate additional growth opportunities in the advertising business over the long run.

bymuratdeniz

Investment Thesis

Netflix (NEOE:NFLX:CA) (NASDAQ:NFLX)’s stock has seen a strong rally over the past year, largely driven by significant organic growth across all fundamental metrics, which has even pushed valuation multiples lower. The company has accomplished a significant YoY improvement in top-line revenue, operating margins, earnings, and FCF, primarily due to previous price increases and a successful crackdown on password sharing last year. I believe this healthy trend is expected to continue, driven by strong customer engagement and growth acceleration in paid memberships.

In my previous article in July 2023, I maintained a buy rating on the stock, due to a J-curve effect from pricing strategy and paid share crackdown expected to drive growth rebound into FY2024 as users are compelled to subscribe additional members. Since then, the stock rallied 43% which has largely beat the S&P 500 index of 21%. The company reported better-than-expected 2Q FY2024 earnings, supported by robust paid membership trends. Despite missing revenue guidance for 3Q FY2024, I reiterated my buy rating on NFLX as continued accelerating growth amid lower valuation is a bullish signal.

2Q FY2024 Takeaways

NFLX topped both revenue and GAAP EPS consensus in 2Q FY2024. However, the stock muted due to a weaker-than-expected 3Q FY2024 revenue outlook, largely driven by the FX headwind on strong US dollar and price changes in Argentina. It’s encouraging to see that the company slightly raised its FY2024 revenue guidance by 0.5%, implying a YoY growth of 14.5%, which indicates a strong rebound from 6.7% YoY in FY2023.

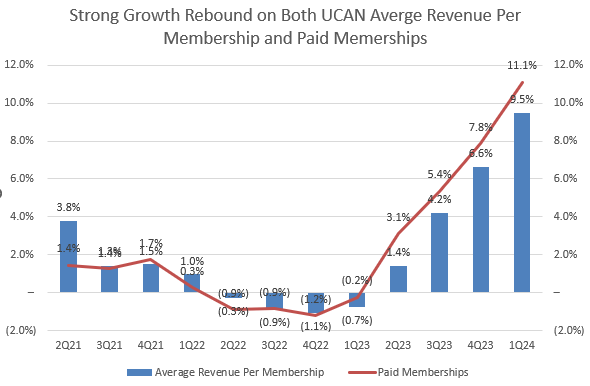

I believe one of the bullish signals is that NFLX’s global paid membership growth remains incredibly robust, increasing by 16.5% YoY in 2Q FY2024, up from 16% YoY in 1Q FY2024. Meanwhile, the strong growth in total revenue was largely driven by UCAN division, which showed continued growth acceleration in both average paid revenue and paid memberships. Specifically, its paid memberships grew 11.4% YoY in 2Q FY2024, up from 11.1% YoY in 1Q FY2024. The average revenue grew 11.2% YoY, accelerating from 9.5% YoY in 1Q FY2024. I have included a historical chart in the next section.

In addition, the company’s operating margin is expected to be resilient as well, with guidance at 28.1% for 3Q FY2024, following a 480 bps YoY increase in 2Q FY2024. The guided EPS in 3Q FY2024 is significantly ahead of market consensus by 7.6%, highlighting the high-quality nature of the stock.

Lastly, in terms of advertising business, NFLX admits that it is not currently a primary growth driver. In the 2Q FY2024 earnings call, the management stated that the company still has a small penetration in connected TV homes, maintaining only 10% of TV time in the countries where it operates. However, they expect that advertising revenue will start to make a meaningful contribution in FY2026.

Successful Price Increases and Monetization on Paid Share Boost Average Paid Growth

The company model

Let’s look at the NFLX’s growth catalysts. Last October 2023, the company increased the price of the Basic plan from $9.99 to $11.99 per month in the U.S. We notice from the chart that the average revenue from each membership of its UCAN segment has experienced a significant growth re-acceleration over the past 5 quarters after suffering from YoY decline in FY2022. It is typical for incremental revenue from price increases and a crackdown on password shares to generate a growth headwind in paid memberships (weakening demand). However, we observed concurrent growth re-acceleration in both paid memberships and average revenue per membership in the UCAN segment, demonstrating effective execution by management.

The company model

Meanwhile, total paid membership growth has also shown strong re-acceleration since 1Q FY2023, helping the company return to double-digit revenue growth since 4Q FY2023. NFLX has reestablished itself as a growth company, and I believe its current focus on sports entertainment will diversify its content offerings and create further growth opportunities in the advertising business. NFLX will stream two NFL games on Christmas Day this year.

Margin Expansion Significantly Boosts Earnings Growth

The company model

Despite ongoing investments in marketing and content, NFLX has not sacrificed margins. The company has reached a record operating margin of 28.1% in 1Q FY2024, which significantly boosted its EPS growth. Although the margin slightly decreased to 27.2% in the last quarter, management continues to project 28.1% for 3Q FY2024. NFLX is currently making a transition from growth to quality as we saw a significant increase in earnings and FCF.

The company has grown over 300% YoY in FCF to $6.9 billion in FY2023, which was largely driven by robust growth in OCF. The management also expects around $6 billion increase in FCF in FY2024. According to Seeking Alpha, the company is expected to generate over 30% YoY forward growth in diluted EPS in the next 12 months basis, which will push down its P/E multiple on a forward basis. I believe that it demonstrates NFLX’s leading position in a highly competitive online streaming industry.

Valuation

Despite a significant rally in stock over the last 12 months, NFLX is currently trading at 44.6x of P/E TTM and 8.2x of EV/Sales TTM. Considering its strong growth potential in its EPS, the P/E multiple will come down to 35x on a forward 12 months basis. Although this multiple is slightly higher than 30x of the Nasdaq 100 index, the company’s key growth metrics are still accelerating, justifying a higher multiple. Its current multiples are not overly stretched compared to its 5-year average, with the non-GAAP P/E fwd 29% below its 5-year average.

Given its strong earnings growth outlook, the stock’s non-GAAP PEG fwd is 1.19x, which is 21.5% below the sector average and 24.5% below its 5-year average, according to Seeking Alpha. This indicates an attractive risk-reward profile for the stock. Especially during the current economic slowdown, NFLX, as a large-cap, high-quality stock, is well-positioned to perform well in this environment.

Conclusion

Nevertheless, NFLX continues to demonstrate a strong rebound in growth and margins expansion in a competitive market. The recent rally is supported by solid YoY growth across all fundamentals, driven by successful price increases and a crackdown on password sharing. The company’s ability to sustain strong global paid membership growth and average revenue per membership highlights its effective execution and resilient customer engagement. With a strategic focus on diversifying content, particularly in sports entertainment, NFLX is well-positioned to drive meaningful growth in its advertising business over the long run. Moreover, the stock’s current valuation remains attractive. Therefore, given its high-quality nature and low-to-mid teen revenue growth trajectory, I remain bullish on the stock, which is poised to perform well even amid economic slowdowns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.