Summary:

- NIO continues to report growing deliveries in FQ2’24 and early July 2024, implying that the price cuts have worked as intended in boosting sales.

- With its sales figures almost exceeding TSLA’s growth rates and the management already looking to launch mass market models, we believe that we may see 2025 bring forth improved numbers.

- While NIO is likely to remain unprofitable and further dilutive cash raises are likely in the near-term, we believe that the worst may already be behind it.

- The stock remains attractively valued compared to its EV peers given the robust double digit growth rates, offering investors an excellent margin of safety.

- It goes without saying that NIO is likely to remain volatile in the intermediate term, with the stock highly shorted and sentiments surrounding EVs/ Chinese ADRs still mixed.

Jirsak/iStock via Getty Images

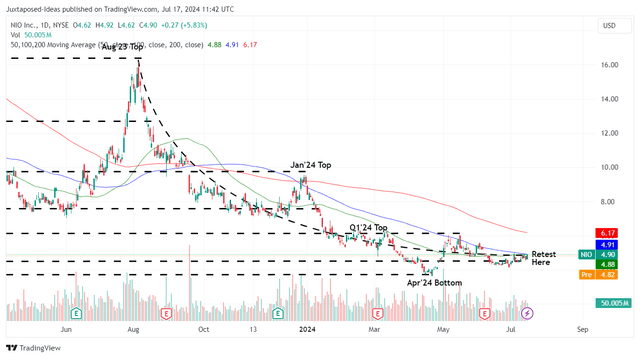

We previously covered NIO Inc. (NYSE:NIO) in April 2024, discussing why we had downgraded our previous Buy rating to a Hold, with the stock continually charting lower highs and lower lows, implying the lack of bullish support despite the notable improvements in its balance sheet and profit margins.

Combined with the ongoing price war in China and EV glut in the EU, we thought there might be more pain in the near-term, with things likely to get worse before they get better.

Author’s Historical Rating

By this time, it is painful to admit that we have had mixed luck with NIO, with our numerous Buy ratings underperforming expectations, as observed since our first Buy rating in April 2022 at -78% against the wider market at +25% and the last Buy rating in December 2023 at -42% and +19%, respectively.

While it remains to be seen if the recent floor may hold, we maintain our belief that NIO continues to offer a compelling investment thesis for those looking to buy an attractively valued EV stock with double-digit growth prospects, thanks to its upcoming mass market models.

We shall also be discussing certain metrics from its recent earnings call and latest delivery data from China, with it underscoring our growing optimism surrounding the oversold stock.

NIO’s Investment Thesis Remains Compelling For Opportunistic Investors

For now, NIO continues to report robust June 2024 deliveries of 21.2K vehicles (+3.2% MoM/ +98.1% YoY), with the cumulative Q2’24 deliveries of 57.37K vehicles (+90.9% QoQ/ +143.9% YoY) also exceeding expectations.

With NIO’s numbers well exceeding XPeng (XPEV) at June 2024 deliveries of 10.66K (+5% MoM/ +24% YoY) & Q2’24 deliveries of 30.19K (+38.4% QoQ/ +30.1% YoY), it is apparent that the former has temporarily emerged as a winner among the two, while trailing behind BYD Company (OTCPK:BYDDF) and Li Auto (LI) thus far.

These numbers also beat NIO’s original midpoint guidance of 55K vehicles (+83% QoQ/ +133.8% YoY), further underscoring why its FQ2’24 performance is likely to exceed the original revenue guidance of around RMB16.85B (the equivalent of $2.33B, compared to the consensus estimates of $1.99B).

While there may be near-term uncertainties surrounding the automaker’s prospects in the EU, we believe that those fears have been overblown indeed. This is why.

For reference, NIO reports 30.05K deliveries in FQ1’24 (-39.9% QoQ/ -3.2% YoY), with its overseas sales only comprising 388 or the equivalent 1.2% of its overall deliveries.

As a result, while the EU has decided to impose a 20.8% tariff on the automaker’s export to the region, the near-term effect is unlikely to be impactful, since it only comprises a miniscule portion of the company’s sales at the moment.

If anything, NIO has already guided potential adjustments in prices if the tariffs are eventually imposed, exemplified by the management’s expectations of its vehicle margins returning “to double-digits in Q2 and continued to improve in Q3 and Q4,” with the additional costs likely passed to consumers.

At the same time, readers must note that the automaker is slated to release their mass-market models, Firefly at an estimated price range of between RMB 100K to 200K in China from Q4’24 onwards and the EU from Q2’25 onwards.

This builds upon the recent launch of Onvo, aimed at the RMB 200K to 300K Yuan end-market and its existing NIO at above RMB 300K, effectively demonstrating NIO’s well diversified portfolios across value to premium price points.

While the first model for Onvo, L60, is still in the pre-order stage with delivery only expected by September 2024, it is apparent that demand has been more than healthy, with pre-orders exceeding “expectations by a 2-3 times.”

As a result, we believe that NIO may be well positioned for future success, with the highly strategic penetration across different price segments allowing it tap into the volatile domestic market demand.

At the same time, we have observed from BYDDF’s global execution that it is possible to achieve positive profit margins, regardless of the export tariffs.

For example, BYDDF’s entry EV model, Dolphin, retails for RMB 99.8K Yuan domestically ($13.86K), $47.65K in Australia with zero trade tariffs, and €28.99K in the EU ($31.6K) despite the previous 10% tariff.

When compared to Tesla’s (TSLA) entry EV model 3 at $38.99K in the US, $54.9K in Australia, and €40.99K in the EU ($44.26K), it is apparent that BYDDF’s offerings remain highly attractive to value oriented consumers.

As a result, while there have been no further details offered on NIO’s Firefly models beyond the estimated price tag of below €30K, we believe that it may remain competitive to its global EV peers, no matter the imposed tariffs in the EU, as similarly highlighted by the management:

We certainly don’t want to end up with so many additional tariffs, but if that’s what’s ultimately decided, then for Firefly, even with these additional tariffs, it will still be competitive in Europe. (CNEVpost)

At the same time, NIO has highlighted the potential “localized operations” (local manufacturing) once demand hits 100K units – a strategy that has been actively pursued in BYDDF in numerous global locations, implying the former’s determination to go global once there is more traction for its well diversified offerings.

NIO Appears Attractively Valued Compared To Its Peer Group

The Consensus Forward Estimates

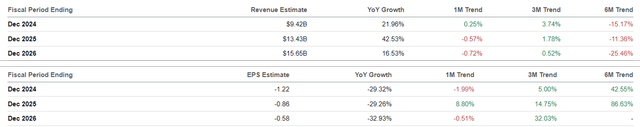

As a result of the robust FQ2’24 deliveries and recent mass-market developments, it is unsurprising that the consensus continues to offer promising forward estimates, with NIO expected to record an impressive top-line growth at a CAGR of +27% through FY2026.

Despite this, readers must note that the automaker is unlikely to report positive EPS profitability in the intermediate term, as observed in the still negative adj net income margins of -58.4% in FQ1’24 (-27.3 points QoQ/ -9.4 YoY) and the consensus forward estimates above.

NIO Valuations

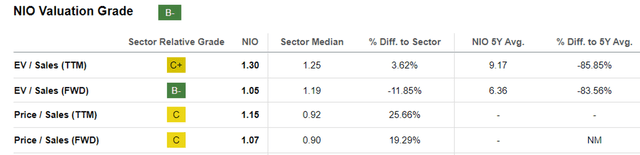

Even so, NIO appears to be attractively valued at FWD EV/ Sales of 1.05x, compared to its 5Y average of 6.36x and the sector median of 1.19x.

Even when compared to its EV peers, such as BYDDF at 0.94x with a lower projected top-line growth at a CAGR of +20.5% through FY2026 and TSLA at 7.81x/ +12.5%, respectively, NIO remains cheap in comparison – offering interested investors with an excellent margin of safety in our view.

So, Is NIO Stock A Buy, Sell, or Hold?

NIO 1Y Stock Price

As highlighted above, our Buy rating has yet to perform as expected, with NIO consistently charting lower lows/ lower highs, and it’s remaining to be seen if the recent April 2024 bottom may hold.

With the trade war still ongoing, market sentiments likely to be volatile as the US election continues, and the Fed yet to pivot, we may see the stock remain depressed for a little longer before things improve.

NIO’s EV Registration/ Sales In China

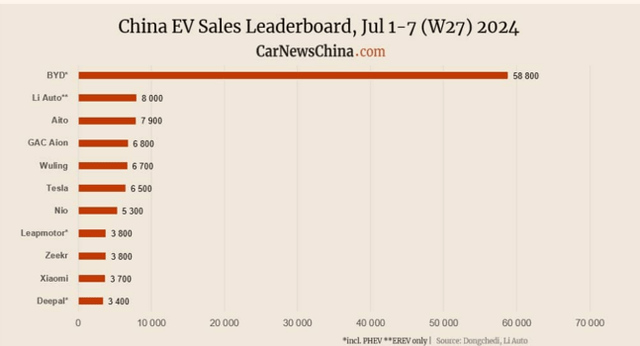

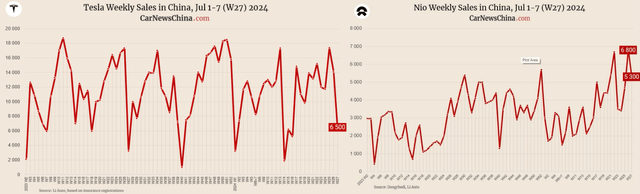

On the other hand, while NIO continues to face intensifying competition domestically, the automaker has been able to hold its own while reporting weekly registrations of 5.3K units in week 27 of 2024 (-22% WoW/ +70% YoY).

Price Cuts On TSLA’s & NIO’s Sales

With NIO’s price cuts working as intended in growing sales on a QoQ/ YoY basis, compared to TSLA’s sideways movement over the past year, we believe that the former’s reversal is likely to occur in the near-term, if the company delivers the slow but sure reversal in its profitability through the mass market models.

As a result, we are reinstating our former Buy rating, though with no specific entry points since it depends on individual investor’s dollar cost averages and risk appetite.

It goes without saying that NIO is likely to remain volatile in the intermediate term, with the stock highly shorted, sentiments surrounding EVs still mixed, and the automaker unprofitable.

Its balance sheet continues to deteriorate on a QoQ/ YoY basis as well, with another round of dilutive capital raise likely – a trait commonly observed with other start ups.

Lastly, with sentiments surrounding Chinese ADRs still pessimistic, it goes without saying that NIO is only suitable for investors with higher risk appetite and long-term investing trajectory.

Even so, we believe that the automaker appears to be well positioned to weather the intermediate term uncertainties. This is attributed to the management’s clear vision surrounding the price segments and the growing sales/ deliveries despite the intensifying market competition.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.