Summary:

- Since I upgraded Broadcom stock from “Hold” to “Buy” in April 2024, it has gone up by nearly 21% since, beating SPY meaningfully. I think more to come.

- Q2 FY2024 financial results show revenue growth, particularly in AI, and infrastructure software segments.

- I believe that AVGO’s diversified customer base and high recurring revenues from multi-year contracts position the company for sustainable growth in the coming years.

- My updated DCF valuation model indicates AVGO stock is undervalued by 38.6%, making it a good investment in the medium term.

- That’s why I confirm my “Buy” rating today, calling AVGO probably the best AI-related stock pick among large-caps.

G0d4ather

Intro & Thesis

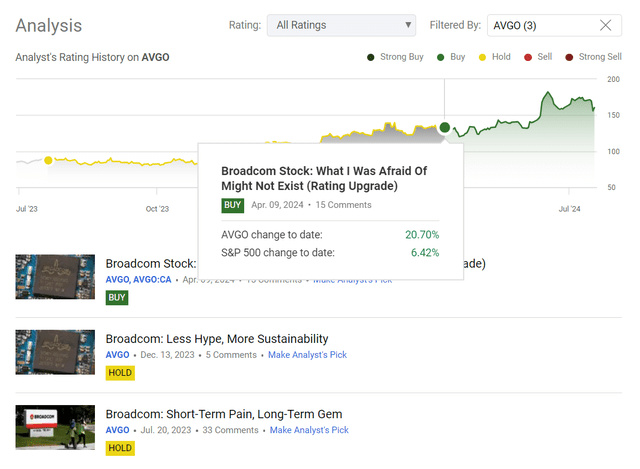

I initiated coverage of Broadcom Inc. (NASDAQ:AVGO)(NEOE:AVGO:CA) stock about a year ago with a “Hold” rating, which I upgraded to “Buy” in April 2024, admitting my mistake. Since my upgrade, the stock has continued to rise, gaining nearly 21% to date and outperforming the S&P 500 Index (SP500) (SPY) by more than three times:

Seeking Alpha, the author’s coverage of AVGO stock

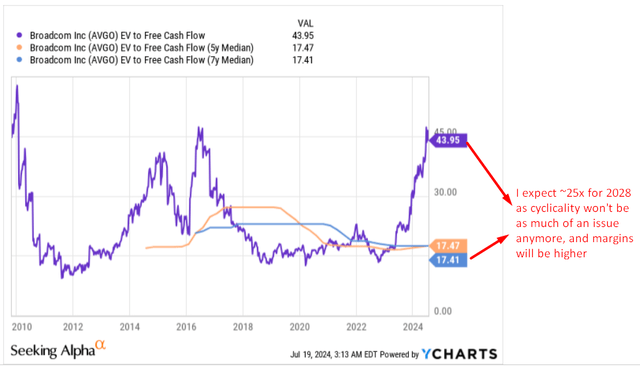

In my last article on AVGO, I argued that the stock was actually looking quite cheap despite its seemingly high valuation multiples on a TTM basis. At the time, I tried to model out the company’s future using a DCF valuation method, which showed a great undervaluation of around 25% – and therefore upside potential. However, with the stock up almost 21%, I decided to look at AVGO again and do the same analysis as last time. Based on the latest data (Q2 FY2024 financials and recent news), I again conclude that the price target for AVGO should be higher – the stock is still undervalued, so today I reiterate my previous “Buy” rating.

Why Do I Think So?

Let’s take a quick look at AVGO’s latest financial results for Q2 FY2024. I know it’s been a while since the results, and they’ve probably already been reflected in the stock price, but in my last update I didn’t have the Q2 data yet, so I feel it’s necessary to discuss it here.

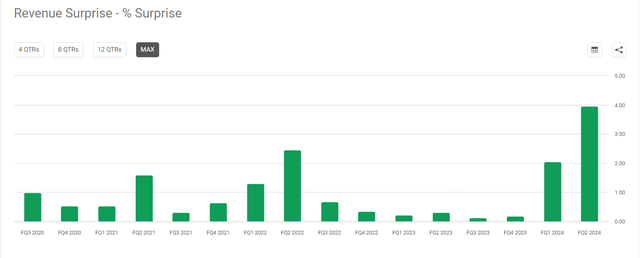

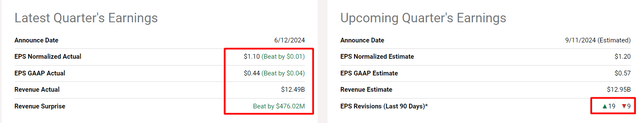

Actually, Broadcom reported stunning Q2 2024 revenue growth of $12.49 billion, up 43% YoY and 4% quarter-over-quarter, beating the consensus estimate of $12.01 billion (this was the biggest quarterly surprise over the past few years, according to Seeking Alpha data).

Speaking of particular segments, Broadcom’s AI revenue increased to $3.1 billion, up 280% compared to Q1 2024 results ($2.3 billion). We saw that strong bookings at VMware contributed to this significant increase, potentially suggesting higher revenues for the remainder of FY2024. Infrastructure software revenue amounted to US $5.3 billion, up 175% year-on-year and 16% quarter-on-quarter, mainly due to VMware contributing $2.7 billion in all three months; excluding VMware, infrastructure software revenue was US $2.6 billion, up +35% YoY and +5% QoQ, so the growth is not just all about VMware’s impact.

Semiconductor Solutions accounted for $7.20 billion, up +6% YoY and -3% QoQ. The company increased sales of AI solutions such as Ethernet products and AI accelerators by more than 40%, while generative AI solutions, among others, accounted for more than half of total sales in this category. However, other business lines showed mixed results in different areas within the business lines Networking contributed almost half (45%) more to sales in the previous year and a further +15% in the previous quarter, mainly due to “the accelerated rollout of high- speed networks and increased hardware sales.”

Wireless revenue of $1.6 billion increased only by 2% YoY (-9% QoQ), pointing to the stability of Broadcom’s wireless outlook, underlined by its multi-year pact with Apple (AAPL) for 5G RF components. In contrast, Storage Connectivity revenue fell -25% year-over-year and -7% quarter-over-quarter due to “carrier and enterprise destocking”, despite initial expectations of an uptick in this area. Finally, broadband revenues fell by more than 1/3 year-on-year and by 22% QoQ due to “low capital expenditure by service providers”, which is expected to lead to a very large annual decline of 30%.

The consolidated adjusted EBITDA amounted to almost $7.5 billion – that’s a margin of 59% relative to sales. Around 72% of that EBITDA settled down in the bottom line, so despite the share outstanding amount rising by >12% YoY in Q2, AVGO’s non-GAAP EPS share were $10.96, up 6% YoY (slightly lower than the prior quarter though). It was more than enough to beat the consensus on this front either.

Seeking Alpha, AVGO, the author’s notes

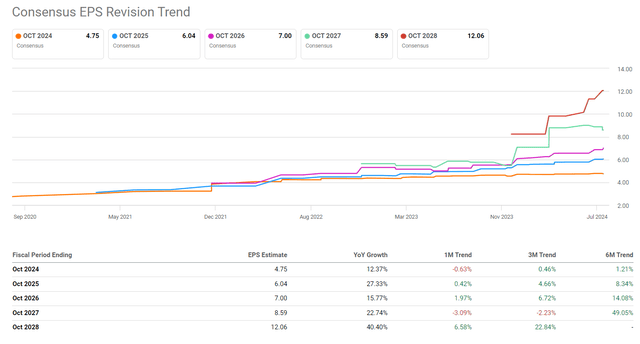

As the management reiterated its previous guidance for wireless revenue to be essentially flat year-on-year in FY2024, and probably looking at the QoQ declines across some segments, Wall Street analysts were ambivalent about changes to their EPS and sales projections for the next few quarters; despite the strong Q2 figures, only 68% of all estimates revisions were positive. However, in fairness, it’s worth noting that the revisions trend in the longer term looks very bullish:

Seeking Alpha, AVGO’s EPS revisions

I usually take EPS revisions as strong as AVGO’s as a very positive sign, as they show me that the market continues to have confidence in the company, and this confidence is likely to justify a premium to its valuation from now on. However, these positive revisions must be supported by real fundamental growth and expansion opportunities (desirably both in sales and margins). I think this is exactly the case here. I believe AVGo’s AI-driven growth should help it mitigate cyclical weaknesses in the broadband and memory businesses. The CEO said they anticipate that generative AI will account for at least 37% of semiconductor revenue in FY2024, and if that’s the case indeed, the cyclicality will become a less major risk factor in the future, in my view.

Broadcom has raised its annual revenue guidance to over $51 billion and expects growth of >40%, with a significant portion coming from software, potentially improving the company’s margin profile. The diversified customer base and high recurring revenues from multi-year contracts position Broadcom for sustainable growth and market share gains. Just a few hours ago, the news broke that AVGO is in talks with OpenAI to develop new AI chips – thus the company’s reach continues to grow, making my assumption that AVGO’s sales will grow organically without being as dependent on the economic cycle as before closer to reality.

With all this in mind, I intend to update my DCF model based on my new estimates.

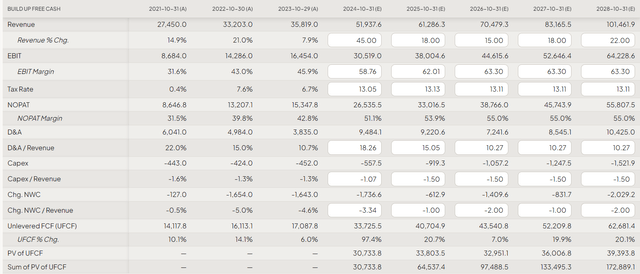

Currently, the Wall Street analysts’ forecasts are for AVGO sales growth of ~13.04% over the next 5 years. But given the acceleration in revenue growth in recent quarters, I think the actual CAGR could be even higher – adding 1-2% to each of the forecast years, I expect the implied revenue CAGR for the next 5 years to be ~14.3%.

Due to the lower dependence on cyclicality and the potential expansion of the EBIT margin through a gentle change in the sales structure, I think that AVGO has every chance of achieving a long-term EBIT margin of ~63%. Based on the historical averages for the ratio of D&A to sales, CAPEX to sales, and NWC to sales, I get the following outputs:

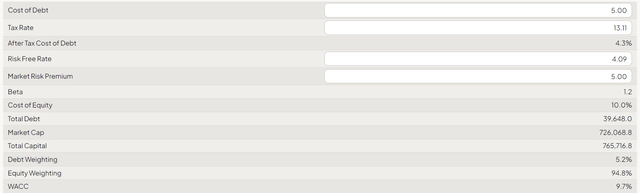

Assuming 5% in cost of debt, 5% in MRP, and a risk-free interest rate of just over 4%, I obtain a WACC of 9.7%. This rate is 0.4% below what I expected 3 months ago, but it’s worth remembering that expectations for the Fed’s policy reversal have also risen in that time.

I use an exit multiple method to calculate the terminal value – in this case, I use an EV/FCF multiple of 25x. Why 25x? Again, my decision was influenced by the assumption that AVGO’s operating performance would be more stable than we had previously seen. Therefore, the premium to the current valuation should remain at a reasonable level. Compared to the TTM EV/FCF multiple of 45x, my assumption seems quite conservative; on the other hand, I give AVGO a premium relative to its 5-10-year median.

So what do I get? According to my updated valuation model, which is admittedly more optimistic than before, AVGO stock looks even more undervalued than 3 months ago – it’s undervalued by 38.6%:

From all this, I conclude that AVGO can still be a good investment in the medium term. Furthermore, AVGO could be the best AI growth stock pick among large-cap companies today due to its potential upside.

Where Can I Be Wrong?

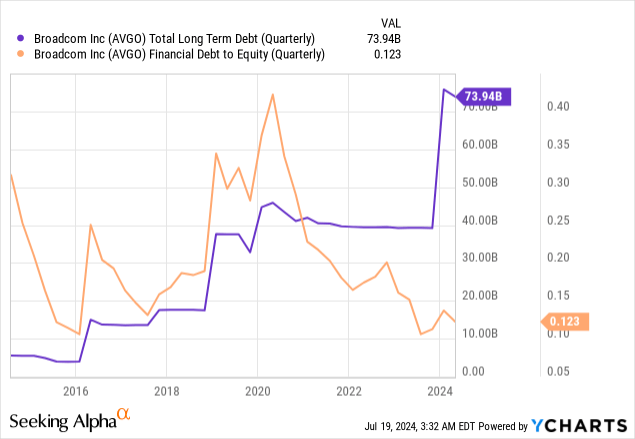

As I noted in my previous article, all prospective buyers of AVGO stock should keep in mind that investing in Broadcom, like anything else on the stock market, comes with risks. It’s essential for investors to consider the company’s recent acquisition spree, which has significantly increased the company’s debt load. However, I’d like to immediately note here that thanks to the strong FCF that the company generates (FCF margin = 33% of sales), its debt-to-equity is still well below 1, and it keeps falling lower:

Although AVGO’s debt seems to be manageable, if the company fails to sustain its growth momentum over an extended period, the burden of debt could negatively impact its financial performance and, subsequently, its stock price.

Another risk factor to consider is the fair valuation of Broadcom stock. There’s a possibility that I’m leaning towards too optimistic scenarios regarding future margin growth, which is a key element of my DCF calculations. If the company’s EBIT doesn’t reach the level I expect over the next 5 years, the validity of my forecasts could be called into question. Although I apply a significant discount to the free cash flows (at 9.7%), I use a relatively high exit EV/FCF multiple [25x] to calculate the terminal value. If this assumption doesn’t hold – say AVGO’s EV/FCF will be 18x in FY 2028 instead of 25x – this could indicate that Broadcom’s current stock price is reasonably valued, suggesting limited growth potential based on fundamental value analysis.

I am also puzzled by the high probability of consolidation of AVGO stock, at least in the next few months. The point is that AVGO may need more time to grow further after its phenomenal rally in recent years. Therefore, I’d recommend everyone to be cautious; you may even consider buying AVGO not based on current prices, but waiting for a decent dip.

TrendSpider Software, AVGO weekly, notes added

The Bottom Line

Despite the above-mentioned risk factors, as well as some segments’ weaknesses in Q1, I believe that AVGO’s diversified customer base and high recurring revenues from multi-year contracts position the company for sustainable growth in the coming years, making AVGO’s revenues less cyclical and the consolidated margin higher by historical standards due to the shift to higher margin revenue segments. Based on my revised DCF valuation model, AVGO stock now appears to be even more undervalued compared to three months ago, showing a 38.6% undervaluation. That’s why I confirm my “Buy” rating today, calling AVGO probably the best AI-related stock pick among large-caps.

Thank you for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!