Vale Production Report 2Q24: Positive Signs Despite Challenges

Summary:

- Positive points were an increase in the volume of iron ore production and a possible positive outcome for environmental liabilities.

- Negative points were prices lower than expected, due to lower premiums.

- Despite the risks, the company trades at a valuation of just 3.6x EBITDA, extremely cheap.

Andyborodaty/iStock via Getty Images

Investment Thesis

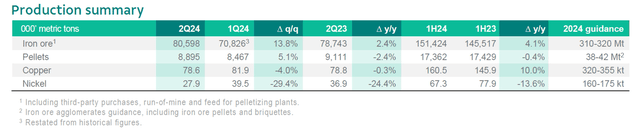

I recommend buying Vale shares (NYSE:VALE). The company released its production report on July 16th, with production volumes coming in above expectations, indicating that iron ore guidance for 2024 between 310 and 320 Mt is well on track.

However, we had negative points, with realized prices coming in below expectations and indicating that the company will once again report results below expectations. In the quarter, we also saw developments in the legal proceedings involving Samarco.

Introduction

Hello reader, in this report I will show you the production and sales data in 2Q24 released by Vale on July 16th. Remember that this type of report usually gives clues that anticipate the financial results, which the company will release soon, enjoy reading!

Iron Ore And Pellets Operations

The iron ore and pellets businesses represented more than 83% of Vale’s revenue in the last result, so we will start here. Vale released strong production figures, reaching 80.6 Mt (+13.8% q/q and +2.4% y/y).

Production Summary (IR Company)

Even with an annual base that was difficult to overcome, with a 2Q23 with robust production, Vale still managed to grow production, contrary to the most pessimistic expectations, which confirms my positive vision for the company. Now let’s look at the prices:

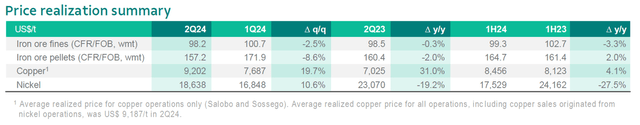

Price Realization (IR Company)

The realized price of iron ore fines was $98.2/t (-2.5% q/q and -0.3% y/y). The reasons are the lower price of 62% Fe ($112/t in 2Q24 vs. $124/t in 1Q24).

In addition to Vale having chosen to ship products with a higher silica content and, therefore, lower quality, drastically affecting the premium, I will talk more about this in the thesis risks. Now, let’s talk about the base metal division.

Base Metals Operations

First, let’s talk about copper. Shipments reached 76.1 kt (+3% y/y), with prices realized at $9,202/t.

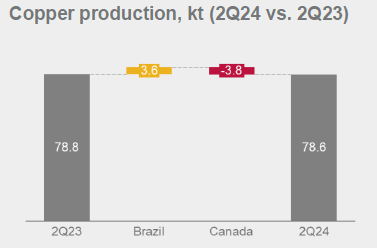

Copper Production (IR Company)

Production was 78.6 kt (-4% q/q), due to stronger production in Brazil, mainly resulting from higher productivity rates at Salobo I and II, and partially offset by a fire at Salobo III and weaker production in Canada due to the biannual shutdown for smelter maintenance.

For nickel, shipments reached 34.3 kt (-15% y/y) partially cushioned by the consumption of inventory in 1Q24. Realized prices were $18,638/t (+11% q/q).

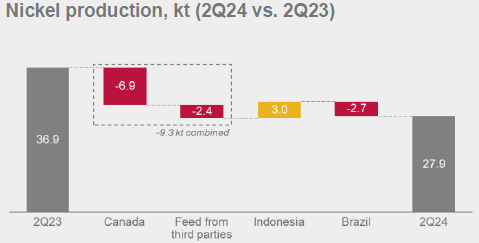

Nickel Production (IR Company)

Production was 27.9 kt (-24% y/y and -30% q/q), explained by maintenance work in Sudbury and Onça Puma and lower purchasing from third parties in Canada, which was partially offset by stronger performance of operations in Indonesia.

In my view, there was an improvement in productivity offset by the impact of maintenance in the base metals division in 2Q24. Now, I’m going to talk about another important point, the legal consequences of the Samarco case.

Judicial Liabilities

In May 2024, Vale, BHP and Samarco proposed a payment of $25 billion, which includes past and future payments, to place a limit on your obligations to Brazilian authorities. I talk more about this in my coverage initiation report.

This should reduce the asymmetry of information in the market, and should be resolved soon as a change of mediator at Federal Regional Court 6, judge Ricardo Rabelo, should take place by August.

Overview of Disclosed Data

In my view, the data anticipates yet another result with profits below expectations, in addition to little visibility on the scenario for mining companies in 2024. However, I also saw positive trends as the company moved towards meeting the guidance proposed for the year.

With the variation in results, I predict that reported revenue will rise by around 4% year-on-year. The EBITDA margin should remain stable compared to 2Q23, at around 38%.

Finally, net income is expected to reduce the expansion seen in 1Q24, rising around 15% and below market expectations. Even between ups and downs, I feel comfortable when I analyze the company’s valuation.

The Valuation Is Quite Discounted

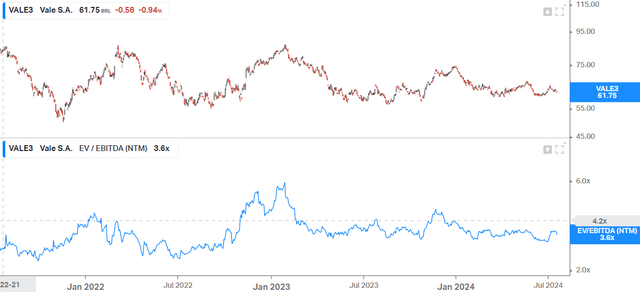

To evaluate Vale, I will use the company’s historical EV/EBITDA multiple. I will use this multiple because it does not consider the financial result and prioritizes the company’s cash generation.

Over the last 3 years, Vale has traded at a projected EV/EBITDA multiple of 4.2x, which implies an upside potential of 16.7% to the company’s current multiple of 3.6x. This corroborates my recommendation to buy the Vale shares. Now, let’s check the Quant Rating and Factor Grades.

Vale According To Quant Rating And Factor Grades

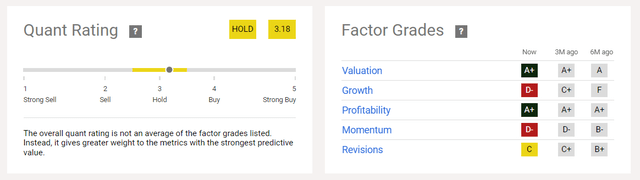

Below, we can see that the Quant Rating recommendation is to hold the shares:

Quant Rating and Factor Grades (Seeking Alpha)

This is due to the poor growth and momentum ratings, one is derived from the other, and I will explain more about this in the risks chapter.

Potential Risks To The Bearish Thesis

As I mentioned above, prices were lower than expected due to lower premiums. Vale is losing one of its biggest competitive differentiators compared to BHP (NYSE:BHP), Rio Tinto (NYSE:RIO) and Fortescue (OTCQX:FSUMF), which is the quality of its product mix.

It appears to be that the lack of compliance in achieving the premium in iron ore fines is linked to the low compliance of Chinese steel mills in paying an additional fee for low silica products, with their margins remaining compressed and dependent on subsidies.

Therefore, it is not a lack of operational management by the company, but rather a market condition, and this is dangerous. For reasons like these, growth prospects are bad, and consequently, momentum is bad.

Finally, it is worth highlighting that the proposal that the company made with Samarco and BHP to end the legal disputes in the Mariana case reduces the asymmetry of information in the market regarding the size of the compensation, but still does not resolve the issue. The risks to the thesis are diverse, and investors should be cautious when investing in the company.

The Bottom Line

Concerns about the future of China and its demand for iron ore are valid, however it is noteworthy how Vale has increased its production volume in recent quarters, which is positive for shareholders.

However, it seems that there is little adherence by Chinese steelmakers to higher-quality ore like Vale’s, which reduces the sales price and should result in the company’s reported results being slightly lower than expected.

In any case, the company is trading at just 3.6x EBITDA, below the average of the last 3 years, which does not match the company’s latest results and strategic assets for the future, such as base metals.

Based on this analysis, I recommend buying Vale shares. In my view, investors should focus on the increase in production carried out by the company and the great possibilities of resolving legal cases that would dissipate the risks. The company will release its full financial results on July 25th.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.