Summary:

- Apple’s massive installed base and wide-reaching ecosystem represents a key gateway to consumer AI.

- So far in this AI race, Nvidia has been cementing its position as the core operating system for running Generative-AI software applications in this new era.

- The introduction of Apple Intelligence challenged this dominance by running Gen AI on servers not powered by Nvidia, with Apple striving to be the core operating system for consumer AI.

- Apple’s bold and independent AI strategy has encouraged investors to assign AAPL a richer valuation.

- While Apple’s AI growth opportunities are encouraging, the stock is simply too expensive, and arguably should not be trading at a higher valuation multiple than Nvidia.

Justin Sullivan/Getty Images News

Last month, Apple (NASDAQ:AAPL)(NEOE:AAPL:CA) officially entered the AI race with the introduction of Apple Intelligence. Since then, several new pieces of information have come out relating to Apple’s AI strategy, although various unknowns still remain. Nonetheless, the onset of Apple Intelligence has sparked an astounding rally in the share price, with investors assigning a stock valuation as if the company is set to dominate the era of AI, a crown that currently belongs to Nvidia.

In the previous article on Apple, we discussed Apple’s growth opportunities in the enterprise space amid the AI revolution. We discussed how Apple already has a competitive advantage in designing its own chips for years, on which it had already been running Machine Learning/ Artificial Intelligence workloads for years, paving the way towards building silicon to support generative AI workloads now. We also discussed opportunities on the enterprise software side for Apple.

Now in this article, let’s cover Apple’s revenue and profit growth prospects through the Apple Intelligence platform. We delve into the bull case, and then compare the stock’s valuation to AI leader Nvidia and other Magnificent 7 stocks. A ‘hold’ rating has been maintained on Apple stock.

Apple Intelligence expected to boost iPhone sales

Apple Intelligence is essentially Apple’s own AI platform, constituting of on-device processing and private server processing in the company’s own data centers.

Wall Street analysts have turned very optimistic on the company’s growth opportunities following the revelations of new generative AI capabilities on its hardware devices, as part of the iOS 18 rollout later this year.

Recent research from Morgan Stanley revealed that:

Our deep-dive analysis into Apple’s upgradeable iPhone base, upgrade rates, new user growth and iPhone model mix suggests that Apple will ship nearly 500M iPhones over the next two years, 6% higher than the record FY21-FY22 cycle, while also driving 5% annual iPhone ASP growth, resulting in nearly $485B of total revenue and $8.70 of earnings power by FY26, 7-9% above consensus

…

The bank expects Apple to ship 235M iPhones in fiscal 2025 and 262M in fiscal 2026.

Note the investment bank cited both “upgrade rates” and “new user growth” as catalysts for iPhone sales growth. In terms of upgrade activity expectations, Wedbush Securities research pointed out that:

270 million, of 1.5 billion iPhones, have not upgraded in 4+ years

That comes out at 18% of the iPhone installed base which are due for an upgrade. Now whether Apple will be able to persuade the rest of the user base to upgrade in order to access Apple Intelligence, or even attract new consumers into the ecosystem, will highly depend on how well Apple actually executes on this AI vision presented at the 2024 Apple Worldwide Developers Conference.

Apple will need to prove that Apple Intelligence, running on its in-house models, GPUs and servers, can match up in performance against Google and Microsoft’s generative AI-powered software services/ assistants, namely Gemini and Copilot, respectively.

The fact that Apple has built and trained its own generative AI models to power the new Siri, along with the other generative AI features, is certainly a very encouraging sign. Now these are much smaller models that can run on-device to complete various day-to-day generative AI-powered tasks. Apple revealed that its on-device model is 3 billion parameters in size. The tech giant also runs a larger language model on its private servers in its own data centers, to which workloads are sent for tasks that cannot be processed by the iPhone’s silicon. Apple has not disclosed how many parameters constitute this model, but likely to be much smaller than the current publicly available Large Language Models (LLMs). For context, OpenAI’s GPT-4 model is estimated to have almost 1.8 trillion parameters.

Industry observers believe that the larger the model, the greater its capabilities. Though smaller language models should indeed suffice for personal use-cases among smartphone users.

While the demos at WWDC were intriguing, Apple will now need to prove to both customers and investors that the models it has designed in-house can seamlessly and effectively execute all sorts of tasks prompted by its users.

Nonetheless, Apple building its own models positions the company better than rival Microsoft, which is still outsourcing its models from OpenAI to power the Copilot+ PCs introduced earlier this year. From this perspective, Google is a more viable competitor, with its powerful, multimodal Gemini model powering its suite of new AI services, augmenting the value proposition of its Android operating system for smartphones.

Nonetheless, Apple remains better positioned than both these tech rivals, given that out of the three, it offers the most well-established suite of personal computing devices, including smartphones, laptops/ desktops, and even smartwatches.

But perhaps Apple’s biggest advantage is that it controls the entire technology stack, down from the silicon to the hardware device itself, to the operating system, and all the way up to the consumer-facing software applications like iMessage. This unmatched vertical integration yields incredible performance advantages for Apple devices. Now Apple is striving to prove that this deep integration across multiple layers can also yield better AI inferencing performance, such as in the form of lower latency to provide faster responses to user prompts. Apple’s unique vertical integration certainly gives it a leg-up over its key rivals.

Apple’s AI monetization opportunities

At the hardware level, Apple will undoubtedly charge a premium for its next-generation iPhones and Macs with the debut of Apple Intelligence, supporting Average Selling Price [ASP] growth. As per the citation earlier in the article, Morgan Stanley expects “5% annual iPhone ASP growth”. Though aside from higher price points driving revenue growth, Apple’s ASP could also benefit from higher compute processing needs on devices.

Moreover, Apple’s new generative AI-powered Siri and other features like “Genmoji” will require a lot more computing power than the traditional prompts until now. To process these increasingly compute-demanding prompts and queries, Apple will be rolling out new generations of its silicon, which will be monetized through higher retail prices for its devices. But additionally, these complex queries will also require much higher on-device memory (both short-term and long-term memory).

To understand this additional revenue opportunity, remember that hardware devices come with two forms of memory, Random-Access Memory [RAM] and Storage memory. RAM memory is used for temporary processing of everyday tasks, mainly running and loading apps. It is a form of short-term memory. For example, asking Siri about the weather forecast or using the calculator app on an iPhone would use RAM memory. The more RAM memory a device has built in, the faster the processing of such tasks will be.

iPhone 15 Pro and iPhone 15 Pro Max reportedly have 8GB of RAM.

And then there is the long-term storage memory, which is the memory used for storing data, files, music, photos, etc. All iPhone base models come with 128GB memory, with availability to upgrade to 256GB and 512GB models. Apple charges $100 extra for every additional 128GB in storage memory.

While the RAM memory on iPhones cannot be upgraded, it can be upgraded for MacBooks. Base models for MacBooks come with 8GB memory, with upgrade possibilities to 16GB and 24GB. Apple charges around $200 for every 8GB of additional memory.

Processing complex generative AI workloads will require higher RAM memory, giving Apple the opportunity to sell base models with higher RAM memory built-in.

At the WWDC, Apple also emphasized the importance of data privacy in the era of Apple Intelligence, and highlighted that:

When you make a request, Apple Intelligence analyzes whether it can be processed on-device. If it needs greater computational capacity, it can draw on Private Cloud Compute, and send only the data that’s relevant to your task to be processed on Apple silicon servers. Your data is never stored or made accessible to Apple. It’s used exclusively to fulfill your request.

So in other words, Apple does not store user data on its servers, all data will be stored on-device. So as the new, more advanced Siri assists users with more complex personal queries, more long-term memory storage may be required on devices so that Siri can store data about the user’s personal preferences and recall that data the next time the user makes similar requests. (Though greater use of iCloud storage subscription services by users could counteract the need for higher storage memory on devices).

Nonetheless, the overarching point is, growing utilization of generative AI-powered software applications and the new Siri should increase memory requirements on-devices (particularly RAM). Hence, Apple could potentially introduce base models with higher memory capacity built-in to facilitate a more seamless and richer experience for Apple Intelligence, enabling the tech giant to charge an additional hundred dollars or more per device sold, boosting top-line and bottom-line growth for investors.

Now moving onto Siri, as per Apple’s announcements at WWDC, the new generative AI-powered Siri and various other features will be available for free to all Apple device users as part of iOS 18. Though, additional monetization opportunities could arise as Apple’s product roadmap evolves.

Let’s consider how other tech giants are planning to monetize similar generative AI-powered services.

Google allows people to use the Gemini chatbot for free to a certain extent, and ultimately encourages them to upgrade to Gemini Advanced for a subscription fee, to access larger models and complete more complex tasks. There have also been reports of Amazon planning to charge a monthly subscription fee for a new generative AI-powered Alexa voice assistant. And on Meta Platforms’ last earnings call, CEO Mark Zuckerberg also suggested charging users for access to larger AI models, while the current Meta AI assistant remains free.

Indeed, processing these increasingly complex queries in the era of generative AI is resulting in higher computing costs, and other tech giants are seeking to pass on these costs to consumers through monthly subscription fees.

As Apple’s Siri becomes increasingly advanced and develops more agentic capabilities to complete more complex, multi-step tasks at once, Apple may eventually have to charge monthly subscription fees for this feature as well, given that it may not be able to continue absorbing the costs of processing on its private cloud servers. Alternatively, instead of processing tasks on servers, Apple could build increasingly powerful chips for its devices to facilitate more on-device processing, and monetize more versatile Siri capabilities up-front by raising prices for its hardware like iPhones and Macs.

Furthermore, perhaps one of the most anticipated announcements at WWDC was the partnership with OpenAI, with ChatGPT becoming accessible through Siri to answer questions about “broad world knowledge” or “specialized domain expertise”. Bloomberg reported that Apple is not having to pay OpenAI for the integrated service. Apple benefits from being able to provide more extensive AI capabilities to its users, while OpenAI gains accessibility to Apple’s massive installed base. Going forward, Apple will likely strike deals with other model providers like Google and Anthropic to give consumers more choice.

Now investors are trying to foresee Apple’s monetization opportunities here. Currently, the primary monetization approach of these third-party model providers is to give away the simple version of their chatbots for free, while charging a subscription fee for their more advanced models. Certain market participants are expecting Apple to potentially earn a share of revenue if these third-party model providers gain subscribers through the Apple ecosystem. Though uncertainties still remain around, Apple’s exact monetization strategies here.

Risks to the bull case for Apple stock

While the new generative AI-powered features introduced by Apple and other tech giants are highly expected to encourage consumers to upgrade, Apple has said that the features may not be perfect and could make mistakes. There is a risk that consumers wait to upgrade, relying on product reviews and experiences from other users, before they decide to buy. This could lead to an underwhelming upgrade cycle relative to Wall Street’s expectations.

Take Microsoft’s Copilot rollout as an example. While initially enterprise customers were very excited to deploy Copilot within their organizations based on the demo videos, adoption of the generative AI-powered assistant (costing $30 per user/ per month) following official launch has been slow, with reports of Copilot making various mistakes when used for a range of organizational tasks. It is worth noting that Microsoft has also cautioned users that Copilot on its new Copilot+ PCs, which compete directly against Apple’s AI-powered Macs, could make mistakes, given the nascency of this technology.

Now in the case of Apple, it is already embarking on a bolder strategy relative to most other tech giants, by relying solely on in-house silicon, servers and operating systems to facilitate generative AI-powered services, while competitors are heavily relying on Nvidia’s technology. Apple will need to prove that the iPhone 16, iOS 18 and Apple Intelligence will live up to the hype in terms of performance.

While publicly available chatbot services and AI models have been frequently tested and compared to determine performance strengths and weaknesses, the efficacy of Apple’s in-house models and generative AI-powered services can only be determined upon the launch of Apple Intelligence later this year.

Any hint of glitches or underwhelming user experiences could discourage users from upgrading and wait for future generations until the AI technology is perfected. New smartphone buyers could even opt for Android devices, if Gemini is able to facilitate richer AI experiences than Apple’s AI models. Or even if the performances of these models match up to each other, Android devices offer lower price entry points for consumers to experience AI, giving it an edge to attract customers into the Google ecosystem.

Moreover, while the WWDC boasted a broad range of generative AI capabilities, not all features may be immediately available. For instance, cross-app task completion capabilities with Siri may not be available until 2025. Hence, we may only gain clearer visibility of iPhone sales prospects once Apple reveals which features will be available as part of iOS 18.

Despite the uncertainties and risks around the next upgrade cycle, AAPL stock seems to be priced for perfection at 35x forward earnings, leaving little room for error. This heightens the risk of a major stock price connection.

Apple’s Financial Performance and Valuation

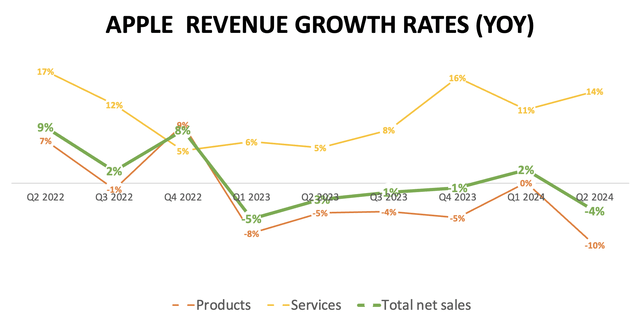

Apple’s revenue growth had been in decline for over a year, contracting by 4% last quarter, led by hardware sales falling by 10%.

Nexus Research, data compiled from company filings

Following the launch of Apple Intelligence, the market is now optimistic that this will reverse the revenue trend, as consumers are enticed to upgrade to devices fit for the AI era.

Apple’s full control over its entire technology stack, from the GPU up to the software applications, allows investors to be confident that the Cupertino-based giant will be able to deliver industry-leading consumer AI experiences.

Silicon advancements to enable greater on-device computing and augment the user experiences could yield stronger pricing power, driving revenue and profit growth for shareholders. And as discussed earlier, facilitating more complex computations to run generative AI workloads will extend the need for more memory capacity on devices, further supporting Apple’s ASP growth, conducive to a rebound in revenue growth.

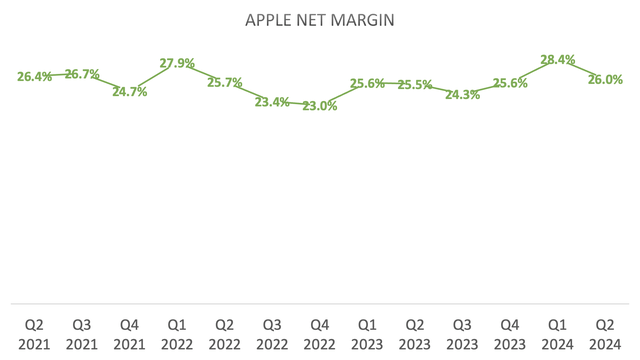

Now in terms of profitability, Apple’s net margin has remained relatively steady around 25% over the past several years.

Nexus Research, data compiled from company filings

The expected ASP growth for its hardware devices amid the generative AI wave will be accretive to Apple’s profit margins. Although the higher costs of computing through Apple’s Private Cloud, when users’ more complex queries can not be processed on-device, could undermine net margin expansion potential.

Nonetheless, unlike other major tech giants that are spending heavily on building out data centers using Nvidia’s AI computing solutions, Apple has not signaled plans to significantly step up CapEx to support the company’s AI ambitions, suggesting that CapEx will stay in the usual range of $10 billion to $11 billion annually. In fact, when asked by an analyst on Apple’s FY2024 Q2 earnings call, CEO Tim Cook said:

We have our own data center capacity and then we use capacity from third parties. It’s a model that has worked well for us historically and we plan to continue along the same lines going forward.

Apple’s lighter approach to data center buildouts should also support net margins for the foreseeable future. Apple is likely to allocate more of its CapEx spending on designing increasingly more powerful chips to facilitate more on-device processing, thereby reducing the need to send queries to private servers. This would certainly be a much wiser approach, as it would yield more superior inferencing performance that augments users’ experiences, and bolsters Apple’s ability charge higher prices for its suite of hardware devices.

That being said, there are indeed risks that could manifest in an underwhelming upgrade cycle. As discussed earlier, Apple will need to prove that its in-house generative AI models are competitive against the popular models currently out there. Users waiting to see if the upgrade is worth it, and/or Apple Intelligence not living up to expectations among the beta testers, or competitors like Google potentially offering better AI experiences, could all result in slower top-line and bottom-line growth for Apple.

Though these uncertainties have not stopped investors from pushing Apple stock’s valuation higher. Apple currently trades at a forward PE multiple of around 35x, significantly higher than its 5-year average of almost 27x.

Furthermore, Apple’s expected EPS FWD Long Term Growth (3-5Y CAGR) of 10.39% is rather underwhelming relative to how the stock is currently valued.

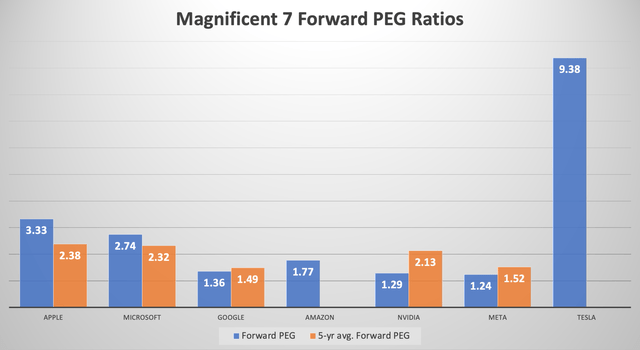

Adjusting the forward PE by this anticipated EPS growth gives us a forward Price-Earnings-Growth [PEG] ratio of 3.33, much higher than its 5-year average of 2.38, and making it one of the most expensive stocks out of the Magnificent 7.

Nexus Research, data compiled from Seeking Alpha

For context, a forward PEG ratio of 1 would imply the stock is trading at fair value, though popular tech stocks traditionally trade at a premium valuation of between 1.5 to 2.

Excluding Tesla, Apple would be the most expensive Magnificent 7 stock. In fact, it is even more expensive than Nvidia, the crowned king of the AI revolution. The fact that the Cupertino-based giant is not reliant on Nvidia’s expensive GPUs and hardware, like rivals Google and Microsoft are, and that Apple will be running generative AI workloads on purposely built on-device chips, in-house private cloud servers, and in-house operating systems, has certainly impressed Wall Street, signaling that is in better control of its AI future than initially perceived.

Boasting an installed base of over 2 billion devices, Apple is a force to be reckoned with in the consumer AI space. And with a notable proportion of consumer AI running on its own operating systems across iPhones, Macs, iPads, smartwatches as well as private cloud servers, the market has rewarded AAPL with a lofty valuation.

Although Apple stock is currently valued as if it is the king of AI, Nvidia. The market may be getting ahead of itself by rewarding AAPL with a higher valuation than Nvidia.

In a recent article, we delved deeply into Nvidia’s monetization opportunities for NVIDIA AI Enterprise, the core operating system powering AI software applications, with Nvidia earning $4,500 per GPU/ per year, and locking customers into the ecosystem to induce frequent upgrades to the next generations of its chips. Contrarily, Apple has yet to show investors how it can convert its full control of its AI infrastructure into recurring hardware and software revenue. Convincing end-consumer to upgrade their iPhones regularly for AI updates could be more difficult than Nvidia convincing enterprises to purchase increasingly powerful AI chips on a frequent basis to stay competitive. For context, Nvidia’s expected EPS FWD Long Term Growth (3-5Y CAGR) is 33.48%

Hence, while Apple’s AI growth story is certainly a bullish one, it is hard to make the case for buying the stock when it is trading at a lofty forward PEG ratio of 3.33, while the most sought-after Magnificent 7 stock, Nvidia, trades much closer to fair value at 1.29. This does not necessarily mean that AAPL has to trade at a cheaper valuation multiple than NVDA to make it a stock worth buying, but a forward PEG closer to (or preferably below) its 5-year average of around 2.30 would make it a more reasonable valuation.

But for now, Apple stock remains a ‘hold’.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.