Summary:

- Mastercard has consistently outperformed the market, with a 509% return over the past decade. It benefits from strong growth in the global payment sector and technological advancements.

- The company is expanding globally, enhancing its services, and signing significant new partnerships.

- Despite a high P/E ratio and low dividend yield, Mastercard remains a strong investment due to its strategic growth, aggressive buybacks, and robust future prospects.

lcva2

Introduction

24.3%.

That’s how much Mastercard (NYSE:MA) (NEOE:MA:CA) has returned every single year since January 5, 2007. An annual return of more than 24% would have turned $10,000 into roughly $86,000 after ten years and $739,000 after twenty years!

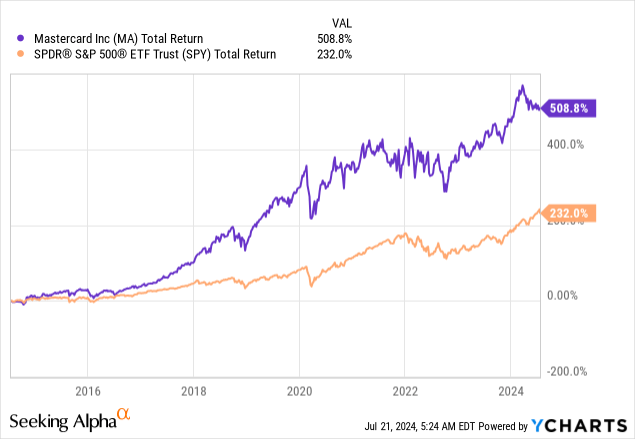

Over the past ten years, Mastercard returned 509%, beating the impressive 232% return of the S&P 500 by a huge margin.

So far, so good.

Unfortunately, past returns are no guarantee of future results. However, they can offer an indication, as Mastercard has proven it’s capable of exploiting strong secular growth in the global payment sector.

My most recent article on this company was written on December 17, when I highlighted attractive growth opportunities, including cybersecurity and AI-powered fraud detection.

In this article, I’ll update my thesis using new developments and conferences and explain why I remain very bullish on the company going into its second-quarter earnings.

MA Continues To Fire On All Cylinders

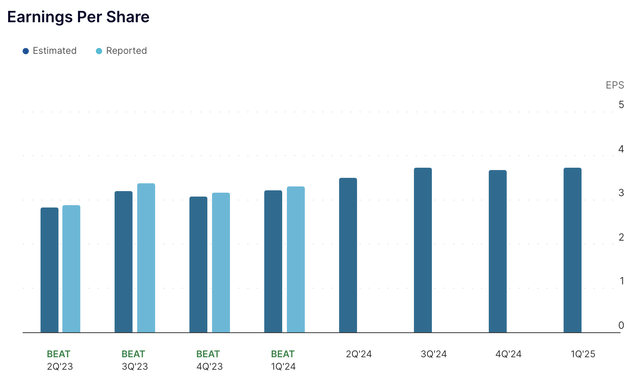

On July 31, Mastercard is scheduled to release its 2Q24 earnings, which, if history is any indication, should come in higher than expected. According to FactSet data, Mastercard has missed its earnings just 17% of the time over the past two years, with the past four earnings all coming in higher than expected.

2Q24 is expected to see $3.51 in EPS, which would be 21% higher compared to the prior-year quarter!

In general, analysts are very upbeat about the company’s future. These are the year-over-year growth rates that are expected in 2024-2026 (based on the FactSet data used in the Fast Graphs chart in the valuation part of this article):

| Year | EPS | Y/Y Growth |

| 2024E | $14.31 | 17% |

| 2025E | $16.65 | 16% |

| 2026E | $19.46 | 17% |

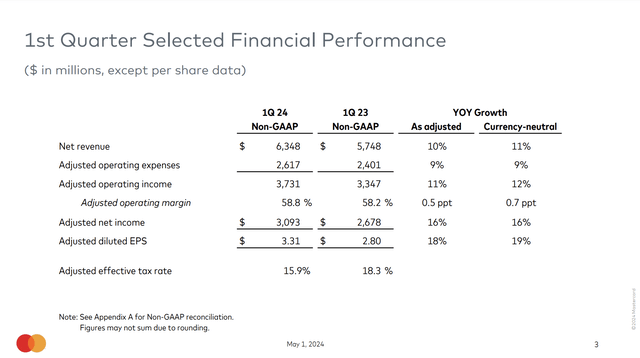

Even in 1Q24, the company was hitting it out of the park, reporting 11% revenue growth and a 16% increase in adjusted net income on a currency-neutral basis.

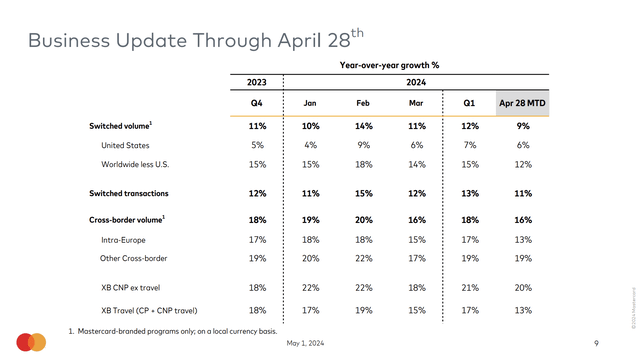

According to the company, growth was driven by healthy consumer spending and a significant 18% year-over-year increase in cross-border volume on a local currency basis.

One notable achievement the company mentioned during its 1Q24 earnings call is the widespread adoption of its contactless technology, which now accounts for more than two-thirds of in-person switched purchase transactions.

Moreover, in the first quarter, the company signed a significant agreement with Banco Bradesco in Brazil, which further supports its presence in the fast-growing South American market.

Additionally, a 10-year exclusive partnership with First Abu Dhabi Bank in the UAE covers multiple countries, including Saudi Arabia, Oman, and Egypt.

Earlier this month, the two corporations signed an agreement to work closer together when it comes to supporting businesses and implementing AI.

Thanks to these tailwinds, the company repurchased $2 billion worth of stock in the first quarter, part of an $11 billion buyback authorization it announced in December 2023. This buyback program is roughly 2.7% of its $412 billion market cap.

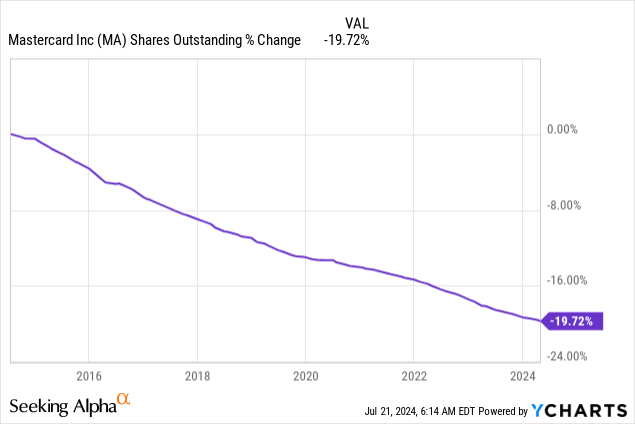

Over the past ten years, the company has bought back roughly a fifth of its shares, which significantly contributed to its favorable stock price performance.

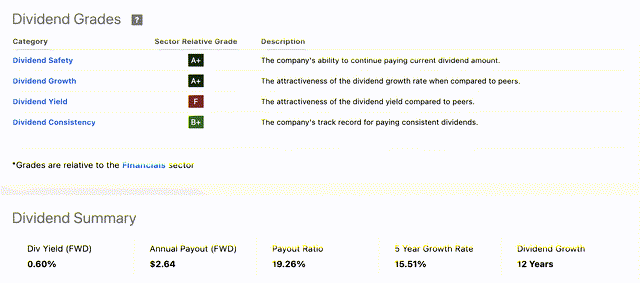

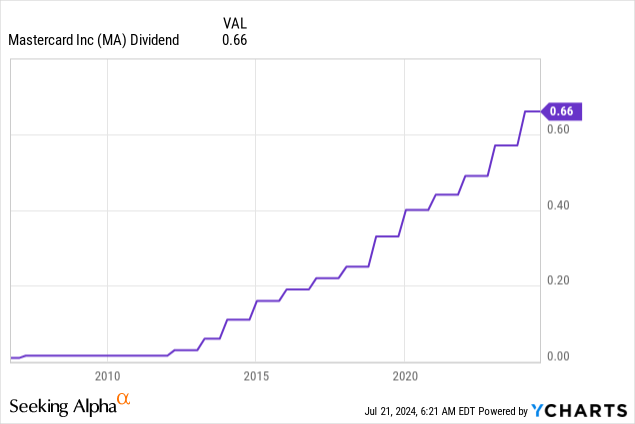

Moreover, Mastercard has a dividend. Although it yields just 0.6%, it comes with a sub-20% payout ratio and a five-year CAGR of 15.5%.

In other words, the only reason why the yield is so low is because the stock price more than offset dividend growth. That’s bad news for investors looking for income, but fantastic news for everyone who has bought Mastercard in the past.

Hence, it also makes sense that the company’s dividend yield is the only component of the dividend scorecard that comes with a poor grade. It scores A+ on both safety and growth.

It also helps that Mastercard remains very upbeat about its future, which is no surprise given the analyst estimates I already showed.

A Path To Long-Term Elevated Growth

Going forward, Mastercard remains very optimistic for 2024, expecting to grow revenue at the high end of a low-double-digit range on a currency-neutral basis.

According to the company, this outlook is supported by healthy consumer spending, an increase in demand for its value-added services, and growth initiatives.

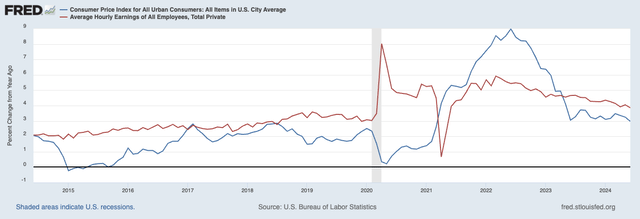

Regarding consumer spending, the company used the most recent Bernstein Strategic Decisions Conference to explain that it sees strong employment markets and outperforming wage growth in certain areas.

Federal Reserve Bank of St. Louis

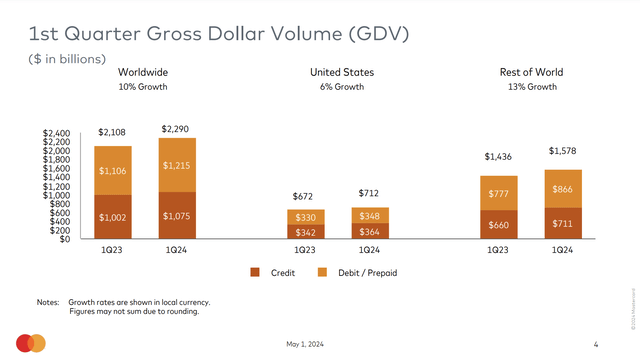

Briefly going back to the first quarter, worldwide gross dollar volumes were up 10% worldwide, with outperforming growth of 13% in non-U.S. markets.

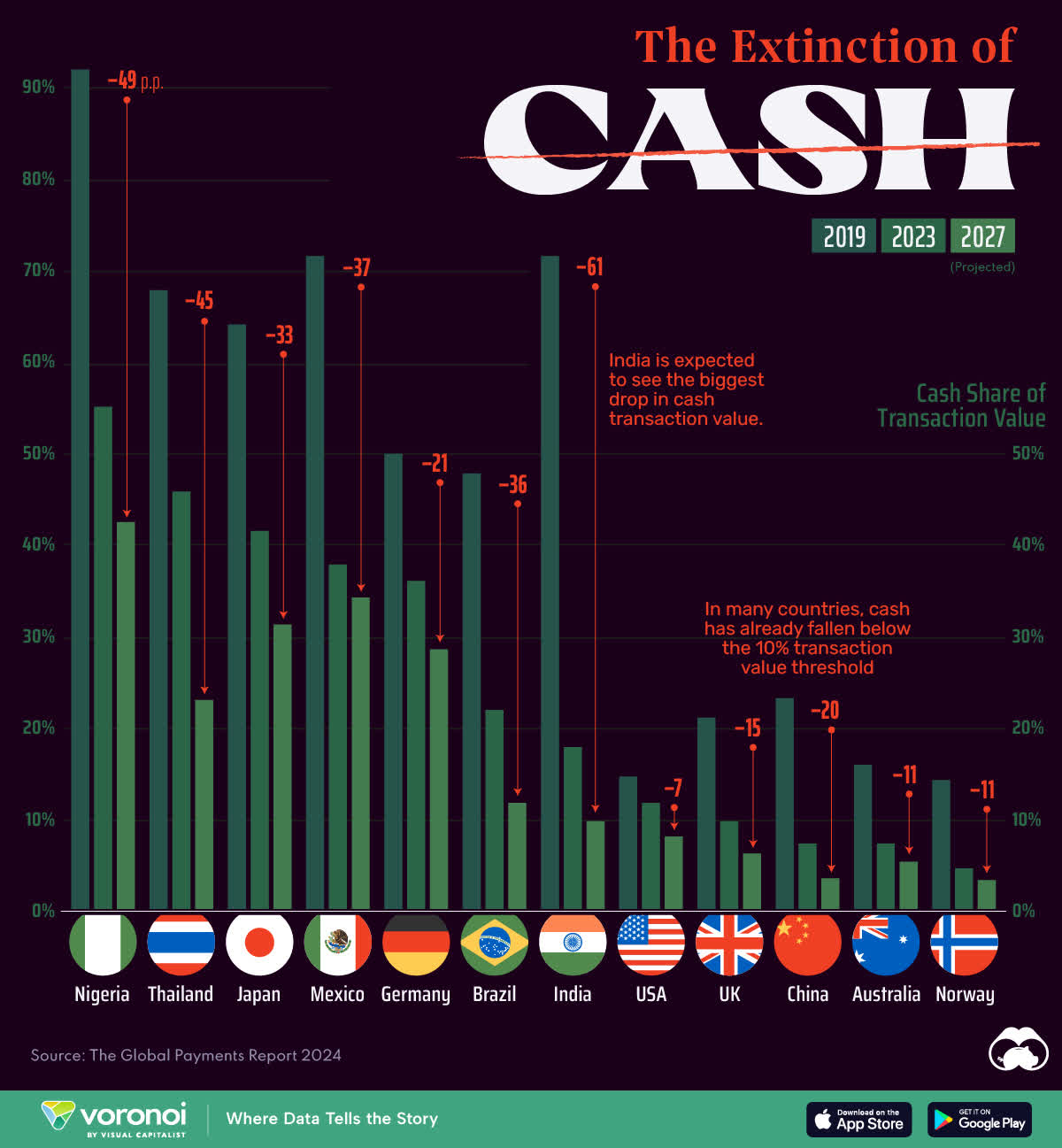

What’s interesting is that the company’s bread-and-butter, electronic payments, are still seeing strong secular growth. It’s a market that may be mature in certain developed markets but also a market with significant growth opportunities in other areas.

During the Bernstein conference, the company noted that the penetration rate of electronic payments is still heavily weighted towards cash, mainly in transaction volume.

Visual Capitalist

Essentially, this scenario presents two opportunities for Mastercard: increasing the volume of carded transactions and the number of transactions.

Even better, our economies are changing. The rise of the gig economy, more subscription services, and delivery platforms have caused significant opportunities for much higher payment volumes.

Uber Eats is a great example. I added emphasis to the quote below:

So just as an example, if you go back to the pre-COVID days, it’s not like the likes of Uber Eats didn’t exist, they existed, but doesn’t get an acceleration in terms of the utilization of platforms like Uber Eats. And what that does effectively do is where in the past, you’d go and do one transaction to buy your lunch at the store for a certain dollar value. Now you’re doing that same transaction on the Uber Eats platform, which is then being followed up by a payment by Uber Eats, to the merchant in question, which is a second transaction with incremental volume coming out of the system. So we view that as an important place for Mastercard. – Mastercard

It also keeps winning new deals, including with major European banks like NatWest, Santander, and Deutsche Bank.

China is another market where the company has been doing business for a while, as it’s one of the largest and most profitable markets in the world.

So far, the company has mainly done cross-border transactions in China. Now, it has a license for domestic operations, using a joint venture to effectively gain a bigger share of this market.

Mastercard is also increasingly growing its footprint in the commercial sector, which includes a wide range of card-based solutions, including SME propositions, travel and entertainment cards, fleet cards, and virtual cards.

Last year, these operations accounted for 13% of Mastercard’s gross dollar volume.

Moreover, Mastercard has been investing in the account-to-account (“A2A”) payments space, aiming to complement its existing card offerings.

A2A payments are gaining traction, mainly in bill payments and business-to-business (“B2B”) transactions. The company sees that its strategic acquisitions in real-time payment assets and open banking capabilities are expanding its total addressable market in these areas.

Essentially, the account-to-account payment is a way for Mastercard to support a wider variety of payments, which is key in a market with an increasing number of transaction alternatives.

On top of that, the company is aggressively focusing on value-added services, which account for more than 35% of its net revenues.

These services include fraud and security solutions, loyalty programs, payment gateways, open banking capabilities, and digital identity services.

By using data analytics and AI solutions, the company can easily expand these offerings, including hyper-personalized loyalty programs.

Valuation

Mastercard isn’t cheap. However, it’s far from being overvalued.

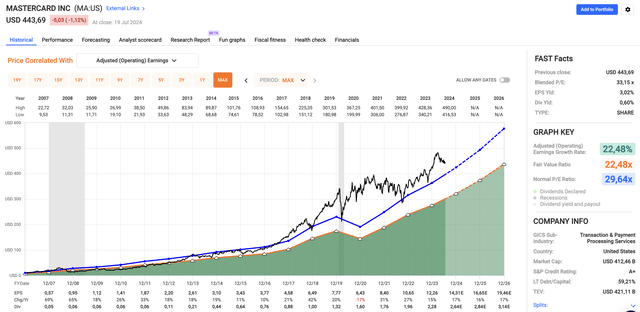

Currently trading at a blended P/E ratio of 33.2x, it has room for double-digit annual returns, even if we assume a return to its long-term normalized P/E ratio of 29.6x.

As we briefly discussed in this article, analysts expect the company to maintain elevated growth, growing its EPS by 16-17% per year through at least 2026.

This paves the way for a $577 price target, 30% above the current price.

Although Mastercard will likely sell off a bit if the market continues its corrections, I’m very upbeat about the future of this giant and still aim to make it a holding of my portfolio.

Right now, I don’t have the cash to do so. While I’m reinvesting dividends, I added four new stocks to my portfolio this year, including two that now account for 18% of my total portfolio. Hence, I’ll need some time to rebuild my war chest for a new investment.

Takeaway

Mastercard’s incredible track record continues to impress, with expectations for strong future growth supported by healthy consumer spending, its expansion into new markets, and strategic investments.

Despite a rather low dividend yield, its aggressive buyback program and consistent growth in earnings make it a compelling long-term investment.

While I’m currently unable to add it to my portfolio due to recent investments, Mastercard remains a top candidate for my strategy, as I believe this business model is the perfect fit for my strategy.

Needless to say, as we approach the upcoming 2Q24 earnings release, I remain highly bullish on Mastercard.

Pros & Cons

Pros:

- Exceptional Performance: Mastercard has consistently outperformed the market, returning 509% over the past ten years.

- Strong Growth Prospects: With expected EPS growth of 16-17% annually through 2026, I believe the company is set for continued success.

- Strategic Relationships: New partnerships and market expansions, especially in South America and China, support future growth.

- Value-Added Services: Investments in AI, cybersecurity, and A2A payments put Mastercard in a great spot to generate additional value through its massive existing product platform.

- Aggressive Buybacks: A robust buyback program enhances shareholder value, having already repurchased a fifth of its shares over the past decade.

Cons:

- High Valuation: Trading at a blended P/E ratio of 33.2x, Mastercard isn’t cheap and might be prone to market corrections.

- Low Dividend Yield: At just 0.6%, the dividend yield is very low, which might not appeal to income-focused investors.

- Market Dependence: Continued growth is heavily reliant on sustained consumer spending and economic stability, which can be unpredictable.

- Execution Risks: Expansion into new markets and technologies comes with execution risks and potential regulatory headwinds.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.