Summary:

- AT&T is set to announce Q2 2024 fiscal year data on July 24th.

- Analysts expect revenue growth but predict a decline in profits.

- The company’s core operating assets show impressive growth, making it an attractive prospect for the future.

- On top of this, shares are attractively priced and likely deserve upside as a result.

wdstock

Those who follow my work closely know that one of the companies I own shares of is telecommunications conglomerate AT&T (NYSE:T). Even though it’s only the 6th largest of my 8 holdings in my concentrated portfolio, it still accounts for 10.2% of those assets. So clearly, I have a lot at stake in how the performance of the company goes. Of course, given how exposed I am to the business, I make sure to re-evaluate my position based on new data that comes in. It just so happens that management is about to announce new data, data covering the second quarter of the company’s 2024 fiscal year. This is expected to occur on July 24th, before the market opens.

For that time, management expects continued revenue growth. However, profits are expected to pull back somewhat. Considering the company’s guidance for the current fiscal year, I find this peculiar. I wouldn’t be surprised if earnings exceed forecasts. After all, when you look under the hood, you actually see a large and vibrant enterprise that is experiencing attractive growth across all but one of its operations. Given this picture, as well as how cheap shares currently are, I think that it makes sense to consider the business a top tier prospect for the foreseeable future.

A look at upcoming results

In the last article that I wrote about AT&T, published in April of this year, I rated the company a ‘strong buy’. Since then, things have gone quite well. The stock is up 16.8% at a time when the S&P 500 is up only 10.1%. In my own personal view, this can be attributed to the market finally coming to terms with the quality operation that we are dealing with. But of course, this picture can always change, both for the better or for the worse.

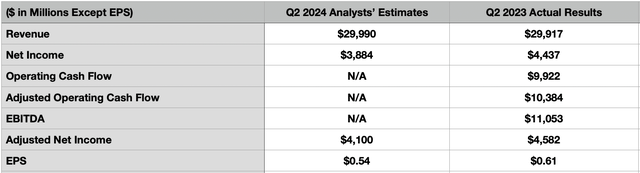

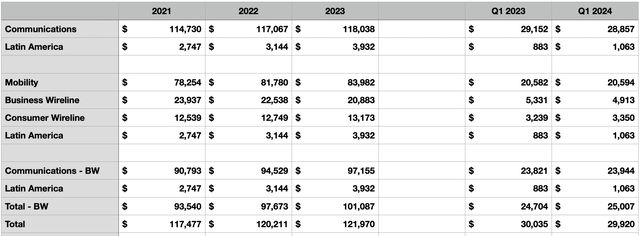

As I mentioned already, management is going to be announcing financial results for the second quarter of the 2024 fiscal year. Leading up to that time, analysts anticipate revenue for the company of $29.99 billion. If this comes to fruition, it would translate to an increase of 0.2% compared to the $29.92 billion the company reported the same quarter of the 2023 fiscal year. Almost certainly, this will be driven by growth across all other company’s operations, with the exception of its Business Wireline segment. For years now, as you will see shortly, this part of the firm has been experiencing decline, not only from a revenue perspective, but also from a profitability perspective. I would be shocked if there is any material weakness from any other part of the business.

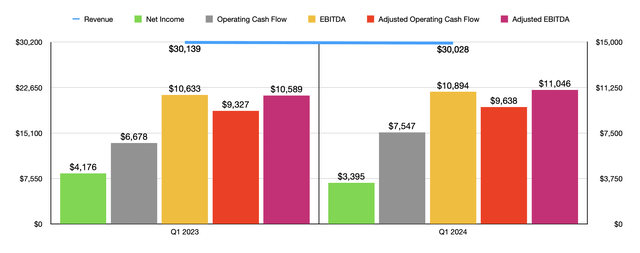

On the bottom line, analysts seem to be quite pessimistic. Earnings per share are forecasted to come in at only $0.54. That would be down from the $0.61 per share reported for the second quarter of 2023. This would translate to a decline from $4.44 billion to $3.88 billion on a year-over-year basis. Even if we look at adjusted earnings per share, the expectation is for a decline from $0.63 to $0.57. That would result in a drop in adjusted profits from $4.58 billion to $4.10 billion. In the table above, you can see other profitability metrics for the second quarter of 2023. If net income is to fall, especially on an adjusted basis, it would not be surprising to see these pull back as well. However, I would find this to be a bit surprising.

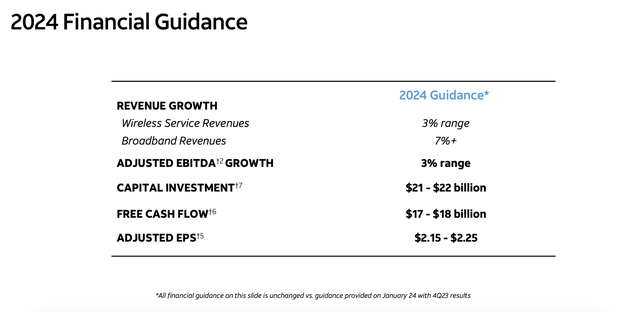

In addition to looking at headline news items and other cash flow figures, investors would be wise to be looking out for any changes in guidance for the year. When the company announced financial results for the first quarter of 2024, it said that its wireless service revenues should be about 3% higher this year than last year. They said that broadband revenue should climb a robust 7%. And thanks to capital expenditures of between $21 billion and $22 billion, EBITDA would be able to grow by roughly 3%.

For the year as a whole, this implies adjusted EBITDA of somewhere around $44.70 billion. That would be up from the $43.40 billion reported one year earlier. These figures add back in certain extraordinary items, mostly changes from one year to the next in terms of the pension expenses that the business incurs. And with management anticipating total free cash flow of between $17 billion and $18 billion, the capital expenditure budget of the business implies operating cash flow of about $39 billion. But if the relationship between operating cash flow and adjusted operating cash flow looks the same this year as it did last year, this would give us an adjusted figure of about $41.50 billion.

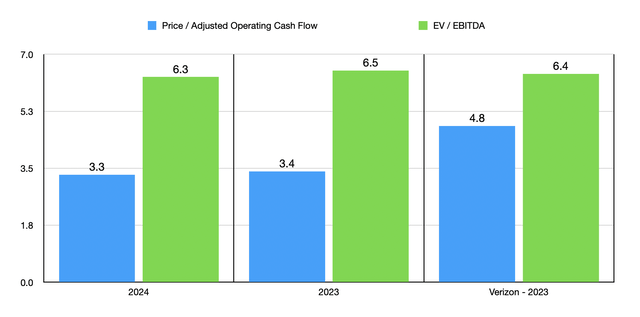

Using these figures, shares of the conglomerate look attractively priced. In the chart above, you can see how the company is valued using historical results for 2023 and estimates for 2024. That chart also compares the company to rival Verizon Communications (VZ). Historically speaking, AT&T has traded at a slight discount to Verizon Communications on an EV to EBITDA basis. But now, and it’s trading at a hair of a premium. It is still at a discount, however, to the company on a price to adjusted operating cash flow basis. While I do believe that AT&T is the better of the two companies, I would argue that both are attractively priced and deserve upside from here.

A reputation that AT&T developed over the past several years has been that of a troubled conglomerate that has too much debt and that has been punished by the market by a series of poor decisions. I have long argued that the debt situation is not even remotely close to what many argue it is. But there is no denying that the business has made mistakes over the years. Throughout my time writing about the firm, I have followed the company’s progress in unwinding these past mistakes. And today, the firm is largely rid of these bad assets.

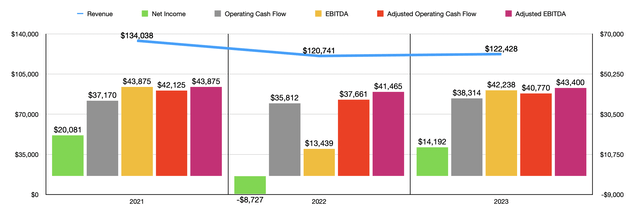

Even so, when you look at the overall financial performance for the business over the past three years, and through the first quarter of 2024. You see a lot to complain about. Revenue in 2021, for instance, was $134.04 billion. Even though 2023 was higher than 2022 was, 2023 still sells substantially lower revenue at $122.43 billion. Net profits have fallen, and the same can also be said of cash flows. The bottom line for the business largely improved in the first quarter of this year compared to the same time last year. But the big exception to this was a decline experienced in net income from $4.18 billion to $3.40 billion.

Taking a cursory view of the business, I can understand why some investors would think that AT&T is a dud. But it’s also important to keep in mind that a lot of this volatility has been driven by assets that it no longer has or by certain one time events. For instance, back in 2021, the company generated $15.51 billion from its video operations. These were eventually spun off into another asset entirely. So for comparability purposes, it doesn’t make sense to still use the GAAP revenue the company reported for that year. In addition to this, ‘other income’ for the company fell from $9.39 billion in 2021 to only $1.42 billion last year. And from the first quarter of 2023 through the first quarter of this year, it dropped from $935 million to $451 million. A lot of this change has been the result of earlier gains on pension assets. When we strip all of this out and instead look at the company’s core operating assets, the situation looks remarkably different.

In the table above, you can see the main operations of AT&T during the timeframe we are focused on. These days, the business has two different operating segments, Communications and Latin America. But underneath the Communications segment we have three different units known as Mobility, Business Wireline, and Consumer Wireline. For years now, the Business Wireline part of the company has been in a permanent state of decline. This is largely the result of customers switching over to Mobility. If we exclude this from the equation, revenue for the firm as a whole would have risen from $93.54 billion in 2021 to $101.09 billion last year. And for the first quarter of this year, revenue would have increased from $24.70 billion last year to $25.01 billion this year.

The total aggregate growth rate between 2021 and 2023 for these operations, excluding Business Wireline, was 8.1%. That’s well above the 3.8% if we include Business Wireline. I would like to point out that every one (Business Wireline) of AT&T’s other major assets experienced growth during this time. And perhaps the most impressive part of the growth story has been its small set of operations in Latin America. From 2021 through 2023, revenue jumped 43.1%. And for this year, the $1.06 billion generated by that unit was 20.4% above the $883 million seen in the first quarter of 2023.

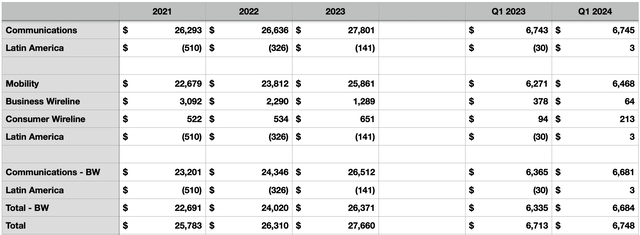

We can see similarly impressive results when looking at segment operating profits. Over the last three fiscal years, the Business Wireline unit reported a decline in operating income from $3.09 billion to $1.29 billion. In the first quarter of this year, the gain of only $64 million paled in comparison to the $378 million reported the same time last year. Even with this pain, total profits at the segment level for the company grew from $25.78 billion in 2021 to $27.66 billion last year. And the $6.75 billion generated in the first quarter of this year beat out the $6.71 billion reported last year. It is worth noting that some of the company’s improvement has come from its Latin America business. Back in 2021, AT&T reported an operating loss of $510 million from those assets. That loss dropped to $141 million last year. And in the first quarter of this year, it booked a small profit of $3 million. But that was far better than the $30 million loss reported for the first quarter of 2023.

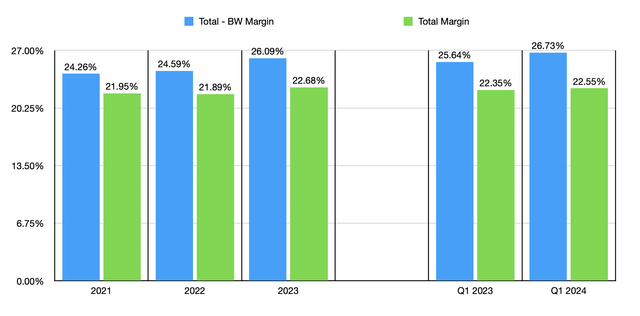

If we remove Business Wireline from the equation, growth becomes far more impressive. Instead of growing operating profits by 7.3% over the last three years, the increase in this scenario would be 16.2%. Year over year in the first quarter, the rise would be 5.5% compared to the 0.5% improvement seen when we include Business Wireline in the mix. We also can see this from a profit margin perspective. As the chart below illustrates, the operating profit margin for the company improved over the last few years, whether we include Business Wireline into the mix or not. But the improvement from 2021 through 2023 was a robust 1.83% if we exclude it from the picture. This is well above the 0.73% improvement seen when we keep it in.

To be perfectly honest with you, I don’t know what the future plan might be for Business Wireline. For the past few years, management has essentially just been winding it down. It does have valuable assets to it and revenue generation is still great to see. It is reaching the point where profitability is going to be a problem. But the good news is that the rest of the company is incredibly healthy. And in all honesty, I don’t expect that picture to change for the foreseeable future.

Takeaway

Heading into earnings, analysts may have mixed expectations. But that doesn’t change my own bullishness about the business. In my mind, AT&T is a really attractive prospect that, in the long run, should continue to generate significant positive cash flows. The company will likely continue paying down debt as time goes on. But it will also allocate a lot of its capital toward dividends. Personally, I would prefer a greater emphasis on share buybacks. That’s especially the case when we see how cheap shares are. Given all that I disclosed about the company here, and my own experience with it, I suspect that the picture will continue to get better from this point on. Whether or not the firm will exceed analysts’ forecasts on its top and/or bottom lines is something that nobody knows. But as a long term, value-oriented investor, I remain confident in the business

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!