Summary:

- Etsy stock has underperformed the S&P 500 since I initiated my “hold” rating in May, where I expected the stock to face headwinds with GMS and profitability declining in Q1 FY24.

- Etsy is due to report its Q2 earnings on July 31, where revenue is expected to grow 1.7% YoY, while adjusted EPS is expected to decline 33% YoY to $0.98.

- However, management’s commentary and guidance on GMS growth for the remainder of the year will be key, along with their projections for take rate and Adjusted EBITDA margin.

- I believe that Q2 will likely mark the trough, and revenue and earnings should pick up pace from here on as Temu shifts its focus away from US, inflation is on its way down and the company repositions its brand.

grinvalds

Introduction & Investment Thesis

I initiated a “hold” rating on Etsy (NASDAQ:ETSY) on May 12, and since then, the stock has underperformed the S&P 500. My “hold” thesis was predicated on my belief that the company will continue to see short-term headwinds as it translates its product innovation into accelerating Gross Merchandise Sales (“GMS”), which had declined 3.7% YoY in Q1 FY24 earnings under a challenging macroeconomic environment.

The company is due to report its Q2 FY24 earnings on July 31, where it is expected to grow its revenue 1.7% YoY to $629.62M, while adjusted earnings per share is expected to decline 33.27% YoY to $0.98. Although the company has very low analyst expectations going into the earnings, I believe that investors will be paying close attention to management’s commentary on GMS growth in the second half of the year. In its Q1 earnings, the management outlined that GMS should see a modest acceleration in the second half of the year. So, if the company is able to raise its guidance for GMS as pressures from Temu, owned by Chinese e-commerce giant PDD (NASDAQ:PDD) slightly subside along with the management’s renewed efforts to reposition the company in an overall improving macroeconomic environment, it should boost investor confidence in the stock.

Given my assumptions, where I expect growth and profitability to accelerate from current levels, I believe the stock has sufficient upside from its current levels. Therefore, I will upgrade my rating from “hold” to “buy,” where investors can initiate a small position before the earnings call while waiting for further management commentary on the GMS growth and profitability landscape in the coming quarters.

A quick recap of the Q1 FY24 earnings call

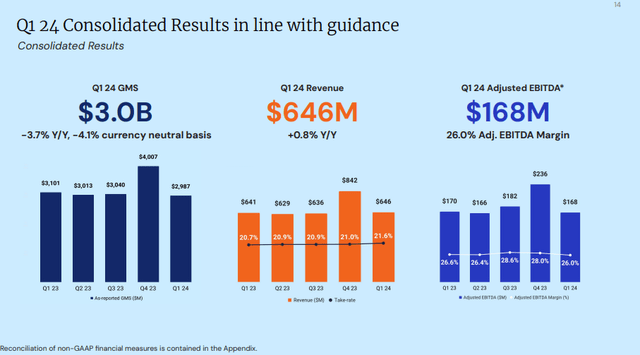

In Q1 FY24, Etsy generated $646M in revenue, which grew just 0.8% YoY, missing estimates, while Adjusted EBITDA declined 1.4% YoY to $167.9M with margins shrinking by 60 basis points to 26%. While overall GMS declined 3.7% YoY in the last quarter, the bright spot was that Etsy was able to reactivate its buyers on the platform, while Active Buyers also grew 1.9% YoY. At the same time, the company also saw its GMS from gifting grow in the low single digits after it launched its interactive gift shopping experience called Gift Mode to attract new and existing buyers into the funnel and delight them in the whole process of finding the perfect present.

Q1 FY24 Earnings Slides: Etsy’s Q1 Earnings Snapshot

However, despite the company’s efforts to improve search relevance and leverage AI to suppress product listings that violated their policies, the elongated period of high inflation had depressed consumer sentiment, with Josh Silverman, CEO of Etsy, outlining that consumer wallets were squeezed and competition from larger players who are able to offer deeper discounts in the “sea of sameness in e-commerce” was rising.

What has happened since then?

-

Since its Q1 FY24 earnings, Etsy’s competitor Temu, which is owned by Chinese e-commerce giant PDD Holdings, has decided to shift its business priorities away from the US, especially after the House passed the TikTok bill in March, which served as a wake-up call for Temu to reduce its reliance on the US market. Even though Temu had become the US’s second-most popular app after Amazon.com (NASDAQ:AMZN), it had been coming under greater scrutiny as US lawmakers expressed concerns around forced labor. Although Wall Street analysts have not changed their rating or price target after the announcement, I believe that this should act as a significant tailwind for Etsy, in my opinion, boosting GMS on the platform.

-

At the same time, the company also launched a major overhaul of policies that govern the site, including new labels on its website and app to show how each seller created a particular item as per their new creativity standards. At the same time, sellers would also need to disclose if they created an item using AI so that the company could remain true to its mission of keeping commerce human. In order to drive the message and better position itself against commoditized commerce, it has also launched an ad campaign celebrating seller stories, so people are reminded of the human touch and therefore feel compelled to shop from Etsy once again.

-

Since the last earnings call, inflation has been steadily declining, which has increased the odds of the Fed cutting interest rates by September. Meanwhile, retail sales also showed moderate growth, driven by sectors such as online sales, general merchandise stores, and clothing and accessory stores. Should the labor market stabilize at current levels without further weakening, followed by rate cuts starting in September, we might see a reignition in consumer spending, which should boost Etsy’s top-line growth.

Things to look out for in Etsy’s Q2 earnings

Etsy is due to report its Q2 FY24 earnings on July 31, and we need to pay attention to the following metrics and management commentary for guidance on these fronts.

-

GMS: The company is expected to report a decline in GMS in Q2 in a similar range to Q1 in the -3.7% range. On one hand, while investors will be pleased if GMS outperforms expectations, I think there will be a bigger focus on the management commentary for what lies ahead. In the previous earnings, the company had outlined that it expects GMS to see a modest acceleration in the second half. Should the company raise its guidance on this front, as it sees an improving macroeconomic environment and its investments in product innovation and marketing initiatives pay off, I believe there will be upward movement in the stock price.

– Active Buyers: There is no guidance on this front; however, a growing number of Active Buyers, along with reactivating existing buyers, can also be seen as a tailwind for the company’s top-line growth.

– Take Rate & Revenue Growth: In Q1, the company’s take rate was 21.6%, higher than the 20.7% take rate in the previous year. The company expects its Q2 FY24 take rate to be in a similar range to the prior quarter. For the full year, the company expects its take rate to be in line with or ahead of its Q1 FY24 levels. So either a combination of higher guidance for GMS while keeping take rate projections constant or increasing its take rate projections while keeping GMS expectations anchored will boost overall revenue growth, which should boost investor confidence.

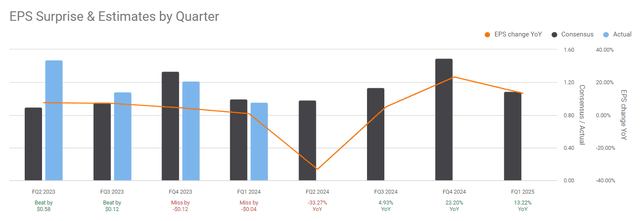

2. Adjusted EBITDA Margin: For Q2, Etsy is expected to generate a similar Adjusted EBITDA margin of 26%, like in the previous quarter, while its non-GAAP EPS is expected to decline 33% YoY to $0.98. I would like to note that this figure has been revised downward 17 times by Wall Street analysts over the last 90 days. While meeting or exceeding its Q2 expectations would be a positive sign, what is important to note is that this should mark the bottom with the last quarter of EPS declines, as can be seen in the chart below. While the management believes that Adjusted EBITDA margin in FY24 should be at least the same as FY23 at 27.4%, a potential raise in its GMS or take rate guidance could lead to further expanding margins as it leads to more operating leverage.

Seeking Alpha: EPS should bottom in Q2 and start to accelerate

Revisiting the valuation: Price target is unchanged

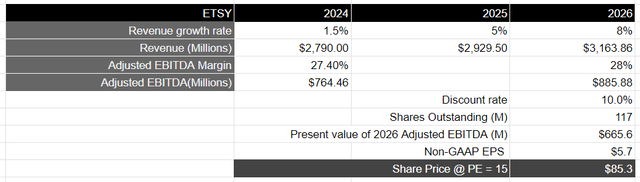

I will keep the underlying assumptions of my valuation model the same as in my previous post, where I took the consensus expectation for revenue growth in FY24 at 1.5%, followed by an acceleration in the mid- and high single digits the years later, resulting in a total revenue of approximately $3.16B. This will be possible as the company re-establishes its mission of keeping commerce human as it nurtures its ecosystems of buyers and sellers by providing meaningful experiences along the customer journey, thus driving higher GMS on the platform.

From a profitability standpoint, assuming that Etsy is able to maintain its Adjusted EBITDA margins of 27.5%-28% over the coming years, it should generate close to $885M in Adjusted EBITDA, which is equivalent to a present value of $665M when discounted at 10%.

Taking the S&P 500 as a proxy, where its companies grow their earnings on average by 8% over a 10-year period, with a price-to-earnings ratio of 15–18, I believe that Etsy should trade at par with the index, given the growth rate of its earnings. This will translate to a PE ratio of 15, or a price target of at least $85, which represents an upside of 37%.

My final verdict and conclusions

Although the management still has to showcase that it can accelerate growth with its product innovation and marketing initiatives amidst a tough competitive landscape, I believe that the overall macro environment has improved since the time of my writing. With Temu shifting its focus away from the US market, Etsy repositioning its brand by setting new creative standards and launching ad campaigns to attract buyers on the platform, and overall inflation declining, I believe that it sets the foundation in place for revenue and profitability to start to accelerate from their current levels.

Plus, I believe that an upside of 37% provides sufficient margin of safety in the event that the company’s results come at par with expectations or slightly under. Therefore, I have decided to upgrade my rating from a “hold” to a “buy” at the moment, as I believe investors can initiate a small position before the earnings call while waiting for further management commentary on the GMS growth and profitability landscape in the coming quarters.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.