Summary:

- I’m cautious about paying 36x forward free cash flow for Snowflake Inc. stock due to its slowing revenue growth.

- Snowflake’s impressive free cash flow increase doesn’t outweigh the challenges of its decelerating revenue.

- Snowflake’s high valuation seems risky given the current macro environment and pressure on IT budgets.

Sundry Photography

Investment Thesis

Snowflake Inc. (NYSE:SNOW) is a stock that I’ve been openly dismissive of for some time. My rationale here is straightforward. A company can bedazzle its shareholders for some time, but after a while, investors start to become apprehensive and cautious.

Today, Snowflake is a “show-me” story. And yet, not everything is bad with this investment. In fact, Snowflake carries a tremendous amount of cash on its balance sheet, which amounts to more than 10% of its market cap as cash and marketable securities.

Nevertheless, I’m unexcited to pay 36x forward free cash flow for Snowflake, given its steadily decelerating revenue growth rates.

All considered, I’m neutral on this stock.

Rapid Recap

In my previous analysis, in May, I said,

I can understand why investors that are long this stock may continue to buy more of a stock with such an alluring narrative on Wall Street, but for new investors looking at the stock with fresh new capital, I do not see the appeal.

Simply put, Snowflake isn’t worth its premium.

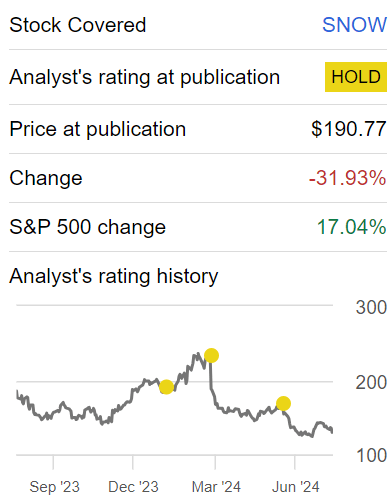

Author’s work on SNOW

This is a stock that I’ve been neutral on for some time. Indeed, since my neutral rating, Snowflake is down slightly more than 30%, while the S&P 500 (SP500) continues to rage ahead, with Snowflake underperforming the market by more than 45%. And now, as I look ahead, I argue that investors should not be fooled into buying the dip here.

Snowflake’s Near-Term Prospects

Snowflake is a cloud-based data warehousing company that provides a comprehensive platform for data storage, processing, and analytics. It enables organizations to consolidate their data in a single location, making it easily accessible and usable for various data science tasks.

Snowflake’s platform is designed to handle large volumes of structured and unstructured data. Unstructured data is information that doesn’t have a predefined format, think of emails, videos, and social media posts that are “always on.” Snowflake enables customers to derive actionable insights and improve their decision-making processes.

Meanwhile, Snowflake faces headwinds. One significant challenge is the pressure on the price per query, driven by a competitive landscape and the need to offer tiered storage pricing to accommodate large customer commitments. This adjustment, while beneficial for customer retention and growth, has a direct impact on Snowflake’s margins. Snowflake’s usage-based service works tremendously well in a strong macro environment, but is perilous in a weaker environment, such as the one we are now navigating.

Given this balanced background, let’s now discuss its fundamentals.

Revenue Growth Rates Moderate

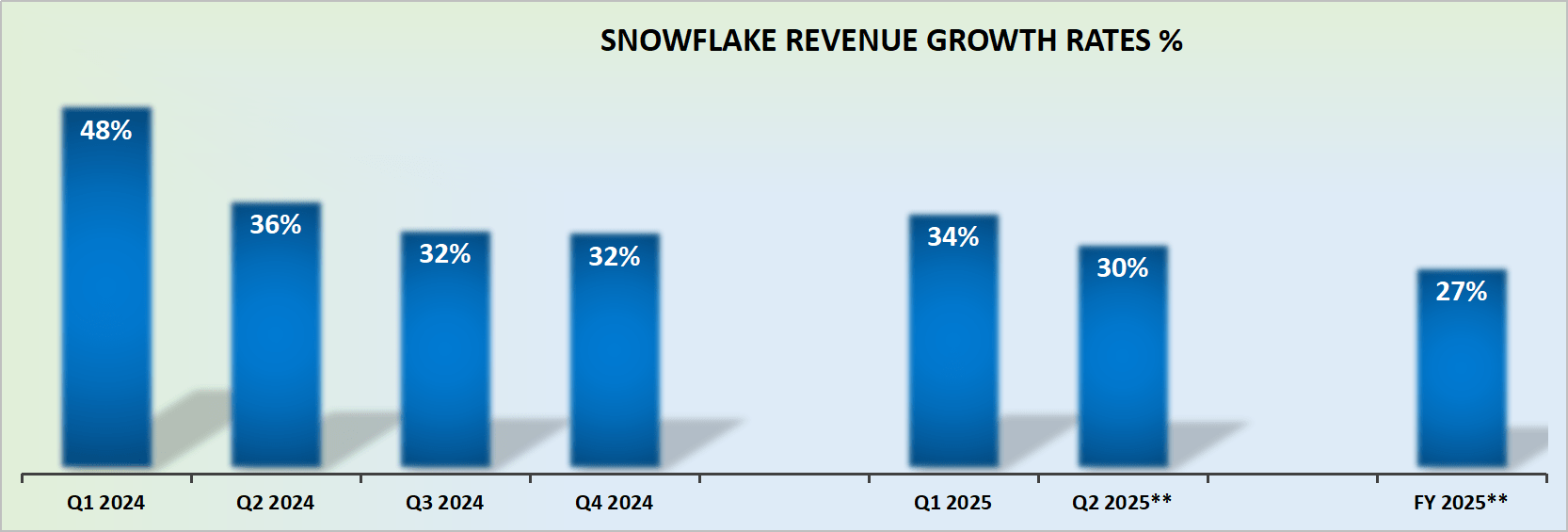

SNOW revenue growth rates

Let’s cut to the chase. Whether you are bullish or not on Snowflake, you can’t avoid the fact that Snowflake’s growth rates are slowing. The time when this company could be relied upon for +30% revenue growth rates is now a mirage.

It’s a company that has built a shareholder base of fanatics. Over time, I’ve seen numerous such companies that manage to lure fans to their shareholder base. Obvious successful names here are Tesla, Inc. (TSLA), NVIDIA Corporation (NVDA), and Palantir Technologies Inc. (PLTR). While the less successful obvious names, with equally ferocious shareholder bases, are BlackBerry Limited (BB), Affirm Holdings, Inc. (AFRM), Upstart Holdings, Inc. (UPST), and Twilio Inc. (TWLO).

My point is this, being in a strong and fully convinced crowd doesn’t by itself mean a lot. It’s mighty important to think independently because I’ve followed these names over time, and see that people with the strongest convictions in investing are rarely the investors with the best performances.

Given this consideration of the adaptability of one’s mind when it comes to investing, let’s discuss SNOW’s valuation.

SNOW Stock Valuation – 36x Forward Free Cash Flow

Snowflake’s guidance implies that around $1.2 billion of free cash flow could be on the cards in this fiscal year. That’s a 50% increase from the same period a year ago. A terrific increase in free cash flow, that decries a high-quality company, right?

Well, I would counter this by charging that it’s difficult for a company to grow its free cash flows by 50% y/y, while its revenue line is expected to grow at less than 30%.

Moreover, this means that Snowflake is seeking to maximize its profits over its growth. How long can a company maximize its profit line, without plowing back its profits back into its business?

The time when companies had a seemingly unlimited budget in their IT departments has now come and gone. We are now in a new era. IT departments are being forced to make substantial cutbacks, even if the platform is offering essential services. There are prolonged sales cycles and every line of a company’s budget is being questioned in the current macro environment.

Given this consideration, is it advisable to pay 36x forward free cash flow? I don’t believe it does.

And yet, I would be remiss if we didn’t discuss Snowflake’s balance sheet. Case in point, Snowflake carries about $4.5 billion of cash, cash equivalents, and marketable securities, including long-term investments. This amounts to more than 10% of its market cap. Given this aspect, it’s difficult for anyone to be outright bearish on this stock.

But at the same time, it’s difficult for me to be bullish either, as I believe there are several better investments in other pockets of the market.

The Bottom Line

Paying 36x forward free cash flow for Snowflake is already a fair price given its decelerating revenue growth rates and the challenging macro environment.

While Snowflake boasts a strong balance sheet with significant cash reserves, its slowing growth and competitive pressures cast doubt on its ability to reignite the premium it once held.

With the IT budget constraints, investors need to be cautious about Snowflake. This fairly priced stock is too “flaky” for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.