Summary:

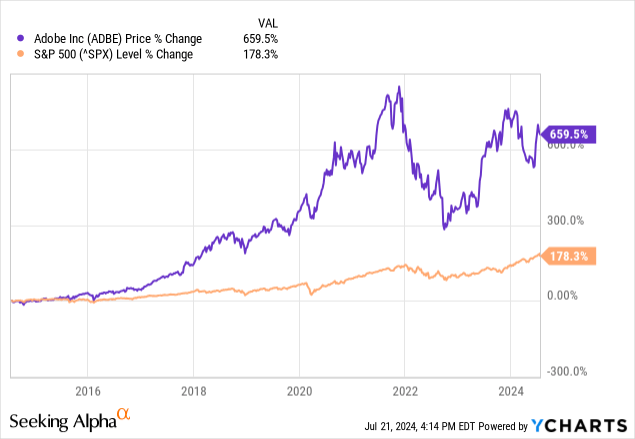

- Adobe has outperformed the S&P 500 over the last decade, with strong returns.

- The company is seen as a significant AI beneficiary, with its AI products gaining traction in the market.

- Adobe’s fundamentals, risks, and valuation suggest it is currently a Hold for investors.

JHVEPhoto

Adobe (ADBE) (NEOE:ADBE:CA) has proven an excellent investment over the last decade. Its returns have substantially beaten those of the S&P 500 (SPX).

Some investors perceive the company as a massive Artificial Intelligence (“AI”) beneficiary and believe AI will help maintain its revenue growth rates. The company reported earnings on June 13, 2024, which showed that its AI products were gaining traction in the market. Although Adobe AI products are still in the early stages, some, such as the AI workflow automation service Firefly, are gaining traction. Chief Executive Officer (“CEO”) Shantanu Narayen said on the second quarter 2024 earnings call:

We released Firefly services. We’ve started to see some customer wins in Firefly services. So they’re using it for variations, and these are the custom models that we’re creating, as well as access to APIs. I would say that’s early in terms of the adoption, but the interest as customers say how they can ingest their data into our models as well as custom models, that’s really ahead of us, and we expect that to continue to grow in Q3 and Q4.

CEO Narayen also discussed how the AI Assistant interfaces in Acrobat and Photoshop have “seen a significant amount of usage.” Still, AI also presents risks for the company, and investor worries over slowing revenue growth and lackluster valuation make the company a less-than-ideal candidate for new investment today. I initiate my coverage of Adobe with a Hold.

This article will overview Adobe’s business and discuss its fundamentals. It will also review the company’s risks, valuation, and why the stock is a Hold.

Adobe Overview

Adobe offers customers content creation, publishing, marketing, and advertising tools. The company can be confusing at first glance for the novice because of the way it has grouped some of its products into reportable revenue segments. The description of some Adobe products may seemingly sit on the borderline of a reporting segment until one understands the company better. The company has three reportable segments:

1. Digital Media

Adobe’s original core business was in content creation, primarily graphic design, printing, and publishing. Today’s Digital Media business is an evolution of the company’s original functionalities into the digital age with new services, such as video editing, mobile app development, cloud-based solutions, and other tools to aid creators in designing and delivering content. Two clouds compromise the digital media business: Adobe Creative Cloud and Adobe Document Cloud.

The company’s 2023 10-K describes Adobe Creative Cloud:

Creative Cloud addresses the needs of all content creators, from creative professionals, such as artists, designers, developers, students, and administrators, to knowledge workers, marketers, educators, enthusiasts, communicators, and consumers. Our customers rely on our products for content creation, photo editing, design, video and animation production, mobile application (“app”) and gaming development, and more.

The company offers Adobe Creative Cloud as a subscription for students and teachers, and small and medium-sized businesses (SMBs). The company provides Adobe Document Cloud as an Acrobat subscription for individuals, SMBs, and enterprises. The 10-K describes Adobe Document Cloud:

A unified, cloud-based document services platform that integrates Adobe’s pioneering PDF technology with our Acrobat and Acrobat Sign apps to deliver fully digital document workflows across all surfaces. We have the opportunity to continue to accelerate document productivity with Adobe Document Cloud and transform how people view, share, collaborate, and engage with documents.

The company is dominant in its Digital Media business and has a high switching cost moat and, to a lesser extent, a network effect moat. The company’s cloud products encourage collaboration, and the more people collaborate within the company’s cloud products, the more valuable its Digital Media clouds become. Thus, the network effect moat.

The high switching cost moat comes from the graphic design, printing, and publishing industries standardizing on several Adobe file formats such as PDF (for documents), PSD (graphics and photo editing), and AI (vector graphics and illustration). According to one website, “PDF is the 3rd most popular file-format on the web (after HTML and XHTML).” This type of dominance makes it challenging for existing Adobe customers to switch to a competitor using a different file format, where file conversion and compatibility issues may arise. The more invested a company or user becomes in learning Adobe’s tools, the more reluctant that company or user becomes to switch to a competitor because all the time spent on learning how to use Adobe’s sophisticated tools would go to waste.

2. Digital Experience

The company expanded from content creation to marketing, mainly by acquiring Magento Commerce and Marketo in 2018. Although Adobe has a solid switching cost moat in its Digital Experience business, it is far less dominant than in its Digital Media business. By establishing this marketing business, Adobe went into direct competition with several heavyweights, including Salesforce (CRM) Commerce Cloud, SAP SE (SAP) Commerce Cloud, Oracle (ORCL) Commerce Cloud, and HubSpot (HUBS). So, it’s not number one in Digital Experience like it is in Digital Media.

This segment offers AI-powered automation and personalization tools for marketers, advertisers, ad agencies, publishers, and company executives to provide consumers with a personalized experience. It also has tools for business-to-business marketing and content creation and delivery tools. The company provides these tools via Adobe Experience Cloud. The company describes the Experience Cloud in its 10-K:

Adobe Experience Cloud is powering digital businesses by helping them provide exceptional personalized experiences to their customers via a comprehensive suite of solutions. Addressing the challenges of customer experience management is a large and growing opportunity and we are in position to help businesses and enterprises invest in solutions that aid their goals to transform how they engage with their customers and constituents digitally.

The company will soon offer a generative AI product named Adobe GenStudio, an example of one Adobe product with a description that may confuse some about whether it belongs in Digital Media or Digital Experience. It’s a marketing tool that can create AI-generated images while providing content planning, management, and other services. Management decided to include it in the Digital Experience reporting segment because although it has some content creation capabilities, they are for marketing purposes. The company’s website states:

Adobe GenStudio, coming soon, is an intuitive product that collects the top tools marketers need to deliver on cross-channel campaigns. Built on generative AI, it empowers any team member to quickly find and generate assets, create variations, and optimize experiences based on real-time content performance insights. It’s built for small businesses to large enterprises and designed to be used by marketers or agencies.

Like the Digital Media Cloud, the Digital Experience Cloud is also a subscription business.

3. Publishing and Advertising

This segment contains a mish-mash of the company’s legacy products. The company describes the products in this segment in its 10-K, “Our Publishing and Advertising segment contains legacy products and services that address diverse market opportunities including eLearning solutions, technical document publishing, web conferencing, document and forms platform, web app development, high-end printing and our Adobe Advertising offerings.” The company could have put some of these legacy products in Digital Media or Digital Experience. However, the company likely put products that don’t meaningfully contribute revenue or growth into this segment. For instance, this segment only contributed 0.6% to the company’s 2023 full-year revenue, and this segment’s revenue declined 7% from 2022.

Company Fundamentals

The following image shows that Adobe estimates its total addressable market (“TAM”) at the end of 2024 as $205 billion. At the end of the first quarter of 2024, the company generated trailing 12-month (“TTM”) revenue of $20.43 billion, approximately 10% of its 2024 TAM and 7% of its 2027 TAM of $293 billion. The company has a long runway for growth.

Adobe 2024 Investor Meeting

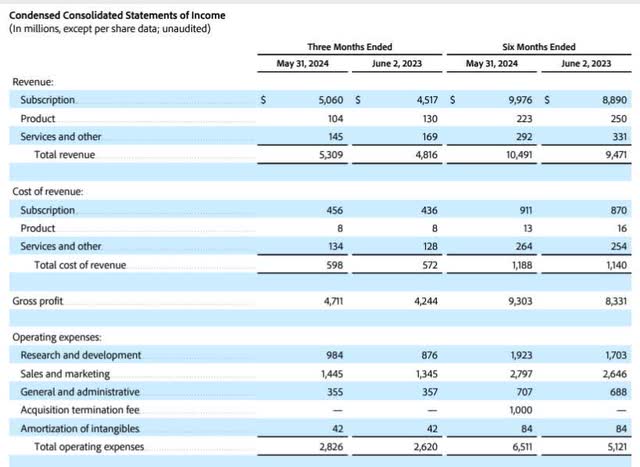

Adobe grew second quarter 2024 revenue 10% over the previous year’s comparable quarter to $5.31 billion, exceeding analysts’ estimates by $15.67 million. Remaining Performing Obligations (“RPO”), the contracted revenue Adobe expects to recognize once it delivers the service to customers, grew 17.3% year-over-year to $17.86 billion. The current RPO, the contracted revenue Adobe expects to realize within the next year, rose 12%. Current RPO growing faster than revenue is generally a positive sign, as it indicates that the company has the potential for faster revenue growth over the next year. Investors will sometimes award a stock a higher valuation when they see a trend of current RPO growing faster than revenue. However, RPO fails to indicate precisely when the company will recognize that revenue. So, investors should not assume that faster current RPO growth will immediately result in more rapid revenue growth.

Adobe Second Quarter FY 2024 Earnings Release.

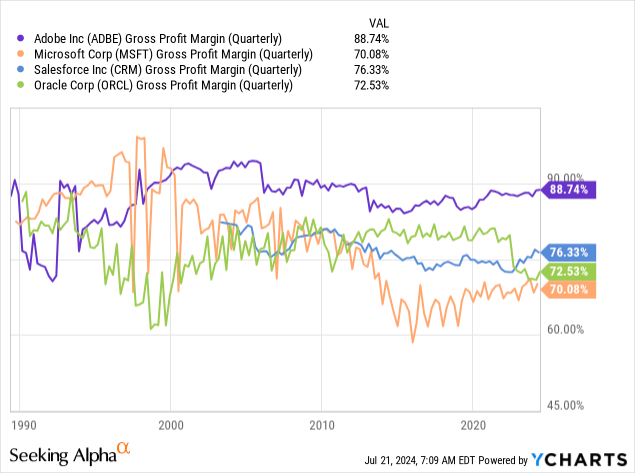

Adobe’s second quarter 2024 GAAP (Generally Accepted Accounting Principles) gross margins were 88%, among the highest in the software industry. This is a sign that it has significant pricing power for its cloud-based software tools.

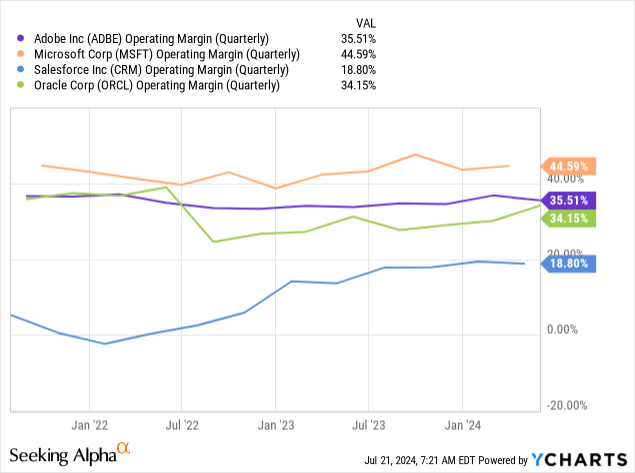

Adobe’s operating margin is also one of the better ones in the software/cloud industry. Microsoft is one of only a few that exceeds its operating profitability. Management has accomplished this feat while investing heavily in AI. The company’s high gross and operating margins, combined with the company generating over 90% of its revenue from a subscription business, may be why the market is willing to award Adobe a premium valuation.

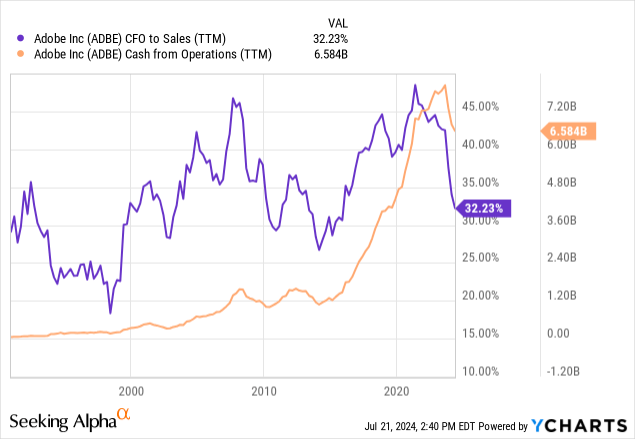

The company reported GAAP earnings-per-share (“EPS”) of $3.49, beating analysts’ estimates by $0.11. The following chart shows that Adobe’s Cash flow from operation (“CFO”) and CFO to sales both dropped on a TTM basis.

The CFO dropped because of a $1 billion termination fee Adobe recorded in the first quarter for the canceled Figma acquisition. Figma, a U.S.-based company, describes what it does on its website: “Figma Design is for people to create, share, and test designs for websites, mobile apps, and other digital products and experiences. It is a popular tool for designers, product managers, writers, and developers and helps anyone involved in the design process contribute, give feedback, and make better decisions, faster.” Whether the Figma acquisition would have been good or bad for Adobe is still disputed. On the positive side, the acquisition would have eliminated a major competitor (a possible reason European regulators did not like the deal). On the negative side, when the company announced the terms of the agreement, some felt Adobe overpaid. So, some are glad the deal failed.

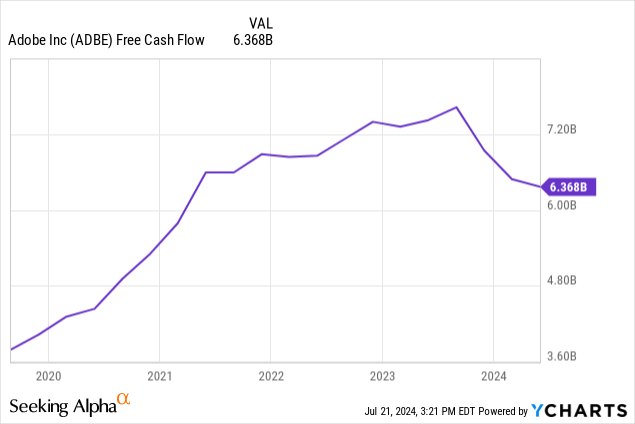

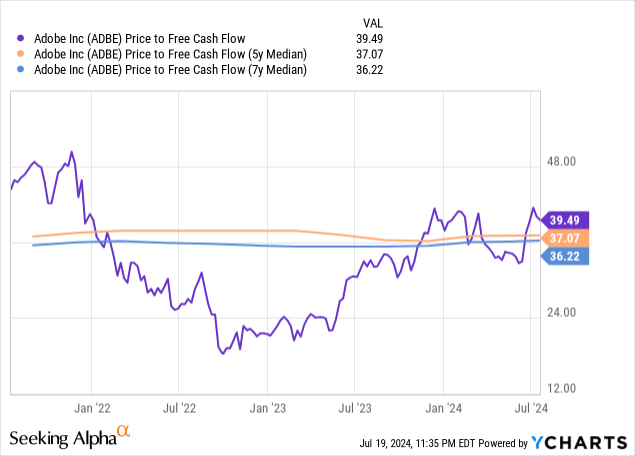

The termination fee the company needed to pay Figma will hurt Adobe’s CFO and free cash flow (“FCF”) on a TTM basis for the next two quarters. The following chart shows the drop in FCF. As you read this article’s valuation section, remember that Adobe paying Figma a termination fee currently distorts valuations based on FCF. However, in the first quarter of 2025, the negative impact on FCF will be gone, and FCF and FCF margins should move much higher. At that time, investors may view the stock’s FCF-based valuations differently.

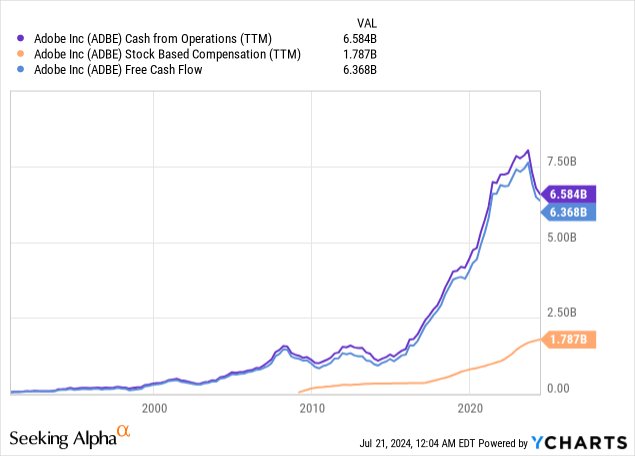

Another thing to note is that Adobe has a relatively high stock-based compensation (“SBC”) compared to FCF. According to the reported numbers for the second quarter, the company’s SBC makes up 28% of FCF on a TTM basis.

Adobe announced a new $25 billion stock buyback program at the end of the March quarter that should minimize shareholder dilution. Still, some investors might find the company’s SBC undesirable as it reduces funds it could use to invest in AI, reduce debt, buy back stock, or possibly future dividends. When this article later discusses valuing the stock based on shareholder yield, remember that the company’s high level of SBC compared to FCF may negatively impact shareholder yield, potentially lowering the valuation investors award to the company.

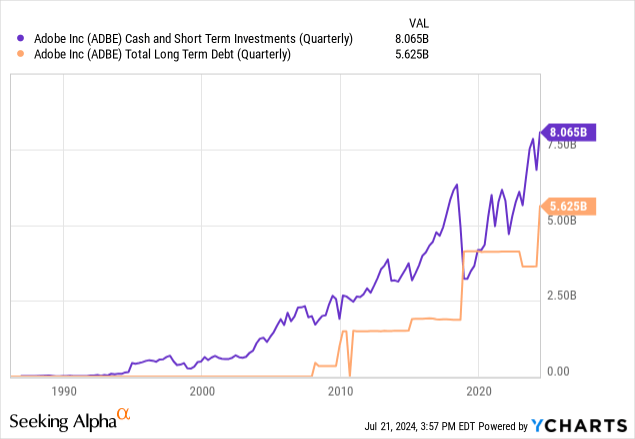

The following chart shows the company has $8.07 billion in cash and short-term investments against $5.63 billion in long-term debt.

Adobe’s debt-to-EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) ratio is 0.77, which is excellent and signals that the company is capable of paying its debt obligations. Its debt-to-equity ratio is 0.41, indicating that the company uses more equity than debt to finance its operations. The company’s balance sheet is in excellent shape.

Risk from AI in content creation

For about the last six months, Adobe has been a battleground stock as people debate whether AI will hurt or help the company’s content creation business. Some believe that AI will make content creation much more straightforward and make short work of Adobe’s switching costs moat. In February 2024, OpenAI demonstrated Sora, a new text-to-video generative AI application, igniting the market’s fears over whether AI would quickly disrupt Adobe’s video editing business. The stock reacted poorly, with a month-long decline. However, the stock price has since recovered.

Adobe responded to the AI concerns in April with a plan to incorporate Sora and other third-party tools into its video editing software Premier Pro. A Seeking Alpha article quoted the following from a company representative:

“Adobe is reimagining every step of video creation and production workflow to give creators new power and flexibility to realize their vision,” said Ashley Still, senior vice president, Creative Product Group at Adobe in a statement. “By bringing generative AI innovations deep into core Premiere Pro workflows, we are solving real pain points that video editors experience every day, while giving them more space to focus on their craft.”

Adobe CEO Shantanu Narayen believes that generative AI won’t 100% take over areas like video editing because he believes content creation still requires a human creativity aspect. Narayen conducted interviews in 2023 to address AI concerns before Sora even appeared on the scene. He implied in a 2023 CNBC interview that he believes generative AI will be a co-pilot rather than a pilot of content creation. Narayen may be right. However, considering that Microsoft (MSFT) is one of Adobe’s most significant competitors and one of the leading AI-focused companies in the world, there is a potential that AI could help it breach Adobe’s moats in content creation tools.

Other risks

In June, The Federal Trade Commission and Department of Justice (“DOJ”) filed a civil enforcement action against Adobe for potential violations of the Restore Online Shoppers’ Confidence Act (ROSCA). The two government agencies accused the company of making it too hard for customers to cancel annual subscriptions. The announcement of this action on the DOJ website stated, “The lawsuit seeks unspecified amounts of consumer redress and monetary civil penalties from the defendants, as well as a permanent injunction to prohibit them from engaging in future violations.”

Additionally, the company recently changed its Terms of Service in a way that some users interpreted as giving Adobe royalty-free access to user content to train its AI. The company encountered a considerable backlash, forcing it to clarify its changes in a blog to quell customer discontent.

Valuation

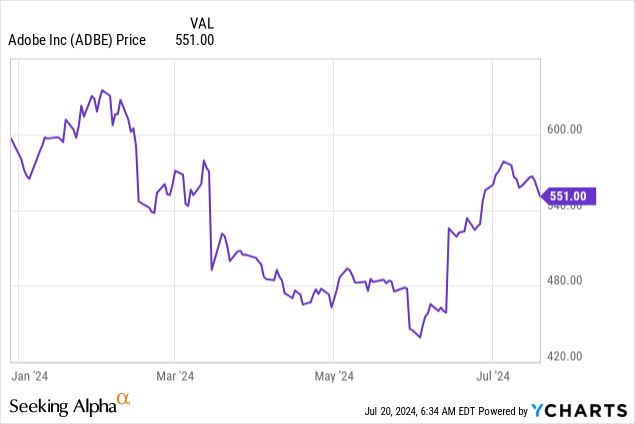

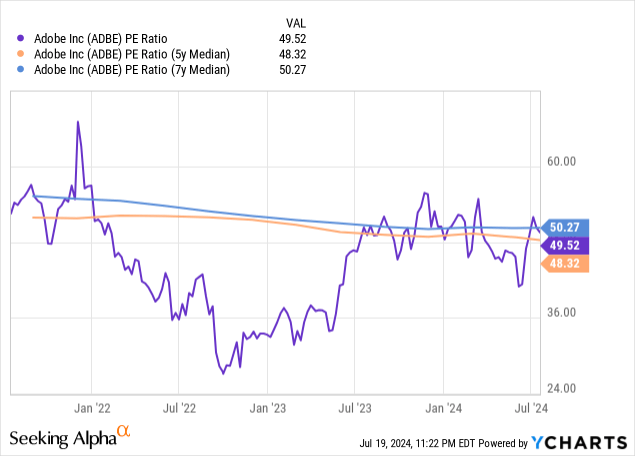

Adobe looks overvalued based on most traditional valuation methods. Seeking Alpha Quant rates the stock’s valuation a D. The stock trades at a price-to-earnings (P/E) ratio of 49.52, above the five-year P/E median but below the seven-year P/E median. Its P/E ratio is also way above the Information Technology sector’s PE/ ratio of 31.56.

The company’s price-to-FCF was 39.49, above the five- and seven-year median. If Adobe traded at its five-year price-to-FCF, the stock price would be $518.61, down 6% from the July 19, 2024 closing stock price. If it traded at its seven-year price-to-FCF, the stock price would be $506.72, down 8%.

Let’s do a reverse discounted cash flow (“DCF”) analysis to determine whether the current stock price is justified.

Adobe Reverse DCF

|

The first quarter of FY 2025 reported Free Cash Flow TTM (Trailing 12 months in millions) |

$6368 |

| Terminal growth rate | 2.5% |

| Discount Rate | 10% |

| Years 1-10 growth rate | 16.6% |

| Current Stock Price (July 19, 2024 closing price) | $551.00 |

| Terminal FCF value | $30.319 billion |

| Total Present Value of Cash Flows | $155.856 billion |

| FCF margin | 31.2% |

Since analysts expect Adobe’s revenue to grow at a CAGR of 11% over the next ten years, the assumptions I used in the above DCF would not justify a stock price of $551 at a 31.2% FCF margin. Still, the company will likely average a higher FCF margin moving forward. In 2021, Adobe had reached an FCF margin of 43.67%. Although its FCF margin dropped substantially over the last year due to the Figma termination payment, analysts expect an FCF margin of 40% in 2025 and 2026. The following table assumes that the company maintains revenue at a CAGR of 11% over the next ten years. The left column is the FCF margin the company can average over the next ten years, and the right column shows the expected stock price. The following estimated stock prices are well below Adobe’s July 19 closing stock price of $551.00, suggesting the market overvalues the stock at a forecasted revenue growth rate of 11% over the next ten years.

| FCF margin | Estimated Stock price |

| 36% | $422.57 |

| 37% | $434.29 |

| 38% | $446.01 |

| 39% | $457.74 |

| 40% | $469.51 |

Alternatively, assuming the FCF margin is at an average of 36% over the next ten years, and the company could maintain revenue growth at 20% over the next ten years, the estimated intrinsic value would be $817.29, up 48% over the July 19 closing stock price.

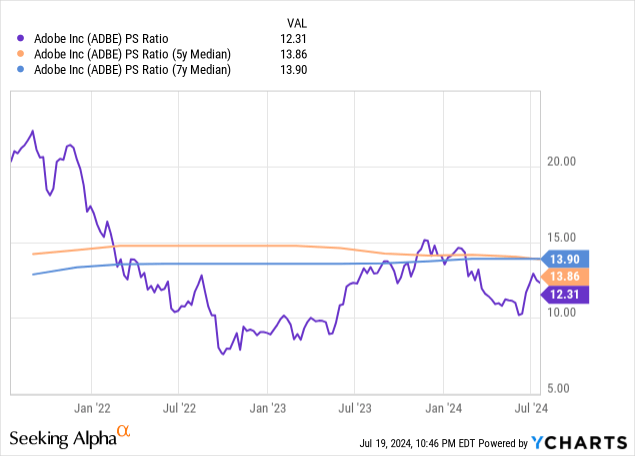

Several valuation methods suggest that the market undervalues Adobe. The company’s price-to-sales ratio is 12.31, below its five- and seven-year median. If the company sold at its seven-year median, the stock price would be $622.58, up 13% over its closing price on July 19, 2024.

The company’s Enterprise Value to Sales (EV/S) is 11.99, compared to its average five-year EV/S ratio of 14.13. If the stock traded at its five-year average EV/S, its price would be $632.88.

The assumptions I used with EV/S and P/S valuations are slightly above analysts’ consensus one-year price target, as seen in the image below.

Source: Seeking Alpha.

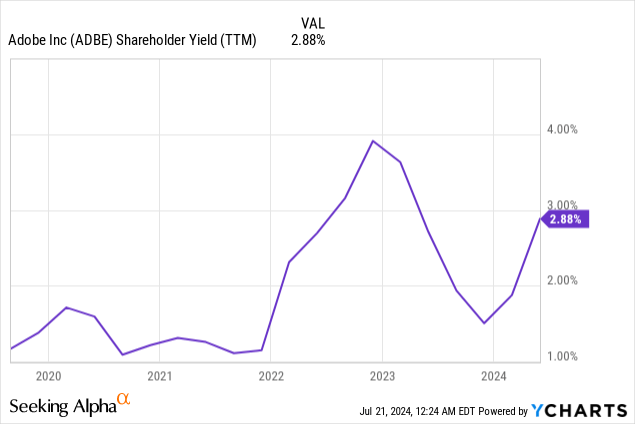

Sometimes, when I get too many conflicting signals about a stock’s potential overvaluation or undervaluation, I will look at shareholder yield, which is cash dividends, stock repurchases, and debt reduction divided by market capitalization.

Generally, when shareholder yield is low, the market overvalues the stock. When shareholder yield is high, the market overvalues a stock. According to those rules, the best time to buy Adobe over the last five years was from the middle of 2019 to the beginning of 2022 and at the end of 2023. At the current shareholder yield, it sits right in the middle of its shareholder’s yield high of nearly 4.0% and its low of around 1.5% over the last year and a half, suggesting the market is fairly valuing the stock at its closing stock price on July 19 of $551.

Initiating Adobe with a Hold

If you have bought Adobe at shareholder yields below 2%, it may still be worthwhile to hold. However, investors who have yet to buy the company would be better off avoiding the stock at a shareholder yield of 2.88% and higher. I might have believed differently if the company’s revenue growth estimates were 20% or higher, but revenue growth has already descended to 11%. Additionally, the proliferation of AI could potentially increase Adobe’s competitive threats and further decrease revenue growth to single digits. Adobe is a Hold.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.