Summary:

- Home Depot’s robust business model and wide economic moat make it a resilient long-term investment, despite recent economic headwinds impacting sales.

- Strategic investments in pro contractors and an omnichannel approach position HD for future growth, particularly as building maintenance demand rises.

- Consistent dividend growth, share buybacks, and a strong balance sheet highlight Home Depot’s commitment to returning value to shareholders amidst market fluctuations.

patty_c

Introduction

As most of my readers may know, I own two consumer stocks: one consumer discretionary and one consumer staple.

The consumer staple is PepsiCo (PEP). The cyclical consumer stock is The Home Depot (NYSE:HD), the star of this article.

I’m very picky when it comes to buying long-term dividend growth stocks, especially in the consumer space. I prefer to buy companies that operate further up the supply chain, which often comes with bigger moats, pricing power, and a different kind of competition, as it avoids having to find the hottest consumer trends to stay relevant.

That’s where Home Depot comes in.

In fact, the company was one of the first stocks I bought for my dividend growth portfolio, as it’s much more than a cyclical consumer stock.

- It’s the largest do-it-yourself/home improvement store in the United States, with exposure in both Canada and Mexico.

- Due to its size and wide-moat business model, it’s a consumer and housing proxy with the ability to consistently hike its dividend and buy back stock. Investors do not have to bet on certain consumer trends. Home Depot is about DIY projects, not fashion or electronics, which is key.

This is what Morningstar wrote with regard to the company’s moat (emphasis added):

The firm’s wide economic moat rating is based on its economies of scale and brand equity. While Home Depot has realized strong historical returns as a result of its scale, operational excellence and concise merchandising remain key tenets underlying our modest margin expansion forecast. Its flexible distribution network should help elevate the firm’s brand intangible asset, with faster time to delivery improving the do-it-yourself (DIY) experience and market delivery centers catering to the pro business. – Morningstar

In other words, it has a strong brand, fantastic operations, a stellar supply chain and distribution network, and investments focused on high-growth opportunities.

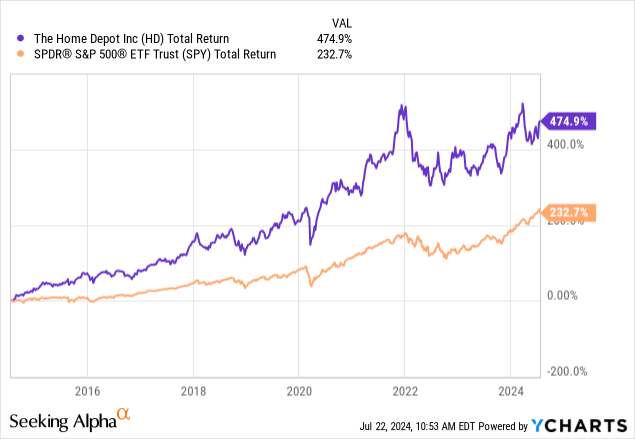

These benefits have allowed the company to return more than 470% over the past ten years, more than twice the 233% return of the S&P 500. Since early 2009, the stock has returned close to 2,700%. I’m sure some people reading this have made a fortune owning the stock.

With that said, the stock has hit some resistance. My most recent article on the stock was written on February 26, titled “Hammer Time Over? When To Ditch (Or Double Down On) Home Depot.” Since then, shares are down 1%, lagging the S&P 500’s 9% by a considerable margin.

In this article, I’ll update my thesis, including some of the company’s investments in growth, which include the highly promising building products.

So, let’s get right to it!

Looking Beyond The Slump

Home Depot requires two things to grow: a strong consumer and a healthy housing market.

Right now, it has neither.

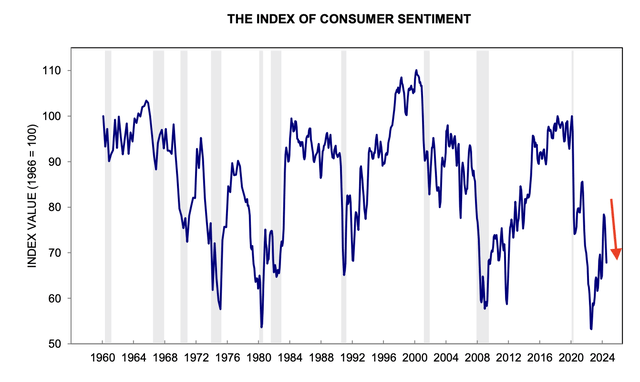

This is what the University of Michigan consumer confidence index looks like after the recent decline:

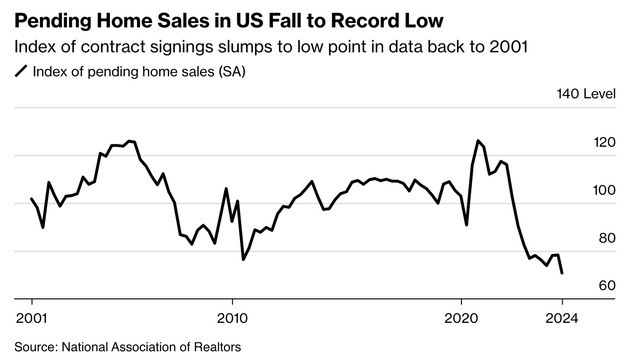

Meanwhile, Bloomberg reported that pending home sales in the U.S. have fallen to a record low on higher rates, likely pressuring prices as well.

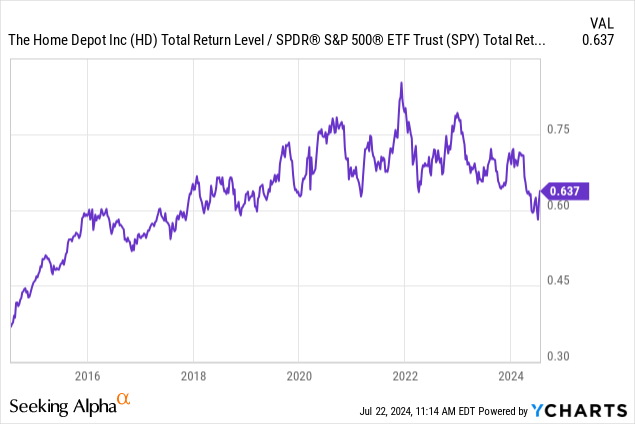

This explains why Home Depot shares have started to underperform the S&P 500 since 2022, as its business environment simply wasn’t favorable anymore.

Even worse (for the ratio below), the S&P 500 benefitted from being very top-heavy due to elevated tech exposure. These stocks continued to do well. HD just couldn’t compete with that.

While I obviously don’t enjoy HD’s performance, I’m neither worried nor surprised, as I expected, inflation to remain elevated.

The good news is that Home Depot is resilient and investing in some very promising areas, which is why I have consistently added to my HD investment.

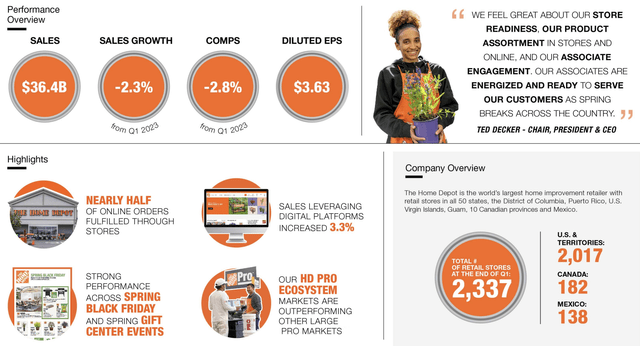

Starting with the bad news, due to economic headwinds, the company saw 2.3% lower sales in the first quarter of this year, with comparable sales being down 2.8%. Big-ticker comps of more than $1,000 were down 6.5%. Pressure is also coming from many people finishing major projects during the 2020/2021 pandemic, when people were at home with elevated savings.

The good news is that the company continues to grow its market share, especially among professional contractors (pro customers), who are a key growth market for the retailer.

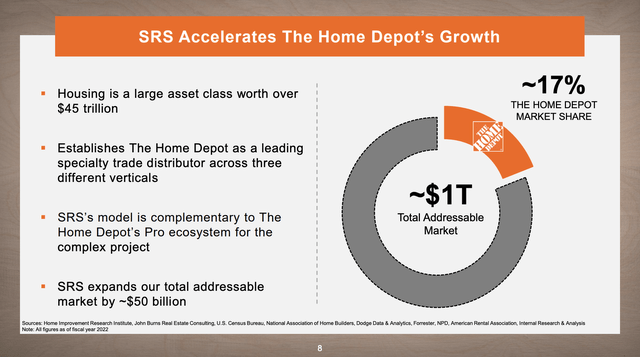

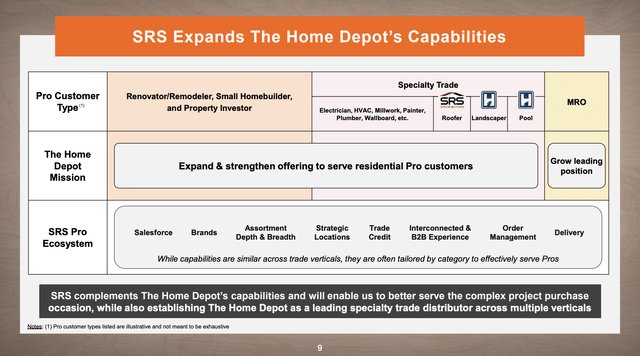

Growth in this area is boosted by the acquisition of SRS, which is a leading specialty trade distributor, which expands its footprint in what is now a $1 trillion addressable market. Home Depot has a 17% market share in this market, which is just a small part of the $45 trillion housing market.

Roughly $250 billion of this addressable market consists of residential pro contractors. The company aims to target these customers through dedicated sales forces, specific digital assets, and enhanced order management capabilities.

As we can see below, SRS’s specialized capabilities and deep product portfolio complement Home Depot’s existing services/products, allowing the giant to better serve (increasingly) complex project needs.

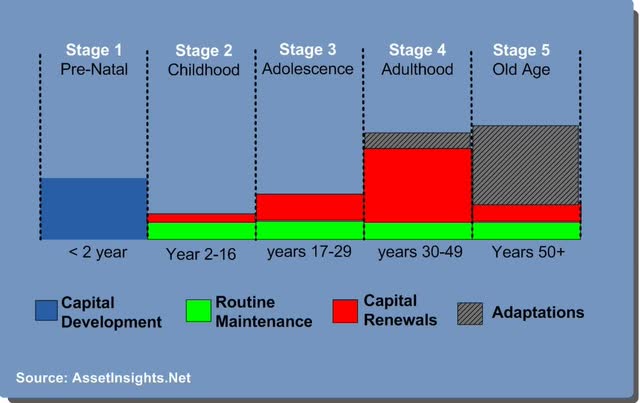

As I have written in prior articles, Home Depot is betting on the right horse, as the average commercial building in the U.S. was 53 years old at the end of 2022. Now, that number is 55 years.

The average life span of a commercial building is 50-60 years, which triggers a significant need for maintenance.

In other words, Home Depot is now accelerating its investments as we may be heading into the “golden age” for building maintenance. That’s also why I am invested in Carlisle Companies (CSL).

Home Depot is also investing in new tech capabilities. For example, the introduction of new capabilities within the pro intelligence tool and CRM platform leverages data science to provide better insights and cross-selling opportunities.

According to the company, this targeted approach not only drives sales but also strengthens customer relationships.

Moreover, improving the “post-sale experience” by offering self-service returns and job site pickups streamlines processes and increases convenience for customers.

In general, Home Depot is doing a terrific job creating a great omnichannel experience using its online capabilities and physical stores. According to the company, online sales leveraging digital platforms saw a 3.3% increase in the first quarter of this year.

Almost half of all online transactions were fulfilled through the company’s physical stores, while online shopping was made easier through enhanced filtering capabilities and “intent-based” searching.

Great News For Shareholders

Home Depot remains extremely dedicated to its shareholders.

This is what spending in 1Q24 looked like:

- $850 million in CapEx to maintain and improve the business.

- $2.2 billion in dividends.

- $600 million in buybacks.

The company has both strong free cash flow and a healthy balance sheet, which are key requirements for any company to pay a sustainable dividend.

Home Depot, which has a net leverage ratio of 1.5x EBITDA, has a credit rating of A and is expected to generate $16.7 billion in free cash flow, 4.6% of its current market cap.

Currently yielding 2.5%, this gives the company a cash payout ratio of 54%.

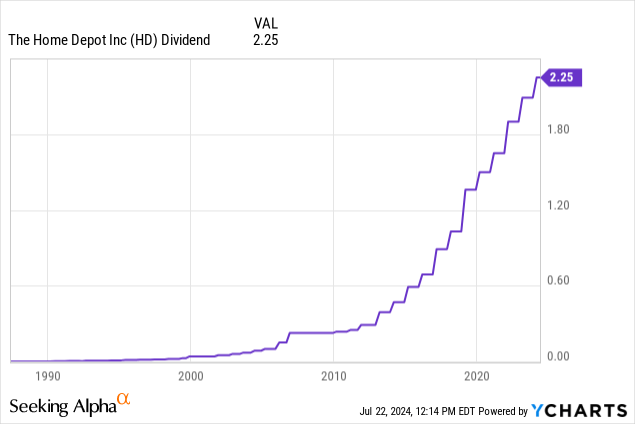

This dividend has a five-year CAGR of 12.7% and a track record of 14 consecutive annual hikes, as it kept its dividend unchanged during the Great Financial Crisis.

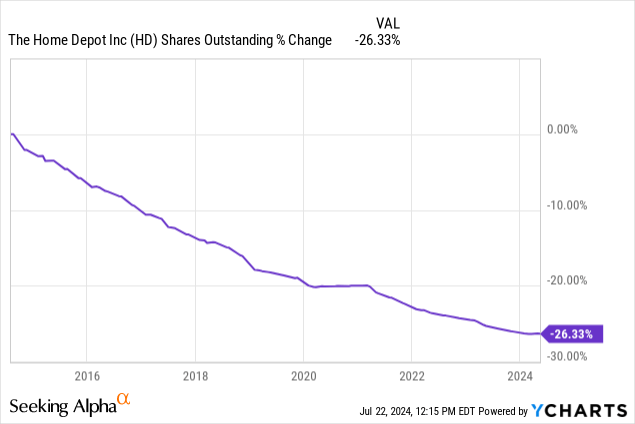

Over the past ten years, Home Depot has bought back 26% of its shares, which meaningfully contributed to its stellar stock price performance.

Looking forward, analysts are bullish on the company’s earnings yet far from euphoric, which makes sense, given the state of the markets this company serves.

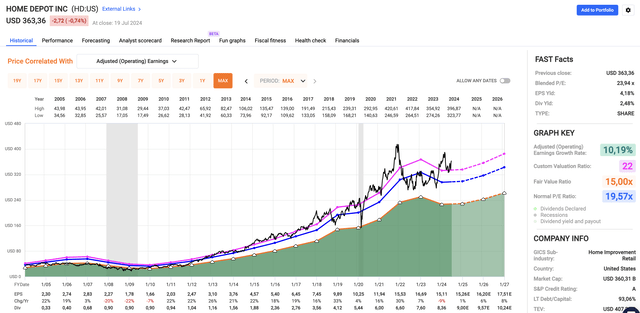

Using the FactSet data in the chart below, analysts expect 1% EPS growth in the current fiscal year, potentially followed by an acceleration to 8% growth in the fiscal year ending January 2027.

If we apply the company’s five-year average P/E ratio of 22.0x, we get a fair price target of $385, 6% above the current price. Its long-term normalized P/E ratio is 19.6x.

The problem is that, given the current growth profile, a 22x multiple is not likely. In order to justify that multiple, we need to see a path to higher growth, supported by a recovering housing market and consumer sentiment.

Until that happens, I stick to my strategy, which is to accumulate HD stock on weakness, as I do not expect this company to turn into a high-flying capital gains machine anytime soon.

However, as I have a long-term view, I’m very happy with the situation. Once the economy recovers, the company is in a great spot to grow, supported by what I expect will be a massive bull market in the building products business.

Takeaway

Home Depot remains a cornerstone of my dividend growth portfolio despite recent underperformance.

The company’s strong brand, operational excellence, and wide economic moat position it well for long-term growth.

While current economic conditions have pressured its financial performance, Home Depot’s investments in market share expansion and its commitment to improving tech capabilities and customer experience are very promising.

With a healthy balance sheet and consistent shareholder returns through dividends and buybacks, I see Home Depot as a resilient investment.

Hence, I will continue to accumulate shares on weakness, as I’m confident in its ability to thrive when the economy recovers and capitalize on what I consider to be a highly profitable building (maintenance) market.

Pros & Cons

Pros:

- Resilient Business Model: Home Depot’s wide economic moat, supported by its scale, operational excellence, and strong brand, makes it a reliable long-term investment.

- Shareholder-Friendly Policies: Consistent dividend growth and share buybacks support the company’s dedication to returning value to shareholders.

- Growth Opportunities: Investments in pro contractors and the building products market position HD for elevated future growth, especially as the demand for building maintenance increases.

- Omnichannel Strength: A successful integration of online and physical stores improves customer experience and boosts sales.

Cons:

- Economic Headwinds: Current economic challenges, including a weak housing market and low consumer confidence, have negatively impacted the company’s sales and stock performance.

- Dependency on Market Recovery: HD’s growth is closely tied to a recovering housing market and stronger consumer spending, which may take time to materialize.

- Valuation Concerns: With the current growth profile, achieving a higher valuation multiple could be challenging without clear signs of an economic recovery.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of HD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.