Summary:

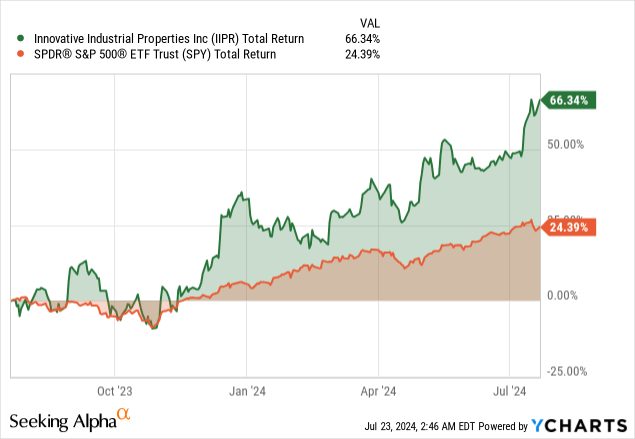

- Innovative Industrial delivered a 69% return over the past year, driven by strategic real estate acquisitions and strong AFFO growth.

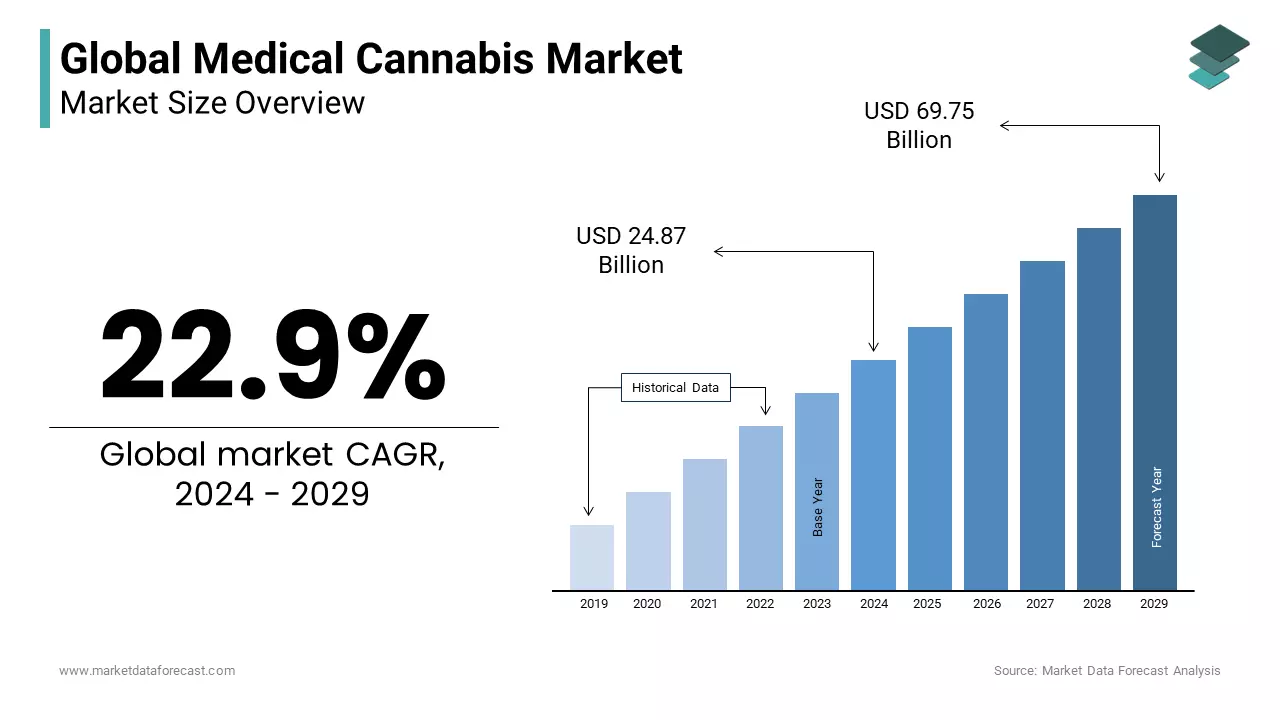

- The global medical cannabis market is projected to grow from $24.87 billion in 2024 to $69.75 billion by 2029, at a CAGR of 22.9%.

- IIPR maintains a high occupancy rate of 95.2% across 108 properties, with diversified tenant and geographic exposure.

- The company’s AFFO for Q1 2024 was $63 million, with a strong AFFO payout ratio of 82%, supporting attractive dividends.

- The company’s robust financial position includes 11% debt to total assets and $203.5 million in total liquidity.

halbergman

Investment Thesis

Last year, we initiated Innovative Industrial Properties, Inc. (NYSE:IIPR) coverage as a buy due to its strong outlook and growth potential. Over the past year, IIPR’s stock delivered a 69% return, including dividends, significantly outperforming the market.

This performance reflects investor confidence in IIPR’s strategic real estate acquisitions in key legalized states, enhancing its portfolio and income potential. IIPR’s strong AFFO growth, driven by new acquisitions and leasing activity, underscores its above-average performance.

Looking ahead, we expect IIPR to maintain its growth through strategic acquisitions and effective portfolio management, benefiting from the cannabis industry’s ongoing expansion. We reaffirm our buy rating, anticipating continued success and shareholder value creation.

Cannabis Market to Skyrocket: $24.87B to $69.75B by 2029

Innovative Industrial is a non-conventional real estate investment trust (REIT) specializing in properties within the growing cannabis industry. Its unique approach, which does not involve cultivating or distributing the federally prohibited product, has distinguished it from its rivals. Moreover, it is one of only two REITs dedicated to investing in real estate within this sector.

Despite the minor pullback last year, it has started 2024 on a positive trajectory, experiencing a surge of over 20% as it seeks to recover from the financial setbacks it faced in recent years. The company had struggled with rising inflation, which dimmed the outlook for the sector after the US central bank decided to increase interest rates to 5.50%, a level not seen in 23 years.

It found its footing as investors note its discounted valuation after a 70% pullback from all-time highs. Notably, the bounce back in recent months also comes from investors noting the company’s robust property portfolio while continuing to pursue real estate opportunities in the cannabis industry.

The global medical cannabis market is predicted to grow from $24.87 billion in 2024 to $69.75 billion by 2029 at a CAGR of 22.9%. This can be ascribed to an upsurge in legalization, altering societal perception, and increasing consciousness about the therapeutic benefits that cannabis possesses. Market driving forces are broadened legal status for the use of medical cannabis in more than 50 countries and increased usage among medical personnel or patients for the treatment of certain health issues, such as chronic pain, epilepsy, anxiety, etc.

Investments in R&D and product innovation are also boosting the market’s growth. However, challenging factors exist, such as high costs, regulatory barriers, limited insurance coverage, and so on.

www.marketdataforecast.com

Dominating the Cannabis REIT Sector with High Occupancy and Strategic Diversification

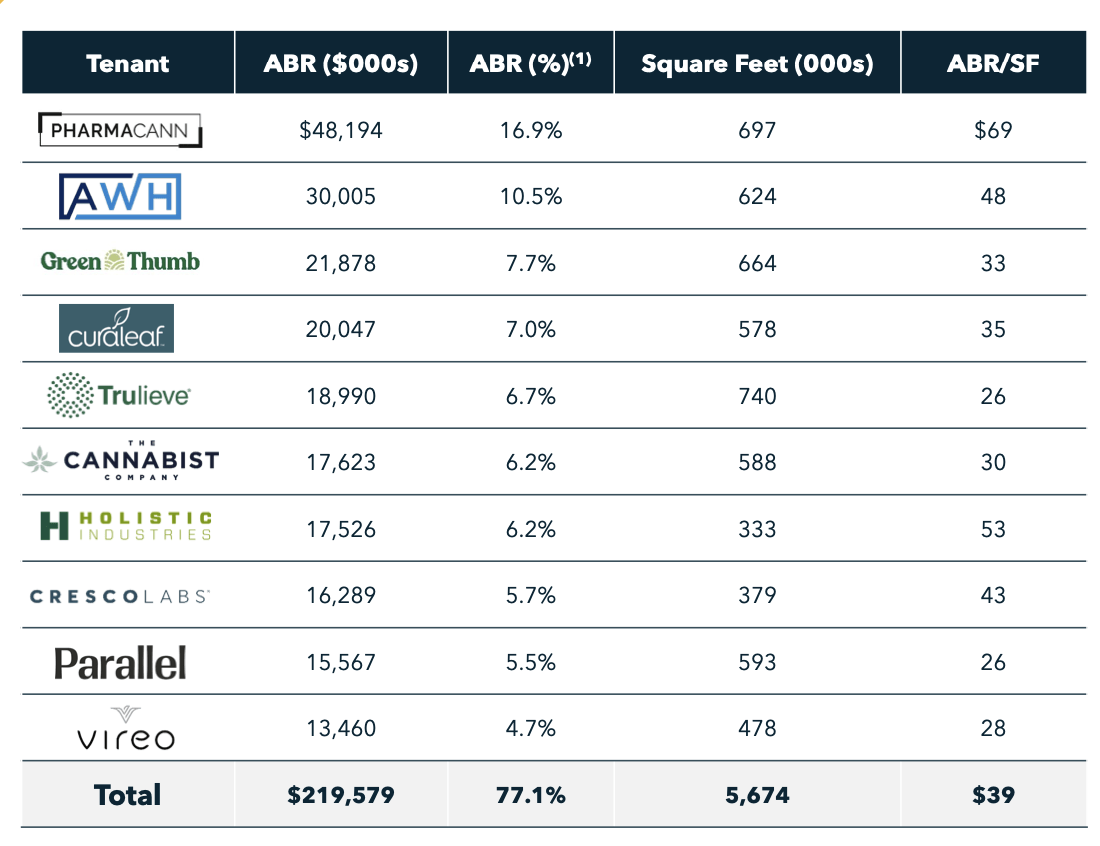

IIPR’s business model, which involves triple-net lease agreements, ensures a stable and predictable income stream by placing most property expenses on the tenants. The REIT owns 108 properties spread across 19 states with a high occupancy rate of 95.2% as of the end of the first quarter. The occupancy rate has stayed above 95% over the past year to reaffirm the quality of the company’s clients, who are required to sign long-term lease agreements. In addition, the company has 8.9 million rentable square feet, underlining its edge as one of the biggest REITs in the cannabis sector. Currently, no tenant represents more than 17% of the company’s annualized rent base, affirming the level of diversification.

IIPR

Additionally, no state accounts for more than 15% of the company’s annualized base rent, with multi-state operators accounting for 90% of the rent base. The company’s long-term weighted average remaining lease term of 14.8 years has allowed it to lock in key property revenue streams. The long leases fuel confidence that the company has locked in steady and reliable revenue that it should continue disbursing to investors through dividends.

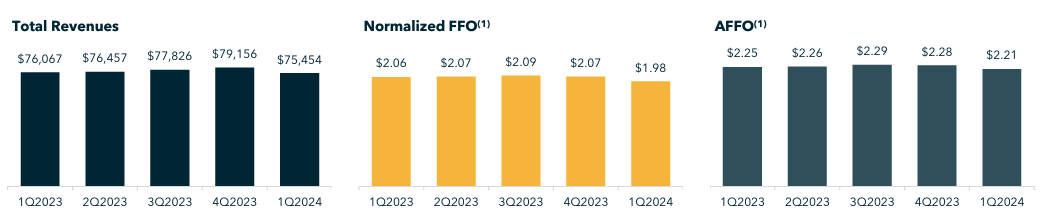

The property portfolio generated revenues of $75.5 million in the first quarter of 2024, a 1% drop from the $76.1 million generated a year ago in the same quarter; this decline was due to a decrease of $5.6 million in contractual rent and property management fees. Net income attributable to common shareholders was $39.1 million or $1.36 a share.

On top of that, the portfolio is diversified so that no single tenant accounts for more than 17% of the annualized base rent, with no one state accounting for more than 15% of the same. This reduces the risk of tenant default and geographic concentration.

For the most part, IIPR has acquired properties strategically, nurtured its tenant relationships, and managed its leases to produce stable adjusted funds from operations (AFFO) to support an attractive dividend policy amidst minor revenue fluctuations. For the first quarter of 2024, Innovative Industrial Properties posted an AFFO of $63 million, down slightly from $64.2 million in the same period last year.

Further, on a per-share basis, AFFO was $2.21 versus $2.25 in Q1 2023, for a decrease of 2%. This minor decline can be attributed to a net reduction of $5.6 million from contractual rent and property management fees related to properties repossessed since March 2023. Despite that, the firm further posted a strong AFFO payout ratio of 82%, indicative of continued support for solid dividend payments.

Favorably, the company’s property portfolio was boosted in the first quarter, securing temporary certificates of occupancy for critical properties. The company is set to lease a New York property to Vireo (OTCQX:VREOF), expected to expand rentable square feet to 389,000 and $81.4 million in committed capital.

IIPR

IIPR remains in a solid financial position, exiting the first quarter with just 11% debt to total assets of $2.6 billion. It does not have any debt set to mature before 2026, allowing it to focus on growing its portfolio rather than finding ways to pay off debt. Its debt service coverage ratio of 16.5 means it generates more income than necessary to meet its financial obligations. Its total liquidity was $203.5 million, comprising cash, cash equivalents, and short-term investments.

Finally, the increased liquidity comes from the company upsizing its credit facility by adding $45 million in aggregate commitments. It also issued 123,224 shares in the first quarter, generating an additional $11.8 million in net proceeds.

Bottom Line

The space expanded with explosive growth before the high inflation and interest rates threatened to dent its expansion. Now, with hefty property portfolios and strategic investments, the sector is rising again. The global medical cannabis market is expected to rise from an estimated $24.87 billion in 2024 to $69.75 billion by 2029, driven by increasing legalization and medical recognition.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of IIPR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.