Summary:

- Hydrogen as an alternative fuel source faces challenges due to inefficiencies in production and conversion from renewable energy, hindering its adoption.

- Technological advancements in next-generation electrolyzers offer hope for a green hydrogen economy, with companies like Hysata leading the way.

- Incumbent electrolyzer producers like Plug Power are at a disadvantage due to technological inefficiencies and financial instability, making them a risky investment.

audioundwerbung

Thesis

I have been very skeptical of hydrogen as an alternative fuel source to replace fossil fuels for quite some time, due primarily to two reasons; the requirement of a fossil fuel (natural gas) to cheaply and efficiently make hydrogen via contemporary mass production methods; and the low efficiencies from converting renewable energy to make hydrogen and vice versa.

Due to the inefficiencies of so-called “green” hydrogen sourced from renewable power, and the fossil fuels required to make “gray,” “brown,” and “blue” hydrogen, this alternative energy source/energy storage medium has been sidelined in favor of other alternative energy sources, like nuclear power, hydropower, geothermal power, and solar/wind power combined with various forms of energy storage. The energy efficiency from these is often high enough to make them satisfactory for customers in many industries, boxing out possible entry points for hydrogen, while these other alternative fuel sources gain popularity and market share.

However, there are certain areas where hydrogen would be exceedingly useful if its fossil fuel dependence and inefficient conversion to and from energy could be mitigated, such as in rocket fuel, airplane fuel, and other uses. Recently, it appears that efforts to make hydrogen a viable fossil fuel replacement with high conversion efficiency have started to pay off, boosting my hope for a true green hydrogen economy to emerge in the next 10-20 years. It is now increasingly likely that hydrogen will eventually find its niche(s) in a future in which fossil fuels are abandoned – a future that appears to be on the horizon and approaching faster than many think.

Unfortunately, for incumbent electrolyzer producers like Plug Power (NASDAQ:PLUG), they are at a significant technological disadvantage. Producers of next-generation electrolyzers and fuel cells will soon begin to scale up and outcompete them in scalability and energy conversion efficiency. I think this publicly listed incumbent will continue to flounder in becoming a green hydrogen leader, and its stock is likely to decline, as investors realize that while the green hydrogen economy may soon start to grow, the company won’t grow with it.

Plug Power has also been a consistent money loser, bringing in inadequate revenues to sustain its operations. As a result, the company has relied on a steady diet of debt and dilution to stay afloat, hurting investors who put their faith and capital in this name, hoping to capitalize on the growth of hydrogen. Even if Plug had an industry-leading hydrogen technology, it would be difficult to recommend buying PLUG stock due to how investor-unfriendly it has been thus far.

For these reasons, I think investors with a long-term focus on green hydrogen should consider selling Plug Power and other green hydrogen plays reliant on inefficient and soon-to-be outdated hydrogen technology.

Next-Gen Electrolyzers – The Lynchpin of a Green Hydrogen Economy

The main driver for renewed optimism that a green hydrogen economy may have a chance to thrive, is the improving energy efficiency of the electrolyzer technology. Capillary-fed electrolysis has been demonstrated in the journal Nature to be much more efficient than conventional electrolyzers, and companies like Hysata are using this new electrolyzer technology to mass produce cost-effective electrolyzers that will be critical in producing green hydrogen. If its claims are to be believed, Hysata’s electrolyzers achieve an efficiency of 95%, a reduction of 20% in energy input compared to the current electrolyzers, and had a 40 gigawatt backlog as of late 2023. Each Hysata electrolyzer should produce energy at a 5 megawatt rate, meaning Hysata had a backlog of 8,000 electrolyzers to work through at the end of 2023. The company appears to aim for customer deliveries by 2025, meaning a probable ramp up of electrolyzer production in 2026 and beyond.

The 95% conversion efficiency is incredibly important, if true, for this efficiency level is about the same as the efficiency of storing energy in lithium-ion batteries. This would make Hysata’s electrolyzers technologically competitive with one of the faster-growing renewable energy storage mediums, an appealing benefit since hydrogen can be used for more than just energy storage, unlike batteries.

Plug Power – Old Dog in a New Age

Plug Power has been attempting to produce hydrogen and electrolyzers at scale for decades. In the end, relatively few customers want them – as I have mentioned throughout this piece, that they are simply too inefficient to be worth their while. Batteries for energy storage, on the other hand, are ramping up nicely, no doubt, due to batteries’ high energy conversion efficiency of 95%. This is as true for transportation as it is for storage – battery electric vehicles have been selling like hotcakes in the past decade, while hydrogen cars hardly register on automotive sales charts.

Compare the 95% conversion efficiency of batteries to the conversion efficiencies of Plug Power’s technology: Plug Power’s advertised use of PEM (Proton Exchange Membrane) electrolyzers indicates that it achieves a conversion efficiency (slide 13) of over 75%, or over 85%, if the customer engages in heat recovery. These efficiencies are clearly inferior compared to both batteries and next-generation electrolyzers, like those of Hysata and others.

Considering how much R&D investment has gone into Plug’s current technology, I don’t think a pivot to a more efficient hydrogen technology is on the cards for the company. I suspect that the company’s management has by now been taken in by the sunk cost fallacy, preventing it from fundamentally altering the base technology at this point in time. Even if it did, it might be too late to catch up to competitors, whose advanced electrolyzer tech is about to ramp in just the next few years. Can Plug Power replace its existing technology and scale to a totally new and more efficient technology before competitors who have more experience with that technology capitalize on it? I don’t think so.

The above technological reasons should be good enough on their own to not bet on PLUG over the long term. As they say, you can’t teach an old dog new tricks.

Financials and Valuation

Technological inferiority is bad enough, but Plug Power’s financial state also leaves much to be desired.

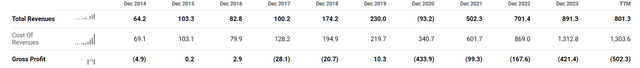

Revenues for Plug were mostly stable for the first half of the last 10 year period, before some exponential growth. Also growing exponentially is Plug’s cost of revenues, meaning Plug’s gross profit is decidedly negative, and that’s before any other costs related to Plug’s business are factored in. This makes the following graphic rather unsurprising, though no less disappointing.

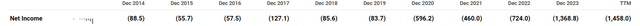

Net income for Plug has been falling off a cliff, which at this point should be expected. There are only so many ways to say a company is fundamentally unprofitable. As for Plug’s core business…

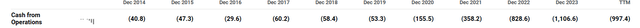

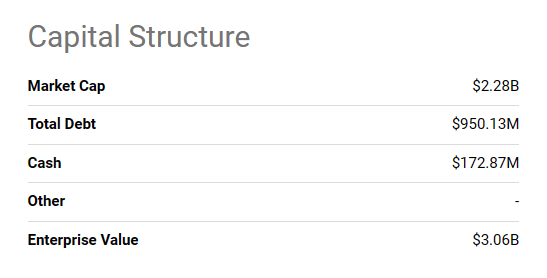

…it is also unprofitable, and exponentially loss-making as well. One might ask, if Plug is so fundamentally unprofitable, making losses of several hundred million to a billion dollars per year, does it have sufficient cash reserves to sustain itself? A quick look at Plug’s capital structure reveals that it probably doesn’t. In fact, Plug Power actually has much more debt on its books than cash.

Seeking Alpha

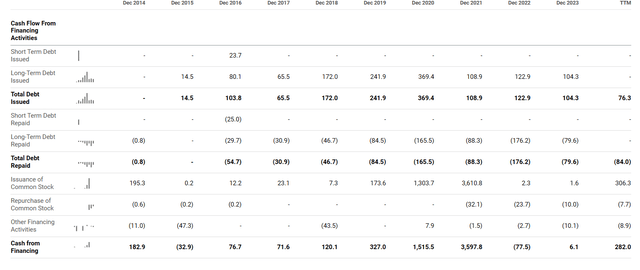

So, Plug Power has huge losses and insufficient cash to sustain itself, with big debts to pay. How does it survive? See the next image:

It seems that Plug Power takes out large amounts of debt or issues large amounts of stock in order to fund its operations, this includes Plug Power’s recent common stock offering of $200 million worth of shares. In my opinion, this isn’t sustainable, and if Plug is also at a technological disadvantage with its hydrogen technology, the company is liable to encounter severe financial difficulties, once investors are unwilling to bet on it.

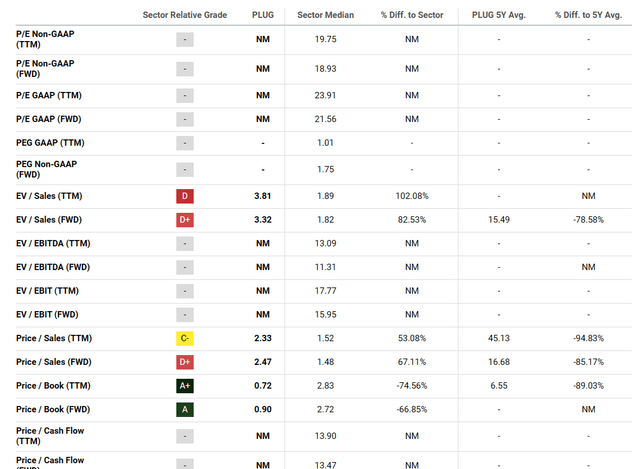

On to PLUG’s valuation. EV/Sales and Price/Sales metrics imply that investors are overpaying for this name. Price/Book implies significant undervaluation, but this is likely due to PLUG’s price having fallen significantly in the past few years after a probable pandemic hype bubble around hydrogen.

Regardless of what the valuation metrics say about PLUG, I would tell investors to run for the hills here. There is no visible upside, so don’t throw good money after bad.

Risks to Thesis

For the main risks to my thesis, there is a chance that even new electrolyzer technology for hydrogen is unable to profitably scale, and that new electrolyzer tech from Plug Power’s rising competitors is unable to see the same high laboratory efficiencies when operating at maximum capacity or in typical-use field conditions. If this risk bears out, the competition that endangers Plug would be greatly exaggerated, giving the company a longer runway to develop and sell products running on existing hydrogen technology.

Another set of risks is that hydrogen incumbent Plug Power either significantly improves its energy conversion efficiencies, pivots to copy the approach of these new competitors, or buys up competitors who have high efficiencies and incorporate those competitors’ technologies into its products. I see all of these as being rather unlikely, since such endeavors would require committing to actions that either strain the company’s weak financials even further or require a complete abandonment of Plug’s status quo. Still, investors should be aware that drastic changes like these could occur with Plug Power.

Plug Power might also price its products far below its competitors’ products in order to undercut them, prompting customers to buy Plug’s devices, despite their lower efficiency. This also seems rather unlikely, since it would mean eating greater losses in the short and medium term, and increased lossmaking is something that neither Plug’s financials nor its investors can sustain much more of.

Lastly, PLUG stock might be positively affected by Department of Energy funding recently secured by the company in May of this year. The boost to PLUG could manifest in a short-lived Meme Stock frenzy, per the analysis of Seeking Alpha analyst Henrik Alex. On the other hand, it could happen more steadily, becoming an additional source of funding to add to Plug Power’s balance sheet – that is, assuming the company’s financials first manage to improve organically with increased profitability and positive margins. Recognition of the DoE funding’s effect on Plug’s books could prompt investors to buy into PLUG.

Conclusion

I think that due to significant improvements in electrolyzer/fuel cell technology, there is a chance that a green hydrogen economy can find niche spaces to prosper in a world free of fossil fuels. However, incumbents in the hydrogen industry like Plug Power are not likely to see the benefits of these improvements, since they are still relying on last generation’s hydrogen technology that customers have been unenthusiastic about for decades. Emerging competitors are scaling new and highly-efficient hydrogen tech that Plug Power can’t beat.

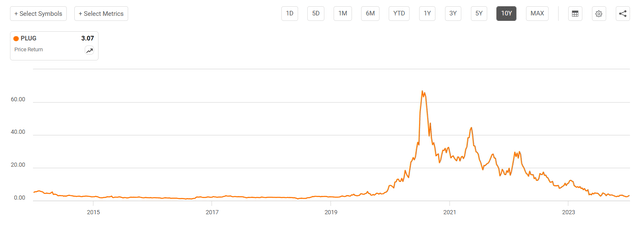

Additionally, the returns of PLUG stock over many years have been totally unproductive, and outright financially destructive, for buy-and-hold investors interested in a future hydrogen economy. The stock has been a money pit for investor capital, and the only justification for investment in PLUG would be that Plug Power is a technology leader in hydrogen production that is the closest to successfully and widely launching hydrogen technology. Unfortunately, that condition for investing in the company probably won’t be met, now that a more advanced, lower-cost, and more efficient hydrogen technology from competitors is on the horizon.

As such, investors should drop this losing hydrogen name, as well as any other hydrogen incumbent whose value as a company is reliant on outdated technologies. Accordingly, I rate PLUG stock a sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.