Summary:

- AMD stock is scheduled to report Q2 earnings next Tuesday.

- The market expects profit margin expansion for AMD, but competition pressure and inventory concerns may lead to disappointment in Q2.

- Looking further out, I consider the market’s margin expectations to become even more disconnected from the competition landscape in the next few years.

Richard Drury/DigitalVision via Getty Images

AMD stock: Q2 earnings scheduled on July 30

I last covered Advanced Micro Devices (NASDAQ:AMD) earlier this month (on July 1 to be exact, as you can see from the chart below). The article title is “AMD: Inventory Does Not Lie.” As the title already gives away, I argued for a hold rating on AMD stock due to inventory concerns. More specifically, I argued that:

With its current inventory buildup, AMD’s growth outlook and valuation multiples have come into question. Competition pressure from Nvidia heightens the concerns. Nvidia chips demonstrate far superior pricing power and no inventory issues at all.

Seeking Alpha

In this article, I want to approach the stock from a different angle and examine the market’s expectation of its future profit margins. Given that the company is about to report its next quarterly financials next week, this article also serves as my preview for the earnings report. To wit, AMD is scheduled to release its earnings report (ER) for fiscal Q2 2024 next Tuesday, July 30, 2024 (after the close of the market).

In the remainder of this article, I will explain why the market’s current profitability expectation is too high and is likely to be disappointed – again – by the upcoming Q2 ER.

AMD stock: Q1 recap and Q2 outlook

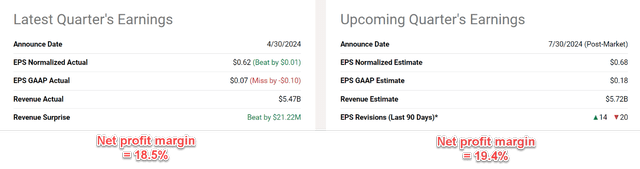

AMD delivered mixed results in Q1 2024. Both EPS and revenues beat market expectations narrowly (on normalized terms) as seen in the chart below. As seen, AMD beat earnings estimates in Q1 by $0.01 per share with normalized EPS of $0.62 (and missed GAAP EPS estimates by $0.10 per share at $0.07). Total revenue dialed in at $5.47 billion, beating estimates by $21.22 million (by about 0.4%).

However, there were concerns in key areas and share prices fell by around 8% after the ER was released. The top concern on my list was AMD’s progress toward the AI GPU market. The company reported reasonable numbers on this crucial front in absolute terms, considering that this was (and still is, in my view) brand new business for it. But the numbers are too small to move the needle, and I don’t see how AMD could reach parity with Nvidia in AI GPUs any time soon (more on this later).

Looking ahead, for the upcoming quarter, analysts expect EPS to be $0.68 with a revenue of $5.72 billion, translating into sequential growth rates of 9.6% and 4.6% respectively. These rates are totally plausible in my view, given the cyclical nature of the business.

What’s not plausible to me is the margins implied in these consensuses. The financials reported in Q1 translated into a net profit margin (NPM) of 18.5%. The NPM is expected to increase from 18.5% to 19.4% in the upcoming quarter based on the consensus estimates (assuming negligible changes in the number of share counts). Next, I will explain why such margin expectation is too high in my view.

Seeking Alpha

AMD stock: Market’s margin outlook is too optimistic

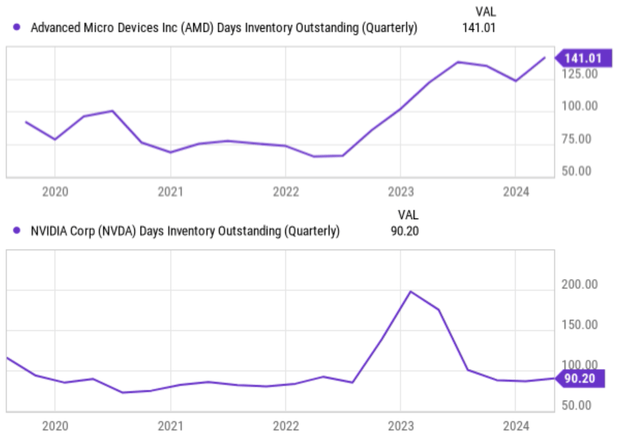

The above margin expectation is too high considering the competition pressure that AMD faces. From the data released so far, my reading is that AMD faces tremendous profit pressure on the AI front as leading cloud and enterprise customers heavily rely on GPU servers to run AI workloads rather than CPU servers. I anticipate NVDA’s leading chips and the vertical integration of hardware and software to remain unchallenged – by AMD or other vendors – for the foreseeable future. As argued in my earlier article, inventory provides good support for this point of view. NVDA’s H100 on average is priced about four times higher than AMD’s MI300x. Yet, I do not see an inventory issue at NVDA at all, in contrast to AMD’s record buildup (see the next chart below).

Seeking Alpha

Besides NVDA, competition from ASIC continues to squeeze AMD from the other end. For readers new to jargon, ASIC stands for Application-Specific Integrated Circuit. These are basically custom-made computer chips designed for a very specific task. They are different from general-purpose chips (like most of the chips AMD and Intel make) and they can be much more efficient for that one task they are designed for (such as running a specific AI algorithm or decoding a wireless signal). AMD certainly recognized the issue and acquired Xilinx in 2020. Xilinx is a leader in Field-Programmable Gate Arrays (FPGAs) which can be configured as ASICs after purchase. This acquisition gives AMD a foothold in this key market segment but not a definite lead yet in my view as other vendors remain highly competitive, such as AVGO, MRVL, many Taiwan vendors, and even INTC.

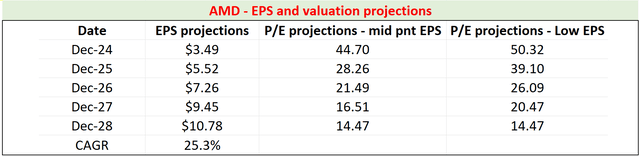

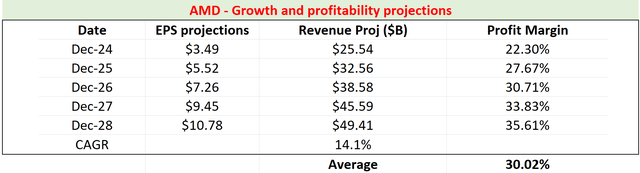

Looking further out, I found consensus expectations to become even more disconnected from the above competition landscape. As seen in the chart below, the consensus EPS estimates for AMD project a CAGR of 25.3% for the next five years, from $3.49 in FY2024 to $10.78 in FY 2028. Here, I won’t debate if such a CAGR is achievable or not – that will be a separate topic for another day. Here, I want to focus on the implied margins, as shown in the second chart below. The consensus estimates project its revenues to grow at a CAGR of 14.1% in the next five years.

The large gap between the EPS growth rate and revenue growth rate can only mean one thing – rapidly expanding margin. Well, as a hypothetical scenario, the company can also very aggressively buy back shares to boost EPS. The operative word here is very. It needs to reduce its share count by about 11% a year to achieve the consensus EPS and revenue growth rates without margin expansion.

My table below shows a more likely scenario in my view. In this scenario, I assumed its shared count to remain fixed at the current level. To provide a broader context, its shared count slightly increased in the past three years. Under this assumption, consensus estimates imply that its NPM would rapidly expand from 22.3% in FY 2024 to 35.6% five years later. The projected margin of 35.6% is almost double the actual margin of 18.5% the company actually achieved in the past quarter.

Author

Author

Other risks and final thoughts

A few other risks are worth mentioning before closing. The valuation is another concern in my mind. The stock currently trades at about 45x of its FWD non-GAAP earnings. But considering the variance in its FWD earnings, the FWD P/E can be over 50x based on the lower end of the EPS forecast as shown in the chart above. In terms of upside risks, the Xilinx acquisition mentioned above holds promise for future growth. Xilinx’s FPGAs are known for their flexibility and ability to be customized for specific tasks. This aligns well with the growing demand for customizable hardware solutions in HPC (High-Performance Computing) and AI. Besides HPC and AI, the progress of industrial automation and the Internet of Things (IoT) provides another good fit for FPGA technology. Xilinx’s FPGAs can be a valuable asset in industrial automation thanks to their low latency, real-time processing, and filed programmability. Over the longer term, I expect the total AI market to grow at rapid rates. As such, even though Nvidia is very likely to capture the bulk of this lucrative market, a rising tide tends to lift all boats and I consider AMD the best-positioned company to emerge as a second source in the AI segment.

However, in the near term, I do not see a definitive direction for AMD’s stock price. In particular, for its Q2 earnings report, I think the market’s high expectations provide a setup for disappointment. The expectation points to a margin expansion of almost 100 basis points compared to the previous quarter, which is very unlikely in my view considering A) its current market share in key growth and high-margin areas, and B) the competition pressures from NVDA and other ASIC manufacturers.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.