Summary:

- Strong cloud growth drives overall top-line growth, with Google Cloud representing over 12% of total revenue and showing 28.8% year-over-year growth in Q2.

- Anticipate Google Cloud business to continue growing by 20%+ with margin expansion potential due to AI workloads and partnerships.

- Fair value estimate of $220 per share for Alphabet Inc. class A shares, with a “Buy” rating based on growth in digital ads, cloud services, and other businesses.

da-kuk/E+ via Getty Images

I presented my “Buy” thesis on Alphabet Inc. aka Google (NASDAQ:GOOGL) in my previous article published in April 2024, highlighting its margin expansion potential in the cloud business. On July 23rd, after the market closed, Alphabet released its Q2 result, showing 15% constant revenue growth propelled by strong cloud growth. I anticipate Google Cloud business continuing to grow by 20%+ with margin expansion potential. I reiterate a “Buy” rating with a fair value of $220 per share for the Alphabet Inc. class A shares.

Strong Cloud Growth Drives Overall Top-line Growth

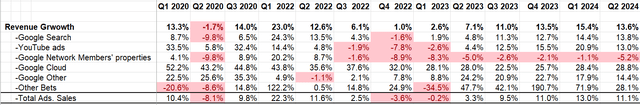

As detailed in the table below, Google Cloud grew by 28.8% year-over-year in Q2, and now the business represents more than 12% of total revenue. It is evident that Google Cloud has become a significant growth driver for Alphabet. Additionally, Alphabet delivered strong revenue growth in total advertising revenue with 11.1% year-over-year growth, driven by both Google Search and YouTube ads.

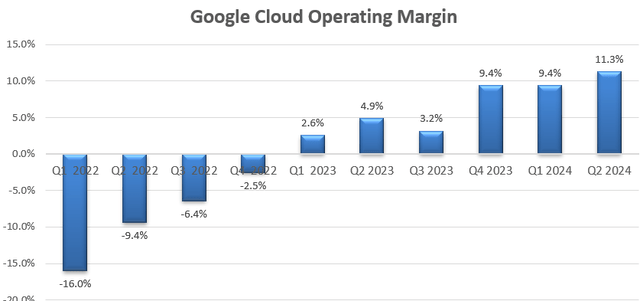

During the earnings call, Google management expressed strong confidence in its cloud business growth. The revenue growth could help the company expand its operating margin due to the operating leverage. As depicted in the chart below, Google Cloud has been consistently expanding its operating margin over the past few quarters, reaching 11.3% in Q2.

I think the strong revenue growth and margin expansion for its cloud business will continue in the near future for the following reasons:

- With the rapid growth in AI workloads, enterprise customers need to migrate their workflows to the cloud infrastructure. The first step is to move all the applications and data to the cloud if they need to perform AI training or inference. Therefore, the popularity of AI could potentially accelerate cloud adoption.

- Compared to Amazon (AMZN) and Microsoft (MSFT), Google Cloud is the smallest player, and the company has expanded its cloud services by partnering with third parties. I think all three cloud hyperscalers have a massive runway for future growth.

- Google has been developing its Gemini for Workspace and cloud services. As communicated over the earnings call, there are more than 1.5 million developers using Gemini across Google’s developer tools. With the growth of Gemini, enterprise customers can leverage Google Cloud to access AI-powered development tools.

FY24 Outlook and Valuation

For Alphabet’s growth, I am assessing the following factors:

- Google Search: Currently, the search business is the largest component of Alphabet’s revenue, representing more than 76% of group sales. Grand View Research forecasts that the digital ads market will grow at a CAGR of 14% from 2023 to 2030. I assume Alphabet will grow in line with the overall market growth.

- Google Cloud: As analyzed in my previous coverages, I forecast Google Cloud will continue to deliver 20%+ revenue growth in the near future. I assume Google Cloud will grow by 25% annually, driven by continuing digitalization and AI workloads.

- Lastly, I assume Google’s other businesses, such as subscriptions and services etc., will grow at 10%, aligning with the historical trend.

Overall, I calculate Alphabet will grow its revenue by 15% in the near future.

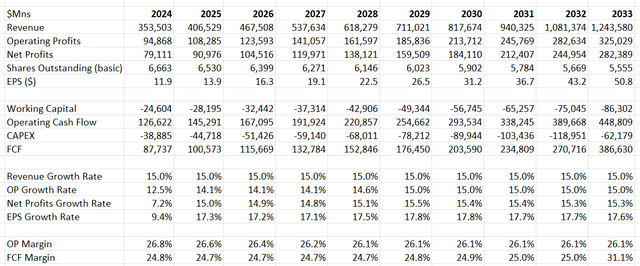

On the margin side, as Alphabet has invested heavily in its capital expenditure over the past few years. The depreciation and amortization costs will be quite high for the company, creating pressures on its operating margin. I estimate that Alphabet’s operating margin will decline 10-20bps annually, and stabilize at 26.1% from FY28 onwards.

The DCF summary can be found as follows:

Alphabet DCF – Author’s Calculations

The WACC is calculated to be 12% assuming: risk-free rate 4.2% (US 10Y Treasury Yield); beta 1.15 (SA); cost of debt 7%; risk equity premium 7%: equity balance $283 billion; debt $13 billion; Tax rate 17%.

Discounting all the future free cash flow, the fair value of Alphabet is estimated to be $220 per share, as per my calculations.

Key Risks

For Alphabet, the biggest risk is whether AI can disrupt the digital search market. It is evident that the traditional keyword search will gradually be replaced by conversational search via human-machine interaction powered by AI technology. I acknowledge that Alphabet has been investing heavily in AI and related search technology. However, new players, such as OpenAI, could potentially enter the search and ads market, taking market share away from Alphabet.

In addition, Alphabet is investing heavily in data centers to capture the growth of AI. They spent $13 billion in CAPEX in Q2, purchasing servers and infrastructure hardware for data centers. I anticipate the company will continue to invest in its CAPEX in the near future, which could create hurdles for its free cash flow growth and margin expansion.

Conclusion

Alphabet is well positioned in the AI era, growing its business in both digital ads and cloud market. I anticipate the company will deliver 15% normalized revenue growth in the near future. I reiterate a “Buy” rating with a fair value of $220 per share for the Alphabet Inc. class A shares.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.