Summary:

- Palantir stock recently received a downgrade due to its high valuation, but analysts are now citing better-than-anticipated AI monetization with price targets of $35 and a bullish case of $50 by 2025.

- Palantir is uniquely positioned to gain global market share with its AI platform, AIP, and is set to become a leader in the AI software industry.

- The AI software market is expected to grow significantly, with Palantir’s AIP offering comprehensive solutions applicable to various organizations globally.

- Due to its exceptional sales and earnings growth potential, Palantir’s stock could expand significantly while maintaining a high P/E multiple.

Colin Anderson Productions pty ltd

The last time I wrote about Palantir (NYSE:PLTR), the stock had dropped after delivering solid earnings and firm guidance. I discussed buying the dip, and the stock has increased by about 30% since. Still, I often hear that Palantir is expensive.

The stock recently received a downgrade due to its “egregiously rich” valuation. The analyst used strong language while assigning Palantir a sell rating and a $20 price target. More recently, Wedbush upgraded Palantir, citing better-than-anticipated AI monetization, a price target of $35, and a “bullish case” $50 price target for 2025.

Palantir remains a top battleground stock. However, it is uniquely positioned, as its artificial intelligence platform, “AIP,” is highly likely (in my view) to continue gaining global market share as we advance. Palantir remains on track to become a leader in the AI software industry and has not even had its “Nvidia moment” yet.

While Palantir’s stock is relatively expensive, with good reason, and Palantir is set to deliver its earnings on August 5. Palantir could provide better than anticipated results, especially in the private segment, and the stock could break out to new highs. Moreover, Palantir could announce significantly better than expected guidance, enabling its stock to move to $35. Furthermore, Palantir could continue outperforming downbeat consensus estimates in future quarters, allowing its stock to reach $50 or higher in 2025.

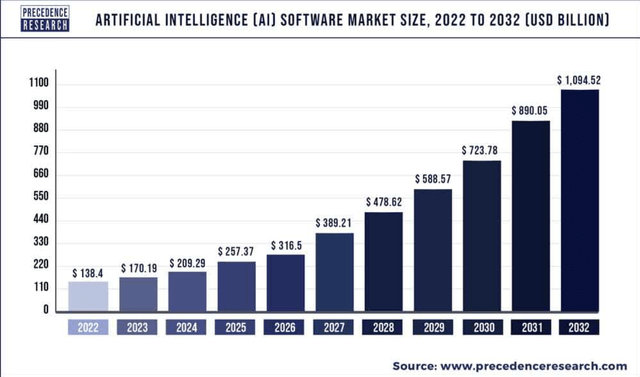

The AI Software Market Should Be Massive

AI software growth (Precedence Research – Statistics Platform for Market Intelligence, Market Research and Insights)

We are still in the early innings of AI, especially in the AI software space. The Software segment is unique because a significant portion of this space may be dedicated to improving corporate efficiency. While recent revenues in this sector may be around $200B (annual), we could see sales skyrocketing to over $1T in the next several years as companies aim to leverage AI to improve various facets of operations.

What Is AIP?

At its core, AIP is designed to optimize organizational efficiency, increase productivity, and, ultimately, improve profitability. Every organization, government and private, foreign and domestic, can benefit from this. AIP collects and processes massive amounts of information, delivering operational-critical solutions to its customers.

Let’s go over several examples. Imagine you are an army commander and see an opposing army amassing nearby. AIP can model what types of scenarios we can expect from the enemy. Also, AIP can model what approaches may work best in which scenario, and it can modify elements in real-time as new elements materialize, providing your army with a significant edge.

In a corporate environment, suppose an earthquake or another natural disaster has impacted or may impact your operations. AIP can model the damage a company may face and how to improve the situation in any scenario. For instance, if a warehouse could be impacted, AIP can provide critical information relevant to cost-cutting and how best to divert operations to another space.

These are several basic examples of what AIP can do and why more organizations use it. More firms will likely become adopters and long-term users of Palantir’s software products and services, as the net benefits often outweigh the costs.

Furthermore, Palantir is unique as (to my knowledge) no other company offers the “complete package,” the ability to bring immense quantities of information together from various facets of an organization, efficiently process it, and provide comprehensive solutions applicable to individual situations all in one place.

Therefore, Palantir is in a highly advantageous blue ocean market position, offering high-quality, market-leading solutions and services arguably applicable to any organization globally. Again, Palantir has no apparent competition that can deliver the entire package nearly as seamlessly and effectively.

Palantir Is Also A “Trump Trade”

Palantir did fine during the Biden administration, but If you want to discuss a “Trump Trade,” this is it. Peter Thiel, Palantir’s co-founder, has been a Trump supporter in the past. Moreover, Thiel donated about $30M to Republican Senate efforts in 2022, and $15M went toward JD Vance’s 2022 senate campaign.

JD Vance, Trump’s VP pick, could be Peter Thiel’s “guy” in the White House if Trump/Vance win in November. Thiel could be a primary reason Vance entered politics, and he even employed him before supporting his Senate campaign. JD Vance owes a lot to Peter Thiel.

Having the President or Vice President’s ear is a constructive factor, especially when your company is a significant government contractor still deriving most of its revenues from the U.S. government. Therefore, if the Trump/Vance ticket wins the White House in November, we could see an uptick in Palantir’s government segment growth, which has lacked lately.

Palantir’s “Nvidia Moment” Approaches

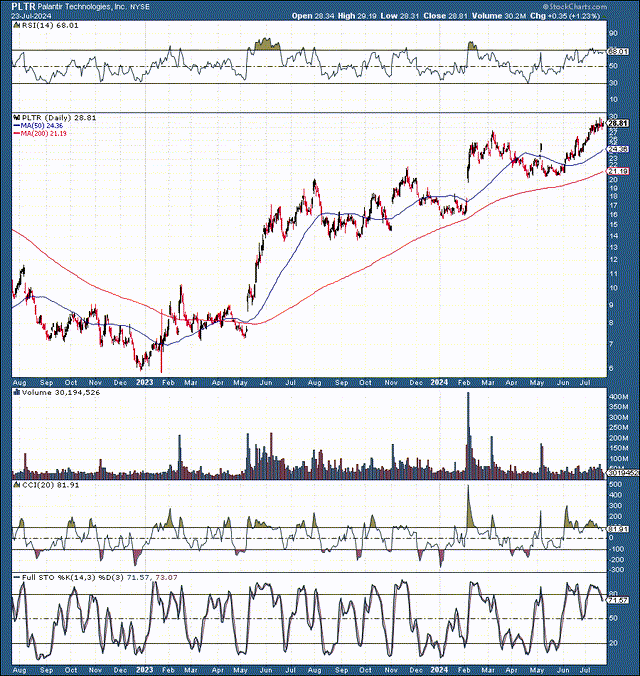

PLTR (StockCharts.com | Advanced Financial Charts & Technical Analysis Tools )

Palantir’s stock has done well since bottoming around $6 in late 2022/early 2023. This dynamic represents a gain of nearly 400%. Palantir is also up by about 100% off its 52-week low recorded in the selloff last Fall. While these are spectacular gains, we have not yet seen that “Nvidia moment” from Palantir.

The Nvidia moment could occur if Palantir preannounces or announces much better-than-anticipated sales and earnings figures and substantially better-than-expected guidance due to increased demand for its services and more effective monetization of its AI platform. This phenomenon would suggest that Palantir’s consensus and even higher-end estimates are likely too low, leading to considerable upward sales and EPS revisions.

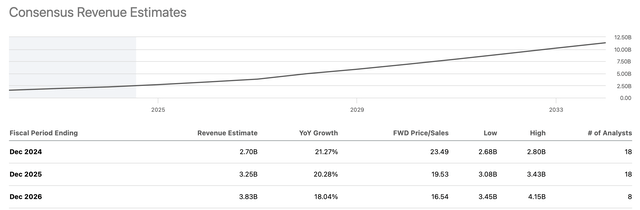

Revenue Estimates Could Be Too Low

Sales estimates (Stock Market Analysis & Tools for Investors )

Palantir’s consensus sales estimates are only about 18-20% growth in future years. Of course, the stock seems expensive if we use these lowballed projections. However, Palantir’s push into the commercial segment with its market-leading AIP and the potential for reinvigorated growth in its government segment business could enable sales to increase much quicker than projected.

If we consider “higher-end” sales estimates, Palantir’s revenue growth could be around 25-30% in the coming years. However, in a bullish case scenario, Palantir could eclipse the current higher-end projections, potentially delivering 30-35% sales growth as we advance.

EPS Could Increase More Than Expected

Palantir’s business is highly profitable. It is a unique software and services company with little, if any, comprehensive competition. Therefore, it will likely remain highly profitable and become more profitable with scale.

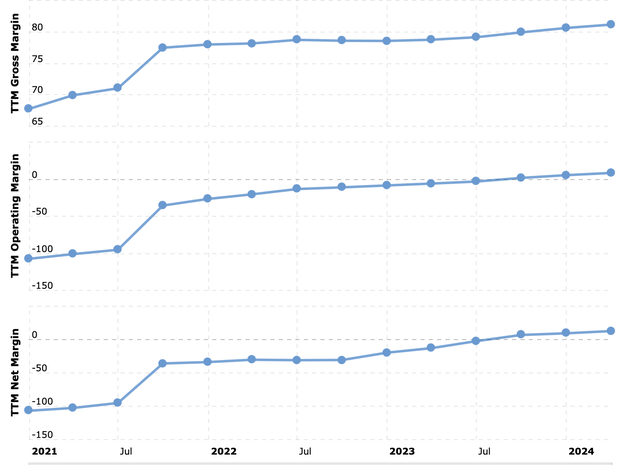

Palantir’s Margins Likely to Continue Improving

Margins (Macrotrends | The Long Term Perspective on Markets)

Palantir’s gross margin is remarkably high, over 80%. Moreover, we’ve recently seen Palantir’s net and operating margins become positive. Thus, Palantir is not some “high in the sky” valuation company that may or may not become profitable in future years. Instead, we see concrete GAAP profitable results from Palantir, and profitability will likely only increase. Furthermore, we could see an acceleration in net profitability metrics as net income could increase more than anticipated as Palantir’s operations increase in scale.

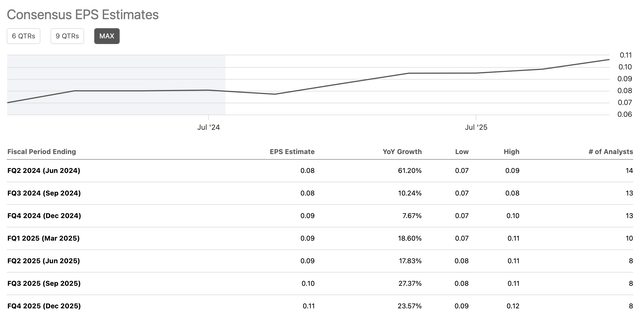

EPS Could Increase More Than Expected

EPS estimates (Stock Market Analysis & Tools for Investors )

While it’s impressive that Palantir has become this profitable this quickly, EPS could increase more than the current lowballed estimates suggest. Palantir could surprise higher on August 5, delivering higher EPS than expected, but whether this quarter becomes its Nvidia moment remains to be seen. Regardless, I am more focused on the intermediate and longer-term image regarding Palantir and its stellar earnings potential.

The consensus 2025 EPS estimate is only about $0.39, and the “higher-end” estimate is only about $0.45. Yet, Palantir could achieve 50 cents or higher in a bullish case outcome. Moreover, we could see substantial EPS growth in future years. Palantir may earn around $1 in EPS in 2027 or 2028 instead of the projected 2030.

How is this possible, you ask?

First, Palantir has demonstrated the ability to become profitable relatively early and is still in a high growth period of its developmental cycle. Second, we see Palantir’s profitability metrics improving consistently. Third, high-quality, monopolistic-style software companies with around 60-80% gross margins produce 25-40% net income margins. So, why wouldn’t Palantir?

Palantir has increased its gross margin to over 80% in recent quarters. Its net income margin has skyrocketed from being continuously negative post-IPO to almost 17% last quarter.

2027 consensus Sales estimates are only for $5B, but that may be the current base case. Applying a 27% net income margin to $5B in sales suggests Palantir could deliver $1.35B in net income in several years (2027). Palantir has around 2.21B shares outstanding, and the share count appears to have leveled off, suggesting that the “major” SBC dilution is behind us.

A net income of $1.35B with 2.4B shares implies Palantir may earn around $0.57 in EPS in this dynamic. However, let’s explore a slightly bullish case scenario in which Palantir achieves around $6B in revenues in 2027 and reaches around $7.5B in 2028.

Additionally, Palantir’s profitability should continue improving with scale, and it may achieve about a 30% net income margin in 2027 and 32% in 2028, with a slightly higher number of shares (roughly 2.4B). Under this somewhat bullish but realistic scenario, Palantir could earn about $1.8B in net income in 2027 and approximately $2.4B in 2028, translating to roughly $0.75 and $1 in EPS.

Where Palantir’s stock could be in the future:

| Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $2.85 | $3.6 | $4.7 | $6 | $7.5 | $8.9 | $10.8 |

| Revenue growth | 28% | 26% | 28% | 28% | 25% | 24% | 23% |

| EPS | $0.38 | $0.48 | $0.61 | $0.75 | $1 | $1.31 | $1.64 |

| EPS growth | 52% | 26% | 27% | 23% | 33% | 31% | 25% |

| Forward P/E | 73 | 75 | 72 | 70 | 65 | 60 | 55 |

| Stock price | $35 | $46 | $54 | $70 | $86 | $99 | $120 |

Source: The Financial Prophet

Due to Palantir’s exceptionally high profitability, extremely long growth runway, and monopolistic-style market position, it could achieve remarkable sales and earnings growth for many years, enabling its stock to garner a relatively high forward P/E multiple of 50-75 in future years. Also, Palantir’s sales growth could eclipse 30% in a more bullish case scenario, and its net profit margin could move above the 25-35% range. Therefore, Palantir’s financials may improve more than my projections suggest, enabling its stock to appreciate more considerably in a more bullish case outcome.

Risks to Palantir

Palantir faces risks despite my bullish assessment. Slower-than-anticipated growth due to a sluggish economy, high rates, and other factors could keep Palantir from achieving its optimal potential. The company also faces the risk of worse-than-expected demand for its AIP and products and services from the commercial segment and government sectors. Palantir also faces the risk of increased competition surrounding its lucrative AI segment. Moreover, Palantir’s profitability could be lower than projected, and the stock price may not appreciate as robustly as my model suggests. Investors should examine these and other risks before investing in Palantir.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2023 47% return) and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Join The Financial Prophet And Become A Better Investor!

Join The Financial Prophet And Become A Better Investor!

Don’t Hesitate! Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!