Summary:

- TSMC reported strong Q2 2024 results with revenue exceeding our expectations, driven by demand for advanced chips.

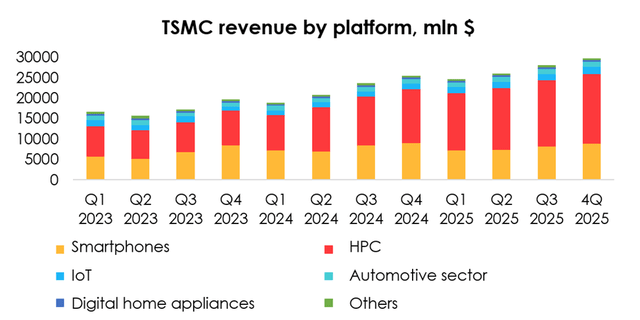

- Revenue structure showed growth in HPC segment and decline in Smartphone segment.

- TSMC is struggling to keep up with the influx of demand for its products, and the company’s production capacity will be fully utilized until the end of 2025.

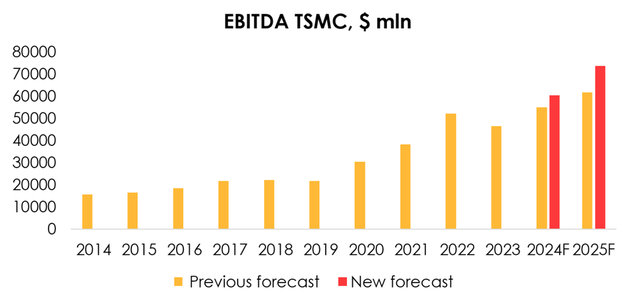

- We have revised upwards our EBITDA guidance from $55.1 bn (+18% YoY) to $60.4 bn(+30% YoY) for 2024 and from $61.7 bn (+12% YoY) to $73.8 bn (+22% YoY) for2025.

Tanaonte

Investment thesis

We have covered TSMC (NYSE:TSM) stock before, and as we expected, our revenue distribution expectations were met. Revenues from the HPC segment represented 52% of the Company’s revenues (+6 p.p. QoQ), while revenues from the Smartphone segment declined to 33% of the Company’s revenues (-5 p.p. QoQ).

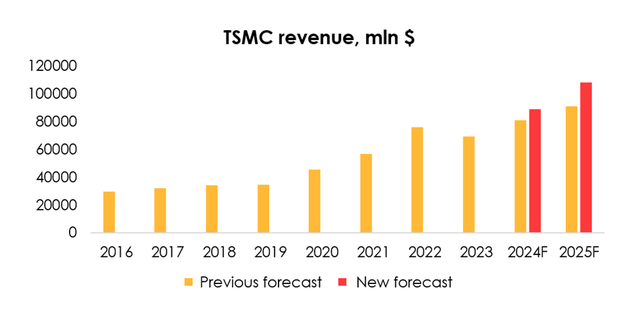

The growth rate of demand for the company’s advanced chips exceeded our expectations, so the company’s actual revenue was higher than our forecast. In general, it is worth noting that TSMC reported a strong 2Q2024.

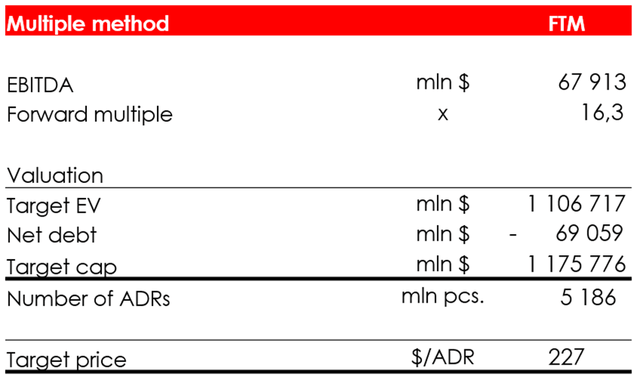

In this article, we raised our revenue expectations for the company due to the strong growth in demand for chips and the expected increase in chip prices, as well as our operating margin forecasts due to TSMC’s successful cost-cutting measures. Together, this led to an increase in the company’s EBITDA forecast and an increase in the price target to $227/ADR.

All would be well, but in the days leading up to the Q2 earnings release, negative geopolitical news hovered over the company, leading to a decline in the share price.

Read more about this in the article below and decide if you want to add TSMC ADR to your portfolio now or not.

TSMC’s revenue structure

The company’s Q2 2024 revenue amounted to $20.8 bn (+33% YoY). The company exceeded its previously announced revenue guidance ($19.6-20.4bn) due to strong demand for its leading 3nm and 5nm chips: the share of revenue from advanced technologies (7nm and below) reached 67% (+2ppt QoQ), with 3nm growing to 15% of the company’s revenue (+6ppt QoQ).

Let’s take a look at revenue per segments with demand for advanced technology:

1. Demand from the HPC segment continues to grow at high rates. Revenue here amounted to $10.8 bn (+57% YoY and +25% QoQ), equivalent to 52% of the company’s revenue (+6 p.p. QoQ).

Against the backdrop of an ever-increasing demand for advanced chips, orders from big tech companies, in particular Apple and NVIDIA, have led to TSMC’s capacity being fully utilized until the end of 2025. We are talking about advanced 3nm and 5nm chips. It was announced that TSMC plans to increase prices for 3nm technology by more than 5% and for CoWoS (“advanced packaging”) by 10-20%.

We expect demand from this segment to continue to grow at a higher YoY rate than we had previously projected amid faster increase in demand for AI chips in real terms and the company’s planned price increase.

We have therefore revised upwards our revenue forecast for the HPC segment from $37.4bn (+25% YoY) to $44.5bn (+49% YoY) for 2024 and to $62.4bn (+40% YoY) for 2025.

2. Demand in the smartphone segment continues to be influenced by the global market’s seasonality. Revenue from this segment reached $6.9 bn (+33% YoY and -4% QoQ), equivalent to 33% of the company’s revenue (-5 p.p. QoQ).

We expect that smartphone shipments will start to recover in 2H 2024. Along with the gradual adoption of AI models, it will have a positive impact on the sales momentum of advanced chips for this segment. Higher prices for advanced chips will also have a positive impact on smartphone revenues. Thus, we revised upwards our revenue forecast for the smartphone segment from $30.4 bn (+17% YoY) to $31.5 bn (+21% YoY) for 2024 and to $31.4 bn (-0% YoY) for 2025.

Geopolitical risks and TSMC’s investment plans

Shortly before the release of the company’s Q2 2024 financial results report, former U.S. President and current Republican candidate Donald Trump had an interview with Bloomberg where, among other things, he stated that despite bipartisan support for Taiwan, he was in no mood to confront Chinese aggression and wanted Taiwan to pay the U.S. to defend itself.

With tensions between China and Taiwan continuing to escalate, such comments from Donald Trump have put additional pressure on TSMC and prompted the company’s customers to once again consider developing a strategy to mitigate geopolitical risks. Almost simultaneously, TSMC investors (as well as a number of other chip-related companies) were alarmed by news that the Biden administration is considering imposing tougher trade restrictions if companies such as Tokyo Electron and ASML Holding NV continue to give China access to advanced chip manufacturing technologies.

During the Q2 2024 financial results conference call, management was asked about possible plans to mitigate geopolitical risks by expanding plant construction in the U.S., prompting a response that TSMC has not changed its original plans to increase its global footprint and is generally committed to its previously announced strategy.

As we mentioned in our previous article, which was written after the company’s Q1 2024 financial results report, TSMC plans to construct three factories in the U.S. that will produce advanced technologies such as 4nm and below.

At the moment, TSMC is struggling to keep up with the influx of demand for its products, and the company’s production capacity is fully utilized until the end of 2025. According to TSMC’s comments, the company is trying to ramp up “whatever, wherever, whenever” they can and hopes to ramp up supply to meet customer demand as soon as possible.

This commentary is consistent with the updated CapEx guideline – TSMC has narrowed its CapEx range for 2024 to $30-32 bn, down from $28-32 bn previously.

TSMC’s financial results

We have revised upwards our revenue forecast from $81 bn (+17% YoY) to $88.7 bn (+28% YoY) for 2024 and from $91.2 bn (+13% YoY) to $108.3 bn (+22% YoY) for 2025 due to an increase in revenue forecast for both the HPC and smartphone segments in 2024-2025.

The rest of the company’s segments are developing in line with our expectations; the forecast revenue dynamics for them are maintained.

We also keep our forecast to expect the largest demand for TSMC’s products to come from the HPC segment, due to orders for 3nm chips from companies needing accelerated computing for AI.

It is worth noting that the company has revised upwards its 2024 revenue guidance and now expects growth of more than 25% YoY, which is in line with our 28% YoY growth guidance.

We have revised upwards our EBITDA guidance from $55.1 bn (+18% YoY) to $60.4 bn (+30% YoY) for 2024 and from $61.7 bn (+12% YoY) to $73.8 bn (+22% YoY) for 2025 due to:

- increase in the company’s 2024-2025 revenue forecast.

- downward revision to the forecast for operating costs as a percentage of revenue in 2024-2025.

The Company maintains its goal of maintaining a long-term gross margin of 53% or higher.

Valuation

We have revised upwards our target share price from $151 to $227 due to:

- increase in the company’s 2024-2025 EBITDA guidance;

- shift in FTM estimates. Future financial results are now 1 quarter closer.

We set a BUY rating on the stock.

Conclusion

Thus, TSMC’s leadership in the development and production of advanced chips gives it an advantageous market position that will ensure strong financial results in the future. The development of 2-nanometer technology is progressing as previously announced, with mass production scheduled for 2025 at a pace similar to the 3nm production.

One risks to the company’s financial results is a possible global oversupply of technologies beyond 7nm. However, at the moment, we assess the probability of this scenario specifically for TSMC as low, as the company is focused on improving the performance of all its products, not just the cutting-edge technologies, which will enable it to continue to outperform competition and retain customers. However, given recent events, geopolitical risks are the most crucial ones for the company.

To manage your positions, we recommend following TSMC’s earnings releases, semiconductors market updates.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.