Summary:

- General Motors shares fell 6% despite beating Q2 estimates and raising key metrics for FY 2024.

- Unexpected loss in China business led to stock selloff, but overall earnings were solid.

- Strong EBIT performance, driven by ICE division, and low valuation create a high safety margin investment opportunity.

peshkov

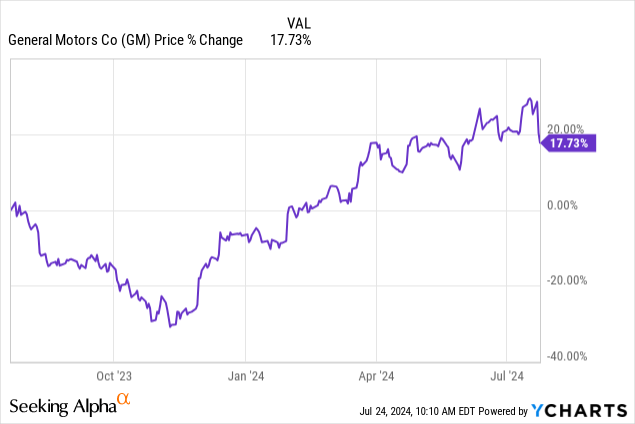

Shares of General Motors (NYSE:GM) fell 6% on Tuesday, after crushing estimates for the second fiscal quarter, and are down another 2% on Wednesday. The auto company raised a number of key metrics for its 2024 fiscal year, including EBIT and free cash flow, as General Motors sees strong demand for its pick-up truck and SUV line-ups. Shares sold off mainly because General Motors reported an unexpected loss in its China business, which the automaker said it would restructure. All things considered, General Motors reported very solid Q2 earnings and GM’s valuation reflects a high safety margin!

Previous rating

I rated shares of General Motors a strong buy in March 2024 as the car brand offered investors a hedge against slowing demand for electric vehicles with its ICE division: An Auto Bargain With A 23% Earnings Yield. Since then, the automaker raised its full-year outlook for adjusted EBIT by $0.5B and its free cash flow guidance by $1.0B. With EV demand waning, those companies that can provide free cash flow and EBIT growth have the highest chance of seeing a higher market valuation, in my opinion.

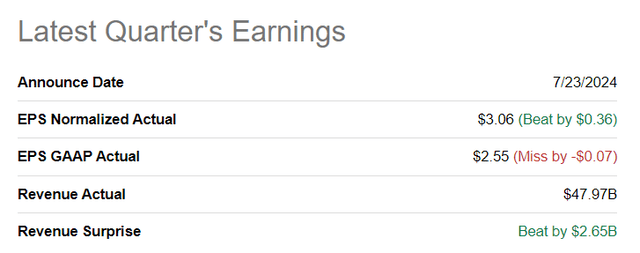

General Motors beats estimates

The automaker reported better than expected results on strength in its ICE division: the company achieved adjusted earnings of $3.06 per-share, beating Wall Street’s consensus estimate by $0.36 per-share. Revenues came in at $47.97B, which compared favorably to an average prediction of $45.32B.

Seeking Alpha

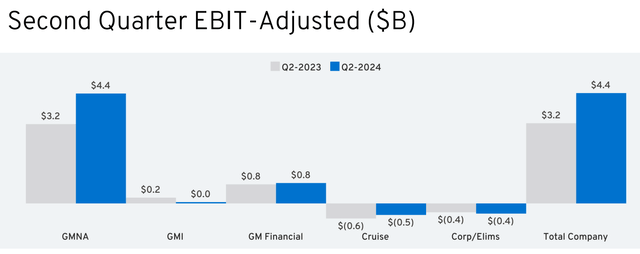

EBIT momentum, raised outlook for FY 2024 due to strength in ICE segment

General Motors is doing really well right now, especially in the non-EV segment. While the automaker delivered 22k electric vehicles in the second-quarter, showing a year-over-year growth rate of 40%, it is the ICE division that was responsible for driving General Motors strong EBIT performance in Q2’24.

General Motors generated $4.4B in second-quarter adjusted EBIT — a key metric for automakers — showing a year-over-year improvement of 37%. This growth chiefly comes from resilient demand for the company’s pick-up trucks and its SUV models. Pick-up trucks that are doing especially well for General Motors right now are the GMC Sierra, which had its best first-half sales in the history of the company this year, and the Chevrolet Silverado, which saw its best sales since 2021.

General Motors

While Q2’24 results were generally strong, one element that stood out negatively — and which likely explains the 6% drop on Tuesday — was that General Motors made an unexpected loss in the important Chinese market. GM’s SAIC joint venture reported a $104M loss (shown as negative equity income in General Motors’ Q2’24). The Chinese market is facing intense competition, especially in the EV market, resulting in pressure on non-Chinese car manufacturers as well.

General Motors has said, however, that it will reduce its costs as part of a comprehensive restructuring and align its manufacturing with slowing demand. Given that General Motors reported quarterly net income of $2.9B; however, I believe that investors overreacted to General Motors’ China restructuring, especially since the company also raised its EBIT and FCF guidance.

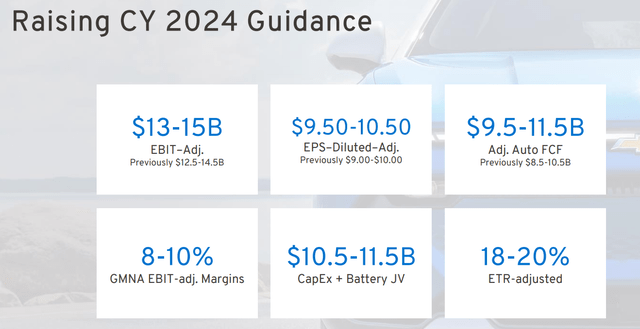

Raised key financial metrics

Strong auto sales in the U.S. are giving General Motors so much confidence right now that the company raised its forecast for adjusted EBIT and free cash flow a second time in a row. The automaker now expects $13-15B in adjusted EBIT for FY 2024 (+$0.5B on both the top and bottom end compared to previous forecast) and $9.5-11.5B in free cash flow (+$1.0B on both ends).

General Motors

The free cash flow forecast especially should be seen in the context of General Motors recently approved $6.0B stock buyback authorization, which calculates to approximately 11.6% of the company’s outstanding shares. Higher free cash flow is therefore set to translate into higher capital returns for General Motors’ investors.

General Motors lowered EV guidance

In June, General Motors lowered its outlook for new electric vehicle production from a range of 200-300k to a new range of 200-250k due to slowing adoption of electric vehicles in the U.S. market. The company’s CFO, however, clarified that GM expects to be able to generate a profit on a production volume in the low 200k production range. In Q2’24, General Motors delivered 21,930 electric vehicles (out of a total delivery volume of 696,086 vehicles), representing a delivery share of only 3.2%. In other words, General Motors will continue to remain reliant on its well-performing ICE business.

Valuation reflects high safety margin

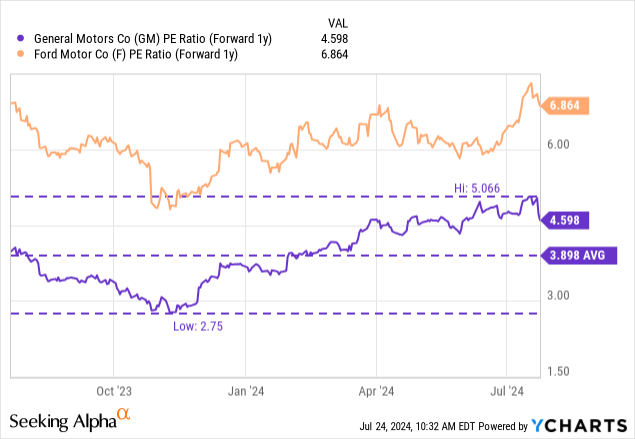

Despite General Motors’ reporting strong Q2 results, shares skidded 6%, which I argued was related to GM’s restructuring of its China business.

General Motors is currently trading at a 4.6X forward (FY 2025) P/E ratio. For context, Ford Motor (F), which is similarly positioned as General Motors — meaning it also has a low-single digit percentage of EV sales and relies on ICE sales — is priced at a 6.9X P/E ratio. Ford’s strong position in the ICE market as well as its low valuation have been two reasons for me why I called the automaker A Hedge Against An EV Market Slowdown in April.

In my opinion, General Motors with still massively undervalued with a less than 5.0X P/E ratio. Shares of GM could be valued at a Ford-like 6-7X price-to-earnings, in my opinion, especially because the company raised its EBIT/FCF forecast twice in FY 2024, GM is very profitable and set to return more cash to shareholders through stock buybacks. A 6-7X P/E ratio implies a fair value range of $59-69 per share of General Motors. This is a dynamic fair value range which may change with the company’s EBIT and FCF trends as well as sales trajectory in the ICE and EV markets.

Risks with General Motors

General Motors is still very much reliant on ICE vehicles, which means the company has currently a competitive advantage over pure-play electric vehicle companies that don’t have an ICE division to offset segment weakness. However, General Motors’ scaling back production in its fastest-growing segment is not especially good news. What would change my mind about GM is if the company were to see slowing sales and EBIT growth, or if the U.S. economy were to skid into a recession.

Final thoughts

General Motors’ Q2’24 results were more positive than negative and shares should not have dropped 6% after earnings given the overall bullish trends in the company’s business. The second consecutive raise in EBIT and free cash flow guidance shows that GM faces strong demand for its products, especially in the pick-up truck and SUV segments. Although General Motors earlier announced that it would scale back its EV production target this year, electric vehicles accounted for such a low share of total sales that it won’t impact the company much at all. Additionally, I believe the $6.0B new stock buyback authorization that could allow the automaker to repurchase up to 11.6% of its outstanding shares is an added benefit to investors that could also help establish a floor underneath General Motors’ share price!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GM, F either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.