Summary:

- Valuation remains an important consideration for me as a dividend growth investor.

- Coca-Cola’s net revenue and non-GAAP EPS grew in Q2.

- The company still enjoys an A+ credit rating from S&P.

- Shares could be priced 5% below fair value.

- KO’s total return prospects aren’t quite enough for me to maintain my buy rating.

Two women drinking cola. fotostorm

In investing, I very much believe in owning dominant businesses. What do I mean?

When it comes to consumer-facing companies, I want them to have millions, if not billions of daily or weekly customers. This comes with numerous benefits. For one, it usually translates into steady and predictable revenue and profits.

This type of devotion to the brands of a business tends to also mean that it has significant pricing power. That can drive revenue and earnings growth over the long haul.

Selling more than 2 billion servings a day in 2023, Coca-Cola (NYSE:KO) is the epitome of a commanding consumer staple. When I last covered KO with a buy rating in May, I wasn’t just impressed by its immense scale. I appreciated that the company was nimble in responding to shifting consumer preferences with new product launches and product evolutions. The corporate credit rating was also upper medium investment grade, just four notches from an illustrious AAA credit rating. Finally, shares presented a high likelihood for double-digit annual total returns.

Today, I’m downgrading KO stock to a hold rating. To be clear, I was pleased with the company’s second-quarter results released recently. KO’s leverage ratio was well below its targeted ratio. The rally in shares in recent months has outpaced the growth in my fair value estimate. Shares are still trading slightly below fair value, but KO’s annual total return potential for the foreseeable future is now below my requirement of 10%.

An Excellent Second Quarter

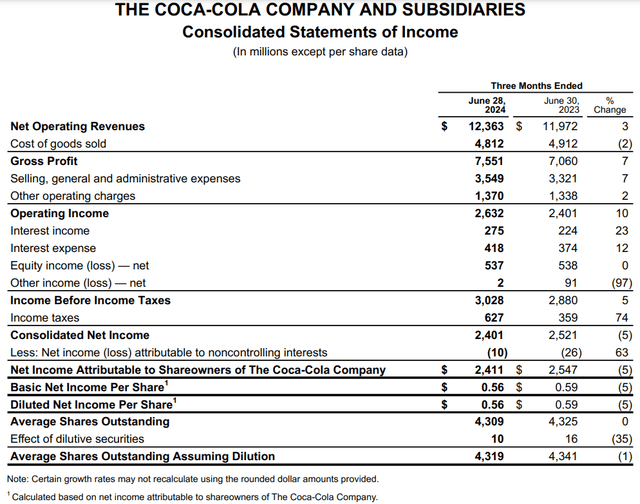

KO Q2 2024 Earnings Press Release

When KO shared its second-quarter results on July 23, it did what I would expect from any phenomenal business: Surpass analysts’ expectations. The company’s net revenue increased by 3.3% year-over-year to $12.4 billion during the quarter.

This came in $650 million better than the analyst consensus from Seeking Alpha. Put another way, KO’s topline modestly expanded rather than the modest decline that was baked into the analyst consensus.

Better yet, the company’s results were better than the initial results may suggest: Organic revenue grew by a whopping 13% in the second quarter.

This was led by price increases and a more favorable product mix. That benefited KO to the tune of 11% for the second quarter. Remarkably, when many other consumer staples have posted volume declines, the company reported a 2% uptick in unit case volume. This speaks to just how much billions of consumers around the world enjoy KO’s products. They respond to higher prices by buying even more of the company’s products.

These tailwinds were largely offset by a couple of headwinds during the quarter, however. KO’s status as a global business resulted in a 6% hit to its topline via foreign currency translation. Just as the refranchising of some bottling operations in India in January and Bangladesh and the Philippines in February weighed on Q1 results, the same was true for Q2. These divestitures set KO’s topline back by 4% during the quarter.

Moving to the bottom line, the company’s non-GAAP (comparable) EPS surged 7.3% higher over the year-ago period to $0.84 in the second quarter. This outpaced Seeking Alpha’s analyst consensus by $0.03.

Aside from the greater net revenue base, KO’s improved operating efficiency was another growth driver for the second quarter. This is what led the company’s comparable operating margin to climb 120 basis points year-over-year to a record 32.8% during the quarter. Along with a 0.5% reduction in KO’s diluted share count, this is how comparable EPS growth registered above net revenue growth in the quarter.

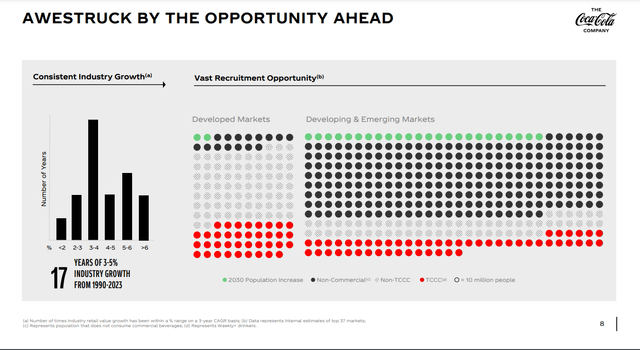

KO CAGNY 2024 Investor Presentation

KO’s results were strong enough that the company upped its midpoint comparable EPS growth forecast for 2024 from 4.5% (4% to 5%) to 5.5% (5% to 6%). That would imply a $0.02 bump in comparable EPS from the present consensus of $2.82 for 2024.

For 2025, analysts expect another 6% growth in comparable EPS to $3.01. In 2026, comparable EPS is projected to climb by another 7.3% to $3.23.

In the coming years, KO has a couple of catalysts that should produce the aforementioned growth. For one, the global population is expected to be 8.6 billion by 2030 per the United Nations forecast. That would be a half billion people more than at present. Simply put, more people equals more demand for KO’s products.

As dominant as the company may be, it also has a lengthy growth runway. Data from Q3 2023 suggests that 6 in 100 baskets contained a non-alcoholic ready-to-drink product from KO. As the company reformulates and relaunches existing products and releases new products, it should reach more consumers. This positions KO to claim a bigger piece of the growing global beverage market over time, which bodes well for net revenue and earnings growth.

Touching on the balance sheet, the company also remains a financial fortress. According to CFO John Murphy’s opening remarks during KO’s Q2 2024 Earnings Call, the company’s net debt leverage of 1.5x EBITDA is well below its targeted range of 2x to 2.5x. This is why the beverage giant possesses an A+ credit rating from S&P on a stable outlook (unless otherwise sourced or hyperlinked, all details in this subhead were according to KO’s Q2 2024 Earnings Press Release and KO’s CAGNY 2024 Investor Presentation).

Fair Value Is Modestly Above The Current Share Price

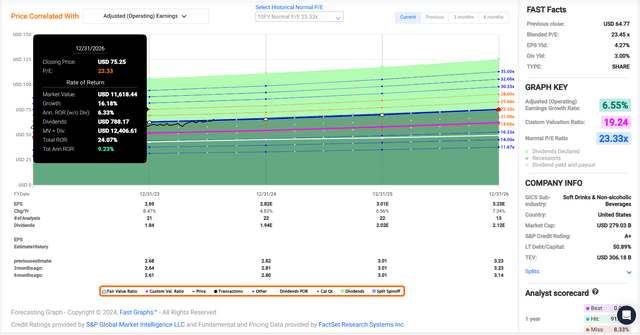

In the nearly two months since my prior article, shares of KO have moved 5% higher. As I’ll outline below, my fair value estimate for the stock has grown by just $1. Thus, share price growth has exceeded growth in fair value.

KO’s current-year P/E ratio of 22.9 (assuming $2.84 in 2024 comparable EPS) is almost in line with the 10-year normal P/E ratio of 23.3. Even with incoming rate cuts, interest rates will probably settle moderately above where they have been in the past 10 years.

The good news is that KO’s comparable EPS growth prospects of 6.6% represent an acceleration from the lower end of mid-single-digit growth delivered in the past decade. This is why I believe that the company’s 10-year normal P/E ratio of 23.3 remains a realistic fair value multiple in the years to come.

In a few days, 2024 will be around 58% complete. This implies that another 42% of the year is left and another 58% of 2025 lies ahead in the coming 12 months. That’s how I’m weighing my 2024 comparable EPS estimate and the 2025 analyst consensus to get a forward 12-month comparable EPS input of $2.94.

This produces a fair value multiple of $69 a share. Stacked up against the current $65 share price (as of July 23, 2024), this would be a 5% discount to fair value. If KO meets growth expectations and reverts to fair value, it could generate 24% upside through 2026. Now, a 9% annual total return potential from a business like this one isn’t bad. It’s just not quite enough for me to justify a buy rating, either.

There’s No Stopping This Dividend King

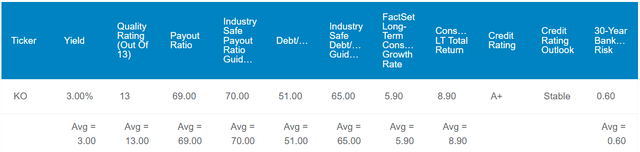

The Dividend Kings’ Zen Research Terminal

KO’s 3% forward dividend yield is just above the consumer staples sector median forward yield of 2.8%. This is enough for Seeking Alpha’s Quant System to award a B- grade for forward dividend yield.

If that wasn’t enough, KO’s payout ratio suggests that the dividend is secure. The company’s payout ratio is poised to come in within the upper 60% range. This is just below the 70% payout ratio that rating agencies like to see from the industry, per The Dividend Kings’ Zen Research Terminal. That’s why the dividend safety grade from the Quant System is a B.

With this in mind, I believe KO’s dividend should grow nearly as fast as comparable EPS for the foreseeable future. This is why I fully expect at least 5% to 6% annual dividend growth over the next few years.

That would allow KO to not just build on its 62-year dividend growth streak, but to do so emphatically. This is sufficient for an A+ grade for consecutive years of dividend growth from the Quant System.

Risks To Consider

KO may be a high-quality consumer staple, but it faces risks nevertheless.

One risk that I highlighted in my previous article was the potential for a recession. Since KO is geared more toward away-from-home consumption channels like theme parks and restaurants, such an event could weigh on its near-term results.

Another risk to KO is that it operates in a highly competitive and fragmented industry. If the company doesn’t continue to quickly adapt to changing consumer preferences, it risks losing market share to competitors. That could cause growth prospects to fall flat.

Finally, the ongoing tax dispute with the IRS could eventually hurt KO’s balance sheet. At issue is the $3.3 billion in alleged U.S. federal tax liabilities that the agency is asserting (page 21 of 146 of KO’s 10-K Filing). Including interest, losing this case would push KO’s net leverage ratio up. It would still be within its targeted leverage range, but that would leave the company with less flexibility to execute an acquisition, should a major opportunity arise.

Summary: I’m Holding Here

Accounting for 0.5% of my portfolio, KO is a smaller holding in my portfolio. This isn’t a knock on the company by any means, and I could see myself at least doubling my allocation to it over time.

KO’s improving earnings growth/dividend growth is what I like to see. The company’s A-rated balance sheet is another undeniable positive. Although shares are slightly undervalued, the value proposition isn’t quite enough for me.

For my circumstances, I would be compelled to think about adding around $60 a share. In my view, the double-digit annual total return potential that would result from such an entry point would be solid risk-adjusted returns.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.