Summary:

- Verizon investors received a rude shock as it fell after its earnings release.

- VZ is still highly profitable, with an appealing 7% dividend yield.

- Its market leadership is intact and executed relatively healthy postpaid phone net additions.

- VZ’s valuation is undemanding, and its price action is increasingly robust.

- I argue why investors must avoid potential panic selling in the market. Read on.

hapabapa

Verizon: Post-Earnings Shocker

Verizon Communications (NYSE:VZ) investors suffered a rude shock this week as VZ fell into a post-earnings decline. It stood in contrast to AT&T (T) stock, as the market cheered T’s earnings, and buying momentum has remained incredibly robust. As a result, VZ has underperformed T since April 2024, even though Verizon is assessed to be the leader of the US postpaid phone market.

In my last bullish Verizon article, I reminded investors to capitalize on near-term pessimism, as the company remains fundamentally strong. Although VZ has slightly underperformed the S&P 500 (SPX) (SPY), the stock is still well-supported above the $40 support zone. Notwithstanding the post-earnings selloff, dip-buyers have not given up defending that level, corroborating my bullish optimism.

Verizon’s Market Leadership Intact

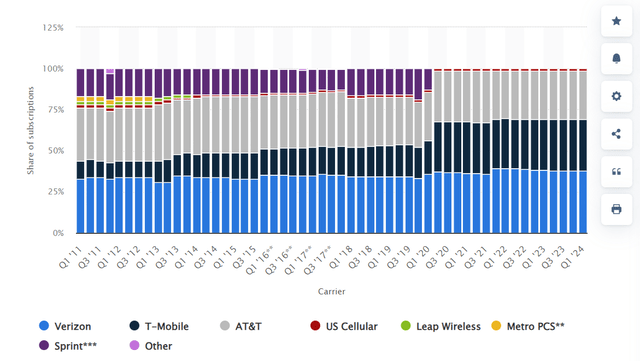

US Wireless network operator subscriptions market share % (Statista)

The big three (Verizon, AT&T, and T-Mobile (TMUS)) dominate the US postpaid market. It’s a highly lucrative market, providing significant clarity into earnings and free cash flow projections. In addition, market share has also been relatively consistent over the past few years, corroborating the more rationalized competitive climate in the telco industry.

As a result, it should assure investors about Verizon’s and its peers’ operating performance, underscoring their ability to continue recovering from their 2023 lows.

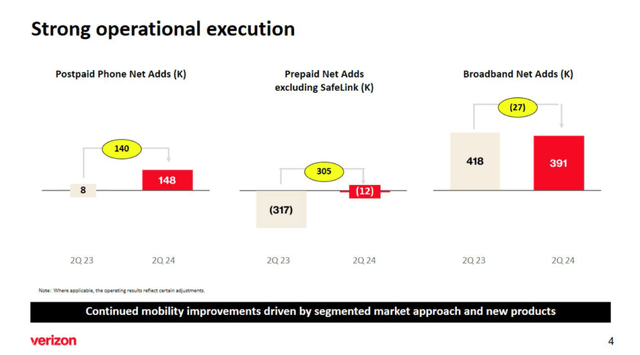

Verizon operational execution (Verizon filings)

Verizon’s Q2 earnings release highlighted a relatively healthy slate of postpaid phone net additions. This underscores more robust execution from VZ, and the momentum is expected to continue. Management highlighted that “consumer postpaid phone gross adds are up 12% YoY,” demonstrating its recovery.

Regarding net adds, Verizon posted total postpaid phone net adds of 148K, well above last year’s metric. AT&T’s recent earnings corroborate the overall industry recovery, highlighting the worst effects of the macroeconomic headwinds are likely behind us.

In addition, the company highlighted additional opportunities from second-line offerings. Management telegraphed such opportunities as “very profitable and contributing significantly to the net adds.” However, the company cautioned that the momentum could slow in H2, although “the core business remains strong enough to achieve positive net adds for the full year.” As a result, I assess that it shouldn’t affect Verizon’s execution markedly, mitigating the impact on its net adds metrics.

However, Wall Street is mixed over the growth prospects and earnings quality of these net adds. When excluding these second-line offerings, “Verizon’s overall subscription growth fell short of Wall Street expectations.”

As a result, analysts are likely concerned with the sustainability of these offerings. Coupled with management’s cautious optimism, I urge investors to carefully monitor the developments in H2, as they could introduce unanticipated volatility in VZ’s critical operational metrics.

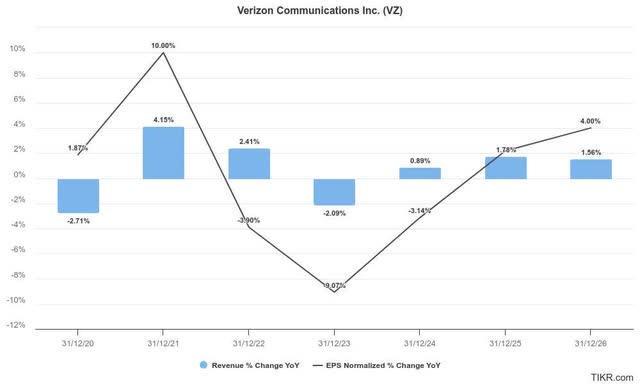

Critically, Verizon’s estimates suggest the worst of the consumer spending and macroeconomic headwinds could be behind us. As seen above, revenue growth is expected to reach just below 1% for FY2024 before accelerating through FY2025. Management’s guidance suggests an adjusted EBITDA growth of between 1% and 3%. The company also guided toward a midpoint adjusted EPS outlook of $4.6. It’s slightly above Wall Street’s estimate of $4.56. While it still marks a decline over the past year, it suggests that last year’s fallout is likely the bottom, improving earnings clarity for Verizon moving ahead.

Furthermore, Verizon’s midpoint CapEx outlook of $17.25B is markedly below last year’s $18.8B spending, helping to improve confidence in more robust free cash flow conversion for FY2024 (estimated: $18.7B).

Verizon has been buffeted by the impact of high interest rates on its operating performance. Management pointed out that “higher interest expense” affected the growth in adjusted EBITDA. Therefore, Verizon must execute robustly to improve its cash flow performance in H2 “that will support paying down debt.”

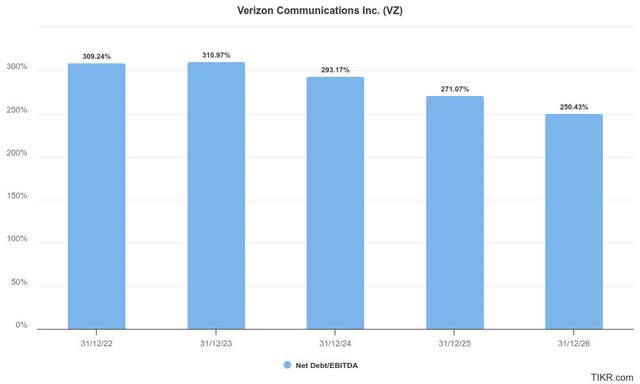

Verizon adjusted EBITDA leverage (TIKR)

Consequently, it should bolster the company’s ability to continue improving its adjusted EBITDA leverage ratio as it aims to continue paying down its debts. Based on the most recent updates, Verizon reported net unsecured debt to consolidated adjusted EBITDA ratio of 2.5x, a slight QoQ improvement from 2.6x. On a total net debt to adjusted EBITDA basis, Verizon is projected to reduce its leverage ratio to less than 3x for FY2024. Coupled with the Fed having reached peak rates, I assess that it should underpin the market’s confidence in VZ’s FCF trajectory, which is pivotal to supporting income investor confidence in its dividend payouts.

VZ Stock: Valuation Remains Undemanding

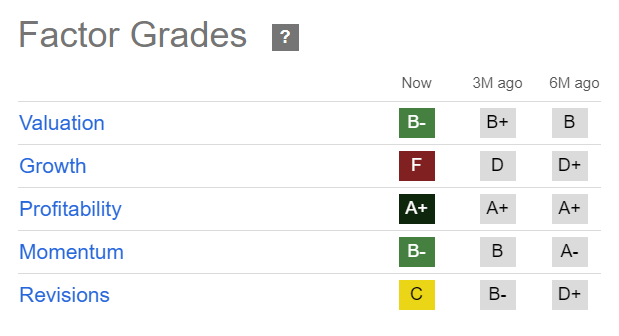

VZ Quant Grades (Seeking Alpha)

VZ remains materially undervalued (“B-” valuation grade) relative to its communications sector peers. VZ’s adjusted forward earnings multiple of 8.7x is more than 30% below its communications sector median, underscoring its relative undervaluation.

However, I urge investors to be cautious about anticipating a significant valuation re-rating in VZ, as it’s not priced for growth. As highlighted previously, market share dynamics are expected to be relatively stable as it competes more rationally with its leading peers. Moreover, management is expected to focus more on paying its debt to reduce its leverage ratio.

As a result, while VZ is assessed to be undervalued, investors must be careful about over-allocating when considering adding exposure.

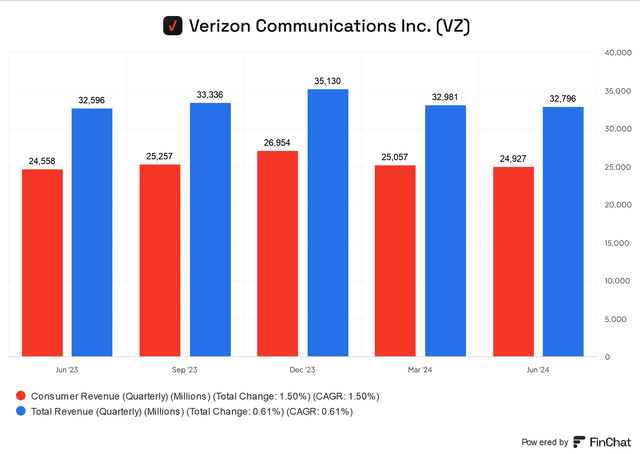

Verizon revenue segments (FinChat)

Notwithstanding my optimism, I must urge investors to be wary about being too aggressive, as the macroeconomic conditions could worsen. Consumer revenue accounted for more than 75% of its total revenue base in Q2. Therefore, a worse-than-anticipated slowdown in consumer spending could hurt investor sentiments on VZ.

There are signs that the economy could be slowing faster than anticipated. As a result, the market could turn increasingly cautious about whether the economy could fall into a recession. While VZ is assessed to be undervalued, its exposure to consumer spending headwinds suggests it will not be immune to a deterioration in the US consumption engine.

Consumer postpaid churn has been relatively low at 0.79% for Q2. However, it’s still relatively stable, providing clarity for VZ investors. Despite that, Verizon could suffer from a potential valuation de-rating if competitive headwinds intensified, given Apple’s anticipated iPhone launch cycle from September 2024. As a result, it could pressure VZ and its peers to compete more aggressively, raising the risks of higher promotional discounts.

Management also alluded to the possibility of these AI phones influencing the upgrade cycle but remains confident about being “disciplined” with the promotions. As a result, it should provide more confidence to investors that the company is committed to its telegraphed guidance and financial framework, mitigating unanticipated discounting risks. Notwithstanding my optimism, it’s a significant risk that investors must observe as we move nearer to Apple’s iPhone launch cycle.

Is VZ Stock A Buy, Sell, Or Hold?

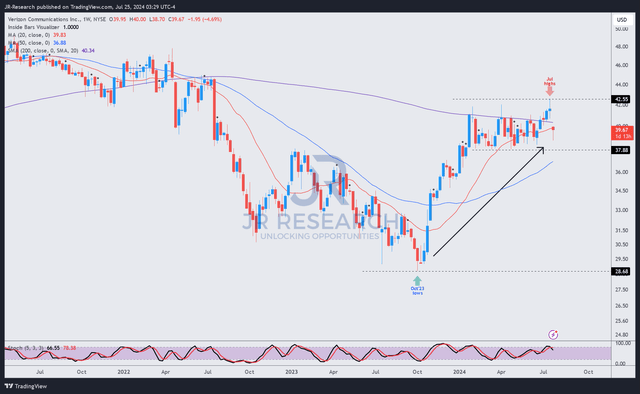

VZ price chart (weekly, medium-term, adjusted for dividends) (TradingView)

Despite an attempted breakout in July above the $42 level, it didn’t pan out. In addition, this week’s post-earnings decline brought VZ back within its consolidation range, underpinned by the $38 support level.

Therefore, I assess the stock as having dropped closer to an assessed critical support zone, potentially attracting value and income investors to return more aggressively.

VZ’s forward dividend yield of almost 7% provides substantial valuation support as the Fed moves closer to potentially cutting interest rates. I view VZ as a multi-year recovery opportunity, corroborated by the bottom in October 2023 and the robustness of its uptrend bias.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!