Summary:

- Despite the previous market concerns about the longevity about its Google Search segment attributed to the rise of ChatGPT, the segment remains GOOG’s top/ bottom-line driver in FQ2’24.

- The management has demonstrated their ability to push Google Cloud into sustained profitability, despite our original skepticism surrounding the new accounting methodology.

- GOOG is also nearing its projected $100B revenue run-rate from both YouTube Ads and Google Cloud by end 2024, as observed from the cumulative FQ2’24 revenue of $19B.

- Its in-house AI capabilities, vertically integrated platform building expertise, and innovation across its existing/new offerings have led to its promising results indeed.

- Combined with its market-leading streaming share and monetization of autonomous driving through Waymo, it is apparent that the market is sleeping on GOOG’s well-diversified capabilities.

Jonathan Kitchen

We previously covered Alphabet Inc. aka Google (NASDAQ:GOOG) in May 2024, discussing its promising prospects in the search engine/ generative AI capabilities, along with robust profitability and rich balance sheet in FQ1’24.

Combined with its ability to consistently deliver profitable growth and robust shareholder returns, we had upgraded our Buy rating to Strong Buy then, with the stock still fairly valued while offering an excellent upside potential.

Since then, GOOG has further rallied by +16.1%, well outperforming the wider market at +8.4%, before the recent rotation away from high growth stock over the past two weeks.

Even so, we are maintaining our optimism surrounding its long-term prospects, thanks to its double beat FQ2’24 earnings call and accelerating Cloud performance metrics.

Combined with relatively cheap P/E valuations compared to its Magnificent 7/streaming/autonomous driving peers, it goes without saying that the stock remains a long-term winner for growth oriented investors.

We shall discuss further.

GOOG’s Integrated AI Investment Thesis Has Paid Off Handsomely

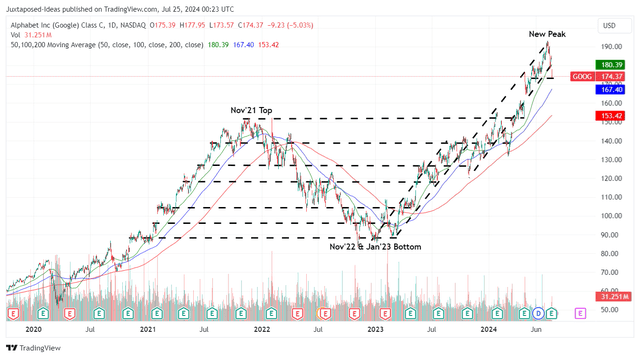

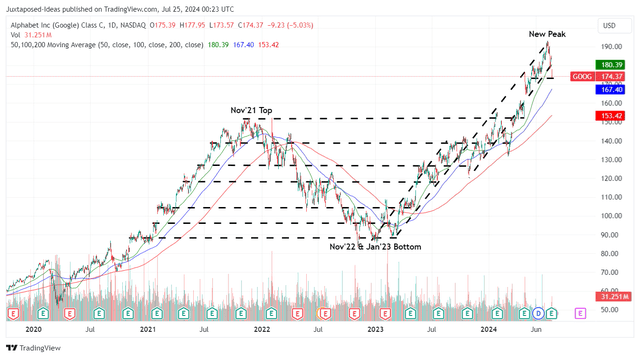

GOOG 3Y Stock Price

GOOG has had a volatile three years indeed, as observed in the stock price chart above, attributed to the pre-pandemic boom, subsequent correction after November 2021, and the eventual recovery after the January 2023 bottom.

Despite the previous market concerns about the longevity about its Google Search segment, as discussed in our GOOG article here in January 2023, it is apparent that those fears have been unfounded.

This is why.

GOOG continues to command the largest global search engine market share at 91.06% as of June 2024 (+0.26 points MoM/ -1.58 YoY/ -1.65 points from December 2019 levels of 92.71%), despite the minimal share losses from November 2022 levels of 92.21% when ChatGPT was launched.

While part of the losses are attributed to Microsoft (MSFT) Bing’s gains, we are not overly concerned indeed, since Google Search continues to generate impressive revenues of $48.5B in FQ2’24 (+5% QoQ/ +13.7% YoY/ +105.1% from FQ2’19 levels of $23.64B).

At the same time, GOOG is also nearing its projected $100B revenue run-rate from both YouTube Ads and Google Cloud by end 2024, as observed from the cumulative FQ2’24 revenue of $19B (+7.5% QoQ/ +21% YoY/ +233.5% from FQ2’19 levels of $5.7B).

Most importantly, the management has demonstrated their ability to push Google Cloud into sustained profitability, despite our original skepticism surrounding the new accounting methodology, attributed to the extended “useful life of its servers from four to six years and network equipment from five to six years.”

This has led to Google Cloud’s expanding operating margins of 11.3% in FQ2’24 (+1.9 points QoQ/ +6.4 YoY), further underscoring why their ongoing innovation across every layer of the AI stack has paid off handsomely.

This is also why we believe that as an AI-first company, GOOG has demonstrated robust monetization efforts across its search/ generative AI/ cloud offerings, thanks to its multi-modal integrated AI capabilities, which in turn enhances the user experience and increases search engine loyalty.

We must remind readers that GOOG boasts an in-house AI team compared to Microsoft’s partnership with OpenAI, which enables the former to vertically integrate the platform building expertise while innovating across its existing/ new offerings.

This further underscores why the management has been able to rapidly deploy/ monetize Gemini across its developer tools and data center to edge use cases.

Combined with the sustained rationalization of its offerings and headcounts, it is unsurprising that we have seen GOOG’s robust top-line growth flow into its increasingly richer adj operating margins of 32.3% (+0.7 points QoQ/ +3.1 YoY/ +8.8 from FQ2’19 levels of 23.5%) in FQ2’24.

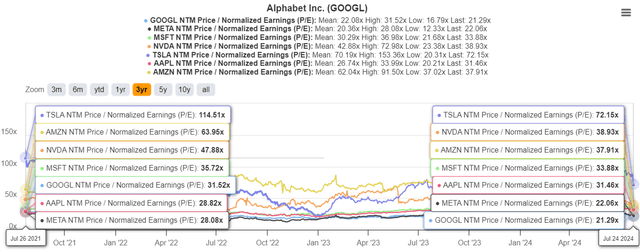

GOOG Valuations

With consensus forward estimates remaining stable over the past three months and GOOG still expected to report an accelerated top/ bottom-line expansion at a CAGR of +11.6%/ +19.4% through FY2026, it is apparent that the stock remains cheap here.

This is especially since GOOG at FWD P/E valuations of 21.29x is still trading well below its Magnificent 7 peers (aside from META at 22.06x) and its 5Y P/E mean of 25x, as observed in the chart above.

Even compared to their bottom-line growth rates, such as Meta at 22.06x at +20.9% through FY2026, AAPL at 31.46x/ +10.3%, MSFT at 33.88x/ +16.5%, AMZN at 37.91x/ +37.5%, NVDA at 38.93x/ +49.6%, and TSLA at 72.15x/ +13.3%, respectively, it is apparent that GOOG is on the cheap side compared to the other Mag 7 peers.

Given YouTube’s leading streaming share of 8.4% in June 2024 (+0.8 points MoM/ +0.2 YoY) in a growing overall market of 40.3% (+1.5 points MoM/ +2.6 YoY), it is apparent that the secular transition from TV Media to streaming is still ongoing.

Even when compared to its streaming peer, Netflix (NFLX) at FWD P/E valuations of 33.57x with the projected adj EPS growth at +31.1% through FY2026, it is apparent that GOOG remains highly attractive at current levels.

Lastly, readers must not forget GOOG’s autonomous driving capability, Waymo, which has started to deliver over 50K weekly paid public rides in San Francisco and Phoenix, along with its ongoing fully autonomous testing (without driver).

While TSLA has touted robo-taxi capabilities with an event now planned in October 10, 2024, it remains to be seen when monetization may actually occur, with Waymo currently leading the race.

As a result of these developments, we maintain our belief that the market is sleeping on GOOG’s well-diversified capabilities, with it offering interested investors with an excellent margin of safety despite the massive rally since the January 2023 bottom.

So, Is GOOG Stock A Buy, Sell, or Hold?

GOOG 3Y Stock Price

For now, GOOG has charted a new peak of $190s and is trading above its 100/ 200 day moving averages, thanks to the robust FQ2’24 earnings results and the market’s conviction surrounding its AI monetization.

Despite the recent correction, the stock continues to trade not too far from our previous article levels of $170s, with current levels still near to our updated fair value estimates of $174.20, based on the LTM adj EPS of $6.97 (+6.9% from the previous levels of $6.52) and the 5Y P/E valuations of 25x.

At the same time, there remains an excellent upside potential of +40.6% to our reiterated long-term price target of $258.30, based on the flattish consensus FY2026 adj EPS estimates.

In addition, GOOG has executed well on its long-term shareholder returns, based on the 269M shares, or the equivalent 2.1% of its float retired over the LTM, and 1.35B/ 9.7% since FY2019, with approximately $54B still remaining in its repurchase authorization.

While minimal, the annualized $0.80 dividend per share allows long-term shareholders to DRIP and accumulate additional shares on a quarterly basis.

As a result of its robust AI monetization prospects and dual pronged prospective returns through capital appreciation/ dividend payouts, we are maintaining our Buy rating for the GOOG stock here.

Do not sleep on this giant.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG, TSLA, META, MSFT, NVDA, NFLX, AMZN, AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.