Summary:

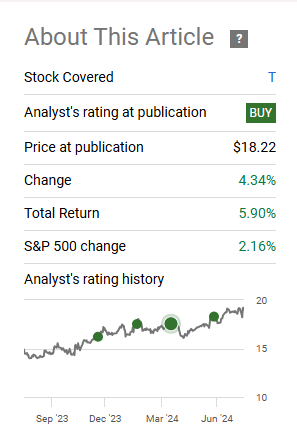

- We had previously given AT&T a buy rating.

- Q2-2024 results showed growth in postpaid phone subscribers, Fiber subscribers, and impressive free cash flow.

- Despite those positives, we are now moving to a Hold rating and go over why.

- The preferred shares have gotten relatively more attractive, though they remain expensive compared to what values we see elsewhere.

jetcityimage

In our previous update on AT&T (NYSE:T), we maintained a Buy and suggested that fair value was modestly higher.

We think that whatever cyclicality we get, the current valuation does offer investors a good buffer. Once we hit that target, a dividend hike is extremely likely. We continue to rate AT&T Inc. shares a Buy and maintain a $21 fair value target.

Source: Seeking Alpha

The stock has continued to trek higher and the same picture below shows that we have been optimistic on this for quite some time.

Seeking Alpha

We go over the Q2-2024 results now and tell you why we are shifting to a hold rating.

Q2-2024

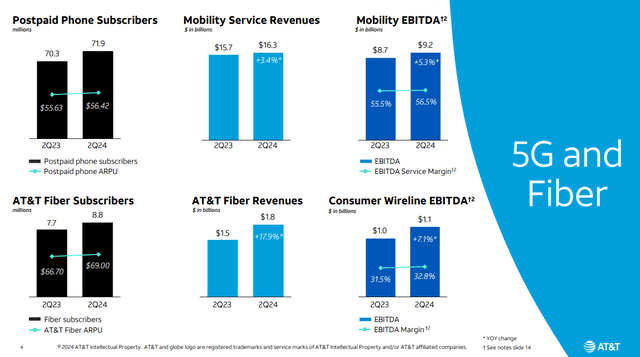

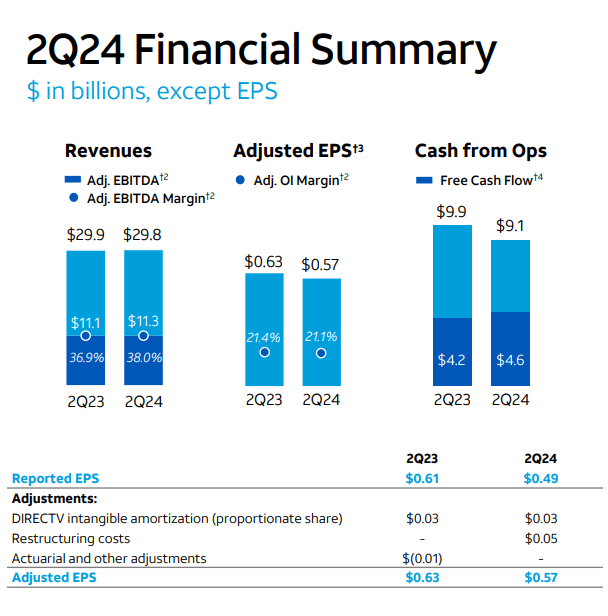

AT&T delivered a surprisingly good quarter and investors were pleasantly surprised after the slightly weaker numbers that came from its competitor Verizon Communications Inc. (VZ). It looked like AT&T was eating Verizon’s lunch as its own postpaid phone subscribers grew year over year to 71.9 million. Mobility service revenues moved up at a slightly faster pace and solid cost control saw EBITDA rise at a 5.3% clip.

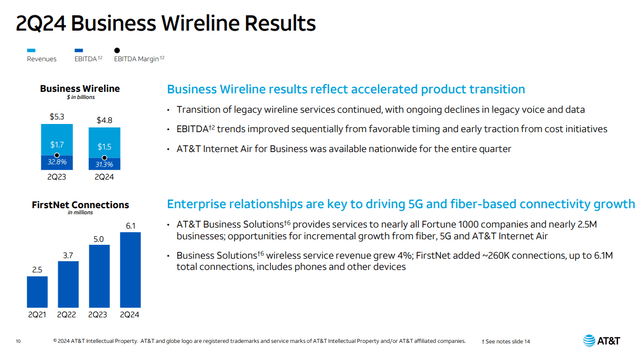

AT&T added some heft behind those numbers with Fiber subscriber and revenues moving up smartly as well. There was some weakness as expected on the business wireline side. That business continues to drop, and we continue to see reverse economies of scales. The EBITDA margin was just 31.3% this quarter and likely heads below 30% in the next 2-4 quarters.

The two forces offset each other in the overall financial numbers as adjusted EBITDA was almost exactly the same year over year. There were some differences in the adjusted EPS and cash from operations but the free cash flow metric was impressive enough to disregard the other two.

AT&T Q2-2024 Presentation

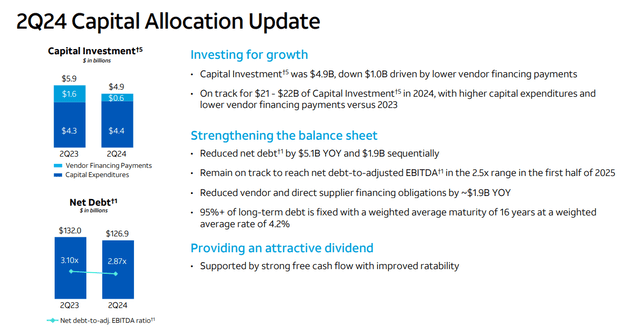

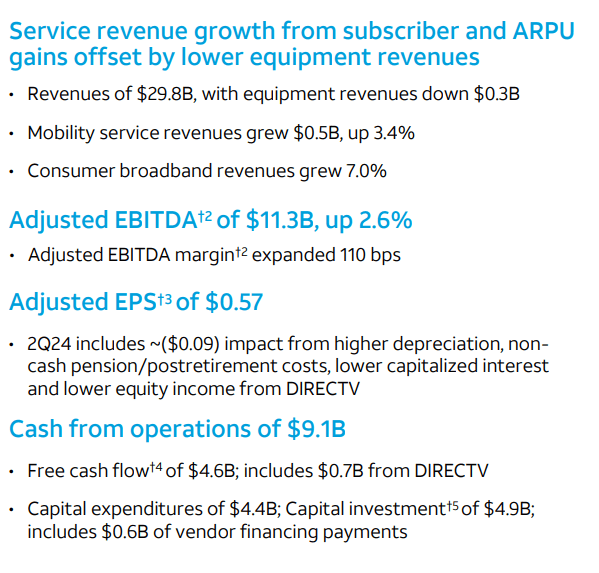

AT&T has been holding the line on its capex and that discipline continues to show here. The worry was that this would either drift higher or cause some potential customer loss over time. Neither has happened so far.

AT&T Q2-2024 Presentation

The progress towards the net debt to EBITDA target continues and this is very disciplined behavior by the company. We will add here that this ratio is better currently than all the three telecoms we cover in Canada. The debt maturity profile is also the best in the business and likely to be a source of strength even in a severe downturn.

Outlook

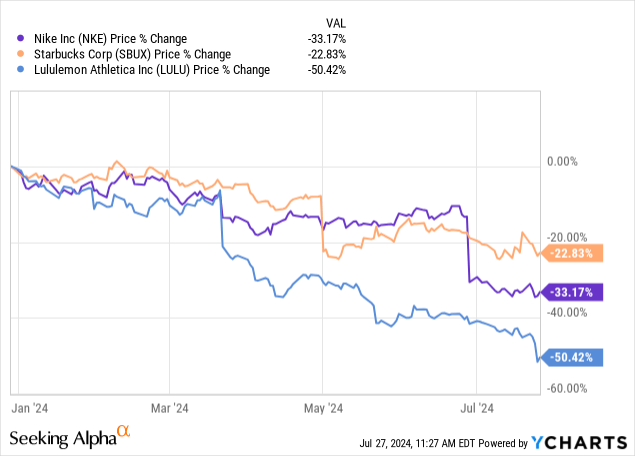

We are seeing increasing risks showing up in the economy. We have had an inverted yield curve for quite some time and the un-inversion is where the “fun” really begins for the stock market.

Some of this is now being reflected in movements of a few consumer discretionary stocks.

AT&T has got the deleveraging part almost done and their sub 2.5X EBITDA ratio looks to be set for 2025. Of course if EBITDA falls, then debt to EBITDA will rise, even as total debt is reduced. We think the telecom space is fairly competitive and we will likely see some price wars in a recession and the odds of a move lower has increased in our view.

Verdict

There is not much you can find wrong with how AT&T has navigated the current economic cycle up to this point. But there is definitely some stress on the consumer, and it is beginning to show across several metrics. If you look at companies like AT&T, their capital expenditure needs tend to be fairly consistent and that does not materially move during a recession. So a contracting top line, alongside contracting margins, can play havoc with the free cash flow projections. The good part is that AT&T is not expensive to begin with, so any pullback is likely going to be modest. The total return will also be buffered by a hefty dividend yield that will keep investors interested. We previously expected a dividend hike in 2025, but at this point, we think it won’t happen if the recession materializes on schedule. For an investor relying on the dividend, we think this is about as safe as it gets for now. From a total return standpoint, which is the only metric that we care about, this has moved to a relative neutral point. Here, the downside risks are about even currently with upside potential.

We are moving this to a Hold rating.

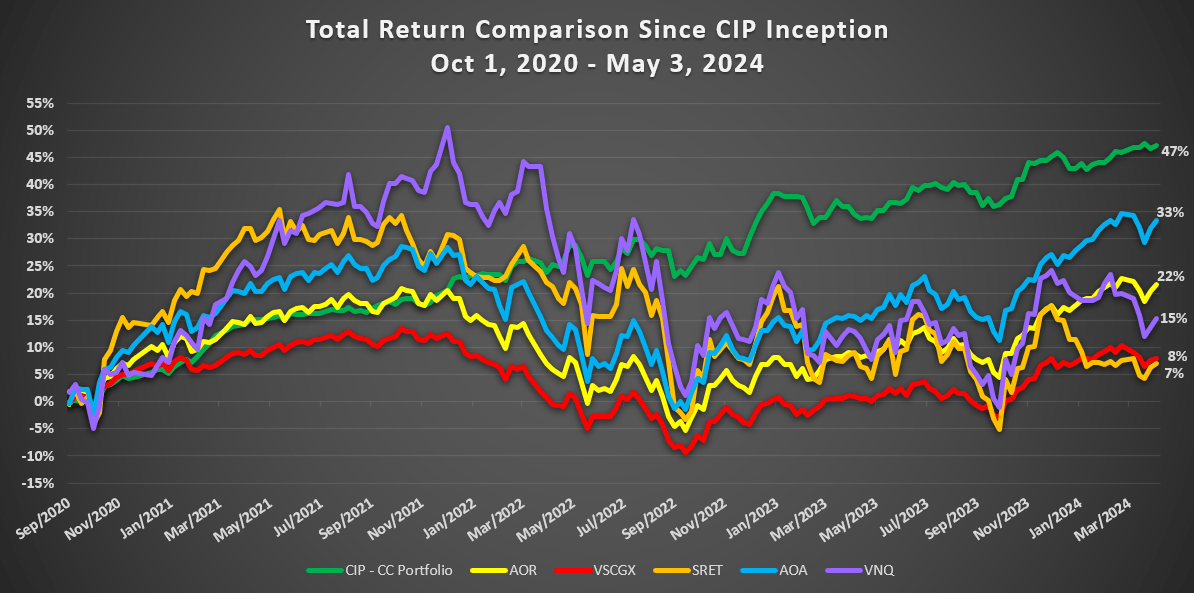

We had been holding the shares for some time without any attached covered calls. On those positions, we used the rally to sell the January 17, 2025 $20 strike covered calls for 76 cents per share. That added a nice “yield” on top of the large dividend and creates some buffer in the interim. While that may seem small, adding such buffers periodically is what has allowed to us to outperform our benchmarks. In this particular case, we expect the range of price movement to also be modest ($16-$22). In that context, an extra 76 cents per share adds a lot.

Preferred Shares

Alongside the common shares, AT&T also has preferred shares listed. These are,

1) AT&T Inc. 5% DEP RP PFD A (NYSE:NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:NYSE:T.PR.C).

In our previous coverage, we had noted that the price has improved, and the two classes were not obscenely valued anymore. Since our previous update, the prices are flat. Since most preferred shares we cover (and we cover and trade a lot of these), are up over this timeframe, we would adjust the relative attractiveness of this up a bit. They are not exactly in the buy zone, so they will continue to be just on our watch list for now. We will note though that their dividend yield currently is identical to that of the common shares. For investors just looking for a nice yield from AT&T, these may actually make more sense than the common shares at the current point.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T, VZ either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are you looking for Real Yields which reduce portfolio volatility?

Conservative Income Portfolio targets the best value stocks with the highest margins of safety. The volatility of these investments is further lowered using the best priced options. Our Enhanced Equity Income Solutions Portfolio is designed to reduce volatility while generating 7-9% yields.

Take advantage of the currently offered discount on annual memberships and give CIP a try. The offer comes with an 11-month money guarantee, for first time members.