Summary:

- Apple’s valuation is often criticized, but potential earnings growth from its AI launch and computer refresh cycle may lead to a recovery story.

- While the Seeking Alpha consensus is not all that upbeat on the stock, I see fundamental upside and technical strength.

- Apple’s strong financial position, improving EPS outlook, and shareholder-friendly moves make it an attractive investment.

- Ahead of earnings on Thursday night, I highlight key price levels to monitor and assess what the options market may be signaling.

kyotokushige/DigitalVision via Getty Images

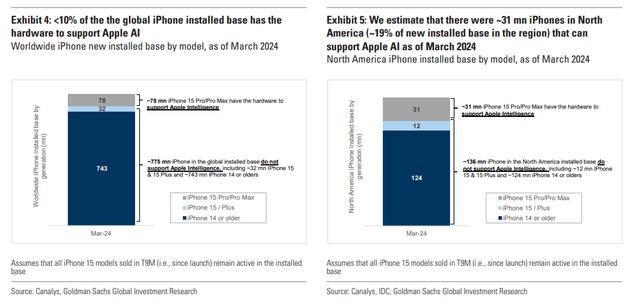

Apple (NASDAQ:AAPL) often gets chastised for its lofty valuation. After all, shares trade at a mid-20s earnings multiple even when using 2026 operating EPS estimates. I see tailwinds, though. Consider that the launch of Apple Intelligence (its own “AI”) and the reality that a computer refresh cycle is likely on the way, now that we are four years removed from the at-home electronics buying binge during COVID, likely means an earnings growth recovery story is on the way.

Ahead of the $3.3 trillion market cap company’s earnings report Thursday night, I have a buy rating on the stock with a price target of $245. I see fundamental upside, while its technical situation appears decent after a key long-term breakout earlier this year.

Apple Highlights a Big Week of Earnings

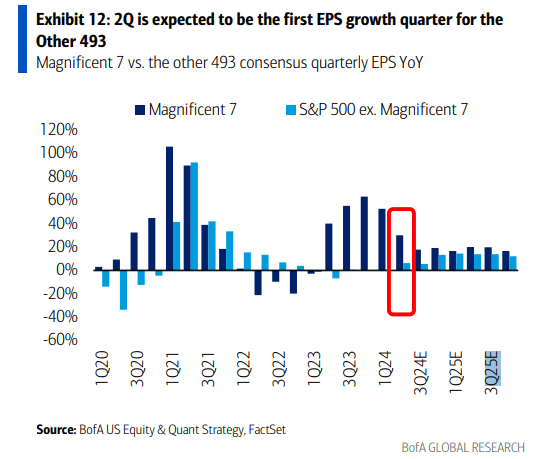

While S&P 493 EPS Growth May Turn Relatively High, AAPL Earnings Should Also Increase Next Year

BofA Global Research

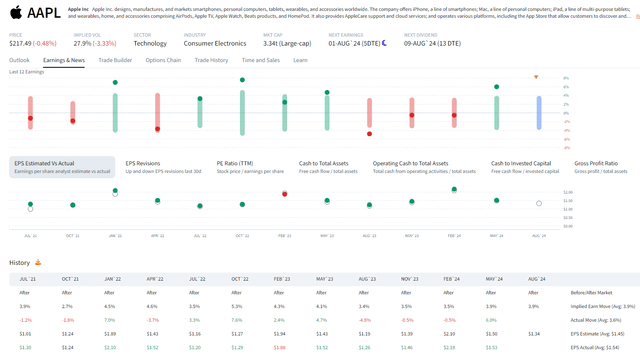

As a refresher, Apple reported a solid Q2 report back in May. Non-GAAP EPS of $1.53 beat the consensus estimate of $1.50 while revenue of $90.8 billion, down 4.3% from year-ago levels, was a small $190 million beat. It was the fifth consecutive bottom-line beat, despite the flat EPS trend over the past two years. Shares jumped 6% the following session – the best response to earnings going back to October 2022. Since then, there has been a steady diet of sellside EPS upgrades, providing a fundamental boost to what has turned out to be a technically strong chart.

CEO Tim Cook and the rest of the management team announced a record $110 billion share repurchase authorization and a 4% dividend hike in early May, both shareholder-friendly moves were received well by the market. But the company’s operating margins were mixed across geographic areas – China was a weak spot in that respect due to aggressive pricing and rising competition, namely from Huawei.

While there have been some regulatory challenges, including a pair of EU investigations and recent rumors of a domestic clampdown from the US Department of Justice, those should prove to be rather immaterial to the long-term profitability trajectory.

What’s more pivotal today is the AI story and the potential for a significant iPhone and Mac refresh cycle that could drive revenue and earnings in the quarters to come, though the imminent quarterly report will likely show a year-over-year drop in iPhone sales.

Analysts at Goldman Sachs expect Mac revenue to surge 13% from the same period a year ago, with close to flat numbers in the wearable space. Services revenue is seen rising at a mid-teens rate amid robust app store spending by consumers.

Apple’s Big Install Base Means Major Refresh-Cycle Potential

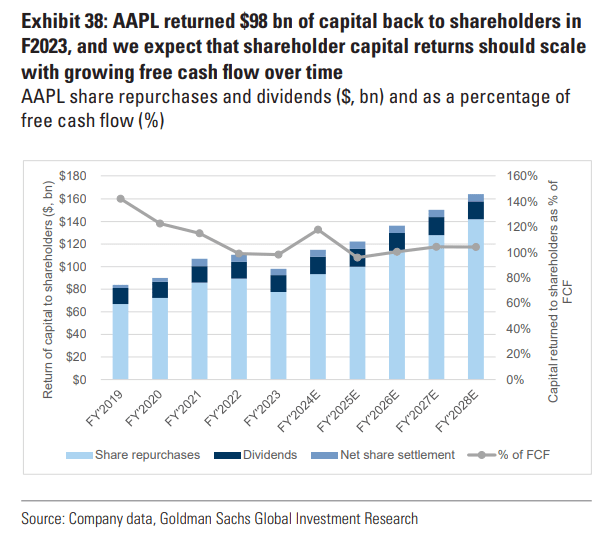

Bigger picture, I assert that investors sometimes get lost in what is a very positive financial engineering story. Apple returned nearly $100 billion to shareholders last year alone. That number is forecast to grow in FY 2024 as the company produces market-leading free cash flow.

So, even as profits have ebbed in recent years, EPS can still grow significantly thanks to the buyback story. Then, as I believe will occur, a bullish operating backdrop can resume in the years to come given Apple’s solid install base and recurring revenue.

Apple: Continues to Reward Shareholders

Goldman Sachs

The Options Angle

As for the quarter to be reported, data from Options Research & Technology Services (ORATS) show a 3.9% earnings-related stock price swing priced into the straddle expiring after the report.

That’s in line with the last dozen EPS reports, while the consensus EPS estimate is $1.33 on an operating basis which would be a 6% increase from Q3 2023. The company has averaged a seven-cent beat in the last five quarters, so the whisper number is likely about $1.40.

A 3.8% Straddle Into Earnings

Investment Rating Risks

Key risks to my buy rating include weaker consumer spending and resulting softer demand for Apple’s more discretionary products and services. Competition continues to grow in both the hardware and services areas, too, which could threaten margins if it persists more than the market expects.

Regulatory risks are present with a large firm like Apple, while clear supply chains are critical for the multinational corporation. It’s also key that the management team continues to execute well on both internal projects and with M&A.

Forward Numbers

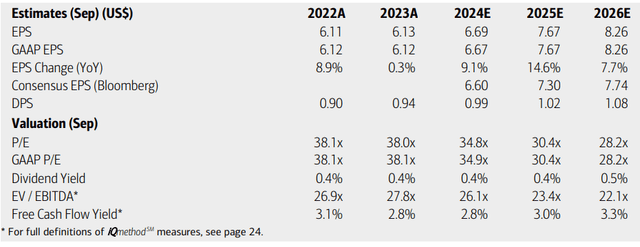

On the earnings outlook, analysts at Bank of America Global Research see operating EPS rising 9% this year after a flat 2023. Per-share profits are then expected to accelerate to a nearly 15% clip in the out year, with still-solid 9% earnings growth by FY 2026. The current Seeking Alpha consensus numbers show a comparable EPS trajectory but with a more balanced earnings growth rate through 2026. Sales are forecast to increase by 7.4% next year, after just a 1.1% rise in FY 2024.

Dividends, meanwhile, should grow at a steady pace over the quarters ahead, while the firm’s free cash flow yield may eclipse 3% should the stock price hold its current level.

Apple: Earnings, Valuation, Dividend Yield, and Free Cash Flow Forecasts

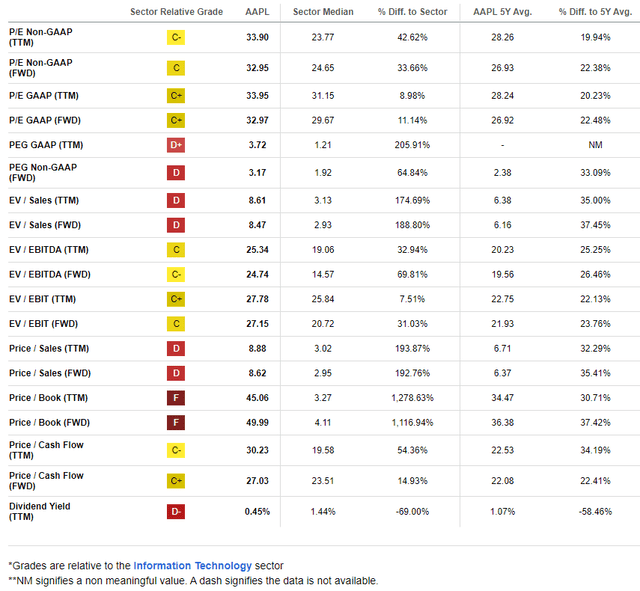

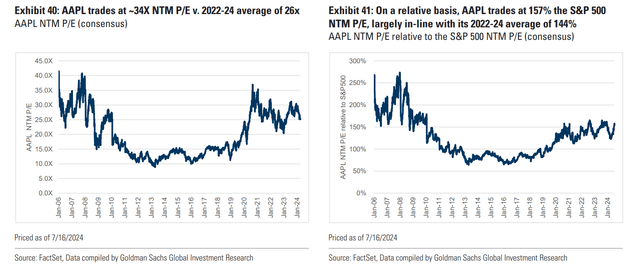

If we assume forward 12-month EPS of $7.50, which I assert is achievable given the strong services and potential hardware refreshes, and apply a low-30s earnings multiple, then shares should trade near $245. That P/E is above the mid-point of its historical range, but I see that as warranted given the multi-year refresh cycle about to commence, the firm’s fortress balance sheet, and a more diverse mix of product and service offerings.

Goldman writes about the possibility of $9 to $10 of NTM non-GAAP EPS, but that may be out of reach given the recent trajectory, and we’ll know more after this Thursday night. Also consider that the consensus is for $8.22 of FY 2026 EPS – a 30x multiple would put the stock near $260 by September next year.

Apple: Not A Cheap Stock, But Attractively Priced On A Forward Basis

AAPL: P/E Multiple History, Absolute & Relative Looks

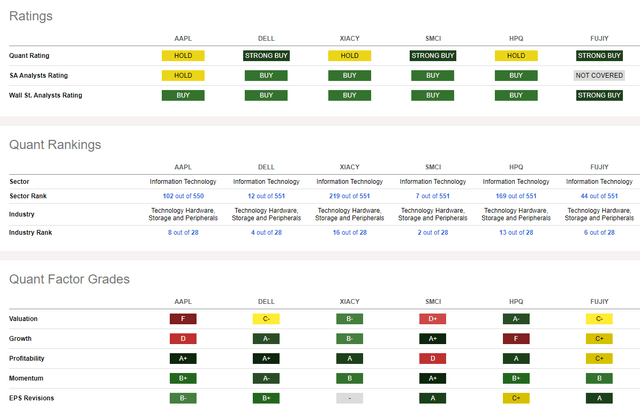

Compared to its peers, AAPL sports a weak valuation, but I contend that its commanding industry presence, high and sustainable margins, and consumer-staple-like penetration in consumers’ lives is unique. What’s more, the P/E multiple premium is not all that much more significant than the average of the rest of the Magnificent Seven.

The growth trajectory has been lackluster lately, but that is set to inflect positive, which should provide bullish headline potential. With stout profitability trends and strong share-price momentum, I see AAPL as a deserving core holding for investors. Finally, EPS revisions have been to the good side in the past 90 days, a trend I believe will persist through the Q3 report.

Competitor Analysis

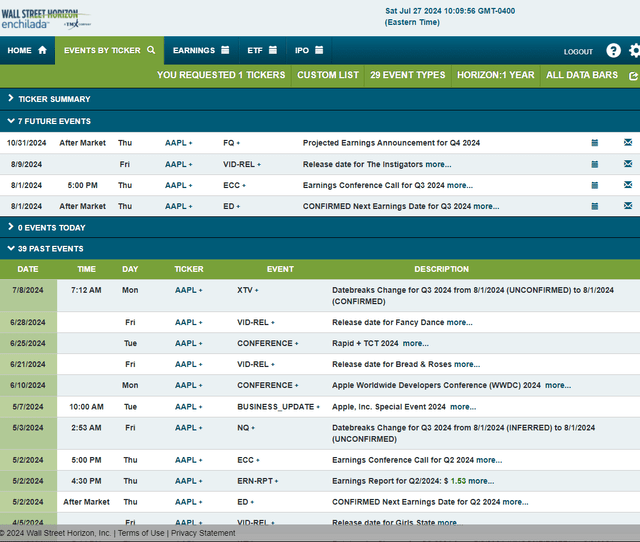

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q3 2024 earnings date of Thursday, August 1 AMC with a conference call immediately after the numbers cross the wires. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

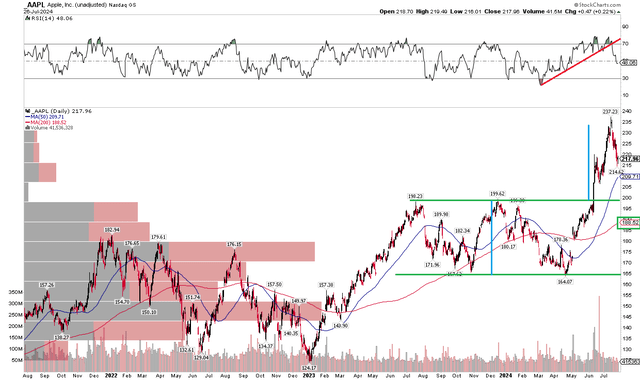

The Technical Take

With shares undervalued in my view and amid positive headlines surrounding the stock, AAPL’s technical situation is constructive. Notice in the chart below that shares broke out from a monthslong consolidation range from the mid-$160s on the low end to just shy of $200 at the upper end.

But shares stalled out near $237 earlier this month, which was very close to the measured move price objective based on the $35 previous range’s height. I see long-term support at previous resistance levels, near $200.

Also take a look at the RSI momentum oscillator at the top of the graph. I must acknowledge that momentum has indeed rolled over amid the broader tech selloff this month. I also don’t like that the Nasdaq Composite is struggling during what is usually a positive period on the calendar.

Nevertheless, AAPL’s long-term 200-day moving average is positively sloped, suggesting that the bulls control the primary trend. Moreover, there is a high amount of volume by price if the stock dips under $200, so buying on a post-earnings dip, if we get it, should be seen as a buying opportunity.

Overall, $198 to $200 is support, while the $237 all-time high is resistance.

AAPL: Bullish Breakout, Key Support at $200, Rising 200dma

The Bottom Line

I have a buy rating on Apple. I see the megacap as a renewed growth story while the company continues to reward shareholders through dividends and buybacks. With shares about 10% below my intrinsic value target, the chart situation is generally healthy after the long-term upside breakout last quarter.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.