Summary:

- A. O. Smith has been around for 150 years and has an excellent track record when it comes to sustainable dividend growth.

- The company recently published its quarterly earnings, which were poorly received by investors.

- Higher steel prices and headwinds regarding growth in China are causing mild stagnation in growth and profitability.

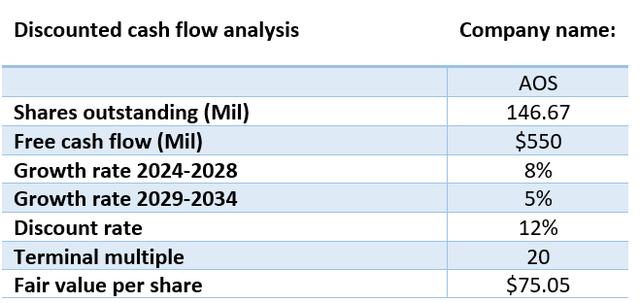

- Based on discounted cash flow analysis, the fair value of AOS stock is $75.05 per share, which implies overvaluation.

- Despite the disappointing results, the company’s fundamentals remain excellent, and the current headwinds could lead to a possible buying opportunity in the short term.

brusinski

Introduction

It is always nice to have companies in your portfolio that are capable of raising the dividend like clockwork. Whether things are going good or bad in the stock market, these companies have a robust business model and a solid balance sheet and are therefore able to achieve sustainable dividend growth.

A. O. Smith Corporation (NYSE:AOS) is a company that meets these criteria. What is special is that the company has existed for 150 years this year. This confirms that AOS stood the test of time and has been able to continue to innovate. Of these 150 years, the company has been paying dividends for 84 years, with a current dividend growth streak of more than 30 years.

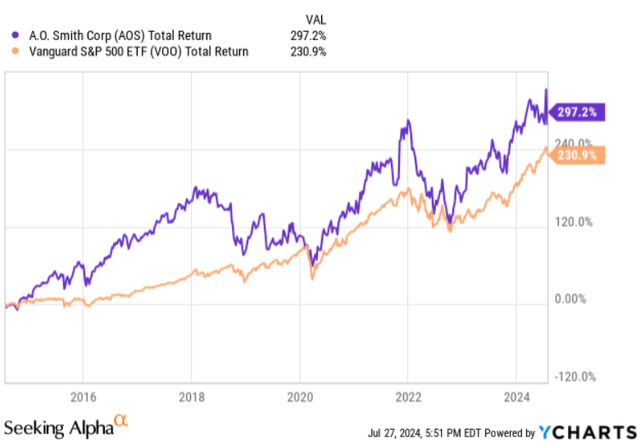

AOS dividend metrics (Seeking Alpha)

AOS scores well on multiple dividend metrics, except for the dividend yield, but that has more to do with the increase in share price.

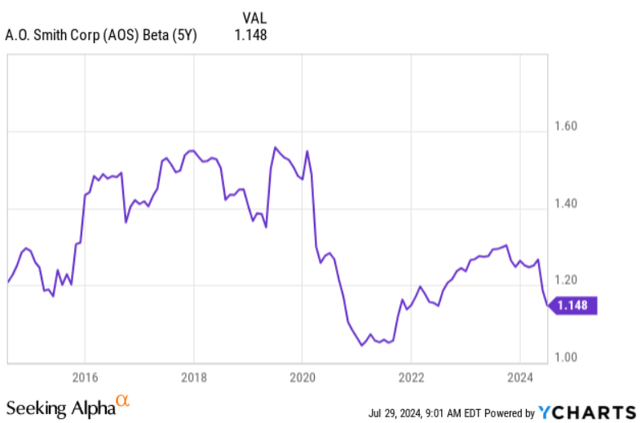

The company has also been able to outperform the S&P 500 index over the past 10 years. Judging from the graph below, it is clear that AOS is the most volatile of these two, but is still able to outperform over a longer period of time. However, it is true that in the past year, AOS has significantly underperformed compared to the S&P 500 (14% vs. 21%).

This has to do with the phenomenal performance of the magnificent 7 that are dominant in this index and the recent decrease in the share price of AOS.

Investors reacted negatively to the Q2 2024 earnings and this caused the share price to drop 8%.

Today I want to update the investment thesis with the latest news and their Q2 2024 quarterly report.

For more details about the fundamentals and investment risks of AOS, I refer to my previously written article.

Q2 2024 results

On July 23, AOS published its Q2 2024 results, and the numbers were not received well.

In my view, AOS was getting a bit too pricey and it was to be expected that any negative news could trigger a drop in share price.

North America

The number in this segment was actually quite strong.

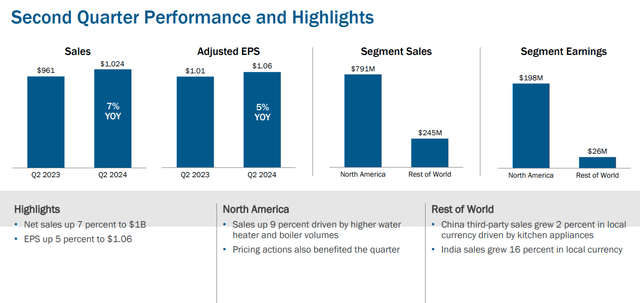

AOS performance highlights (Q2 2024 earnings presentation)

The company achieved record revenue sales (+7%) and adjusted EPS (+5%) compared to Q2 2023.

Firstly, the North America segment has performed well. This is also by far the biggest segment compared to the “rest of the world” in terms of revenue (77.2% vs. 22.8%). When we talk about earnings, the difference is even bigger (88.4% vs. 11.6%).

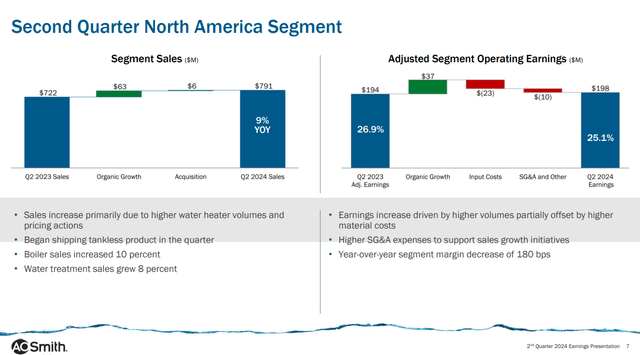

AOS North America segment (Q2 2024 earnings presentation)

The North America sales increased 9% compared to the same quarter in 2023, due to higher boiler and water heater volumes and pricing actions. This was in line with management’s forecast.

What is encouraging to see is that AOS is outperforming the market, especially when it comes to CREST boilers.

The North America earnings increased 2%. The higher earnings were mainly due to increased volumes and pricing actions, but were offset by higher material and SG&A costs to support growth. Margins shrank from 26.9% to 25.1% during this quarter.

Rest of the world

What is disappointing is the revenue- and profit development in the “rest of the world” segment.

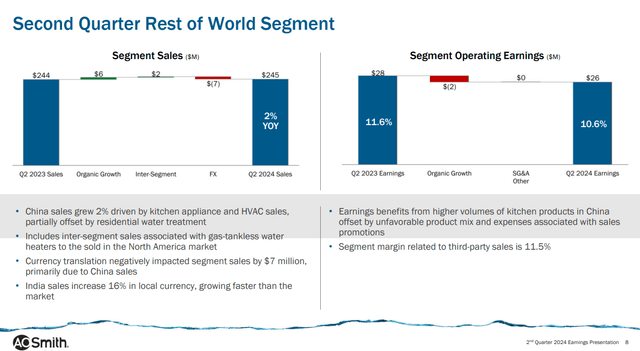

AOS rest of the world segment (Q2 2024 earnings presentation)

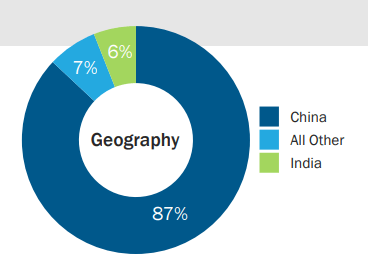

China is a heavyweight there, and it is visible that AOS is having a hard time in this country.

Sales grew 2%, mainly due to sales of kitchen and HVAC products. This was negatively offset by lower sales of residential water treatment products. Through product diversification, AOS has been able to squeeze out a little bit of top-line growth in China.

Overall, profitability has fallen slightly due to a less favorable product mix and promotional activities in China.

A bright spot in the story is their performance in India. They achieved 16% sales growth in local currency, growing faster than the market. This was the 10th consecutive quarter of double-digit growth, with success in both water heater and treatment. Unfortunately, India has so far been a small part of the revenue and profit in the total mix, but this does not alter the fact that there are considerable opportunities here for AOS in the future.

Geography “rest of the world” segment (AOS investor presentation)

AOS’s free cash flow was significantly lower compared to H1 2023 ($236 million vs. $119 million). However, this was mainly due to a bigger working capital and this will be corrected in the second half of the year.

Outlook

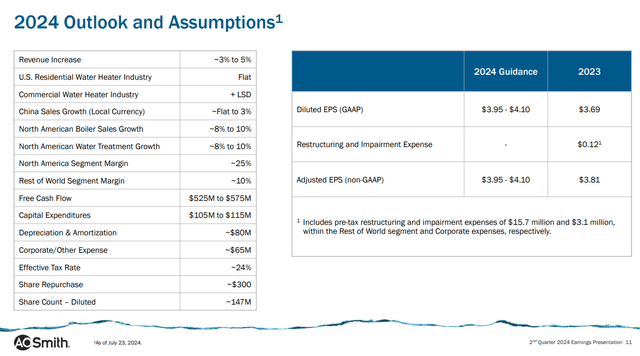

AOS has narrowed their EPS guidance a bit. This implies a +6% of the adjusted EPS year-over-year.

Their outlook also includes price hikes of 4% in water heater products and 8% in heat pump products, which will take effect from Q2 2024.

AOS 2024 outlook (Q2 2024 earnings presentation)

Management also expects volume weakness in Q3 due to the announced price increases, which pulled forward some demand to the first half of the year.

Free cash flow guidance also remains the same compared to expectations earlier in the year ($525 million – $575 million). However, it is assumed that steel costs will remain flat and the supply chain environment will be the same as in 2023.

All in all, the numbers were not that bad, but I do think it is justified that AOS’s share price fell post-earnings. In my opinion, the valuation had risen too much compared to the growth achieved. Also (but this was already known) the free cash flow will not grow this year. AOS itself does not have much influence on the price of steel, and the headwinds when it comes to the Chinese economy won’t help either.

However, I think the performance in North America is very solid and clearly saves the overall performance.

Acquisition of Pureit

On July 15, AOS announced the acquisition of Pureit. Due to its excellent balance sheet, the company can complete the transaction entirely in cash on hand ($120 million). The acquisition should be completed by the end of 2024. Funny to know, Pureit was actually a part of Unilever PLC’s (UL) home care division.

Pureit products (Pureitwater.com)

This is what management says about Pureit:

Pureit business is the majority in India, but it’s also in Bangladesh, and some shipments outside of the — in Sri Lanka and Vietnam. But in total, roughly the same size of their business around $60 million. Profitability-wise, very similar to what our India business has experienced in the last couple of years, meaning low to mid-single-digit profitability. Growth-wise, as a premium brand, they’ve seen also very good growth in the region.

Source: Q2 2024 earnings call transcript

With this acquisition, they are going to double their market penetration in South Asia and according to management, the growth rate of Pureit matches with AOS’s own business operations in India.

At first glance, it looks like an interesting acquisition, which fits the portfolio of AOS quite well and hopefully, they can continue that growth pace in India on a larger scale this way.

Valuation

At a company like AOS, the free cash flow has always been lumpy due to its cyclical nature.

FCF per share development (Seeking Alpha)

Despite the fact that the free cash flow will be somewhat lower compared to FY 2023, the utilized Free cash flow of $550 million is exactly in the middle of the range.

I will hardly make any changes to my DCF model compared to my previous article. I also don’t expect these short-term events to affect their long-term growth. However, the number of shares outstanding has changed and has therefore been adjusted downwards.

The company achieved a 5Y FCF per share CAGR of 10.9% and a 10Y CAGR of 14.9%. Despite the lack of free cash flow growth this year, I think a 5Y free cash flow growth assumption of 8% is reasonable and 5% for the 5 years thereafter, because it is more difficult to make assumptions further into the future.

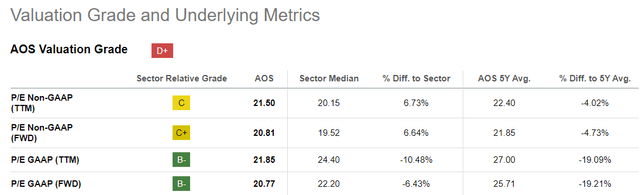

At the moment, AOS has a PE non-GAAP of 21.5, which is actually below its 5Y average of 22.40.

AOS valuation metrics (Seeking Alpha)

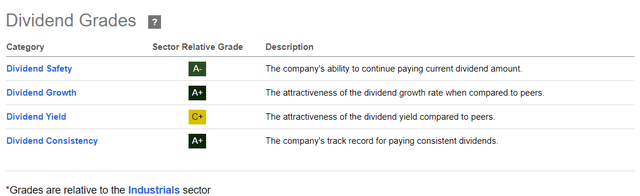

I used a PE of 20 as a terminal multiple because AOS is a high-quality business where I think this multiple can be justified. Finally, I used a discount rate of 12%, this is my personal hurdle rate and the minimum annual return I demand from my investment in AOS. Normally I use 10% but I have made some risk adjustments for the relatively high volatility. The beta has always been, and sometimes considerably, higher than 1 over the past 10 years.

This brings us to a fair value per share of $75.05. With a current share price of $84.50, AOS looks overvalued right now.

DCF analysis (Google Spreadsheets)

Conclusion

From a performance point of view, this year is certainly not the best year for AOS. The company is doing well in America, but is failing to achieve profitable growth in the rest of the world. Margins are also under some pressure due to increased steel prices.

Free cash flow will likely not grow this year and it is certainly possible that the coming quarters could be disappointing due to factors such as a possible further increase in steel prices and falling demand in China. However, this is short-term noise. However, these events can trigger short-term volatility and therefore a possible opportunity to pick up AOS at a great price. In this case, it is important to look at the long-term picture, and in combination with the excellent fundamentals its future looks bright.

The company still has a stable business model with a healthy amount of recurring revenue. AOS can benefit from the transition to higher energy-efficient products and the need for water treatment products all around the world. They still have more cash on hand compared to long-term debt and the company has an efficient capital allocation strategy where they emphasize sustainable growth and complement this with a safely growing dividend and share buybacks.

At the moment AOS has a dividend yield of 1.5%, which is still above its 5Y average of 1.29%. However, the dividend can be called very safe with a payout ratio of 32%. This in combination with a high single-digit dividend growth in the future makes AOS an interesting stock for the long-term dividend growth investor.

I will remain on the sidelines at these price levels, but if the price continues to drop, I certainly want to increase my current position. I always buy AOS according to the DCA principle because of the possible high volatility.

As previously written, AOS has existed for 150 years, which is an exceptional achievement. As long as the company does what they have shown in recent years, the company will certainly continue to exist for a long time. For the time being, I give AOS a “HOLD” recommendation, but if the company shows a decline with these current fundamentals, this could certainly result in a nice buying opportunity.

Happy investing everyone!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AOS either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.