Summary:

- McDonald’s Corporation shares were up 1% in pre-market trading despite missing sales and earnings expectations.

- Looking at the remainder of 2024, McDonald’s is focusing on value offerings to drive traffic back to restaurants and improve sales volume.

- McDonald’s “Accelerating the Arches strategy” continues to drive growth upside.

- Peak pessimism has likely been priced in ahead of earnings, and long-term focused investors are now buying the dip.

- I calculate a fair implied price target equal to $292.

ermingut

McDonald’s Corporation (NYSE:MCD) share were up about 1% in pre-market trading, after the company reported results for the June quarter. Interestingly, the positive price action was building on the backdrop of a miss on both sales and earnings. This suggests that peak pessimism has likely been priced in ahead of earnings, and long-term focused investors are now looking to buy the dip in one of the world’s most valuable brands. Personally, I also think that MCD shares have bottomed out, and I am adding to my long-term position — now looking for a $292 price target (slightly down from my previous estimate of $317, mostly due to slower than expected earnings growth).

For context, since the start of the year, MCD shares have notably underperformed the broader market: YTD, MCD stock is down about 15%, compared to a gain of approximately 15% for the S&P 500 (SP500)

McDonald’s Q2 — What You Need to Know

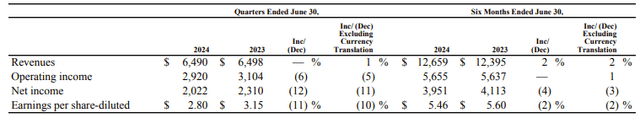

McDonald’s delivered a somewhat disappointing set of Q2 results, missing Wall Street estimates on both top- and bottom-line. During the period spanning from April to end of June, the world’s recognizable Quick-Service-Restaurant generated $6.49 billion of sales. This was about flat compared to the same period one year earlier, but approximately $150 million below what has been expected by consensus, according to data collected by Refinitiv.

Notably, Q2 marked the first quarter of declining sales for McDonald’s since the outbreak of the pandemic, 2020, whereby all reporting segments showed weakness: U.S. sales fell by about 0.7% YoY; sales International Operated Markets segment declined by 1.1% YoY; and sales International Developmental Licensed Markets segment decreased by 1.3%.

On profitability, McDonald’s results also reflected some negativity: Operating income fell by 6% YoY (5% in constant currencies), to $2.92 billion. The result did reflect a few one-off items, like a $97 million in pre-tax non-cash impairment charges and $57 million in pre-tax restructuring charges. However, the drop in profitability was mostly due to negative operating leverage on lower sales, as well as worse-than-expected cost pressures. Net income was reported at $2.02 billion (or $2.8 per share), down 11% YoY, and approximately 12-15% below consensus estimates.

Focus On Value Could Drive A Rebound In Sales Volume

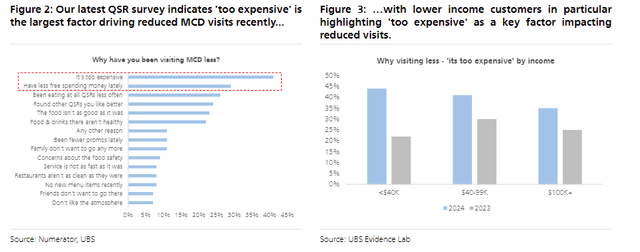

McDonald’s is currently executing on a strategy to enhance customer perceptions of the company’s value offering, to drive traffic back to its restaurants. Indeed, as evidenced by UBS research, the value consideration has been a key detractor for McDonald’s consumption volume over the past quarter (Source: UBS research note on MCD, dated 21st June: McDonald’s Will Expanded Value Offerings Drive Traffic?)

To counteract the effects of years of price increases and strengthen McDonald’s value proposition, the company has launched a $5 meal deal, likely with a potential permanent value platform later in 2024. In the conference call following the Q2 earnings release, McDonald’s management hinted at the observation that the $5 meal deal is so far selling better than what has been projected; however, without specifying any additional quantitative context. Anyway, I argue, as value perceptions improve, McDonald’s should be poised to see a gradual inflection in same-store sales, positioning the company to regain commercial momentum. In addition, investors should note that the “value perception struggle” is not idiosyncratic to McDonald’s, but an issue that also affects peers like Burger King, Starbucks (SBUX) and KFC.

Still Bullish On The Accelerating the Arches Strategy

In an earlier article, I offered a bullish argument on McDonald’s Accelerating the Arches strategy, an ambition that aims for 10,000 new stores by 2027 — the fastest store expansion in McDonald’s history. I highlighted:

McDonald’s aggressive international push is supported by penetration data. In the US, McDonald’s operates with a people-to-outlet ratio of about 25,000 to 1. This ratio increases to 45,000-60,000 to 1 in Western markets like France, the UK, and Germany, and surges to 280,000 and 2.9 million in China and India, respectively. While increased exposure to China poses geopolitical risks, McDonald’s has already demonstrated success in the Chinese market. Additionally, the company’s franchise system mitigates commercial risk by transferring it to the franchise operators.

Reflecting on Q2 results, I don’t see any arguments why the expansion pace should slow down, despite macro pressure. In fact, McDonald’s expects to add over 1,600 net new restaurants in 2024, whereby net restaurant unit expansion will contribute nearly 2% to 2024 systemwide sales growth, in constant currencies for the fiscal year. McDonald’s projects its 2024 operating margin to be in the mid-to-high 40% range.

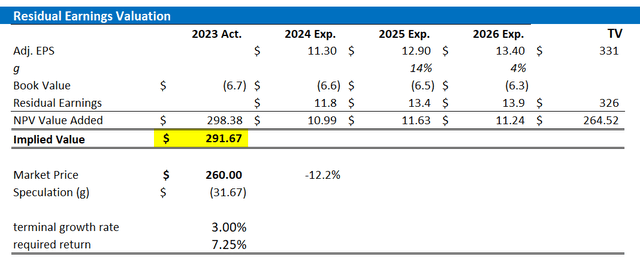

Valuation Update: Lower TP To $292

Following McDonald’s Q2 report, which came in slightly weaker than expected, I have updated my projections for MCD’s earnings outlook through 2026: For FY 2024, 2025, and 2026, I now anticipate EPS to be approximately $11.3, $12.9, and $13.4, respectively. For context, my EPS estimates through 2026 are now about 10% lower than what I estimated in February, mostly because of a weaker than expected consumer backdrop for QSR. At the same time, I maintain a 3% terminal growth rate post-2026, while I keep my cost of equity assumption at 7.25%. With these updated EPS projections, I calculate a fair implied share price for McDonald’s equal to $292.

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price a more fundamental upside compared to my estimates.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

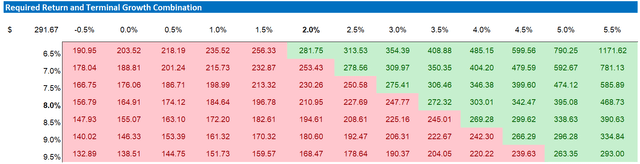

Below also the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Investor Takeaway

McDonald’s released its June quarter results. Despite missing both sales and earnings expectations, shares rose about 1% in pre-market trading and extended their gains in regular trading hours to about 4%. In my view, this price action is very bullish, suggesting that peak pessimism had already been factored in ahead of earnings, and long-term investors are now seizing the opportunity to buy the dip in this globally renowned brand. Personally, I believe MCD shares have hit a low point, and I am increasing my long-term position, now targeting a price of $292.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.