Summary:

- Altria offers high yield, buybacks, and a durable business, but faces challenges with declining cigarette shipment volumes.

- Altria still appears undervalued post it’s recent rally and in spite of these issues, but not by enough to warrant a buy rating.

- Altria’s future growth opportunities in oral tobacco and, even more importantly, the e-cigarette market will ultimately determine whether the stock is, in fact, undervalued or not today.

- I recommend that investors hold their current positions and wait until a better opportunity arises to buy before accumulating more shares.

MmeEmil

Introduction:

The tobacco industry is one which has long fascinated me and an industry which I’ve been bullish on for quite some time, as a result, I’ll be initiating coverage on a number of tobacco company’s, starting with Altria (NYSE:MO).

Altria offers investors an incredible yield of around 8%, coupled with occasional buybacks and a durable business with little threat to it from new entrants, all things which have made me very bullish on Altria at multiple times when I thought the price was opportune over the last number of years.

That being said, Altria’s cigarette sales volumes are starting to show potential issues for the business going forward that weren’t present in the past. Furthermore, the business has rallied about 25% over the last few months.

Going into this rally and prior to these revenue generation challenges, I was of the view that Altria was likely significantly undervalued. Post these recent events, I do believe that Altria is still undervalued, however the degree to which Altria is undervalued isn’t significant enough for me to have a sufficient margin of safety to give Altria a buy rating.

Hence, my view is that investors should hold on to their current shares, but wait for potential opportunities to increase their stake in Altria if the price once again dips below $45, which would make it a more attractive buy or below $40, at which point the stock would be a raging buy presuming the current fundamentals remain similar.

Altria’s Volume Issues:

Over the past few years, Altria’s followed a familiar path, every year, shipment volumes decline in their Smokeable products segment, which accounts for the vast majority of revenue (in their most recent quarterly report as of writing, Q1 2024, smokeable products accounted for around 88% of total revenue).

The company has, however, been able to prevent a decline in revenue by raising prices, and since nicotine products are notoriously desirable to their core consumers, a large portion of their customer base is willing to continue buying cigarettes and other smokeable products at these elevated prices.

Not only has this in the past staved off a decline in revenue, it’s actually led to expanding margins and generally growing profits, since similar revenue is coming in, but less product is having to be produced and sold, lowering costs.

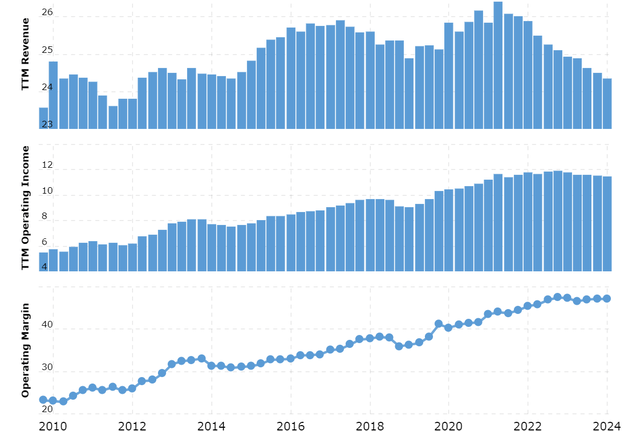

You can observe this trend in the following three charts below:

Altria Revenue, Operating Profit and Operating Profit Margins Overtime (Macrotrends)

The component of this chart which makes me question whether this strategy which Altria has been implementing for so long is at risk of becoming less effective going forward is the consistent decline in revenue that’s been occurring since roughly 2021.

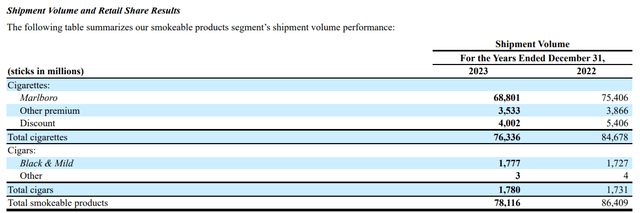

Digging deeper into the figures to try to determine the source of Altria’s revenue declines, it’s clear that the primary issue is that Altria’s smokeable product shipment volumes are declining at an accelerated rate, in other words, they’re selling less product, faster.

Whilst over the past several years Altria’s shipment volumes have been declining at a rate which could be offset by price hikes, in 2023, total shipment volumes of smokeable products declined by nearly 10% from the previous year, a decline large enough that price increases were unable to stabilize revenues.

Smokeable Products Annual Shipment Volumes (SEC)

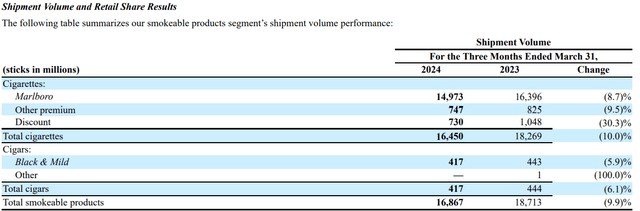

The most recent quarterly figures from Q1 don’t indicate that this trend is showing signs of reversing, the decline in shipment volume was again, about 10%.

Smokeable Products Quarterly Shipment Volume (SEC)

Management believe that these sharper declines are due to low-income consumers coming under pressure as a result of inflation, coupled with increased proliferation of illicit e-vapor products, which act as an alternative to cigarettes.

Pressure on low income consumers may or may not ease significantly in the near to medium term and the FDA does seem to be increasingly cracking down on elicit e-vapor products, but whether or not their efforts will be able to outpace the growth in illicit sales remains to be seen.

Now, all of this is not to say that hope should be abandoned in Altria. Altria is trading at very low valuations that account for these challenges, and it offers a great dividend yield, the core business is highly profitable, and although it is likely to fade overtime, it will provide steady cashflows for Altria to return to shareholders for years to come.

That being said, the persistence of these shipment volume declines indicate in my mind that this trend could potentially be here to stay, if that’s the case then price increases will not be able to offset declining shipment volume and Altria’s current core operations will enter into a phase of declining revenue and declining profits, which will necessitate a transition to more future-oriented business lines in order to create greater shareholder value.

Future Growth Opportunities:

Investors and management have been anticipating a decline in the shipment volumes of Altria’s smokeable products segment for a long time now, this spurred Altria’s original acquisition of a large stake in Juul, a forward-thinking move that would’ve positioned Altria well in the e-vapor market and enabled them an opportunity to grow significantly, making up for declines in their legacy business lines.

Unfortunately for Altria, their investment in Juul had to be written off almost completely after a regulatory crackdown by the FDA on practices core to Juul’s offering, such as flavors, which the FDA argued increased the likelihood of children using the product.

In light of this, Altria has lagged behind competitors such as British American Tobacco (BTI) and especially Phillip Morris (PM), both of which generate a substantially larger portion of their total revenues from new, growth segments than Altria does.

In more recent times, however, Altria has been putting increased efforts into becoming a real competitor in the oral tobacco and e-vapor markets, with the addition of on!, an oral tobacco brand that’s been growing rapidly, and NJOY, an e-cigarette company.

Whether or not Altria will eventually prove to be under or overvalued today hinges on how quickly Altria can scale these businesses.

Valuation:

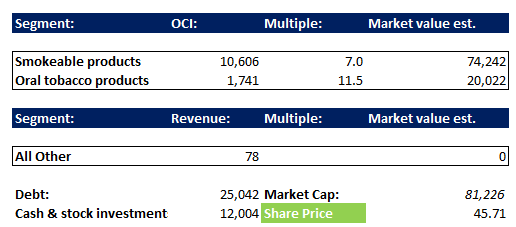

I’d like to split out Altria’s different business segments and do a valuation this way for illustrative purposes. Firstly, I’ll do the valuation assuming that the “All other” segment, under which NJOY falls, is worth 0.

Altria Segmental Valuation (Made by Author)

In this valuation, I’ve taken the operating company income of the different business segments and applied a multiple that I believe is in the correct range, 7x for the smokeable products segment, reflecting the volume challenges outlined above and the fact that it will be phased out over time and 11.5x for the Oral tobacco products segment, due to the segment as a whole remaining steady, but possessing some brands within the segment that have shown growth potential such as On! and leaving the valuation of the NJOY all other segment as 0.

Since these are operating figures, after applying the multiples I then adjust out Debt and add back cash, as well as Altria’s investments in public equities.

The point of this valuation is to show that the bulk of Altria’s current $50.43 price per share is accounted for using only the reasonably stable, profit generating segments of Altria. in this valuation, we come out to about $46 of it being accounted for, you could argue that this figure should be slightly more or slightly less, but I doubt any reasonable investor would argue that the multiples should be massively different to those provided.

This is why Altria to me starts to become a great buy once it dips into the $40-$45 range. The core, stable profitable segments cover your purchase and you get the growth potential of NJOY on top of that.

That being said, whilst there’s a reasonable estimate on the valuation floor, the current true value of Altria is a question mark. NJOY is tiny compared to the business as a whole, but using Altria’s already established sales channels could lead to rapid revenue growth.

Early indications look somewhat positive, but it’s too soon to say for sure. Personally, I believe the current value of this segment to be around $6 a share, based on the cashflows of the segment lying far in the future, but bolstered by the strong focus management are placing on it.

Adding $6 onto the valuation of the other segments comes out to roughly $52 per share, a slight undervaluation compared to the current price, but nothing that screams buy to me.

A simple and quick Discounted Cashflows analysis with conservative estimates including revenue declines of about 2% per annum over the medium term, coupled with margin expansion and a conservative terminal growth rate of -1% p.a., predicated on Altria’s poor positioning for the future relative to competitors, as well as the fact that future nicotine products, and particularly e-cigarettes appear to offer lower margins than their predecessors appears to align roughly with our conclusions, forecasting a price target of $56 per share.

Conclusion:

To conclude, Altria is a solid dividend company and a good defensive stock. That being said, volume issues plague it’s core legacy business and future expansion plans lag behind competitors due to the unfortunate outcome of Altria’s investment in Juul many years ago.

Despite these issues, Altria is cheap enough that I still think it’s probably slightly undervalued, but not enough for it to be worth taking a bite.

I recommend that investors hold and wait for either a downtrend in Altria’s price, allowing them to get in at a better price, or future filings showing progress on growth initiatives, which may present an opportunity for investors to buy with an increased margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.