Summary:

- Highest production levels since 2018 and upcoming projects are expected to increase production capacity by 10% by 2025.

- The company reported an increase in costs, but this was expected due to the seasonality of the first quarter.

- Rumors of a merger with another mining company could change the momentum of the shares.

CUHRIG

Investment Thesis

I recommend buying Vale (NYSE:VALE) shares after the release of its second-quarter results on July 25. As far as possible, the company has released good numbers and trends, which corroborate the positive view of my report to start coverage on April 17, 2024.

The company has shown consistency in increasing volumes, and while investor opinion is divided on the future of the Chinese economy, Vale continues to pay good dividends and seeks to diversify its business.

Review Of Vale’s Results

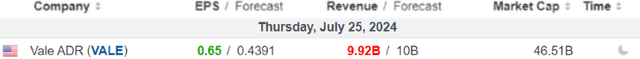

Vale released results with interesting trends. The company beat market estimates for earnings per share and reported revenues in line with expectations.

Below, I will discuss each point of the result in detail. Enjoy reading!

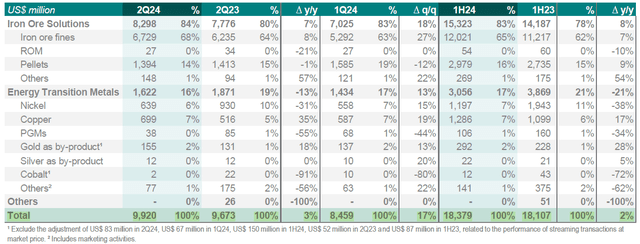

Revenues – Volume Rising and Price Falling

As I presented in the report on the company’s production in Q2, even with a weaker realized price for iron ore fines ($98/t), the company managed to present revenue of $9.9 billion (+3% y/y and +17% q/q).

Net operating revenue by business area (IR Company)

This is the second quarter of the year with the highest production since 2018. In addition, the company is expected to deliver two important projects, Vargem Grande and Capanema, by 2025.

This should increase iron ore production capacity by around 30 million tons, which represents around 10% capacity expansion and corroborates my recommendation to buy the company’s shares.

Costs And Expenses – Worse Cost Was Expected

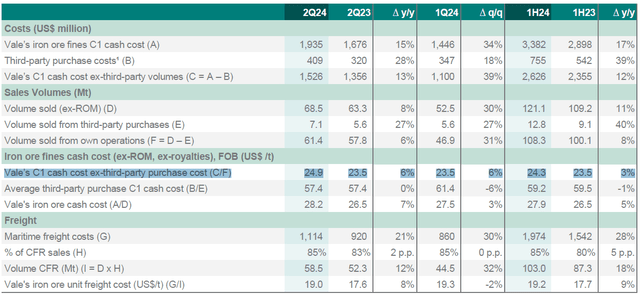

The C1/t cost rose +6% q/q and +6.1% y/y to $24.9/t, as we can see below.

Vale’s C1 cash cost ex-third-party purchase cost (IR Company)

It is important to highlight that the first quarter has slower production and, consequently, there is less dilution of fixed costs. Although the result is from 2Q, some shipments take about 45 days to arrive in China, so part of the sales from 1Q24 are recorded in 2Q24.

In addition, Vale offset the weak price with higher volume, as we saw in the previous chapter, using the inventory accumulated in the previous quarter, which has less dilution of fixed costs due to the rainfall volumes in the producing regions.

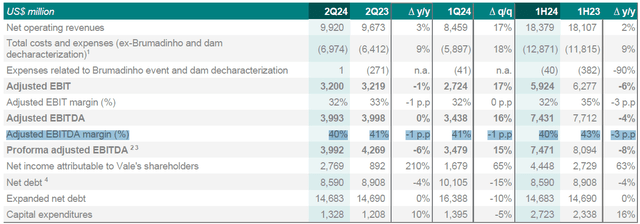

Adjusted EBITDA Margin (IR Company)

With few highlights in expenses, the company reported an adjusted EBITDA margin with a slight drop of 100 bps in the quarterly and annual comparisons. In my view, the cost should fall again in the 2nd half of the year, reaching around $20/t due to seasonality, and this corroborates my positive view on the shares.

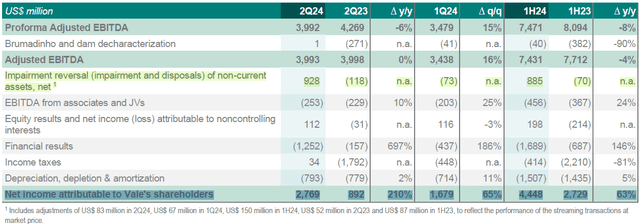

Profits – The Reason For The Surge In Net Income

Net income was $2.7 billion (+65% q/q and +210% y/y), a big positive surprise. However, despite having a positive view on the thesis, I highlight that the reason for the result is not a one-off situation.

This increase in net income is due to reversal impairment, mainly in relation to the sale of a stake in PTVI. It is worth remembering that Vale reduced its stake in PTVI.

Until last year, PTVI had a contract to operate nickel mines in Indonesia, expiring in December 2025. To extend the license, PTVI had to meet certain requirements, including the restructuring of the corporate structure, since the concession could not be extended by a controlling shareholder being a foreign company.

Therefore, in June 2024, Vale reduced its stake in PTVI. In this way, the transaction allowed PTVI to extend its license until 2035. In addition, the transaction generated a gain of almost $1 billion for Vale in 2Q24 due to the reclassification of the remaining investment at fair value.

Therefore, the positive surprise in net income is non-operational and non-recurring. In any case, I see a result with good prospects for the company, mainly due to the distribution of dividends, as I will discuss below.

The Company Announced Remuneration To Shareholders

The company announced a total dividend of $0.37 per share for ADRs on the NYSE. This value indicates a dividend yield of approximately 3.4% on a quarterly basis, or 13.5% annualized. The ex-dividend date is August 5, with payment effective September 11. Let’s now look at the company’s valuation.

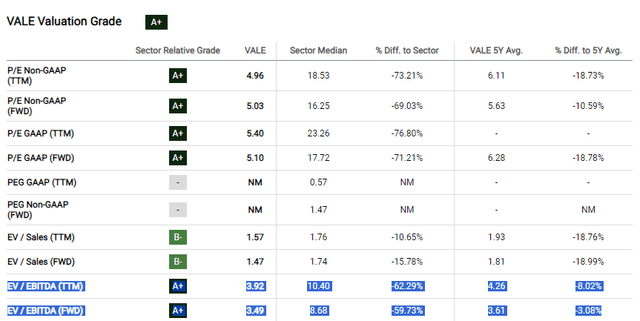

Valuation Remains Attractive

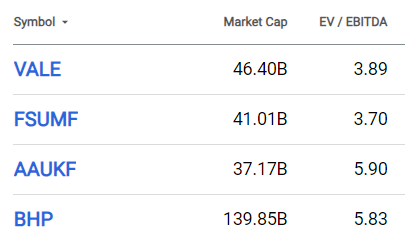

For the valuation, I will do a comparative analysis using Vale’s EV/EBITDA multiple against its competitors, BHP Group (BHP), Rio Tinto Group (RIO), Anglo American (OTCQX:AAUKF), and Fortescue (OTCQX:FSUMF).

EV/EBITDA (Seeking Alpha)

If we add the EV/EBITDA of its competitors and divide by 5, we have a sector average of 4.83x EBITDA. This implies an upside of 24% for Vale shares and corroborates my positive view of the company.

We can also analyze the company versus the sectoral average of EV/EBITDA.

In this case, the sector average is greater than 10x, confirming that the company is cheap. However, I prefer the first method of comparison since the companies have more similar production volumes.

Now, let’s look at the Quant Rating and Factor Grades.

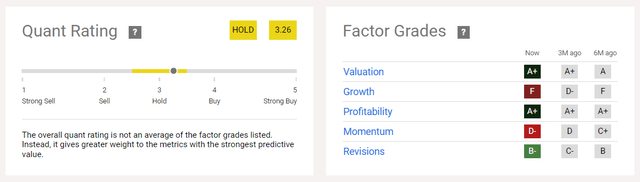

Quant Rating And Factor Grades

As we can see, Quant Rating recommends investors to hold their stocks. This is mainly due to the poor momentum rating, due to the poor performance of the company’s shares.

Quant Rating And Factor Grades (Seeking Alpha)

However, I see this as an opportunity, since a positive news flow can bring good momentum to the stock, changing the recommendation to buy. But what news can bring this buying flow to the stock?

Can Vale Merge Operations With Teck?

Vale recently approached mining company Teck (TECK) about a possible merger of its base metals businesses. Teck has attracted attention due to the possible spin-off of its coal, zinc, and copper businesses.

The company’s copper assets are seen as being of very high quality. In my view, this could improve Vale’s momentum, as it reduces the correlation of Vale’s results with the Chinese economy, which has been one of the biggest concerns for investors.

Potential Threats To The Bullish Thesis

The risks to Vale’s thesis remain highly correlated with the Chinese economy, which recently cut interest rates. Doubts about demand and the price of iron ore should capture investors’ attention.

In addition, the Brazilian government has launched new attacks on the company, indicating that sanctions may be applied to the company due to the mining company’s alleged arrogant stance in sealing agreements to compensate for the damages caused by the Mariana accident in 2015.

The Bottom Line

Vale reported consistent results in 2Q24 with good volume indicators. In addition, the increase in costs was already expected due to the seasonality of the quarter. Impairments were not expected, but they increased profits in the quarter, which is positive.

As for the future, projects should be delivered soon, increasing production capacity by 10%, while seasonality should bring a greater dilution of fixed costs, possibly causing an increase in margins.

Based on this analysis, I recommend buying Vale shares. While investors are cautious about China’s economy, Vale is showing progress where possible, and with an attractive valuation, the risk/return ratio is positive in my view.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.