Summary:

- Netflix’s business is performing well, but growth is likely to slow as the boost from paid sharing wanes.

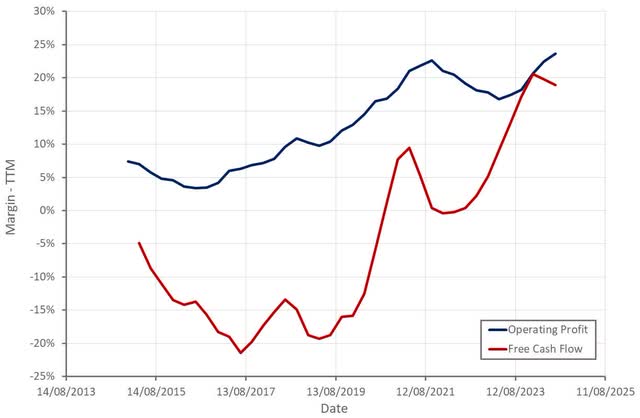

- Netflix’s recent profit margins and cash flows have been particularly impressive, with market structure now appearing more favorable in this regard.

- Netflix’s valuation leaves little room for error though, particularly given that growth is likely to moderate in coming quarters.

Robert Way

Netflix’s (NASDAQ:NFLX) business is performing reasonably well at the moment, with the company aggressively trying to realize the full value of its platform. Initiatives like advertising and paid sharing will only provide a temporary boost, though, meaning Netflix will likely see a sharp growth slowdown over the next few years.

I have previously been skeptical of Netflix’s ability to generate free cash flow due to the heavy content investments required by its business. It is increasingly looking like Netflix will not face any genuine global competitors, though, meaning that it can moderate content investments without suffering excessive churn. This is supportive of the company’s revenue multiple, although I find it difficult to see the stock significantly outperforming the market going forward.

Future returns will be highly dependent on users’ price elasticity of demand and Netflix’s ability to monetize users through advertising and continuing to expand its user base. It is difficult to see ARPU growing significantly though, and subscriber growth is moderating, absent the temporary boost provided by the introduction of paid sharing.

Market Conditions

Streaming is rapidly becoming the dominant method of watching TV in the US, currently accounting for 40% of total TV time. This provides Netflix with an enormous opportunity in its core market, along with large opportunities in adjacent markets. Globally, there is something like a 600 billion USD opportunity across streaming, pay TV, film, games and branded advertising, with Netflix only accounting for around 6% of that.

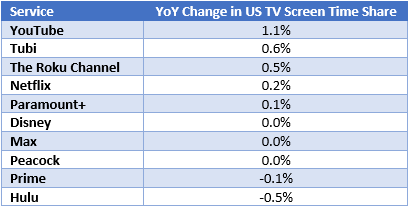

While the market is large, the real question has always been how competition would shape market share and profitability for service providers. In this regard, Netflix now appears well positioned. Competitors are investing in premium content but have generally failed to capture the audiences necessary to justify this investment. With linear TV continuing to decline, many companies will find it difficult to maintain current investment levels and could increasingly turn back to Netflix to help monetize their existing content libraries.

Table 1: YoY Change in US TV Screen Time Share (source: Created by author using data from Netflix)

Generative AI

Generative AI is unlikely to impact Netflix’s core business for many years, although AI is already important in areas like content recommendation and advertising. Extrapolating current trends in AI content (text, audio, image and video) generation, Netflix’s business could be reshaped significantly in the coming decades though.

At the extreme, AI could be used to massively reduce the resources required to create content. While this would reduce costs, it could also result in an explosion in content, pressuring pricing. If this were to occur, I would expect most content to be monetized through advertising rather than subscriptions, which would likely be less favorable for Netflix than Amazon or YouTube. In the near term, there is likely to be a modest tailwind as generative AI enhances productivity and enables things like product placement.

Netflix has added generative AI to the list of risk factors in its annual report, but it is otherwise unclear if AI is factoring into investor considerations of the company yet.

Netflix Business Updates

Netflix’s ad business is scaling nicely, with Ads tier memberships growing 34% sequentially in the second quarter. The ads tier currently accounts for around 45% of signups in Netflix’s ads markets. This is probably the most positive aspect of Netflix’s business at the moment as it indicates the company can significantly expand its user base without undermining the ARPU of its existing subscriber base.

Netflix is now building an adtech platform internally, which will be tested in Canada in 2024 and launched more broadly in 2025. This is expected to provide advertisers with more flexibility, and improved targeting and attribution capabilities.

The crackdown on account sharing in early 2023 contributed to a spike in subscriber numbers. The policy is now enforced in over 100 countries. Netflix has stated that 100 million households use shared passwords, which puts the number of households with access to Netflix well over 300 million. It is difficult to estimate how many of these are now on a paid plan, but it is still clearly only a fraction, and many of these are likely on ad-supported plans.

Netflix also continues to lean on pricing, which makes sense given that demand is relatively inelastic, and that churn remains low. A small survey of students indicated a price elasticity of demand for Netflix of 0.6. Netflix’s 2019 price increases for US subscribers of 13-18%, caused 24% of survey respondents to consider canceling, 3% to definitely cancel and another 10% to consider downgrading. These figures again point towards relatively inelastic demand.

Netflix is also now offering more live content, which may presage a more serious move into sports. The company has already dipped its toes into this water with tennis, golf and wrestling. The timing of the move makes sense, given that it should help to support user growth and has synergies with Netflix’s nascent advertising business. The question is whether the potential incremental revenue justifies the often-enormous sports rights fees. The company’s focus in regard to sports is likely to remain on series and documentaries in the short term though.

Financial Analysis

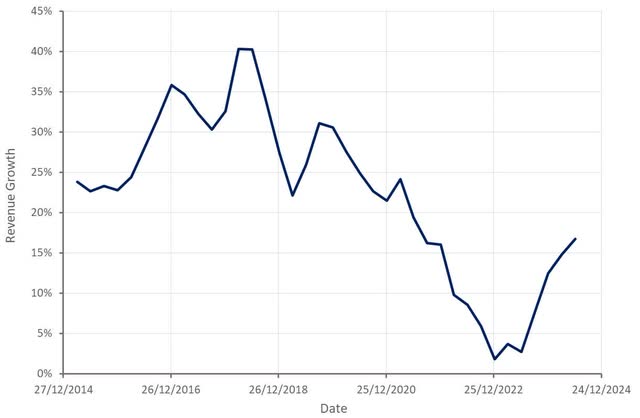

Netflix’s revenue growth continues to rebound, reaching a healthy 17% in Q2. It should be noted that this comes on the back of an easy comparable period in 2023, with comparables becoming much more difficult over the next 2 quarters.

Netflix expects 14% YoY revenue growth in Q3, although I don’t believe there is much buffer built into this guidance. Growth is likely to moderate towards the high single digits over the next 12-18 months.

Figure 1: Netflix Revenue Growth (source: Created by author using data from Netflix)

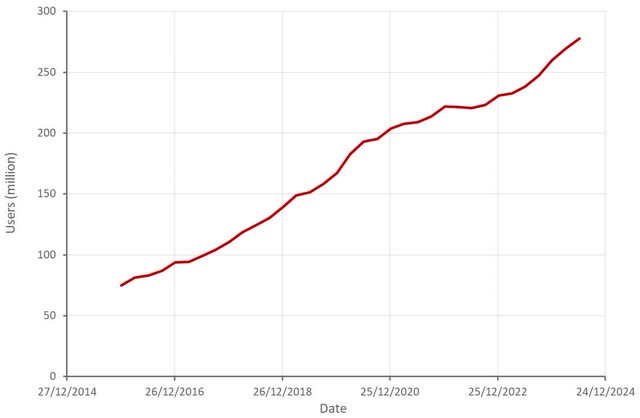

Net subscriber additions are being driven by strong user acquisition, along with healthy retention, across regions, with India an area of particular strength. Netflix’s subscriber growth will continue to moderate as the impact of initiatives like paid sharing and the introduction of ad-supported tiers wanes. Net additions are expected to be lower in Q3 than the prior year period, as Q3 2023 was the first full quarter impact from paid sharing. There is still plenty of room for growth though, as there are over 500 million Smart TV households globally, and nearly 1 billion broadband households.

ARPU has been fairly flat over the past 3 years, and it is difficult to see much progress here going forward, given the impact of ads and the fact that subscriber growth is being driven by international markets. The ARM of ad supported subscribers is currently lower than non-ads subscribers. A return to pre-COVID level subscriber growth, along with stable ARM, suggests a transition to single digit revenue growth.

Figure 2: Netflix Subscribers (source: Created by author using data from Netflix)

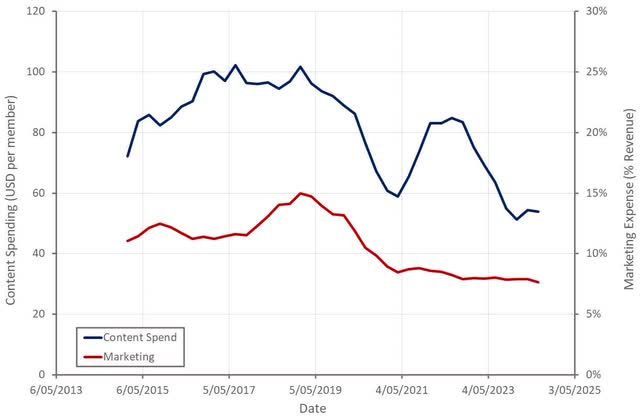

While moderating growth will likely pressure Netflix’s revenue multiple, the company’s strong margins could help to minimize this. In particular, Netflix’s content and marketing spend has been fairly modest in recent quarters. The bull case for Netflix in recent years has been that the burden of content spend would decline as the company scaled, and this has proven to be the case so far. Provided churn remains low and Netflix can continue to improve monetization of its user base through higher pricing, paid sharing and advertising, there is likely more margin upside.

Figure 3: Netflix Content and Marketing Spend (source: Created by author using data from Netflix) Figure 4: Netflix Margins (source: Created by author using data from Netflix)

Conclusion

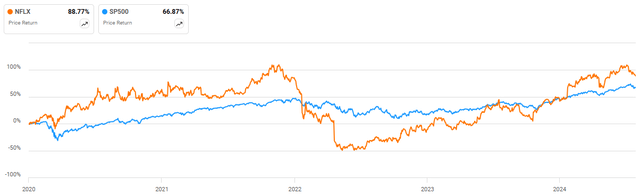

Netflix’s stock has modestly outperformed the market over the past 4.5 years, albeit with significantly higher volatility. Given where the company’s revenue multiple currently sits, there is likely little room for multiple expansion though, meaning returns will need to be driven by revenue growth, which is likely to continue moderating as Netflix’s business matures.

Netflix has pulled a number of value creation levers in recent years, which is indicative of how the company is now having to work much harder to generate growth. Reducing consumer surplus through higher pricing, paid sharing and reduced content spend has its limits, though. The stock will probably continue to perform ok while sentiment remains positive, but there is significant downside risk if investors sour on the stock.

Figure 5: Netflix Share Price Performance (source: Seeking Alpha) Figure 6: Netflix EV/S Multiple (source: Seeking Alpha)

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.