Summary:

- I initiated a “Buy” rating on Pfizer stock in February 2024, and since then, it’s aging well. I believe the recovery rally in PFE stock may be just the beginning.

- The cost management initiatives seem to be progressing faster and more efficiently than one would have thought a few quarters ago – the solid Q2 numbers show that.

- Wall Street analysts are still giving very modest EPS growth projections for the next few years, creating a ground for possible EPS beating in the next quarters.

- My earlier assumptions that the potential for margin expansion at Pfizer was enormous began to materialize. I calculate a growth potential of 42% by the end of 2025.

- I rate PFE stock as a “Buy” again.

no_limit_pictures

My Thesis Update

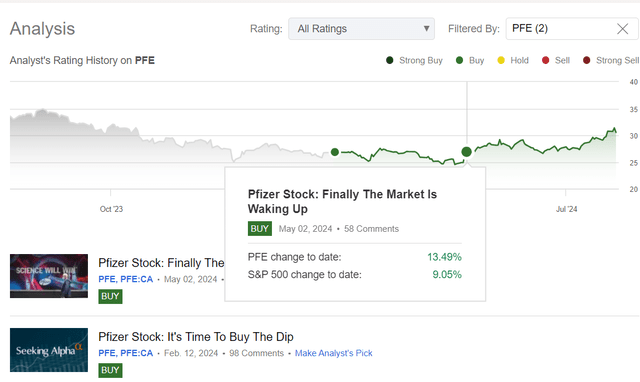

I initiated coverage on Pfizer (NYSE:PFE) stock with a “Buy” rating, stating that the company’s low valuation and strong product pipeline make it the ultimate buying opportunity for income investors in the healthcare sector. In early May, I updated my thesis, noting that the market started to finally wake up on PFE’s prospects of continued growth from non-COVID drugs and potential margin expansion. Back in May, I anticipated that PFE’s dividend stability, recent revenue growth, and effective cost-cutting initiatives may lure back major investors, potentially igniting a resurgence in Pfizer’s stock. And my thesis appears to be working so far:

Seeking Alpha, Oakoff’s coverage of PFE stock

Today, I still stand by my earlier opinion: in my view, PFE’s recovery is only just beginning, as the valuation is still cheap, while cost management initiatives seem to be progressing faster and more efficiently than one would have thought a few quarters ago. I see PFE trading about 40% above current levels in 1-2 years.

My Reasoning

Last time, I began with a description of the results for the first quarter of the 2024 financial year, which were still relatively fresh at the time. Following my tradition, today I’d like to start with a brief overview of Pfizer’s Q2 2024 results, which were released literally 2 days ago.

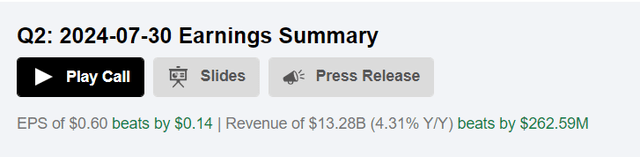

The company reported revenue of $13.28 billion and earnings per share of $0.6 (adjusted), beating market consensus estimates by 2.02% and 30.19%, respectively, according to Seeking Alpha:

The consolidated Q2 revenue figure – unadjusted for COVID products – made the 1st YoY increase [+3% YoY] since Q4 2022; excluding COVID products, revenue growth was an impressive 14% YoY, fueled by “key products like Nurtec, Vyndaqel, Eliquis, and contributions from Seagen’s portfolio.” If we look at the sales structure in detail, we can see the acceleration of sales in the Oncology segment, which reached almost $4 billion. Sales in the Specialty Care segment exceeded $4 billion – the closest PFE came to this mark was in the fourth quarter of 2021. The strength in these segments helped PFE to exceed consensus estimates and offset the weakness in Primary Care.

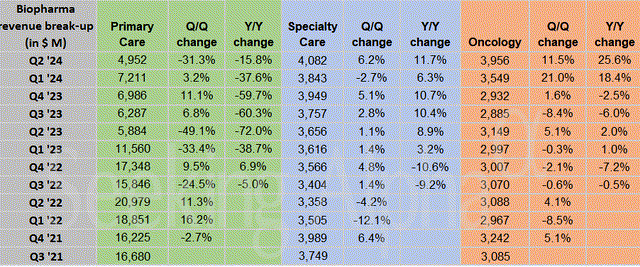

What I liked in Pfizer’s Q2 results was the rise in margins. The adj. gross margin improved to 79% from 76% thanks to favorable non-COVID revenue mix and cost management, as the management commented during the earnings call. A positive difference of 300 basis points is a very big achievement for any company, in my opinion. At the same time, the operating expenses increased by just 5% YoY; that is, in general, adjusted for individual one-off items, the cost control seems to get better. The management keeps working on their recently announced Manufacturing Optimization Program, which together with their cost realignment program is targeting Pfizer’s pre-pandemic EBIT margins (on a mix-adjusted basis excluding Comirnaty). As the earnings press release clarified, Pfizer is on track to deliver at least $4 billion in net cost savings by the end of 2024, and judging by how it has gone since the beginning of 2024, I think the $4 billion may be the low of the range we should expect. If the qualitative growth in the Oncology and Specialty Care segments continues, we can therefore speak of a potential EBIT margin of at least 15-20% by the end of 2025, which is close to the ten-year average.

On the balance sheet side, I see that Pfizer kept the deleveraging process, after which enhanced share repurchases should follow, according to the CFO’s comments.

… we have paid down approximately $2.25 billion in maturing debt, including $1 billion in May of outstanding notes. And though we did not monetize any Haleon shares in Q2, we expect to resume monetization of our 23% Haleon stake in the future.

Our strategy consists of maintaining and growing our dividend over time, reinvesting in our business at an appropriate level of financial return; and finally making value enhancing share repurchases after de-levering our balance sheet.

Source: From Q2 2024 earnings call

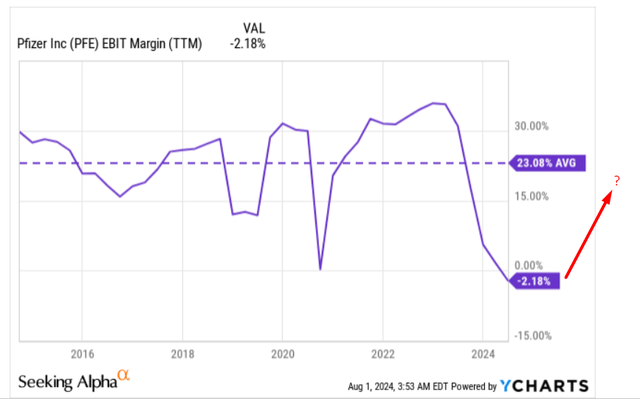

As the Argus Research team mentioned back in May (proprietary source), Pfizer received FDA approvals in 2023 for 9 new drugs (new molecular entities or NMEs) and received approvals for numerous new indications for existing products. In total, from mid-2023 through the end of 2024, it expects to launch 20 new products or new indications. I’m not an expert in the healthcare industry, but it seems to me that Pfizer’s management is working a lot to restructure the business and focus on non-Covid products. The share of sales from non-primary care products is already over 60% and this is only likely to increase as the integration of Seagen has been particularly successful so far. And given the margin expansion and growth rates in the end markets PFE is targeting (oncology, obesity, non-malignant hematology, etc.), I think the company still has many undiscovered growth drivers.

Simultaneously, it’s important to recognize Pfizer’s established leadership in various markets. For instance, in the pediatric segment, Prevnar 20 continues to dominate with >80% market share in the U.S. Additionally, Abrysvo’s performance aligns with seasonal vaccine trends, positioning Pfizer favorably for the expected increase in RSV cases later this year.

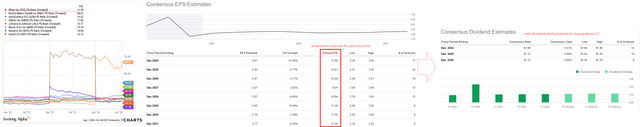

Yes, Pfizer is clearly lagging behind many other peers in terms of margin stability in the recent past (and due to modest growth rates). But these points can hardly logically explain the current picture: The company trades at only 11 times projected earnings and still has a lot of inefficiencies to work on in the foreseeable future, and Wall Street analysts are giving very modest EPS growth projections for the next few years. The implied P/E ratio will be 10.5x in 5 years, which is very low. In my opinion, a fair valuation of PFE stock is at least 15x, which is the historical norm at pre-COVID margins that management is targeting today and the consensus still doesn’t believe in. At the same time, the dividend yield should be above 5.5% over the next few years, which is 100-150 basis points above the company’s average of the last 5 years. In my opinion, all this shows that PFE shares are highly undervalued today.

YCharts, Seeking Alpha, Oakoff’s notes

Assuming that current cost management initiatives continue at least half as strongly as in the first half of 2024, Pfizer could easily exceed current consensus forecasts by at least 10% by the end of 2024. If the market recognizes the company’s recovery prospects by 2025 and grants it a P/E ratio of at least 14x, then we are talking about a price target of $43.4, which implies a growth potential of 42% from the last closing price.

Therefore, I reaffirm my previous “Buy” rating, expecting more upside from PFE stock – what we saw over the past few weeks may be just the beginning of a solid recovery rally.

Risks To My Thesis

Every potential and existing investor should be very careful with the risks surrounding Pfizer so far. A major concern for me is still the impending expiration of patents on key products, which could expose Pfizer to competition from cheaper generics, resulting in lost sales. Between 2025 and 2030, Pfizer will face patent expirations and loss of exclusivity for products that, according to Argus Research (proprietary source, May 2024), generated combined peak sales of $17 billion. This loss of exclusivity could lead to a significant drop in sales unless Pfizer can successfully innovate and bring new blockbuster drugs to market. As you may know, the pharmaceutical industry operates on long product development cycles, and setbacks in clinical trials or regulatory approvals could delay the commercialization of new drugs and hurt Pfizer’s growth prospects.

In addition, Pfizer, like other peers, faces risks related to the reimbursement of its drugs: Insurers in the U.S. and national health authorities in overseas markets may limit or deny coverage for certain high-priced drugs, limiting patient access to these drugs and affecting Pfizer’s revenue streams.

Your Takeaway

Despite obvious risks to the company and its industry in general, anticipating the realization of the announced 2024 guidance, I still expect Pfizer to attract a greater influx of potential investors drawn to its recovery growth trajectory. As evidenced by the strong Q2 2024 results, on the basis of which management raised its full-year 2024 guidance, my earlier assumptions that the potential for margin expansion at PFE was enormous began to materialize. In addition, non-COVID sales started to grow faster, especially oncology sales. Also, the company’s potentially increased buybacks following the implementation of post-acquisition deleveraging and the attractive dividend yield will likely increase the stock’s attractiveness to investors. I consider Pfizer’s current valuation to be quite low, even after the stock has recovered by more than 20% from its April lows – I calculate a growth potential of 42% by the end of 2025. Therefore, I rate PFE stock as a “Buy” again.

Good luck with your investments!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PFE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to access the latest reports from banks and hedge funds?

With just one subscription to Beyond the Wall Investing, you can save thousands of dollars a year on equity research reports from banks. You’ll keep your finger on the pulse and have access to the latest and highest-quality analysis of this type of information.