Summary:

- Apple reported strong FY24 Q3 earnings results. The company announced quarterly diluted earnings per share of $1.40, increasing by 11% compared to the previous year.

- Apple also reported a quarterly revenue of $85.8B, which is an increase of 5% in comparison to the year before.

- In this article, I will show you the implications of Apple’s earnings results for the implementation of your investment approach.

- Despite Apple’s elevated valuation (P/E [FWD] Ratio of 32.99), I rate the company as a buy due to its attractive risk-reward profile, which justifies a premium valuation.

ozgurdonmaz

Investment Thesis

Apple’s (NASDAQ:AAPL) strong FY24 Q3 earnings result confirms my belief that Apple is an excellent core position for any diversified investment portfolio, especially for those portfolios focused on dividend growth.

The company reported quarterly revenue of $85.8B, which is an increase of 5% in comparison to the same quarter in the year before. Additionally, Apple released quarterly diluted earnings per share of $1.40, which is an increase of 11% compared to FY23 Q3.

Competitor Alphabet (GOOG) (GOGL) reported its latest quarter earnings results on July 23, releasing an increase of diluted earnings per share of 31.25% when compared to the previous year.

On Tuesday, July 30, Microsoft (NASDAQ: MSFT) released its FY24 Q4 earnings results, announcing diluted earnings per share of $2.95, which was an increase of 10% in comparison to the year before. After Microsoft released its earnings results, I confirmed my buy rating for Microsoft in a recently published article.

Due to Apple’s and Microsoft’s slightly higher valuations (P/E [FWD] Ratio of 32.99 and 31.64, respectively), both come attached to a slightly higher downside risk when compared to competitor Alphabet (22.48). However, I believe that both Apple and Microsoft should be rated with a significant premium when compared to competitors given their broad and diversified product portfolios and wide economic moats.

In this analysis, I will explain the implications of Apple’s latest earnings results for the implementation of your investment strategy. I will show you why I’m convinced that the company is an excellent core position for an investment portfolio with a dividend growth focus.

I will show you why Apple is not only one of the largest positions in The Dividend Income Accelerator Portfolio but also the largest position in my personal investment portfolio.

I overweight the Apple position in both portfolios due to the company’s attractive risk-reward profile. This means that Apple’s attractive risk-reward profile provides investors with a relatively low risk level while offering elevated probabilities for positive investment outcomes. This is particularly the case due to Apple’s significant competitive advantages, financial health and wide economic moat.

Apple’s strong earnings results strengthen my belief in continuing to overweight Apple in both The Dividend Income Accelerator Portfolio and my private portfolio. The company from Cupertino receives my buy rating despite its currently elevated valuation (P/E [FWD] Ratio of 32.99). Apple’s attractive risk-reward profile justifies a premium valuation compared to its competitors.

Apple’s Stock Performance

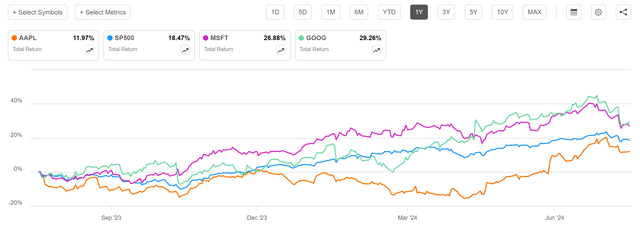

The chart below showcases Apple’s performance over the past 12-month period: With a total return of 11.97%, Apple has underperformed the S&P 500 (NYSEARCA: VOO) (total return of 18.47%), Microsoft (26.88%), and Alphabet (29.26%).

Source: Seeking Alpha

However, I do not see this current underperformance as a problem for Apple investors. It should be highlighted that I’m following a long-term investment approach with both portfolios.

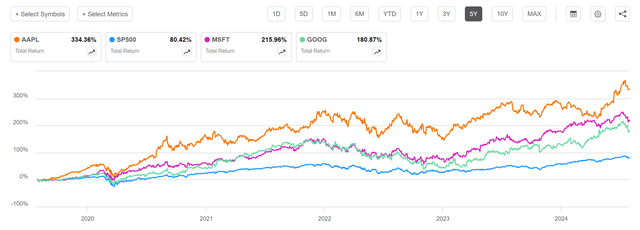

Considering the past five-year period, Apple has clearly outperformed the S&P 500, Microsoft and Alphabet: While Apple has shown a performance of 334.36%, Microsoft’s Total Return has been 215.96%, Alphabet’s 180.87% and the S&P 500’s 80.42%. The chart below underlines my strategic approach to seeing Apple as a buy-and-hold investment.

Source: Seeking Alpha

Apple’s Current Valuation

Apple currently showcases a P/E [FWD] Ratio of 32.99. This is 11.47% above the sector median and 22.42% above its five-year average. Even though the company’s valuation is relatively high, I still believe that Apple is fairly valued.

I’m convinced that Apple deserves a premium valuation when compared to its competitors given the company’s superior risk-reward profile, which includes its significant competitive advantages, financial health and wide economic moat over its competitors, confirming my current buy rating for the company despite its elevated valuation.

Apple exhibits a higher valuation when compared to competitors such as Microsoft and Alphabet. While Apple’s P/E [FWD] Ratio stands at 32.99, Microsoft’s is at 31.64, and Alphabet’s is at 22.48.

Apple’s relatively high valuation is further confirmed when considering that both Microsoft and Alphabet not only have lower valuations but also exhibit higher growth rates: Alphabet’s EPS growth rate diluted [FWD] is 23.98%, Microsoft’s is 17.37%, and Apple’s is only 6.21%.

Due to their currently elevated valuations, I believe that both Apple and Microsoft currently have a slightly higher downside risk when compared to Alphabet. However, I believe that both of them deserve a premium valuation.

Apple’s Strength in Terms of Profitability

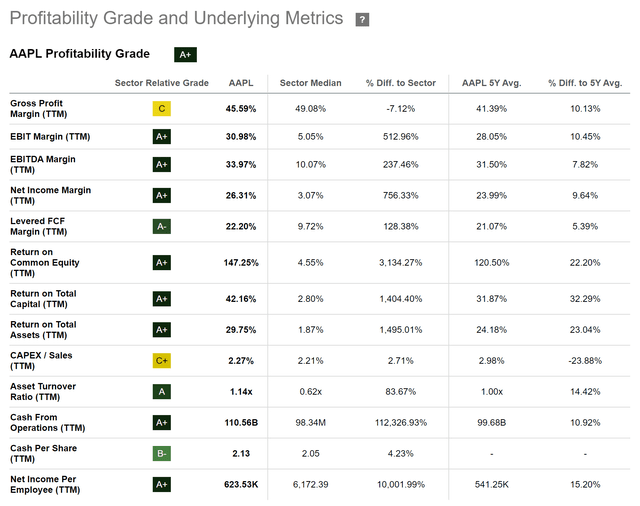

Apple exhibits strong profitability metrics, which underscore my current buy rating for the company. Apple showcases a net income margin [TTM] of 26.31%, which stands well above the Sector Median of 3.07%. In addition, Apple’s return on total capital [TTM] stands at 42.16%, significantly above the sector median of 2.80%.

Apple’s strong profitability metrics underscore the company’s excellent competitive position within its industry, its significant competitive advantages and wide economic moat, further underlying my present buy rating.

Source: Seeking Alpha

Apple’s Dividend Growth Potential

Apple’s dividend growth potential is underlined by the company’s five-year dividend growth rate [CAGR] of 5.56% and its low payout ratio of 14.93%, which leaves plenty of room for future dividend enhancements not just in the coming quarters but also in the following years.

It should also be highlighted that investors can benefit not only from Apple’s dividend growth potential but also from its extensive share buyback program, from which investors benefit when investing in the company over the long term. This allows investors to significantly gain from both dividend enhancements and capital appreciation, further highlighting Apple’s attractiveness for long-term investors.

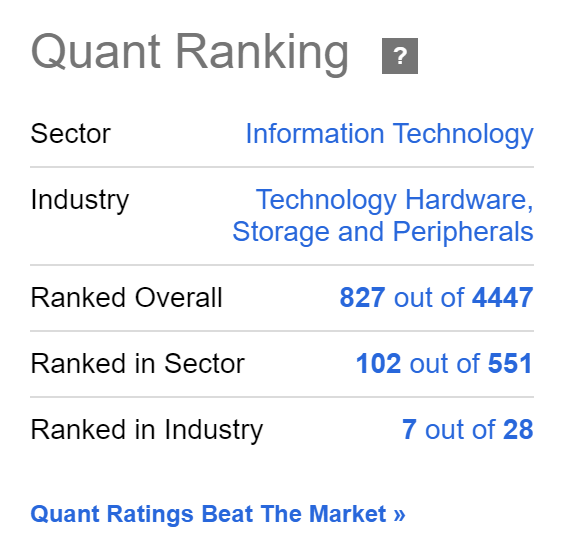

Apple, according to the Seeking Alpha Quant Ranking

The Seeking Alpha Quant Ranking further underlines my current buy rating for Apple. The company is ranked seventh out of 28 within the Technology Hardware, Storage and Peripherals Industry, 102nd out of 551 within the Information Technology Industry, and 827th out of 4,447 within the overall ranking.

Source: Seeking Alpha

Why Apple is among the largest positions within my portfolios

Currently, Apple is the second-largest position within The Dividend Income Accelerator Portfolio. Apple represents 4.17% of this dividend portfolio, which combines dividend income and dividend growth while, at the same time, offering investors a reduced risk level. Only BlackRock (NYSE: BLK) represents an even larger position (currently 4.65%) than Apple since BlackRock provides investors with a superior mix of dividend income and dividend growth.

Further, it’s worth highlighting that both Microsoft (with a current proportion of 1.92%) and Alphabet (with a proportion of 1.65%) are part of The Dividend Income Accelerator Portfolio. However, both companies currently represent a slightly lower proportion of the overall portfolio when compared to Apple.

Within my personal investment portfolio, Apple represents the largest individual position, followed by Alphabet, Amazon (NASDAQ: AMZN), Mastercard (NYSE: MA) and Visa (NYSE: V).

The reason for providing Apple with such a high proportion in comparison to the overall portfolio is that I consider Apple to be one of the world’s most attractive investment options in terms of risk and reward, particularly due to its wide economic moat that the company has managed to establish successfully.

In the near future, I plan to continue overweighting Apple both within The Dividend Income Accelerator Portfolio and within my personal investment portfolio, staying committed to my long-term investment approach.

The Risk Factors Apple Investors Should Consider and How They Can Reduce the Risk Level

Similar to Microsoft, which reported its earnings results on Tuesday, Apple’s elevated valuation represents a risk factor for investors.

As mentioned previously in this analysis, Apple presently has a P/E [FWD] Ratio of 32.99, which is 22.42% above its 5-Year Average. This valuation implies an elevated downside risk for the Apple stock, especially if growth prospects are not met in one of the following earnings results.

An additional risk factor that Apple investors should consider is that the company still depends to a high degree on the revenue generated from its iPhone sales. In FY24 Q3, the company still generated 45.81% of its revenue from its iPhone product category, a fact that underscores this dependency.

In addition to the above risk factors, it’s important to note that one of Apple’s most valuable assets is its strong brand image. Damage to the company’s brand image could significantly impact the company’s financial performance and, consequently, its stock price, particularly over the short term, underscoring my long-term investment approach for Apple.

By limiting the Apple position to a maximum of 10% of your overall portfolio, you can reduce the company-specific allocation risk and the downside risk of your portfolio, which will help you increase the likelihood of positive investment outcomes.

Usually, I suggest setting allocation limits of no more than 5% for a single position. However, given Apple’s attractive risk-reward profile, I do not consider a higher allocation limit to be a significant risk for investors. Within my private portfolio, Apple represents even more than 10% of the overall portfolio, reflecting my personal conviction and risk tolerance.

Conclusion

Apple reported strong FY24 Q3 earnings results, with quarterly diluted earnings per share of $1.40, an increase of 11% when compared to the same quarter in the year before.

Due to Apple’s attractive risk-reward profile, the company from Cupertino is the second-largest position within two of my portfolios. I plan to continue overweighting the Apple position in both portfolios in the near future, staying committed to my buy-and-hold approach with the Apple position.

Apple’s strong earnings results have strengthened my strategy to hold Apple as a predominant position in both portfolios. I continue my buy rating for the Cupertino company.

However, investors should be aware that Apple’s elevated valuation (P/E [FWD] ratio of 32.99, which is 22.42% above its five-year average) represents a risk factor for investors and that the company’s stock price could significantly decrease if earnings are not met in one of the following earnings results.

When compared to competitors such as Microsoft and Alphabet, Apple’s higher valuation and lower growth rates should be highlighted. However, Apple’s and Microsoft’s attractive risk-reward profiles justify a premium valuation compared to peers.

To reduce the risk level of your overall portfolio and increase its likelihood of positive investment results, I suggest a long-term investment approach when investing in Apple. A long-term investment approach will help you benefit from Apple’s dividend growth potential and the company’s share buyback program, which can result in capital appreciation.

Additionally, to reduce the risk level of your portfolio, you can set an allocation limit of 10% for the Apple position compared to your overall portfolio. The allocation limit of 10% is still significantly below the 42.9% that Warren Buffett’s Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B) holds on Apple.

By overweighting the Apple position within your investment portfolio but setting an allocation limit of 10%, you will optimize the risk-reward profile of your overall portfolio while simultaneously reducing its company-specific allocation risk, positioning your portfolio for different market conditions.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, MSFT, GOOG, AMZN, V, MA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.