Summary:

- Apple reported solid headline results, with revenue and EPS both beating expectations.

- Apple enjoyed strong margin expansion compared to this quarter last year due to strong Apple Services performance.

- The largest risk to an investment in Apple is a slowdown in the total active installed base, which hit a record high in Q3.

nayuki

I reiterate my Buy rating on Apple, Inc. (NASDAQ:AAPL) following Q3 earnings because of extremely strong performance in the Apple Services segment.

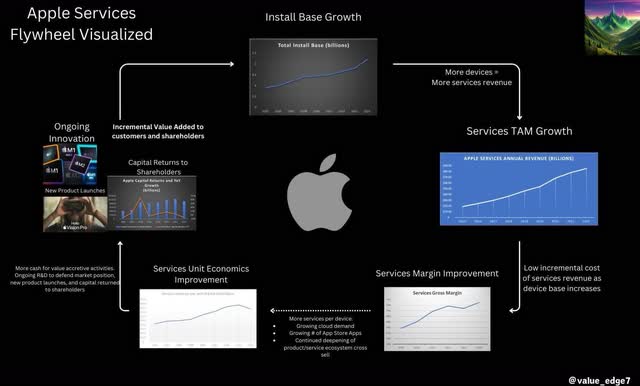

I have covered Apple twice in the past year with Buy ratings both times. My most recent coverage was in February after the Vision Pro launch, which I made the case I was bullish. While it seems I was wrong about the Vision Pro itself, the salient points from that article are unchanged: Apple enjoys an extremely strong flywheel effect with its products that makes it a very compelling investment opportunity.

Prior to that, I covered Apple amidst swirling FUD around a slowdown in China sales. I presented data on both the Apple iPhone 15 and Huawei Mate 60 Pro and discussed why Apple still has the most competitive product. I argued that product quality would help Apple remain competitive in the Chinese market. The company experienced a slowdown in China revenues year-over-year in Q3 but enjoyed growth in all other reportable regions.

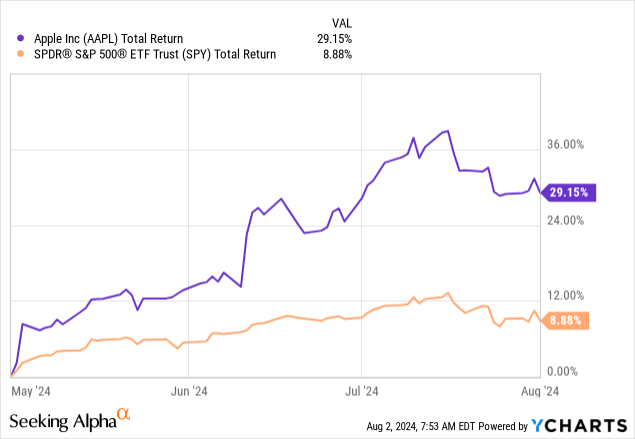

Q3 was a solid quarter for Apple that comes at an interesting time. The stock has been on a tear since Apple released a flurry of AI enhancements to its product line-up at WWDC 2024. It’ll take some time for these features to drive meaningful revenue, but the market is clearly optimistic about this.

Q3 Earnings: The Flywheel in Motion

Apple reported $85.8b in revenue, up 5% YoY, beating estimates by $1.42b. GAAP EPS of $1.40, up 11% YoY, beat by $0.06. The company declared a $0.25 dividend and continued its strong buyback program. During the quarter, Apple generated $29b in operating cash flow and returned over $32b to shareholders.

iPhone sales of $39.3b were down toward historical averages for the seasonally slow Q3. Product sales beat expectations of $60.63b, coming in at $61.56b, with the iPad segment shining with 24% YoY growth. This is a very promising reading after the company launched a refreshed line of iPad’s in May of this year. Apple Services continued its unstoppable ascent, eclipsing $24b in quarterly revenue on 14% growth. Sales of $24.21b beat analyst estimates of $23.96b.

The company enjoyed margin expansion across the board on an annual basis. On the other hand, margins broadly fell from last quarter. Gross margin of 46.3% brought quarterly gross profit to $39.7b and gross margin was up 180 bps YoY. Services gross margin reached 74% while products gross margin was 35.3%. OpEx came in at $14.3b, bringing operating income to $25.4b. Operating margin now sits at 29.6%, up 150 bps YoY. The company reported net income of $21.4b which led to a net margin of 25%, up 70 bps YoY.

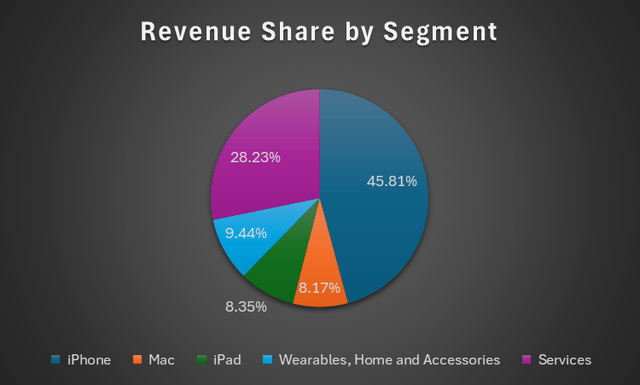

This strong margin expansion was mostly caused by the Services segment continuing to take share of overall revenue mix. Services revenue as a percentage of total sales eclipsed 28% this quarter, up 330 bps from Q3 2023.

Services revenue will continue taking overall market share, since the other four segments ultimately feed into Services. At some point, I expect Services to be the largest contributor to Apple’s overall revenue, something that will greatly enhance the company’s overall margin profile. In a previous article, I visualized the Apple Services flywheel as such:

This flywheel effect is on full display in 2024. Apple’s total active installed base reached an all-time high, helping Services revenue hit a record. This has led to margin improvement and strong cash flow generation. This cash flow is used for ongoing innovation in things like Apple Silicon and Apple Intelligence, while shareholders enjoy enormous capital returns in the form of buybacks and dividends each year. Higher quality products and AI-powered services will drive more demand for Apple products, which will continue spinning the Apple Services flywheel. This is a very difficult train to stop at this point, and one I would not suggest standing in the way of.

My most recent article stating “Vision Pro is Bullish Long-Term” proved to be right and wrong. I was wrong that Vision Pro would find traction right away – it didn’t. I was right, however, that Apple Services has an extremely strong and compelling flywheel that makes long-term compounding extremely likely. Despite the flop of the Vision Pro, services revenue continues marching higher on the back of a record number of paid subscriptions and all-time revenue records in advertising, cloud, and payment services.

The services business is thriving. CFO Luca Maestri noted that both transacting and paid accounts reached all-time highs. Both paid accounts and paid subscriptions enjoyed double-digit growth YoY. The number of paid subscriptions has more than doubled in four years to reach “well over 1 billion”. The growing number of paid accounts and subscriptions has helped the company grow ARPU consistently as well.

Apple ended the quarter with $153b in cash and $101b in total debt. The company returned $32b to shareholders across $3.9b in dividends and $26b in share repurchases. Looking ahead, the company expects total revenue to grow about 5% YoY in Q4 and services revenue to continue growing in the double digits. Gross margin is expected to be between 45.5% and 46.5% and OpEx is expected to be between $14.2b and $14.4b.

The primary risk for Apple remains a slowdown in active device installed base. My entire thesis is dependent on consistent TAM expansion for the Services segment, so if active installed base begins to slow, this will become a serious threat to Apple’s top and bottom-line growth and margin profile. This remains the most important data point by far in my opinion.

Investor Takeaway

Apple is clearly a quality compounder and presents a solid long-term investment option. It would be unwise to expect the same returns in the next ten years as investors have enjoyed in the previous ten years, but I believe Apple is likely to continue beating the market over that time. The company is trading above historical averages for both forward Non-GAAP PE (33) and forward PS (8.6). The stock yields less than 1%. Consensus estimates suggest EPS will grow double digits in each of the next three years, which will help sustain the 16.7% 5-year EPS CAGR.

Apple remains a Buy in my opinion. The company has officially pivoted into the AI era with Apple Intelligence. The suite of AI features should greatly enhance the quality of the Apple Services business, although management avoided commenting on the extent of this impact. While AI enhancements will come at the expense of elevated R&D levels, they will cause the Apple flywheel to turn ever faster. I reiterate my Buy rating on Apple after Q3 earnings due to the exceptional performance of Apple Services.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.