Summary:

- The growth and adoption of artificial intelligence is driving massive investment and growth opportunities for data centers.

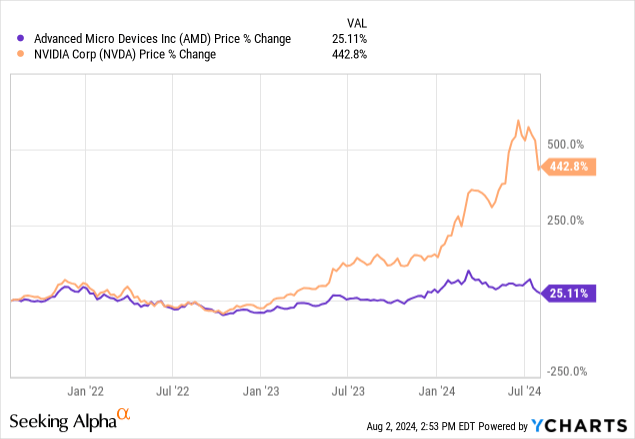

- Nvidia dominates the AI chipset market with a 98% market share, but Advanced Micro Devices is quickly catching up.

- AMD’s data center segment revenue doubled year over year, positioning the company as a key player in the AI revolution and a competitor to NVDA.

- Is AMD too late to capitalize? We explore AMD’s recent success in catching NVDA and examine emerging risk factors.

Klaus Vedfelt/DigitalVision via Getty Images

Data centers and artificial intelligence have remained two of the hottest topics of conversation over the past twelve months. Many believe we’ve entered a new era of technology and innovation including participants in the boom such as Nvidia (NVDA) CEO, Jensen Huang. Just recently, Huang said “we’re at the beginning of a new industrial revolution.” The implications of such change are enormous and evident through the massive investment funneling into artificial intelligence-based resources, including generative AI, across industries.

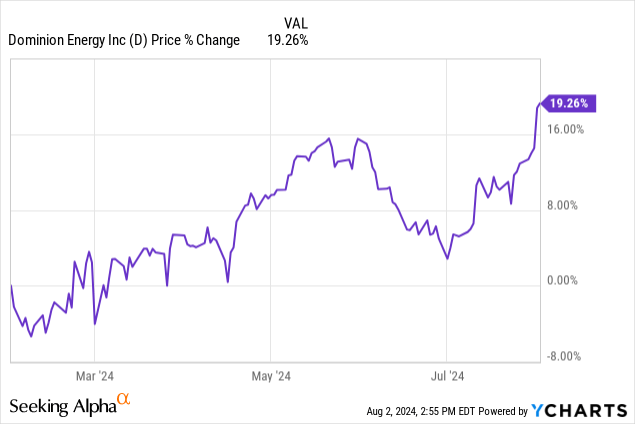

These changes have been a recent theme of our writing. For example, several months ago, we discussed what increasing power demand could mean for data center REITs. The main thesis there was around the increasing power requirements facing data center operators such as Equinix (EQIX) and Digital Realty Trust (DLR). As data centers grow in complexity and computing power, they are demanding additional power to operate, posing challenges to heavily-impacted regional players, like Dominion Energy (D) which serves Northern Virginia.

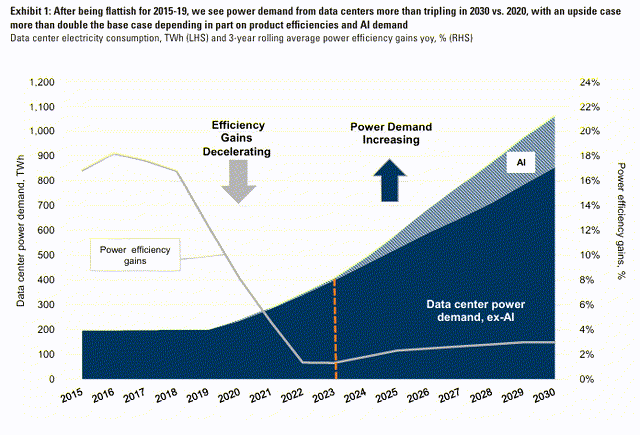

The trends are clear when it comes to increasing power demand. Data centers are hungry.

The source of the energy demand is also clear. Data centers are requiring more internal computing power to fulfill modern requirements of data center tenants. This means more processing power including AI GPUs must be packed into facilities to meet computing demand. The trend has created an unprecedented wave of demand for chips, primarily from market leader NVDA. Following Q2 earnings, we covered NVDA’s rise to dominance in the data center sector. However, with a massive demand wave, there are opportunities for competitors to step up and take a bite out of NVDA’s apple.

Advanced Micro Devices (NASDAQ:AMD) has been hard at work to catch up to NVDA and establish a meaningful market share of their own. This week, AMD reported Q2 earnings which reflected significant progress in their data center segment. In fact, it appears as though AMD could be the only meaningful competitor against NVDA with Intel (INTC) delivering disappointing earnings. Today, we will explore AMD’s growing data center segment.

Data Centers Are Booming

No corner of real estate is hotter right now than data centers. The largest institutional real estate investors such as Blackstone (BX) are hard at work putting pedal to the metal filling the massive demand wave for data center capacity. According to Data Center Dynamics, BX has over $70 billion in data center deals in their pipeline, more than their existing portfolio of the same asset class.

Investment management company Blackstone has more than $70 billion in prospective data center pipeline development.

In its latest earnings call, the world’s largest alternative asset manager said that it also had a current data center portfolio of $55bn, including facilities under construction.

CEO Stephen Schwarzman claimed that “the consequences of AI are as profound as what occurred in 1880 when Thomas Edison patented the electric light bulb.” He said that, “while it took years to develop commercially viable products, the subsequent build out of the electric grid over the following decades has parallels to the creation of data centers today to power the AI revolution.”

Schwarzman noted that “current expectations are that there will be approximately $1 trillion of capital expenditures in the United States over the next five years to build and facilitate new data centers, with another $1 trillion of capital expenditures outside the United States.

Every so often, a demand driver creates an unusual wave of attention towards a specific asset class. Four years, the pandemic launched a wave of interest in large footprint industrial space as every retailer turned towards an omni-channel approach to continue reaching consumers. Industrial had been slow and steady, but nearly overnight demand exploded. The adoption of artificial intelligence affected data centers similarly.

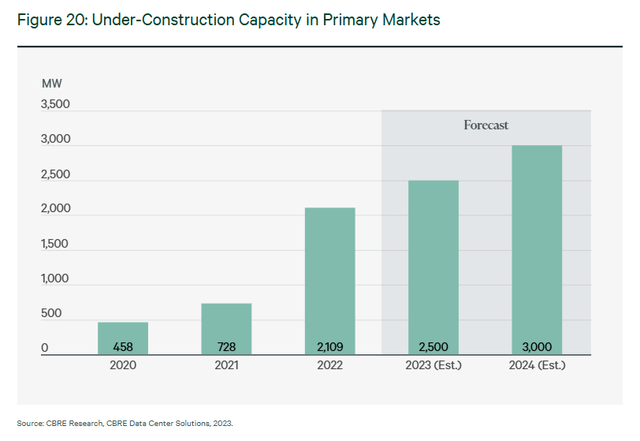

Other real estate players like CBRE (CBRE), are similarly bullish on the asset class, forecasting extraordinary construction underway for data centers. Capacity under construction has increased more than 5x since pre-pandemic averages. CBRE expects more than 3,000 MW of capacity to be delivered this year.

The critical piece of this demand wave is the internal infrastructure of new data centers. These modern facilities are power hungry beasts that command substantial computing power as compared to older vintage assets. This means additional chipsets filling the internals of the building. Who provides this computing power? Companies like NVDA and AMD.

NVDA Is Winning…

NVDA has emerged as the clear winner in the early engagements of the data center war. The company’s H100 chipsets have set the industry standard. NVDA’s data center business clocked $18.4 billion in gross sales last quarter, marking a 400% year over year increase for chipset sales.

The flagship H100 chipset has exceeded extraordinary expectations. For example, Mark Zuckerberg of Meta Platforms (META) recently spoke about the chipset. META’s future data center infrastructure will include over 350,000 H100 chips by the end of this year. At an estimated price of $25,000 to $30,000 per units, these chips have quickly become a core piece of NVDA’s business.

At this point, it’s estimated that NVDA controls around 98% of the AI chipset market.

Nvidia had an explosive 2023 in data-center GPU shipments, which totaled roughly 3.76 million units… Nvidia’s GPU shipments in 2023 grew by more than 1 million units compared to 2022, when Nvidia’s data-center GPU shipments totaled 2.64 million units, according to the study…Nvidia had a dominant 98% market share in data-center GPU shipments in 2023, similar to market share numbers in 2022.

It is uncommon for a single participant to dominate market for a prolonged period. Over the past two years, NVDA has owned the data center segment, however, costs and inventory shortages continue to open opportunities for competitors.

But AMD Is Catching Up

As data center developers and operators continue to upgrade their new and existing assets, chipset providers are struggling to meet demand. While NVDA leads the market, competitors such as AMD are quickly catching up.

AMD has been the second strongest competitor in the segment, but has still trailed NVDA. According to information from HPC Wire, AMD shipped around 500,000 GPU units in 2023. AMD’s MI300-series units have locked in orders from large players in the technology segment, including Microsoft (MSFT). This is important because it proves that their chips include enough computing power to meaningfully compete with NVDA.

On the recent earnings call, AMD discussed their expanded relationship with MSFT, which included using MI300X to power their new AI-based copilot services for the Office suite.

Microsoft expanded their use of MI300X Accelerators to power GPT-4 Turbo and multiple co-pilot services including Microsoft 365 Chat, Word, and Teams. Microsoft also became the first large hyperscaler to announce general availability of public MI300X instances in the quarter.

The new Azure VMs leverage the industry-leading compute performance and memory capacity of MI300X in conjunction with the latest ROCm software to deliver leadership-inferencing price performance when running the latest frontier models, including GPT-4. Hugging Face was one of the first customers to adopt the new Azure instances, enabling enterprise and AI customers to deploy hundreds of thousands of models on MI300X GPUs with one click.

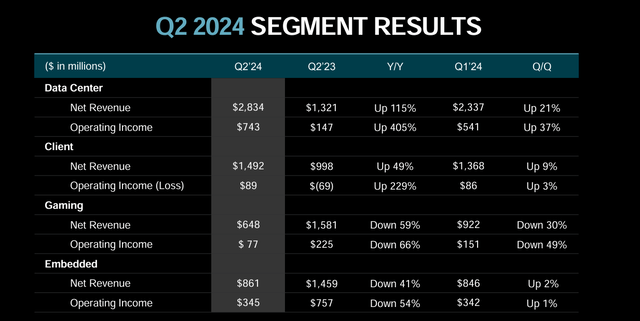

Progress appears to be exceeding AMD’s expectations. This week, AMD reported Q2 earnings, which included significant updates to their data center segment. While Q2 earnings were broadly strong, performance split across business units. Top businesses such as data centers grew, while gaming declined on a quarterly and annual basis.

Despite some downsides on the consumer end, strength in the data center segment is ample to power AMD’s business. Data center revenue more than doubled year over year, reaching $2.8 billion compared to $1.3 billion for the comparable quarter of the prior year. While doubling, this market share is still considerably smaller than NVDA’s $22 billion quarterly data center revenue.

As the demand gap begins to widen, AMD is emerging as another clear winner in the AI revolution. In AMD’s Q2 earnings release, management commented on the rapid expansion of the segment.

Record Data Center segment revenue of $2.8 billion was up 115% year-over-year primarily driven by the steep ramp of AMD Instinct™ GPU shipments, and strong growth in 4th Gen AMD EPYC™ CPU sales. Revenue increased 21% sequentially primarily driven by the strong ramp of AMD Instinct GPU shipments.

AMD also noted on their earnings call that they appear to be following a similar cadence to NVDA as far as new product releases. This year will see the release of MI325X followed by the MI350 series in 2025 and the MI400 series in 2026.

AMD’s business has quickly accelerated due to factors including expanded research and development. Their data center GPUs have reached quality on par with NVDA’s product line and AMD has begun integrating into the market with some of the largest data center occupants such as MSFT. By all accounts it appears as though AMD has caught traction in the data center game with revenue growth accelerating. But are they coming to the table too late?

Risks

When I listen to commentary from leadership in the semiconductor industry including Jensen Huang and Lisa Su, I feel inspired. They share visions of the next industrial revolution which will revolutionize the human experience, much less the data center segment. However, there are many assumptions going into their grand visions of the future. One key assumption serving as the basis of this future is the adoption of AI.

Looking ahead, the rapid advances in generative AI and development of more capable models are driving demand for more compute across all markets. Under this backdrop, we see strong growth opportunities over the coming years and are significantly increasing hardware, software and solutions investments with a laser focus on delivering an annual cadence of leadership data center GPU hardware, integrating industry leading AI capabilities across our entire product portfolio, enabling full stack software capabilities, amplifying our ROCm development with the scale and speed of the open source community and providing customers with turnkey solutions that accelerate the time to market for AMD based AI systems. We are excited about the unprecedented opportunities in front of us and are well positioned to drive our next phase of significant growth.

On the earnings call, Lisa Su comments on growth opportunities in future years around continued innovation and recurring sales to new and current clients. The future trajectory hinges on the staying power of these AI-based investments. The investment is clear thus far. Companies far and wide are piling into the generative AI game and investing in the resources required to compete. Let’s explore one case.

Morgan Stanley (MS) recently launched a client service assistant that is based on AI. The role of AI @ Morgan Stanley is to generate efficiencies which will ultimately replace in-office and outsourced employees such as executive assistants. This will cut down costs and increase efficiency for financial advisors who will no longer interface with their associates.

It also largely depends on financial advisors adopting and using the technology. The average financial advisor is in their mid-50’s and likely to retire within the next decade. AI @ Morgan Stanley is specifically geared to serve their financial advisors as a client service replacement for their existing assistants.

I see little likelihood that a 55-year-old financial advisor who plans to retire in five years will begin using generative AI let alone replace their entire support staff with Chat-GPT. This means many of these ongoing investments into generative-AI based companies could temper or flop. While the initial investment phase has already begun, it brings into question how long the expansion period will last. At what point will some investments dry up and will this cause the market to shrink?

This risk is compounded by the significance of data centers for AMD’s current growth trajectory. On the Q2 earnings call, management discussed that growth of the business is driven primarily by the data center, with other business units beginning to lag.

Data Center delivered record quarterly segment revenue of $2.8 billion, up 115%, a $1.5 billion increase in year-over-year. The Data Center segment accounted for nearly 50% of total revenue, led primarily by the steep ramp of AMD Instinct GPUs and strong double-digit percentage EPYC Server revenue growth.

On a sequential basis, revenue increased 21%, driven primarily by strong momentum in AMD Instinct GPUs. Data center segment operating income was $743 million or 26% of revenue compared to $147 million or 11% a year ago. Operating income was up more than 5 times from the prior year, driven by higher revenue and operating leverage, even as we significantly increase our investment in R&D.

As the concentration on AI continues to accelerate, this creates a principal risk that AMD and other companies could be pouring extraordinary amounts of capital into a business which could be close to peaking.

Conclusion

The data center industry is booming at an unprecedented cadence. Should forecasts pan out, the next five years are poised to change the game in terms of data center demand and design, and companies such as AMD are poised to fill the gap. The innovative products slated to be released over the next three years have secured AMD a spot at NVDA’s table.

As revenue in the data center unit doubles year over year, AMD has clearly gained traction in the AI revolution. Should the massive investment into AI continue over the next several years, AMD will prove a key participant in AI. Should AMD begin to eat further into NVDA’s market share, there could be an extraordinary growth opportunity at hand for the company.

With data center now powering both businesses, AMD has additional room for growth. Currently, AMD earns a “Buy” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.