Summary:

- Amazon stock fell 8% on Friday, causing it to crash briefly into a bear market.

- In AMZN’s worst selloff since its October 2023 bottom, investors are likely taking risks off the table.

- I explain why, while profit-taking is justified, the decline seems overstated.

- I detail why Amazon’s deeper forays into advertising and AWS’s resilience help undergird its growth prospects.

- With AMZN down to lows last seen in April 2024, I argue why you should follow my lead and buy its dips without undue fear.

Justin Sullivan/Getty Images News

Amazon (NASDAQ:AMZN) investors were likely stunned by the steep selloff that engulfed the stock of the e-commerce leader last week. Its stock fell more than 8% on Friday (August 2), briefly sending AMZN into a bear market (down 20% or more) since its early July 2024 highs. The stunning decline followed a closely-watched earnings report, suggesting investors were discernibly disappointed. In Amazon’s mixed Q2 earnings release, the company also guided below Wall Street’s expectations. Therefore, I assess that the decline to dissolve the heightened optimism heading into its earnings scorecard is justified.

In my previous bullish Amazon article in June 2024, I indicated that a bullish breakout seemed increasingly likely. My thesis panned out as AMZN surged toward the $200 level. However, the bullish momentum has been reversed, given the steep decline over the past three weeks. Despite that, Amazon’s performance in Q2 shows my optimism about the resurgence of Amazon Web Services and deeper forays into advertising played out.

In its Q2 release, Amazon faced increased consumer spending headwinds, although I don’t think it surprised investors (since AMZN topped out in early July), given the recent challenges facing American consumers. Despite that, I assess that the market likely didn’t anticipate the cautious commentary by management, highlighting its observation that consumers traded down. Therefore, investors might need to brace for a more significant impact in the second half, as macroeconomic headwinds could intensify. The focus on AWS and advertising isn’t expected to mitigate the decline in domestic consumer spending challenges, as demonstrated by the recent employment reports.

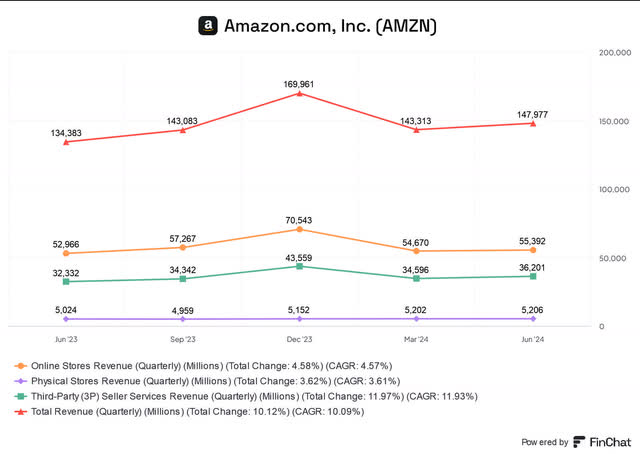

Amazon retail revenue segments (FinChat)

As seen above, Amazon’s retail e-commerce segment (first-party, third-party, and physical stores) accounted for more than 65% of its total Q2 revenue base. Hence, it’s not reasonable for investors to focus only on AWS’s robust growth and ignore the challenges facing its retail segment.

However, Amazon’s massive e-commerce scale suggests the company is well-positioned to weather weakness compared to smaller peers. It also aligns with its recent strategy to compete more aggressively in the discount category, taking a direct shot against the incursions of Temu (PDD) and Shein.

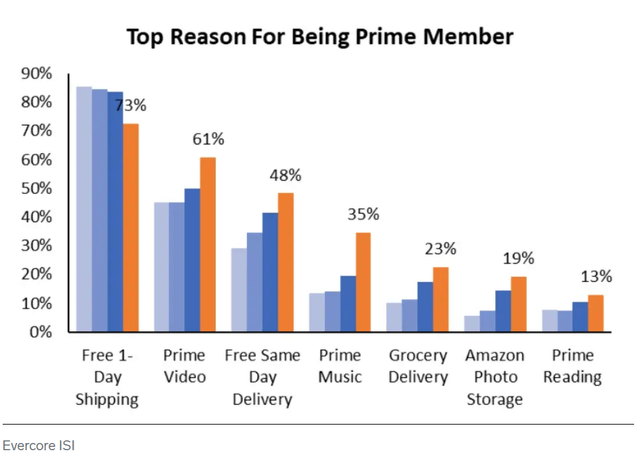

Top reasons for being prime members (Insider)

Moreover, Amazon Prime membership offers the company a highly competitive moat to maintain its e-commerce clout. As seen above, Amazon’s fast and reliable shipping capabilities are considered the “top reason” for Prime membership.

It aligns with a recent report that Amazon has broadened its delivery coverage. Accordingly, the company has expanded “its one- to two-day delivery capabilities into rural areas, aiming to boost sales in less-populated regions.” I assess it to demonstrate the e-commerce leader’s ability to outperform its logistics-focused peers, strengthening its network effect moat. It also underscores the company’s ability to drive nascent growth vectors into underserved areas within rural America. Hence, we shouldn’t understate the scale and capabilities of Amazon’s logistical and fulfillment network to undertake these exciting growth prospects.

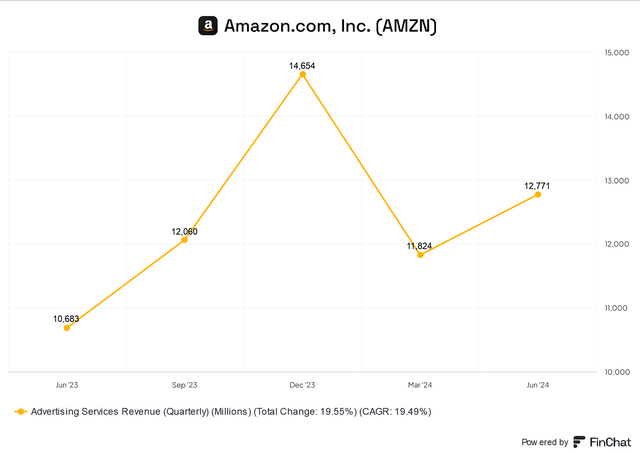

Amazon advertising revenue (FinChat)

Amazon Prime-driven competitive advantages also extend into Prime video, as seen above. Over the past twelve months, its advertising business has delivered more than $50B in revenue. Therefore, it has reached a scale that positions Amazon incredibly well in the digital advertising market, ranking just below the duopoly of Google (GOOGL) (GOOG) and Meta Platforms (META).

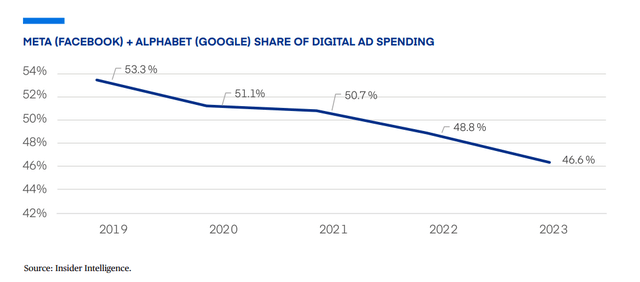

Meta and Google share of digital advertising % (The Trade Desk filings)

The rise of the open internet (outside the Meta+Google walled gardens) is gaining traction, as seen above. As a result, I expect Amazon advertising to mount more substantial challenges against the “old order” in the digital advertising ecosystem.

Management highlighted that the company has only scratched the surface of its foray into video advertising, as much of the current growth has been driven by “sponsored ads.” Therefore, I urge investors to assess its ability to gain traction in CTV advertising as it attempts to take more share against legacy TV networks.

Amazon’s recent foray into the NBA underscores its ability and ambitions to take advantage of the secular downtrend affecting legacy TV operators. Prime Video also has high user engagement and satisfaction, corroborating its platform capabilities to take on leader Netflix (NFLX). Coupled with Prime’s network effect moat, advertising could be one of Amazon’s most significant growth vectors outside AWS.

AWS’s growth has remained robust, despite facing more intense competition from Microsoft Azure (MSFT) and Google Cloud. AWS is still the cloud infrastructure market leader, although Azure is expected to narrow the gap further. Azure reported 29% in revenue growth, well above AWS’s 19% revenue increase. Google Cloud has also reached the $10B milestone in quarterly revenue. While growth isn’t expected to be as fast as its smaller rivals, AWS has significant opportunities to expand in the PaaS and SaaS stack.

Amazon’s approach to Generative AI is predicated on giving customers as wide a choice as possible. Amazon has its Titan family of foundation models. In addition, Amazon Bedrock offers “high-performing foundation models from leading AI companies through a single API.” Coupled with its custom Trainium and Inferentia AI chips to potentially “enhance performance and efficiency for AI workloads,” the company has a full-stack approach to leveraging Generative AI.

It remains to be seen how significant the underlying demand for Amazon’s custom chips is. Management highlighted that it’s “seeing significant demand.” However, a May 2024 report by Insider indicated the struggles facing its custom AI chips.

The Information also reported the strong demand dynamics in Nvidia’s next-gen Blackwell architecture. Meta CEO Mark Zuckerberg’s increasingly close partnership with Nvidia corroborates the criticality of having access to these chips. Consequently, while I am confident in Amazon’s chip design capabilities, Nvidia’s full-stack approach to AI systems makes it challenging to untether. It also underscores the underlying demand for Nvidia’s prized GPUs, intensifying the challenges for Amazon to justify the superior TCO of its chips to its customers.

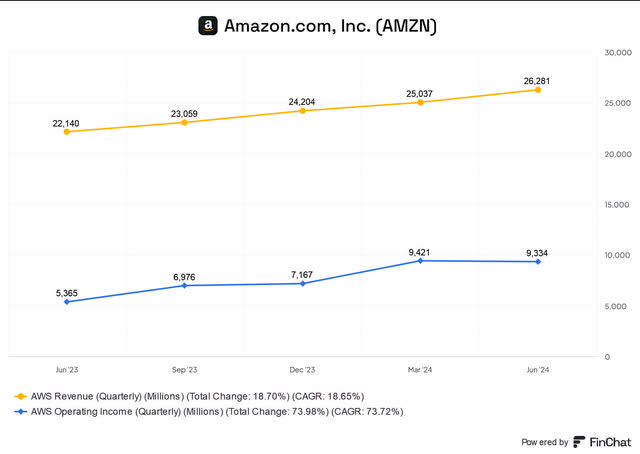

AWS revenue and operating income (FinChat)

Consequently, I assess the selloff as justified. The market needs more confidence in AWS’s ability to fend off challenges from Azure and Google Cloud as they attempt to erode AWS’s IaaS scale advantages. Amazon’s cloud segment is still the company’s main operating profit driver, delivering more than $9.3B in Q2.

Therefore, investors are likely concerned about the underlying impact on Amazon’s profitability and free cash flow, as it is expected to expand its technical AI infrastructure more aggressively. This is aligned with its big tech peers’ more aggressive capital spending. Given the potential for disruption by Generative AI, these companies are worried about the potential risks of underinvesting.

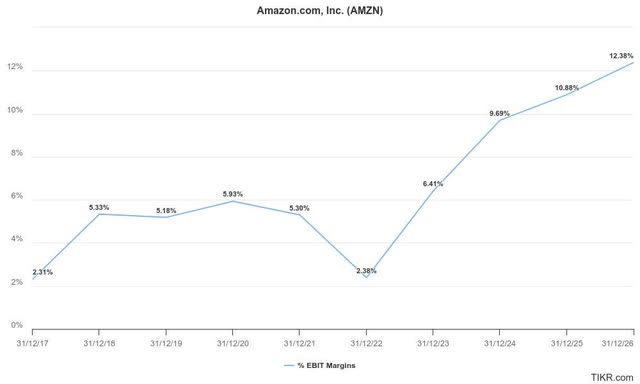

Amazon operating margin estimates % (TIKR)

Amazon’s aggressive CapEx expansion in its retail business contributed to significant operating profit volatility, as seen in FY2022. Under the leadership of then-retail head Dave Clark, Amazon’s consumer business experienced “a series of missteps by the business he ran, including warehouse overexpansion, overstaffing, and spiraling costs.” Therefore, investors could have assessed higher execution risks on AWS’s anticipated expansion plans, which are likely necessary to help maintain market share losses against its leading cloud rivals.

Despite that, Wall Street remains optimistic about AMZN despite the near-term risks. I’m also generally bullish on the GenAI business cycle, even though we could face near-term monetization challenges.

AWS’s demonstrated scale and profitability are expected to help assure investors about its ability to chart a profitable growth trajectory. Coupled with the company’s more aggressive expansion through its advertising segment, it’s too early for bearish investors to write off CEO Andy Jassy and his team.

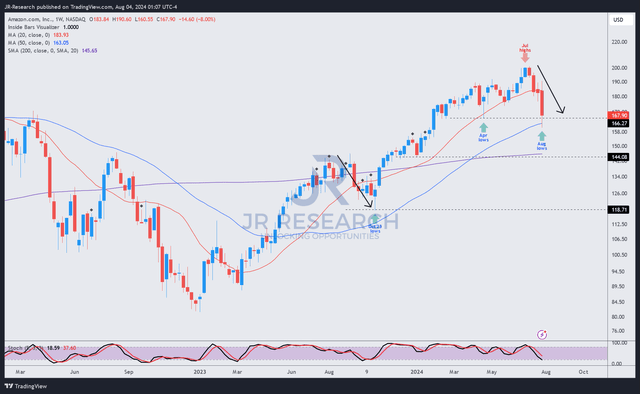

AMZN price chart (weekly, medium-term) (TradingView)

AMZN’s forward-adjusted PEG ratio of 1.75 is more than 20% above its sector median. Therefore, there’s little doubt that AMZN is still valued at a premium compared to its peers. Hence, the recent pullback has helped to alleviate some over-optimism, although AMZN is still priced for growth. Investors likely reacted negatively to potentially more aggressive CapEx spending, which could introduce more operating profit volatility. Given its growth premium, the company must continue to execute well to improve buying sentiments.

Despite that, its price action remains constructive, even though it fell into a bear market this week. While the pullback is assessed to be the steepest since its October 2023 bottom, investors shouldn’t panic.

I assess the stock’s uptrend continuation bias as intact. In addition, there seems to be a potential bear trap (false downside breakdown) just above its April 2024 lows at the $165 level. While not validated yet, it sets up AMZN well for a possible bullish reversal, providing more confidence in a subsequent recovery toward its recent July 2024 highs.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing, unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, META, PDD, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!