Summary:

- Apple’s shares hit a new 52-week low on Tuesday.

- Nikkei Asia again warns of production cuts.

- Warning now may only fuel demand concerns.

KanawatTH

One of Tuesday’s more notable losers was technology giant Apple (NASDAQ:AAPL). Shares of the company lost 3.75% on the day, dipping below a $2 trillion market cap, after a report surfaced of potential production cuts coming soon. With Apple management previously warning about iPhone supply issues and analysts continuing to reduce their estimates in recent months, shares have now hit their lowest point in over a year.

The reason for the fall was a Nikkei Asia report that Apple has told suppliers to build fewer components for the Watch, Mac, and Air Pods during the first quarter of this year. Some of the slowdown can be attributed to weaker demand, the report suggests, but also possibly due to not enough workers as China continues to grapple with the coronavirus. I will note, however, that Nikkei Asia is notorious for reporting negative news like this surrounding Apple. Here are just a few examples over the years:

- January 2016 – Apple to cut iPhone production by 30%, seen here.

- December 2016 – Apple to reduce iPhone production by 10%, seen here.

- January 2019 – Apple reducing Q1 iPhone production plans, seen here.

- March 2021 – Apple to cut orders for all iPhones, seen here.

- December 2021 – Apple production of iPhone 13 down 20%, seen here.

- March 2022 – Apple to cut iPhone SE and Air Pods production, seen here.

With Apple not releasing units sales in recent years and obviously holding its cards close to the vest, it is hard to determine if any of these reports were true or not. However, Nikkei Asia has consistently been the one outlet to report news like the piece we saw this week. Since Apple management doesn’t come out and either confirm or deny these reports, investors usually sell the stock given the added uncertainty. That’s what we saw on Tuesday.

There also was another article published on Tuesday that indicated iPhone production at Foxconn’s largest plant is back to 90% capacity. That would help alleviate some of those iPhone supply concerns detailed late in calendar 2022, especially on the Pro versions, that caused lead times to be a bit elevated. Some analysts have speculated that demand would just be pushed into the March quarter, but there could be some sales destruction too.

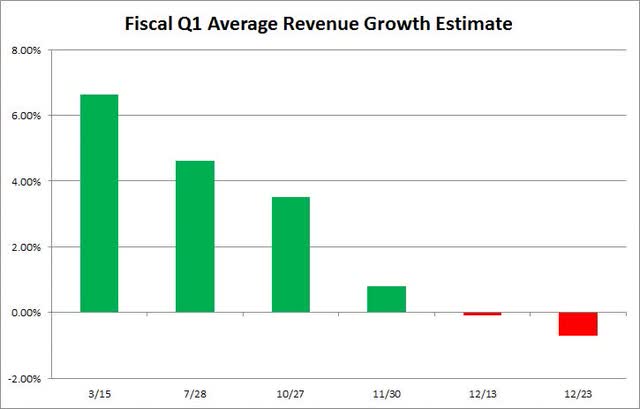

In my most recent Apple article back in mid-December, I detailed how analyst revenue estimates for the December (Apple’s fiscal Q1) quarter were continuing to come down. In fact, they had dipped into negative territory for the first time that week, a significant reversal as seen in the chart below. The average has gone lower still, with the 0.71% expected decline as of 12/23 being the current average. As a reminder, this all important holiday quarter was 14 weeks this time around instead of the usual 13 weeks due to how the calendar fell. Thus, accounting for the extra sales time suggests that an equal time period would see an even larger top line decline.

Apple Fiscal Q1 Revenue Estimate Average (Seeking Alpha)

Because management did not provide any formal guidance for the quarter, it really isn’t obligated to update investors if things did turn out a bit worse than expected. If they were, hypothetically, we could get a sales warning like we have seen in the past at times. That, however, would probably send the stock even lower, and would likely increase worries about demand in the near term. More likely, if things aren’t that good right now, management is probably hoping that analysts continue to lower their numbers before the Q1 report later this month. That way, if there is a top line miss, it won’t be as bad as a potential warning now could be.

I mentioned in my previous article using 20 times this year’s expected earnings as a potential price target, based on the stock’s valuation in recent years. Since then, the average EPS estimate has come down by 3 more cents, now sitting at $6.18 per share. In a worst case scenario where EPS were to fall to say $5.75, I’d probably argue for you to discount that multiple by 10%, meaning 18 times. That would imply a stock price of $103.50, or more than 17% below Tuesday’s closing price.

In the end, Apple shares dropped to their lowest point in more than a year on Tuesday after another Nikkei Asia report about production cuts. While this bearish piece from that outlet didn’t include the iPhone this time, the report suggested three product lines aren’t doing as well as hoped. With analysts already cutting revenue estimates for the December period, this might lead to more cuts for the March quarter as well. Until we get more clarity from Apple on how sales are really doing, investors are going to remain quite nervous, and that could mean the stock continues lower unless we see an overall market rally.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.