Summary:

- Advanced Micro Devices has surpassed Intel in size, benefiting from strong GPU business and AI demand.

- Despite being overvalued compared to Nvidia, investors are optimistic about AMD’s future.

- The company’s success in CPUs and potential in GPUs could lead to long-term shareholder returns and growth, but it also poses risks.

Javier Lizarazo Guerra

Advanced Micro Devices, Inc. (NASDAQ:AMD) is now more than double the size of its traditionally much stronger competitor, Intel. The company has benefited from building a strong GPU business at a time of strong AI demand. The company has dropped almost 30% since we recommended against it and 40% from its 52-week highs, despite a 3% growth in the S&P 500.

Still, the company’s current share price is overhyped. As investors bid it up versus its more expensive competitor, Nvidia, the company is an overvalued investment.

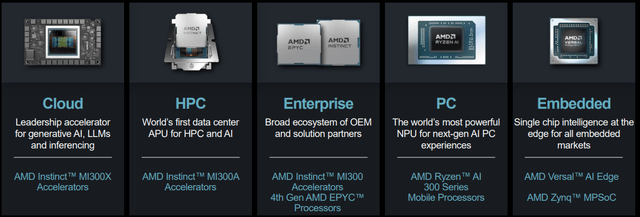

AMD Positioning

The company has built up a strong positioning across numerous impressive assets, including HPC and Cloud, some of the most exciting. The company has an MI300x that’s competitive with Nvidia’s accelerators, EPYC that’s competitive with Xeon, and competitive CPUs as Intel struggles with 13th and 14th gen voltage issues.

The company has also competed to be competitive in server CPUs with PC and EPYC accelerators. The company is also building its popular MI300X accelerator, which is increasingly competitive with Nvidia. That’s especially true given recent design delays that are causing Nvidia to push out its Blackwell GPUs by 3 months.

Similar delays with Intel are what enabled AMD to once again become competitive.

AMD Revenue and Margin

Despite the company’s impressive positioning, it needs to find a way to justify a valuation that’s now more than $230 billion.

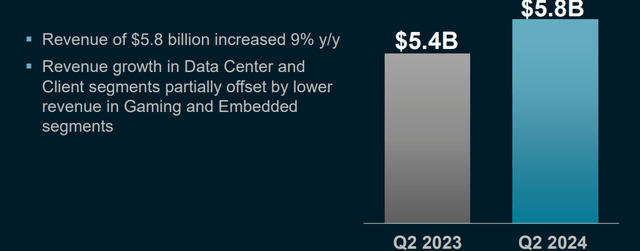

The company managed to increase its revenue by 9% YoY to $5.8 billion, as its gaming and embedded segments took a hit, but the company’s data center and client divisions have remained strong. The problem here is that timing is more important than anything else. Nvidia has benefited from being in the right place at the right time.

Now CEOs from Nvidia’s largest customers, Google (GOOGL) (GOOG) and Meta Platforms (META), are admitting that they might have spent too much on GPUs and are competing. That combines with new competitors like Google building their own TPUs, which Apple used to train its AI instead of using Nvidia or AMD accelerators. Weak revenue growth for AMD as Nvidia has grown much quicker indicates the gravy train is slowing down.

AMD Financial Performance

AMD does have reasonably strong financial performance, but it still doesn’t have the earnings to justify its valuation.

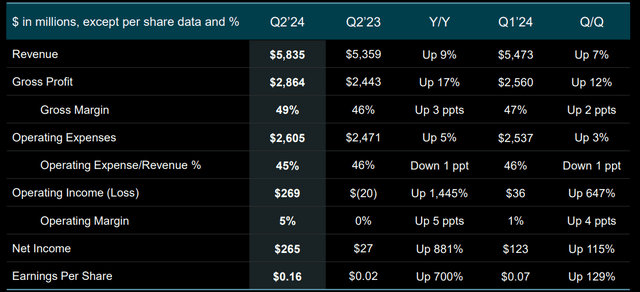

The company’s 9% revenue growth led to 17% YoY gross profit growth, as the company managed to increase its margins by 3%. That was caused by operating expenses growing by 5% while revenue growing at 9%. At the end of the day, the company had $2.8 billion in gross profit and $270 million in operating income.

The company is annualizing its earnings at $0.64. That puts the company at a P/E of more than 200x. The company needs to grow its EPS by an order of magnitude to justify its valuation, which is a tall order at 9% annualized growth during a strong bull market.

AMD Outlook

The company’s outlook highlights continued strength, but also the difficulty of justifying its valuation.

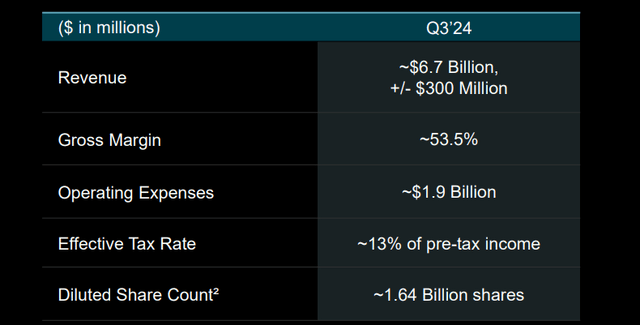

The company is guiding for revenue of ~$6.7 billion with a gross margin of 53.5% showing some continued improvements. The company expects $1.9 billion in operating expenses, a QoQ decline that will support a high gross margin and a modest pre-tax income. Still, the company’s EPS will grow but remain weak.

That outlook will show how the company will continue to justify shareholder returns versus its valuation.

AMD Shareholder Returns

AMD has had a difficult 5-months, however, despite that, the company is still overvalued. The issue with a high-flying tech market where companies go to 5-10x their fair valuation is they always have further to fall than you might think. AMD is a lesson in this, as the company hit a market capitalization of more than $400 billion.

The company is growing, and it has a strong portfolio of assets. Intelligent management, along with mistakes at Nvidia and especially Intel over the last few years, have enabled the company to position itself well. However, it needs $20 billion in earnings eventually to justify its valuation when the chicken comes home to roost, which is in the coming years as we expect the market reverts chipmakers to historic P/E ratios.

Currently, the company’s earnings are nowhere near $20 billion and the company’s growth rate doesn’t have a path for that. Our justification for this is based on chipmaker Intel, which has the premium positioning and brand in the market from 2010 to 2019, when it still commanded a peak P/E of ~15.

As a result, we recommend against investing in AMD.

Thesis Risk

The largest risk to our thesis is that AMD does have a massive addressable market. The company has done well competing in CPUs versus Intel, and becoming competitive in GPUs versus Intel could help the company generate long-term shareholder returns and grow into its current valuation.

Conclusion

AMD has fallen 40% from its 52-week highs. The company has fallen almost 30% since we last recommended against investing in it, despite 3% growth for the S&P 500. The company has seen 9% revenue growth as it’s taking advantage of growth in enterprise and datacenter spending, and its EPS has remained positive.

That comes in line with delays from Nvidia with Blackwell and Intel’s continued struggles to remain profitable. The company is unable to earn enough to justify its valuation of more than $230 billion. That, combined with CEOs indicating they might dial back spending, and we still recommend against investing in AMD at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

You Only Get 1 Chance To Retire, Join The #1 Retirement Service

The Retirement Forum provides actionable ideals, a high-yield safe retirement portfolio, and macroeconomic outlooks, all to help you maximize your capital and your income. We search the entire market to help you maximize returns.

Recommendations from a top 0.2% TipRanks author!

Retirement is complicated and you only get once chance to do it right. Don’t miss out because you didn’t know what was out there.

We provide:

- Model portfolios to generate high retirement cash flow.

- Deep-dive actionable research.

- Recommendation spreadsheets and option strategies.