Summary:

- Intel’s latest report reinforce concerns about the business’ future.

- Intel’s pivot to the foundry business is risky and exacerbates the troubled position of the business.

- Declining revenues and collapsing margins in key segments indicate poor operational performance and execution issues.

- Financials show a deteriorating business with declining revenues, increasing debt, dilution of shares, and negative free cash flow.

JHVEPhoto/iStock Editorial via Getty Images

Investment Thesis:

Roughly two years ago, I published an article where I expressed my bull case on Intel and my bear case on AMD. At that time, I was long Intel (NASDAQ:INTC). I have, since, exited my position for a small loss a little over a year ago. Since I exited my position, I have continued to monitor the stock and haven’t formed an opinion that I deemed strong enough for me to write an article. However, after Intel’s second quarter earnings report, I believe it exacerbates the extremely troubled position the business is in. Intel has deteriorated from a once cash flow king with a strong balance sheet, to a business that is burning billions of dollars in cash every year, with a now tremendous debt pile that is continuing to grow.

Intel’s pivot to the foundry business is extremely capital intensive and requires years for a proper infrastructure to be built out. More so, in the meantime, Intel is required to finance their tremendous losses by taking on additional debt or issuing shares, both of which greatly harm shareholder equity. I admit that I was wrong about Intel two years ago, and I wouldn’t touch it today.

Fundamental Business:

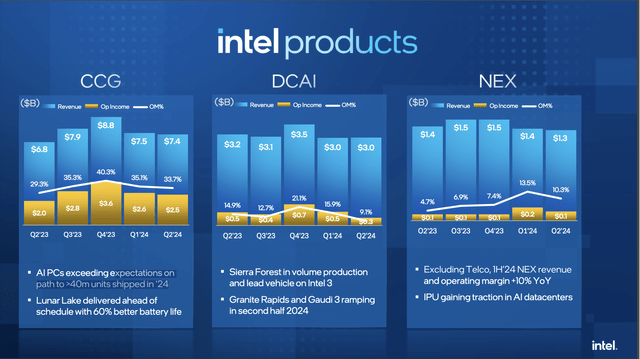

Intel’s fundamental business is flawed and cannot get out of its own way currently. Somehow, in a time of AI boom, Intel’s DCAI segment (Data Center & Artificial Intelligence) has had declining revenues and collapsing margins showcased in their recent quarter (6% decline in revenues and a 40% decline in operating income). Even scarier, Intel’s Cloud Computing Group only grew their revenues 6.8%, at a time when AMD (AMD) and Nvidia (NVDA) have grown their CCG segments by triple digits.

Intel Products (Intel investor relations)

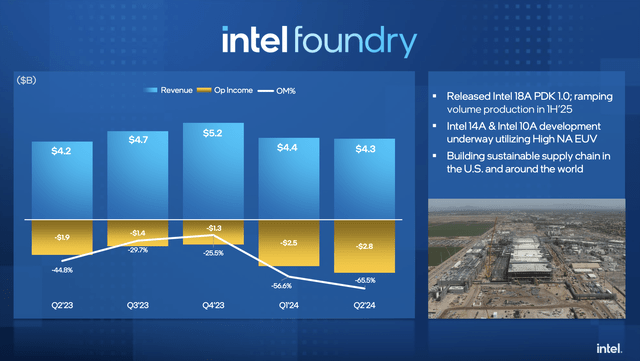

Funnily enough, this isn’t the most alarming element. Although Intel’s entire emphasis has been on the foundry segment, their revenues within the segment were virtually flat year over year. Obviously, it takes a significant amount of time to thoroughly build out new foundries, yet having flat revenue growth YoY on the segment your entire business is pivoting towards is nonetheless very alarming.

Intel Foundry (Intel Investor relations)

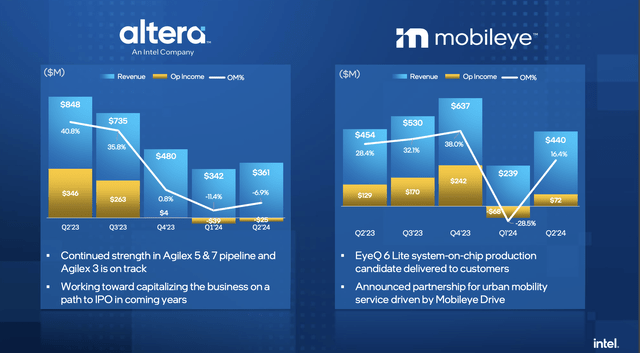

One segment that I find to be evident of Intel’s poor operational performance and lackluster culture within the business, is the Altera segment. Once again, the entire semiconductor sector has experienced a large boom as a result of trends in AI, which has stimulated additional demand for chips within data centers, therefore growing demand for the designers and manufacturers of semiconductors including Micron (MU), ASML (ASML), and many more. Yet, Altera, a subsidiary that Intel acquired in 2015, showcased over 50% decline in revenues YoY in the latest quarter, as well as a swing to an operating loss.

Intel Subsidiaries Performance (Intel investor relations)

Evidently, there is poor execution across the board at Intel. In my opinion, Intel’s plans to spin-off Altera seems useless, now that Altera is evidently floundering.

Financial Performance:

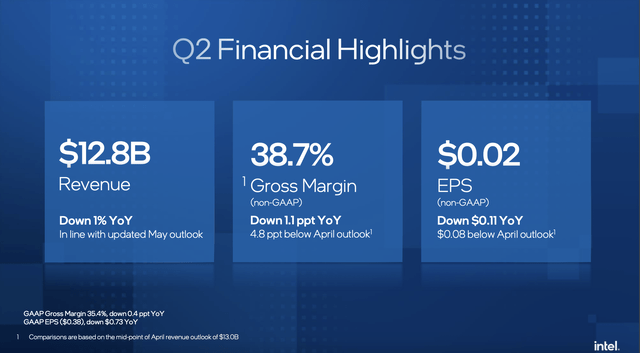

Intel’s financials are simply a mess. If you wanted to know what the financial statements of a deteriorating business look like, Intel would be the perfect example. In their latest quarter, Intel had a 1% decline in their revenues. Once again, this is a decline in revenues at a time when the rest of the semiconductor industry is booming. Zooming out, Intel’s revenues have declined over 30% from a high of $79 billion in 2021 to $55 billion in the TTM. Moreover, Intel reported a 38.7% non-GAAP gross margin in their latest quarter, which was close to 5% lower than their outlook in April. Their GAAP gross margin was significantly lower at 35.4%. Zooming out once again, the margins reported in this latest quarter continue to reflect a trend of rapidly declining margins. In 2021, Intel had 55% gross margins, while in the TTM, they maintained 41.5% margins. In 2014, Intel had 64% gross margins, thus, a steep decline in gross margins has been occurring for a decade now.

Intel Financial performance (Intel Investor Relations)

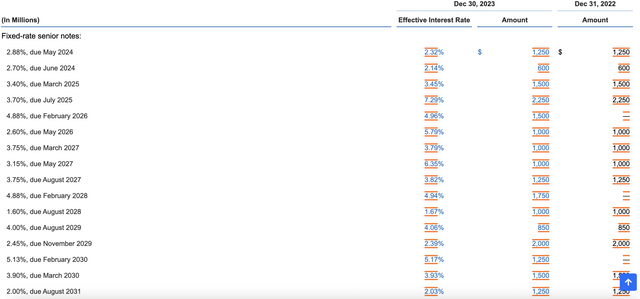

Although I believe Intel’s income statement is a great representation of the declines within the business, their balance sheet and cash flow statement represent more fundamental issues with the business, which could lead to major liquidity issues in the upcoming years if the business continues to execute poorly. The major highlight for me on Intel’s balance sheet, is their long-term debt relative to their cash. Since 2021, Intel’s total debt has ballooned from $38 billion to $52 billion. In the same period of time, their interest payments have grown from around $500 million to $900 million. Although their interest payments are not too large right now, they have $9.75 billion in debt maturing through 2027 which they will have to refinance at significantly higher rates, not just because of higher interest rates, but also because of their deteriorating liquidity and cash flow profile. I calculated the figure for how much debt they have maturing before 2027, as the chart below displays the amount of debt Intel has maturing each year and the interest rates. Through 2027, there is $9.75 billion in debt maturing, most of which are at relatively low-interest rates.

Intel Debt Schedule (Intel 10-k)

Furthermore, Intel has also begun diluting their shareholders as a result of high stock-based compensation and issuance of stock. Since 2021, their shares outstanding have grown from 4.07 billion to 4.257 billion in the TTM, representing an almost 5% increase in shares outstanding. It is not a good combination for Intel shareholders when the business is making less money, while they are also getting diluted. It’s like getting a smaller piece of a shrinking pie.

Lastly, let’s talk about their cash flows. Intel was once a free cash flow king, where, at their peak in 2020, they generated over $35 billion in cash from operations with only $14 billion in capex resulting in over $21 billion in free cash flow. In the TTM, Intel has generated just $12 billion in cash from operations, while they had an outstanding $24 billion in capital expenditures, resulting in free cash flow of negative 12 billion. This is a swing of over $33 billion in less than 4 years. To be fair to Intel, their capital expenditures appear elevated as the incentives and capital given to them by governments are accounted for within Intel’s capital expenditures. However, it does not change the fact that Intel is still continuing to lose a significant amount of money.

Shareholders at Risk:

Intel is poised to harm shareholder value over the next few years, in my opinion, through a poor financial situation.

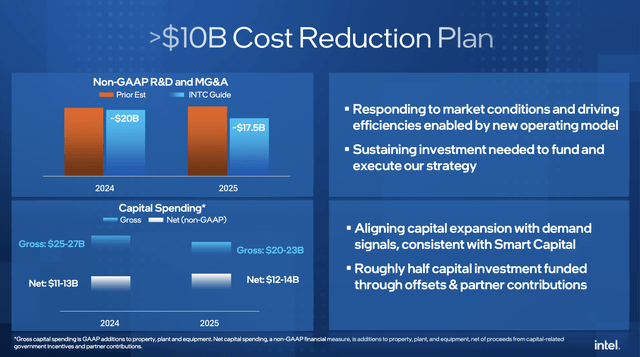

1) Intel is losing a significant amount of money. Although they lowered their expense guidance for 2025 to $21.5 billion in capital expenditures at its midpoint from $26 billion previously. However, their net capital expenditures which represents how much Intel spends net of government contributions are actually projected to still increase YoY. Although concrete free cash flow guidance was not given, with Intel’s current levels of cash from operations, they are poised to continue losing money.

intel Cost Reduction Plan (Intel Investor relations)

2) Intel needs to finance their losses. Like any company that loses money, Intel has to find a way to pay for their losses. Intel has elected to take on significant amounts of debt and issue more shares. Evidently, when a business takes on more debt and dilutes their shareholders, a shareholders’ equity within the business is greatly harmed.

3) Intel has limited growth potential. Although Intel’s foundry business does present a growth avenue, it is many years out, with projections around their profitability more than uncertain. In April, Intel’s CEO stated that the foundry business would just breakeven in 2030. In the meantime and afterwards, Intel has limited growth potential. Within the CPU and PC markets where they have to compete with pure-play chip designers, there is a lot of competition from businesses such as AMD and Nvidia, which only focus on designing semiconductors while Intel is trying to both design and manufacture semiconductors. Furthermore, Intel still has to compete with Global Foundries (GFS) and Taiwan Semiconductor (TSM) in the foundry space, which will result in them continuing to deploy significant amounts of capital into the space. Overall, Intel doesn’t appear to have the growth potential that would be expected with a typical type of business that is losing money. Furthermore, if the decline in their profitability continues, shareholders are in for a rough time, as their equity is already deteriorating.

Valuation:

Due to Intel losing money, it is extremely hard to value, and a typical discounted cash flow model will not work as their path to profitability is so uncertain, especially from a free cash flow perspective. First, after Intel’s large drop, their market cap is hovering around $100 billion; however, I think their enterprise value of $130 billion is more important to look at, as it properly reflects their debt. Besides that, it’s difficult to value a business that is losing lots of money, has flat or declining revenues, is taking on more debt every year, and diluting their shareholders. Although I cannot come up with a number for what I think Intel’s business is worth, from what I’ve seen it simply looks like something I would not want to own.

Risk Factors:

The primary risk to my bear thesis on Intel, is if they are able to execute extremely well in terms of their foundry plans and ability to design semiconductors. Although Intel is likely to lose money in the short term and hurt their shareholders’ equity, if they can finish building their factories ahead of time and have them operational, and demand for domestic manufacturing exceeds expectations, Intel can produce excess amounts of cash flow. In addition, once the factories are fully built out, Intel’s capital expenditures will likely heavily decrease, thus leading to a massive surge in cash flows. If Intel is able to generate large amounts of cash, even many years from now, they can offset the previous effects of their harmful actions towards shareholders by retiring debt and repurchasing shares. Overall, that is the main risk to my Intel bear case.

Final Thoughts:

Intel has elevated capital expenditures as a result of their pivot towards the foundry business, resulting in them having negative amounts of free cash flow. To finance their losses in free cash flow, they have begun harming shareholder equity by issuing more shares and taking on additional debt. In their latest quarter, the business appears to be rapidly deteriorating, at a time when the overall semiconductor sector is booming, representing Intel’s major execution failures in terms of capturing product trends and how they are falling behind their competitors. Although Intel does have the potential to turn itself around, it is still many years in the future and uncertain. In the meantime, before Intel “turns” around its business, shareholders face a great risk, in my opinion.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.