Summary:

- Tesla enjoys meaningful offsetting margin tailwinds, including diminishing factory ramp cost impact, COGS improvement, and considerable IRA benefits starting in January.

- Retail investors are pushing for buybacks, which is highly probable considering the company’s strong balance sheet.

- Transitioning to EVs is not optional for automakers and requires significant spending in the coming years.

- TSLA stock has dropped and trades at much more reasonable valuation levels, making it a buy.

Joe Raedle/Getty Images News

Investment Thesis

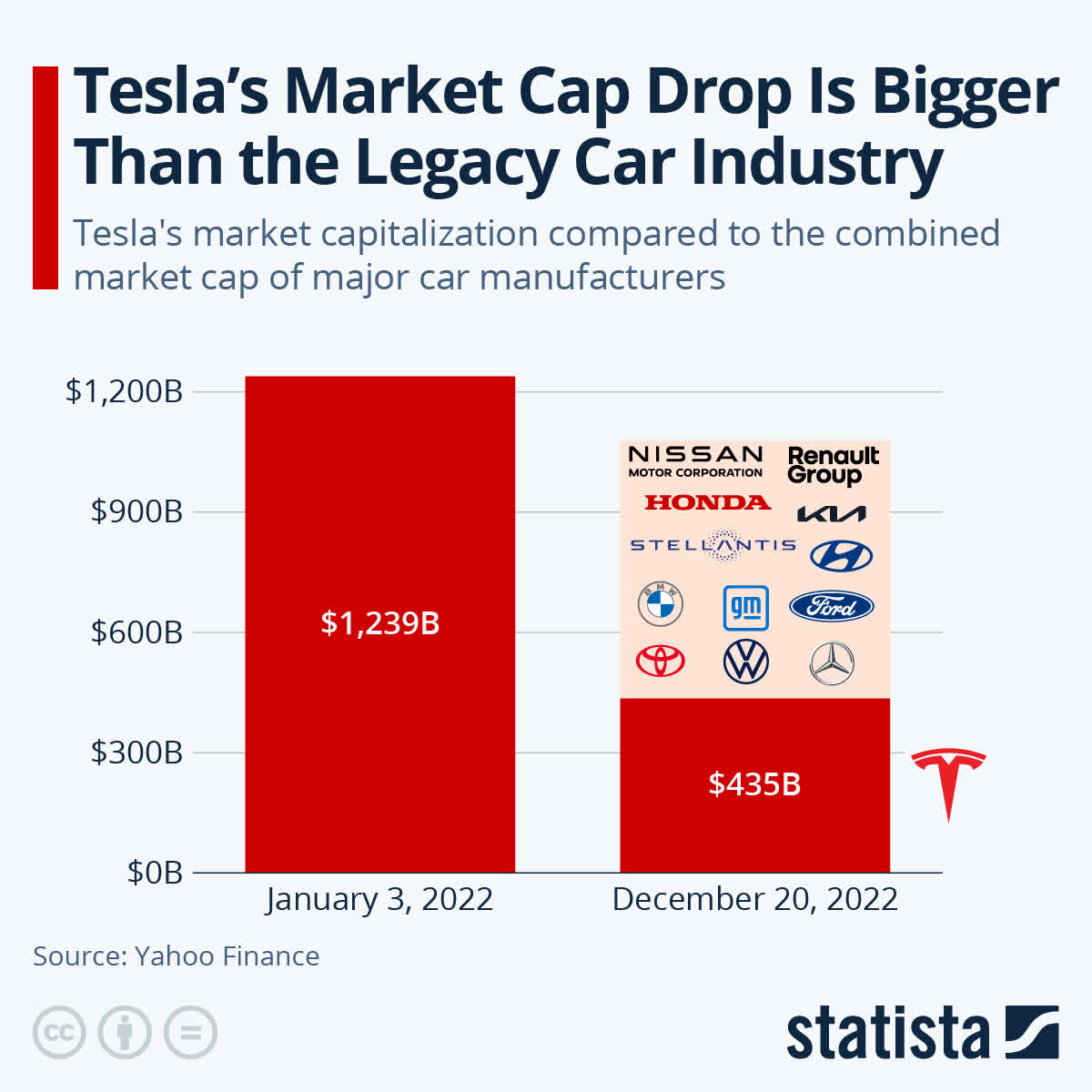

Mr. Market is worried that Elon Musk’s acquisition of Twitter will distract him from Tesla (NASDAQ:TSLA), which might lead to more selling pressure on the stock. Over 50% of the automotive market cap has been wiped out in the last three months. To put Tesla’s market cap into perspective, $850-plus billion has vanished since Jan. 3, 2022, which is more than the combined market cap of the car industry. For years, I have avoided the stock due to its sky-high valuation. Still, following the recent drop, I opened a new position in TSLA, planning to add more in further drops, as Tesla’s long-term prospects and economic moat have not materially changed.

statista.com

New Products On The Horizon

Tesla remains on track for launch with its two major new products, the Tesla Semi truck and Cybertruck. The Cybertruck is being prepared in Texas now, with beta builds underway, setting it on track to begin initial production around mid-2023. In addition, the Semi began initial deliveries in December, with the first few units being handed over to Pepsi. Management indicated it would take about a year to ramp toward full production from there, with a (tentative) goal of producing about 50k units in 2024. The launch of these new products will introduce the automaker to two entirely new segments, unlocking considerable incremental demand.

Price Cuts Likely In 2023

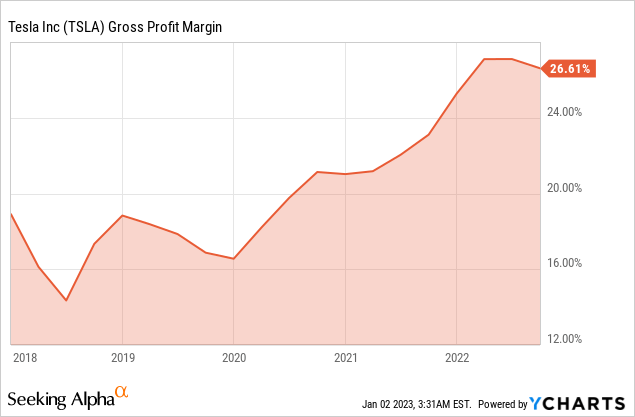

In 2023, management continues to see demand for its vehicles match its highly targeted capacity growth rate of ~50%. As input costs start to unwind toward 2023 meaningfully, the EV maker will be able to pass on some of that benefit to the consumer in the form of price cuts, having a limited impact on margins. The nearly 30% gross margin on Tesla’s automotive operations during the past two years was nearly double that of Ford Motor (F) and General Motors (GM). Nevertheless, should conditions soften, I expect Tesla to use pricing as a lever to bolster demand in a downturn.

While Tesla is not necessarily immune to a downturn, it should be much more resilient in a recession globally, given the various cost levers at its disposal. Furthermore, Tesla is equipped with resilient offsets from significant margin tailwinds, including reducing the impact of factory ramp cost, improving COGS, and considerable IRA benefits starting in January.

Retail Investors Push For Buybacks

With the recent share decline in recent months, Tesla’s retail investors are directly writing to the board to consider share buyback at the “earliest convenience.” In the last earnings call, Musk told the Tesla board that he was seriously considering a buyback program between $5-$10 billion, but the ultimate decision is still up to the board. The petition was written via Change.org and gathered more than 6,000 signatures cumulatively.

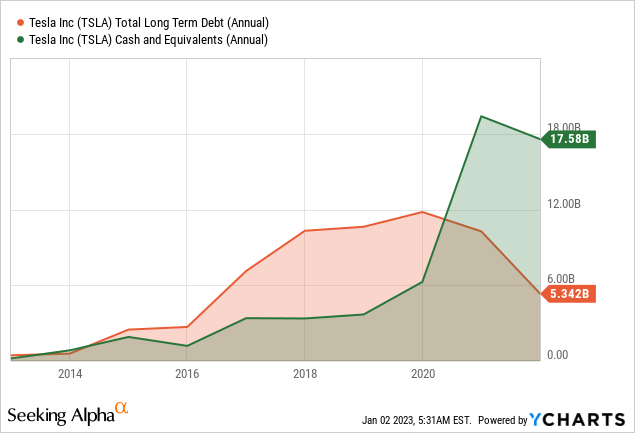

Tesla’s cash flows and de-risked balance sheet provide the capacity to pursue more aggressive capital returns. Tesla’s net debt has improved by $26 billion since Q1 2019 due to improved operating performance and equity offerings, reframing Tesla’s financial risks, flexibility, and optionality. In addition, Tesla’s plan to grow production by about 50% annually over the next several years may temper its enthusiasm to pursue a dividend until its business has matured. Indeed, its financial strength enables it to have a payout ratio similar to its peers.

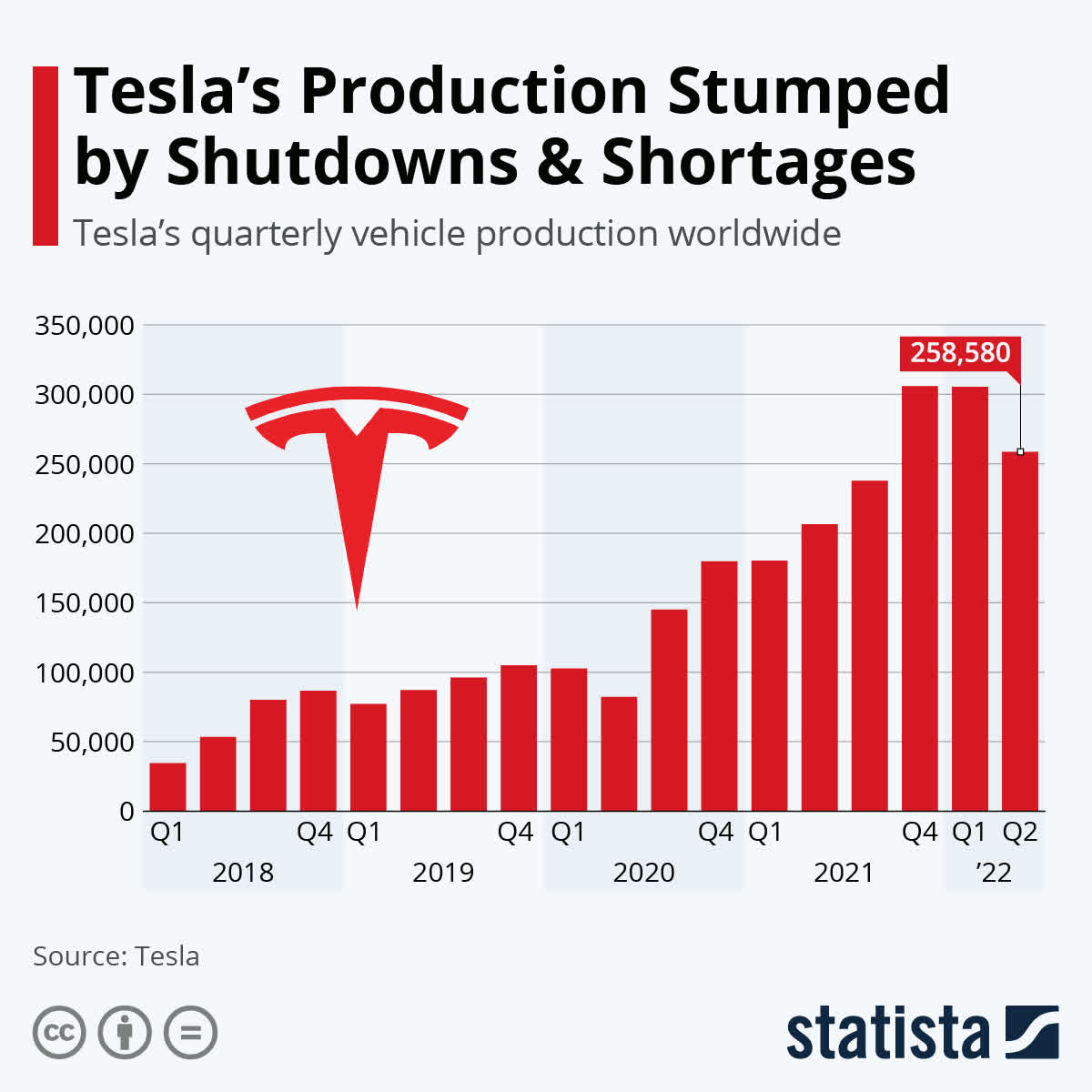

Tesla Suspends Production In Shanghai

Reuters has reported that Tesla has suspended production at its Shanghai plant amidst rising COVID cases among workers. Tesla’s best-selling model, Model Y’s production, would be affected by the shutdown of the Shanghai plant. According to an internal company memo, the shutdown had been in the works as earlier this month, Reuters reported that Tesla would be suspending Model Y production at its Shanghai facility between Dec. 25 and Jan. 1.

Sources close to the matter said that the week of downtime on the Model Y would be part of a 30% production cut in the vehicle’s final month of the year. Tesla has not previously shut production down during the year’s final week. The report indicates that the automaker expects to produce about 20k Model Y vehicles in Shanghai in December, including the downtime (under 7k per week), down from the November run rate of about 13k Model Ys per week. This could be a steeper cut than implied by a previous report suggesting December output would be lowered by about 20%, to which Tesla responded by claiming the report was false.

statista.com

Deliveries Fall Short In Q4

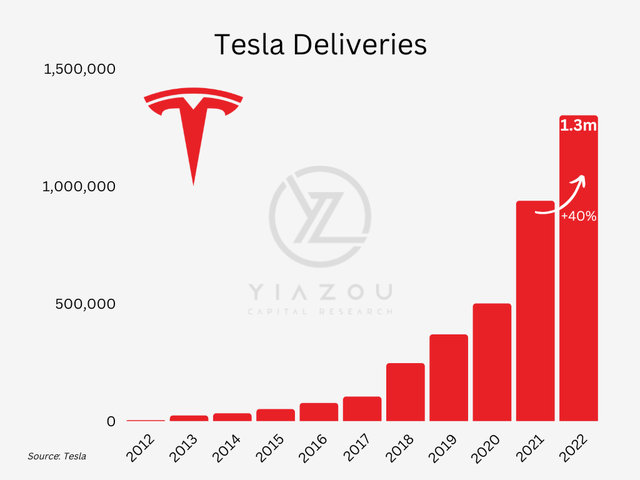

Tesla reported on Monday that it delivered 405,278 automobiles, below analyst expectations of 420,000-430,000. The setback occurred despite Tesla’s new plants in Texas and Berlin continuing to grow output. Not surprisingly, the firm’s production capacity was impacted by supply chain issues, COVID-related manufacturing shutdowns in China, and weakened demand.

The demand for automobiles is anticipated to drop this year as consumers fear an upcoming recession and rising interest rates. However, while supply chain delays may present a short-term challenge, I believe Tesla will outperform the market in the long run due to expanding production and releasing new models. Thus, long-term delivery growth is expected to be supported by the ramp-up of production at gigafactories, 4 (in Berlin) and 5 (in Austin), as well as the introduction of new models, including Semi and Cybertruck.

Despite Tesla falling short of delivery expectations in Q4, the long-term trend remains favorable amidst the gloomy economic outlook. Lastly, the company has a good record of increasing average selling prices. Its pricing power allows it to transfer input costs to consumers through price hikes across its models, protecting its top-line growth prospects.

Transitioning To EVs Is Not Optional

Auto fuel economy and emissions are heavily regulated worldwide. Companies that don’t meet standards face fines or could be required to negotiate with competitors that exceed the standard. The EU, California, and New York are among governments targeting a phaseout of internal combustion engines, many by 2030-35. The US recently raised this fine to $15 per 0.1 miles per gallon below the standard, multiplied by the number of non-compliant vehicles sold. Respectively, the EU fine is €95 for each gram per kilometer in excess.

Tesla’s fleet of electric vehicles meets government standards, and the company has monetized this position. Tesla has generated roughly $4.9 billion from regulatory credits since late 2018, with a quarterly run rate of about $330 million. However, as competitors ramp up the production of zero-emission cars, this source of revenue could wane. In addition, in 1H, Stellantis paid $678 million in penalties related to US fuel-economy standards.

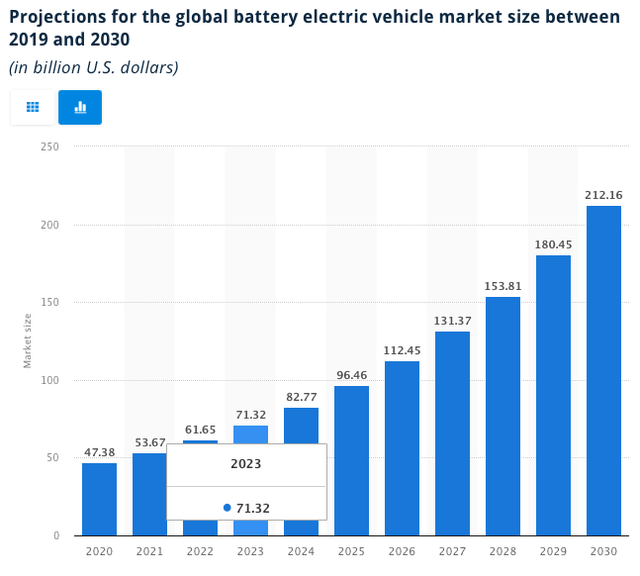

Electrification has been a source of differentiation and valuation premiums, but producers must comply as the phaseout dates approach. In many cases, there are interim targets. For example, California intends to ban the sale of ICE vehicles by 2035, but 35% of cars sold in the state will have to be zero-emission by 2026 (16% now), and this target will rise to 68% by 2030. As a result, companies like Tesla have been able to command a premium selling zero- and low-emission electric cars. Considering the above and the market’s projections, the EV market is set to double in the next five years, with Tesla’s growth story remaining intact.

As governments target a phaseout of ICEs, this won’t be optional, and the transition to EVs will be costly. Meeting government targets for phasing out ICEs will require significant spending. Companies are committing billions of dollars to invest in new technologies, primarily zero-emission vehicles. For example, Ford and VW each committed around $50 billion to EV development by 2026. Ford is building its first US-based factory in over 50 years, while Tesla spent about $5.5 billion on its German Gigafactory. These investments translate into a range of targets for zero-emission vehicle sales.

Concluding Thoughts

Looking beyond, there’s a strong path for continued growth and margin expansion but moderate expectations for 2023 coming off a lower base in 2022 and reflecting the macro backdrop globally. While not immune to a downturn, Tesla’s growth and profitability might be far more resilient than the rest of the sector in a global recession, given the various levers at the company’s disposal.

Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Author of Yiazou Capital Research

Unlock your investment potential through deep business analysis.

I am the founder of Yiazou Capital Research, a research platform designed to elevate your due diligence process through in-depth analysis of businesses.

I have previously worked for Deloitte and KPMG in external auditing, internal auditing, and consulting.

I am a Chartered Certified Accountant and an ACCA Global member, and I hold BSc and MSc degrees from leading UK business schools.

In addition to my research platform, I am also the founder of a private business.